Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

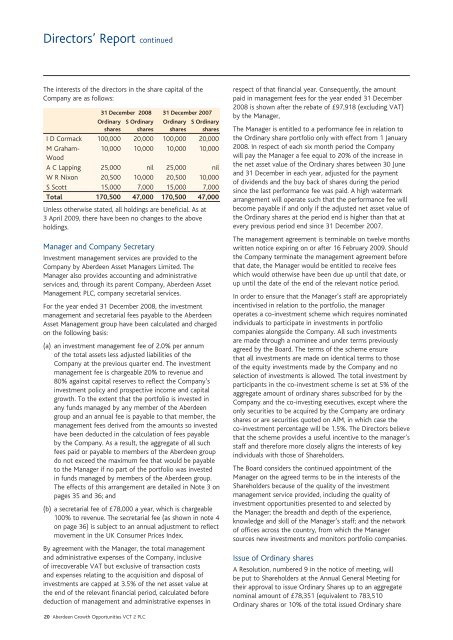

Directors’ Report continuedThe interests of the directors in the share capital of theCompany are as follows:31 December 2008 31 December 2007OrdinarysharesS OrdinarysharesOrdinarysharesS OrdinarysharesI D Cormack 100,000 20,000 100,000 20,000M Graham- 10,000 10,000 10,000 10,000WoodA C Lapping 25,000 nil 25,000 nilW R Nixon 20,500 10,000 20,500 10,000S Scott 15,000 7,000 15,000 7,000Total 170,500 47,000 170,500 47,000Unless otherwise stated, all holdings are beneficial. As at3 April 2009, there have been no changes to the aboveholdings.Manager and Company SecretaryInvestment management services are provided to theCompany by <strong>Aberdeen</strong> <strong>Asset</strong> Managers Limited. TheManager also provides accounting and administrativeservices and, through its parent Company, <strong>Aberdeen</strong> <strong>Asset</strong>Management <strong>PLC</strong>, company secretarial services.For the year ended 31 December 2008, the investmentmanagement and secretarial fees payable to the <strong>Aberdeen</strong><strong>Asset</strong> Management group have been calculated and chargedon the following basis:(a) an investment management fee of 2.0% per annumof the total assets less adjusted liabilities of theCompany at the previous quarter end. The investmentmanagement fee is chargeable 20% to revenue and80% against capital reserves to reflect the Company’sinvestment policy and prospective income and capitalgrowth. To the extent that the portfolio is invested inany funds managed by any member of the <strong>Aberdeen</strong>group and an annual fee is payable to that member, themanagement fees derived from the amounts so investedhave been deducted in the calculation of fees payableby the Company. As a result, the aggregate of all suchfees paid or payable to members of the <strong>Aberdeen</strong> groupdo not exceed the maximum fee that would be payableto the Manager if no part of the portfolio was investedin funds managed by members of the <strong>Aberdeen</strong> group.The effects of this arrangement are detailed in Note 3 onpages 35 and 36; and(b) a secretarial fee of £78,000 a year, which is chargeable100% to revenue. The secretarial fee (as shown in note 4on page 36) is subject to an annual adjustment to reflectmovement in the UK Consumer Prices Index.By agreement with the Manager, the total managementand administrative expenses of the Company, inclusiveof irrecoverable VAT but exclusive of transaction costsand expenses relating to the acquisition and disposal ofinvestments are capped at 3.5% of the net asset value atthe end of the relevant financial period, calculated beforededuction of management and administrative expenses inrespect of that financial year. Consequently, the amountpaid in management fees for the year ended 31 December2008 is shown after the rebate of £97,918 (excluding VAT)by the Manager,The Manager is entitled to a performance fee in relation tothe Ordinary share portfolio only with effect from 1 January2008. In respect of each six month period the Companywill pay the Manager a fee equal to 20% of the increase inthe net asset value of the Ordinary shares between 30 Juneand 31 December in each year, adjusted for the paymentof dividends and the buy back of shares during the periodsince the last performance fee was paid. A high watermarkarrangement will operate such that the performance fee willbecome payable if and only if the adjusted net asset value ofthe Ordinary shares at the period end is higher than that atevery previous period end since 31 December 2007.The management agreement is terminable on twelve monthswritten notice expiring on or after 16 February 2009. Shouldthe Company terminate the management agreement beforethat date, the Manager would be entitled to receive feeswhich would otherwise have been due up until that date, orup until the date of the end of the relevant notice period.In order to ensure that the Manager’s staff are appropriatelyincentivised in relation to the portfolio, the manageroperates a co-investment scheme which requires nominatedindividuals to participate in investments in portfoliocompanies alongside the Company. All such investmentsare made through a nominee and under terms previouslyagreed by the Board. The terms of the scheme ensurethat all investments are made on identical terms to thoseof the equity investments made by the Company and noselection of investments is allowed. The total investment byparticipants in the co-investment scheme is set at 5% of theaggregate amount of ordinary shares subscribed for by theCompany and the co-investing executives, except where theonly securities to be acquired by the Company are ordinaryshares or are securities quoted on AIM, in which case theco-investment percentage will be 1.5%. The Directors believethat the scheme provides a useful incentive to the manager’sstaff and therefore more closely aligns the interests of keyindividuals with those of Shareholders.The Board considers the continued appointment of theManager on the agreed terms to be in the interests of theShareholders because of the quality of the investmentmanagement service provided, including the quality ofinvestment opportunities presented to and selected bythe Manager; the breadth and depth of the experience,knowledge and skill of the Manager’s staff; and the networkof offices across the country, from which the Managersources new investments and monitors portfolio companies.Issue of Ordinary sharesA Resolution, numbered 9 in the notice of meeting, willbe put to Shareholders at the Annual General Meeting fortheir approval to issue Ordinary Shares up to an aggregatenominal amount of £78,351 (equivalent to 783,510Ordinary shares or 10% of the total issued Ordinary share20 <strong>Aberdeen</strong> <strong>Growth</strong> <strong>Opportunities</strong> <strong>VCT</strong> 2 <strong>PLC</strong>