Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

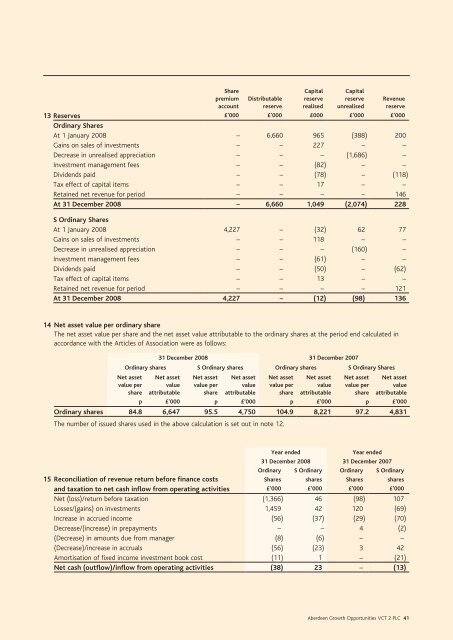

SharepremiumaccountDistributablereserveCapitalreserverealisedCapitalreserveunrealisedRevenuereserve13 Reserves £’000 £’000 £000 £’000 £’000Ordinary SharesAt 1 January 2008 – 6,660 965 (388) 200Gains on sales of investments – – 227 – –Decrease in unrealised appreciation – – – (1,686) –Investment management fees – – (82) – –Dividends paid – – (78) – (118)Tax effect of capital items – – 17 – –Retained net revenue for period – – – – 146At 31 December 2008 – 6,660 1,049 (2,074) 228S Ordinary SharesAt 1 January 2008 4,227 – (32) 62 77Gains on sales of investments – – 118 – –Decrease in unrealised appreciation – – – (160) –Investment management fees – – (61) – –Dividends paid – – (50) – (62)Tax effect of capital items – – 13 – –Retained net revenue for period – – – – 121At 31 December 2008 4,227 – (12) (98) 13614 Net asset value per ordinary shareThe net asset value per share and the net asset value attributable to the ordinary shares at the period end calculated inaccordance with the Articles of Association were as follows:31 December 2008 31 December 2007Ordinary shares S Ordinary shares Ordinary shares S Ordinary SharesNet assetvalue pershareNet assetvalueattributableNet assetvalue pershareNet assetvalueattributableNet assetvalue pershareNet assetvalueattributableNet assetvalue pershareNet assetvalueattributablep £’000 p £’000 p £’000 p £’000Ordinary shares 84.8 6,647 95.5 4,750 104.9 8,221 97.2 4,831The number of issued shares used in the above calculation is set out in note 12.Year ended31 December 2008Year ended31 December 200715 Reconciliation of revenue return before finance costsOrdinarySharesS OrdinarysharesOrdinarySharesS Ordinarysharesand taxation to net cash inflow from operating activities £’000 £’000 £’000 £’000Net (loss)/return before taxation (1,366) 46 (98) 107Losses/(gains) on investments 1,459 42 120 (69)Increase in accrued income (56) (37) (29) (70)Decrease/(increase) in prepayments – – 4 (2)(Decrease) in amounts due from manager (8) (6) – –(Decrease)/increase in accruals (56) (23) 3 42Amortisation of fixed income investment book cost (11) 1 – (21)Net cash (outflow)/inflow from operating activities (38) 23 – (13)<strong>Aberdeen</strong> <strong>Growth</strong> <strong>Opportunities</strong> <strong>VCT</strong> 2 <strong>PLC</strong> 41