Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

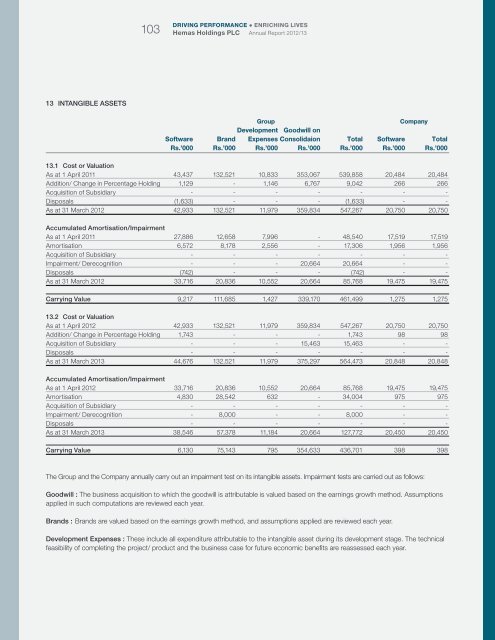

DRIVING PERFORMANCE ● ENRICHING LIVES103 <strong>Hemas</strong> <strong>Holdings</strong> PLC Annual Report 2012/1313 INTANGIBLE ASSETSGroupCompanyDevelopment Goodwill onSoftware Brand Expenses Consolidaion Total Software TotalRs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’00013.1 Cost or ValuationAs at 1 April 2011 43,437 132,521 10,833 353,067 539,858 20,484 20,484Addition/ Change in Percentage Holding 1,129 - 1,146 6,767 9,042 266 266Acquisition of Subsidiary - - - - - - -Disposals (1,633) - - - (1,633) - -As at 31 March 2012 42,933 132,521 11,979 359,834 547,267 20,750 20,750Accumulated Amortisation/ImpairmentAs at 1 April 2011 27,886 12,658 7,996 - 48,540 17,519 17,519Amortisation 6,572 8,178 2,556 - 17,306 1,956 1,956Acquisition of Subsidiary - - - - - - -Impairment/ Derecognition - - - 20,664 20,664 - -Disposals (742) - - - (742) - -As at 31 March 2012 33,716 20,836 10,552 20,664 85,768 19,475 19,475Carrying Value 9,217 111,685 1,427 339,170 461,499 1,275 1,27513.2 Cost or ValuationAs at 1 April 2012 42,933 132,521 11,979 359,834 547,267 20,750 20,750Addition/ Change in Percentage Holding 1,743 - - - 1,743 98 98Acquisition of Subsidiary - - - 15,463 15,463 - -Disposals - - - - - - -As at 31 March 2013 44,676 132,521 11,979 375,297 564,473 20,848 20,848Accumulated Amortisation/ImpairmentAs at 1 April 2012 33,716 20,836 10,552 20,664 85,768 19,475 19,475Amortisation 4,830 28,542 632 - 34,004 975 975Acquisition of Subsidiary - - - - - - -Impairment/ Derecognition - 8,000 - - 8,000 - -Disposals - - - - - - -As at 31 March 2013 38,546 57,378 11,184 20,664 127,772 20,450 20,450Carrying Value 6,130 75,143 795 354,633 436,701 398 398The Group and the Company annually carry out an impairment test on its intangible assets. Impairment tests are carried out as follows:Goodwill : The business acquisition to which the goodwill is attributable is valued based on the earnings growth method. Assumptionsapplied in such computations are reviewed each year.Brands : Brands are valued based on the earnings growth method, and assumptions applied are reviewed each year.Development Expenses : These include all expenditure attributable to the intangible asset during its development stage. The technicalfeasibility of completing the project/ product and the business case for future economic benefits are reassessed each year.