Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

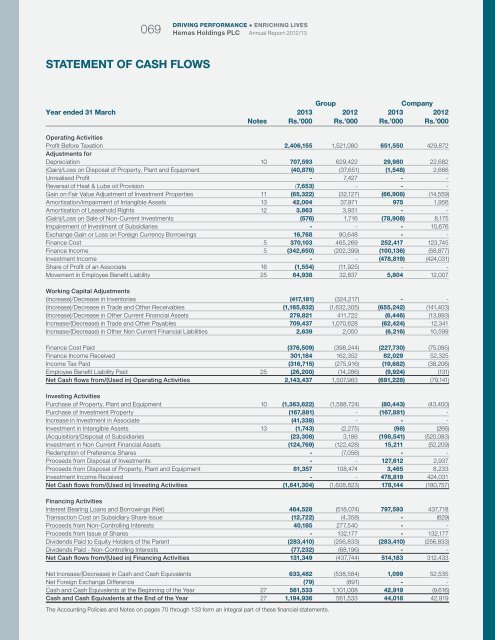

DRIVING PERFORMANCE ● ENRICHING LIVES069 <strong>Hemas</strong> <strong>Holdings</strong> PLC Annual Report 2012/13STATEMENT OF CASH FLOWSGroupCompanyYear ended 31 March 2013 2012 2013 2012Notes Rs.’000 Rs.’000 Rs.’000 Rs.’000Operating ActivitiesProfit Before Taxation 2,406,155 1,521,080 651,550 429,872Adjustments forDepreciation 10 707,593 629,422 29,980 22,682(Gain)/Loss on Disposal of Property, Plant and Equipment (40,876) (37,651) (1,548) 2,666Unrealised Profit - 7,427 - -Reversal of Heat & Lube oil Provision (7,653) - - -Gain on Fair Value Adjustment of Investment Properties 11 (65,322) (32,127) (66,908) (14,559)Amortisation/Impairment of Intangible Assets 13 42,004 37,971 975 1,956Amortisation of Leasehold Rights 12 3,863 3,931 - -(Gain)/Loss on Sale of Non-Current Investments (576) 1,716 (78,908) 8,175Impairement of Investment of Subsidiaries - - - 10,676Exchange Gain or Loss on Foreign Currency Borrowings 16,768 90,648 - -Finance Cost 5 370,103 465,269 252,417 123,745Finance Income 5 (342,650) (202,399) (100,136) (58,877)Investment Income - - (478,819) (424,031)Share of Profit of an Associate 16 (1,554) (11,925) - -Movement in Employee Benefit Liability 25 64,938 32,837 5,804 12,007Working Capital Adjustments(Increase)/Decrease in Inventories (417,181) (324,217) - -(Increase)/Decrease in Trade and Other Receivables (1,165,832) (1,632,305) (655,242) (141,403)(Increase)/Decrease in Other Current <strong>Financial</strong> Assets 279,821 411,722 (6,446) (13,893)Increase/(Decrease) in Trade and Other Payables 709,437 1,070,628 (62,424) 12,341Increase/(Decrease) in Other Non Current <strong>Financial</strong> Liabilities 2,639 2,050 (6,216) 10,599Finance Cost Paid (376,509) (398,244) (227,730) (75,085)Finance Income Received 301,184 162,352 82,029 52,325Income Tax Paid (316,715) (275,916) (19,682) (38,206)Employee Benefit Liability Paid 25 (26,200) (14,286) (9,924) (131)Net Cash flows from/(Used in) Operating Activities 2,143,437 1,507,983 (691,228) (79,141)Investing ActivitiesPurchase of Property, Plant and Equipment 10 (1,363,622) (1,588,724) (80,443) (43,400)Purchase of Investment Property (167,881) - (167,881) -Increase in Investment in Associate (41,338) - - -Investment in Intangible Assets 13 (1,743) (2,275) (98) (266)(Acquisition)/Disposal of Subsidiaries (23,308) 3,186 (198,541) (520,083)Investment in Non Current <strong>Financial</strong> Assets (124,769) (122,428) 15,211 (52,209)Redemption of Preference Shares - (7,056) - -Proceeds from Disposal of Investments - - 127,612 2,937Proceeds from Disposal of Property, Plant and Equipment 81,357 108,474 3,465 8,233Investment Income Received - - 478,819 424,031Net Cash flows from/(Used in) Investing Activities (1,641,304) (1,608,823) 178,144 (180,757)Financing ActivitiesInterest Bearing Loans and Borrowings (Net) 464,528 (518,074) 797,593 437,718Transaction Cost on Subsidiary Share Issue (12,722) (4,358) - (629)Proceeds from Non-Controlling Interests 40,185 277,540 - -Proceeds from Issue of Shares - 132,177 - 132,177Dividends Paid to Equity Holders of the Parent (283,410) (256,833) (283,410) (256,833)Dividends Paid - Non-Controlling Interests (77,232) (68,196) - -Net Cash flows from/(Used in) Financing Activities 131,349 (437,744) 514,183 312,433Net Increase/(Decrease) in Cash and Cash Equivalents 633,482 (538,584) 1,099 52,535Net Foreign Exchange Difference (79) (891) - -Cash and Cash Equivalents at the Beginning of the Year 27 561,533 1,101,008 42,919 (9,616)Cash and Cash Equivalents at the End of the Year 27 1,194,936 561,533 44,018 42,919The Accounting Policies and Notes on pages 70 through 133 form an integral part of these financial statements.