APPENDIX D Key Changes , item 450. PDF 39 KB - Council meetings

APPENDIX D Key Changes , item 450. PDF 39 KB - Council meetings

APPENDIX D Key Changes , item 450. PDF 39 KB - Council meetings

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

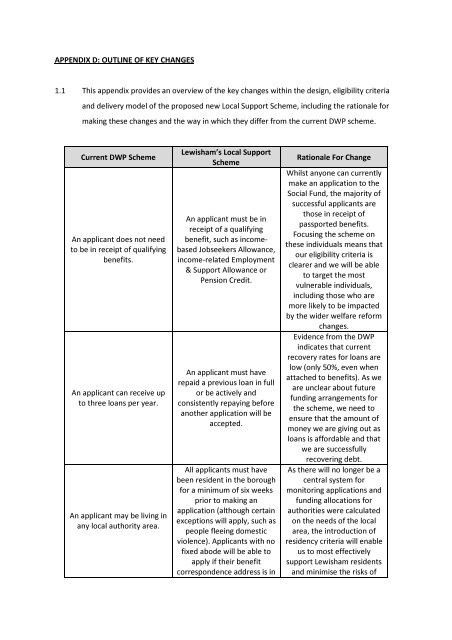

<strong>APPENDIX</strong> D: OUTLINE OF KEY CHANGES1.1 This appendix provides an overview of the key changes within the design, eligibility criteriaand delivery model of the proposed new Local Support Scheme, including the rationale formaking these changes and the way in which they differ from the current DWP scheme.Current DWP SchemeAn applicant does not needto be in receipt of qualifyingbenefits.An applicant can receive upto three loans per year.An applicant may be living inany local authority area.Lewisham’s Local SupportSchemeAn applicant must be inreceipt of a qualifyingbenefit, such as incomebasedJobseekers Allowance,income-related Employment& Support Allowance orPension Credit.An applicant must haverepaid a previous loan in fullor be actively andconsistently repaying beforeanother application will beaccepted.All applicants must havebeen resident in the boroughfor a minimum of six weeksprior to making anapplication (although certainexceptions will apply, such aspeople fleeing domesticviolence). Applicants with nofixed abode will be able toapply if their benefitcorrespondence address is inRationale For ChangeWhilst anyone can currentlymake an application to theSocial Fund, the majority ofsuccessful applicants arethose in receipt ofpassported benefits.Focusing the scheme onthese individuals means thatour eligibility criteria isclearer and we will be ableto target the mostvulnerable individuals,including those who aremore likely to be impactedby the wider welfare reformchanges.Evidence from the DWPindicates that currentrecovery rates for loans arelow (only 50%, even whenattached to benefits). As weare unclear about futurefunding arrangements forthe scheme, we need toensure that the amount ofmoney we are giving out asloans is affordable and thatwe are successfullyrecovering debt.As there will no longer be acentral system formonitoring applications andfunding allocations forauthorities were calculatedon the needs of the localarea, the introduction ofresidency criteria will enableus to most effectivelysupport Lewisham residentsand minimise the risks of

Current DWP SchemeLoans are interest free.Administration of loans andgrants is managed centrallyby the DWP.Repayments are taken atsource and deducted fromDWP benefits.The DWP only provide cashbasedawards and do notretrospectively checkwhether the award was usedfor the purpose intended.The DWP do not checkwhether the need for whichthe application is madecould be met by other localschemes.Lewisham’s Local SupportSchemeLewisham, providing it hasbeen verified by the DWP.A 2% monthly interest ratewill be levied (via the CreditUnion) on all loans.The Credit Union willmanage the administrationof Emergency Loans onbehalf of the <strong>Council</strong> and allapplicants will be required tojoin the Credit Union as acondition of receiving theirloan.The Credit Union will set arepayment plan inconjunction with theapplicant and manage thecollection process.Lewisham will provideapplicants with locallysourced replacement <strong>item</strong>sor vouchers and prepaidcards, which can be used topurchase agreed <strong>item</strong>s atspecified stores.As part of the applicationprocess, the <strong>Council</strong> willassess whether the needcould be met by anotherscheme/funding sourcewithin the authority or by alocal voluntary/communityorganisation.Rationale For Changefraudulent applications.Charging a minimal interestrate on loans will allow us torecycle our available fundingmore effectively, thussupporting a greater numberof residents and ensure thatthe Credit Union is financiallyable to administer thescheme on the <strong>Council</strong>’sbehalf.By using the Credit Union todisburse funds and collectrepayments on our behalf,we will also be able topromote financialresponsibility amongstapplicants and increaseaccess to budgeting support.Unlike the <strong>Council</strong>, the CreditUnion already has existingexpertise and infrastructurein this area. By not needingto establish our ownmechanisms for collectingrepayments, we will be ableto target the maximumamount of funding atvulnerable residents.This approach will ensurethat the requirements of allapplicants are met in themost appropriate mannerand that limited funds areeffectively targeted at thosemost in need.This will not restrict accessto Emergency Loans, butinstead ensure that supportis not duplicated orinconsistently applied. If thesupport that the applicantrequires cannot beaddressed elsewhere anddoes not fall into an areapreviously excluded underthe DWP scheme, then theirapplication will still be

Current DWP SchemeThe DWP do not limit thenumber of grants that anapplicant can receive withina year.Crisis Loans can be used tofund Rent in Advancepayments for applicants whoare moving into theprivately-rented sector.Applications for Crisis Loansare made viatelephone/paper form whilstapplications for CommunityCare Grants are made viapaper form only.Lewisham’s Local SupportSchemeApplicants will be limited toone grant per year.Rent in Advance paymentswill only be made wherethey are part of a successfulSupport Grant applicationinvolving a plannedresettlement process.The majority of applicationswill be made online. Inexceptional circumstances,customers will be able toapply via telephone.Rationale For Changeassessed.By limiting the number ofgrants that applicants canreceive, we will ensure thatthe available funding issustained for the whole yearand the needs of as manyresidents as possible aremet. If applicants requireadditional financial support,then they will be able toaccess this via the CreditUnion.The numbers applying forand receiving funding forRent in Advance paymentsare relatively low, but themoney spent from theoverall Social Fund allocationis significant. However,evidence from the DWPsuggests that the majority ofRent in Advance paymentsare currently made to thoseapplicants who havereceived a Community CareGrant as part of aresettlement process. TheDWP Budgeting Loan schemewill continue to makeprovision for Rent inAdvance payments for allapplicants who are already inreceipt of ongoing benefits,whilst the local scheme willensure that provision is inplace to support people who,because of a period ofinstitutional care, would nothave been eligible forbenefits (and therefore aDWP Budgeting Loan).The introduction of onlineapplications means that theprocess of accessing a loanwill be quicker, easier andmore convenient for themajority of customers whilstthey and third-party

Current DWP SchemeThe DWP have anindependent, nationallybasedSocial FundInspectorate whomunsuccessful applicants canapproach for a review oftheir decision.Lewisham’s Local SupportSchemeReviews will be undertakenby a manager within theBenefits Service who has notbeen involved in either theapplication or decisionmakingprocess.Rationale For Changeadvocates will be required toprovide less supportingevidence. However, therewill be telephone-basedprovision for thosecustomers who are unable toapply online, eitherthemselves or viafriends/family/advocacyorganisation (including thosewill physical disabilities,learning difficulties, mentalhealth issues and thosewhose first language is notEnglish).As each authority whoestablishes a local scheme islikely to have differenteligibility and applicationcriteria, it would not beappropriate to retain anational inspectorate.However, applicants willhave recourse to a local,independent review processif they do not agree with thedecision made regardingtheir application.