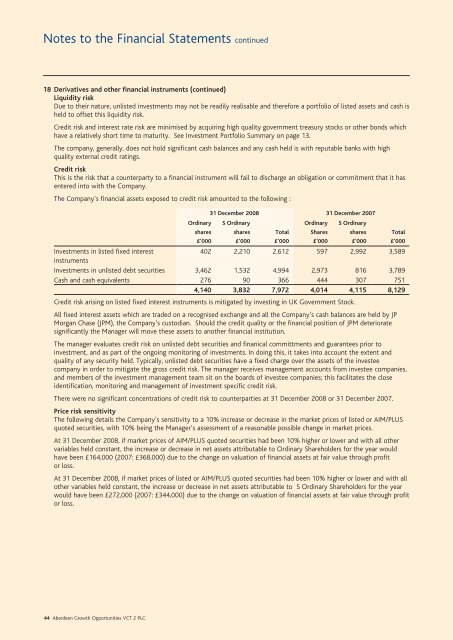

Notes to the Financial Statements continued18 Derivatives and other financial instruments (continued)Liquidity riskDue to their nature, unlisted investments may not be readily realisable and therefore a portfolio of listed assets and cash isheld to offset this liquidity risk.Credit risk and interest rate risk are minimised by acquiring high quality government treasury stocks or other bonds whichhave a relatively short time to maturity. See Investment Portfolio Summary on page 13.The company, generally, does not hold significant cash balances and any cash held is with reputable banks with highquality external credit ratings.Credit riskThis is the risk that a counterparty to a financial instrument will fail to discharge an obligation or commitment that it hasentered into with the Company.The Company’s financial assets exposed to credit risk amounted to the following :Ordinaryshares31 December 2008 31 December 2007S Ordinaryshares TotalOrdinarySharesS OrdinarysharesTotal£’000 £’000 £’000 £’000 £’000 £’000Investments in listed fixed interest402 2,210 2,612 597 2,992 3,589instrumentsInvestments in unlisted debt securities 3,462 1,532 4,994 2,973 816 3,789Cash and cash equivalents 276 90 366 444 307 7514,140 3,832 7,972 4,014 4,115 8,129Credit risk arising on listed fixed interest instruments is mitigated by investing in UK Government Stock.All fixed interest assets which are traded on a recognised exchange and all the Company’s cash balances are held by JPMorgan Chase (JPM), the Company’s custodian. Should the credit quality or the financial position of JPM deterioratesignificantly the Manager will move these assets to another financial institution.The manager evaluates credit risk on unlisted debt securities and finanical committments and guarantees prior toinvestment, and as part of the ongoing monitoring of investments. In doing this, it takes into account the extent andquality of any security held. Typically, unlisted debt securities have a fixed charge over the assets of the investeecompany in order to mitigate the gross credit risk. The manager receives management accounts from investee companies,and members of the investment management team sit on the boards of investee companies; this facilitates the closeidentification, monitoring and management of investment specific credit risk.There were no significant concentrations of credit risk to counterparties at 31 December 2008 or 31 December 2007.Price risk sensitivityThe following details the Company’s sensitivity to a 10% increase or decrease in the market prices of listed or AIM/PLUSquoted securities, with 10% being the Manager’s assessment of a reasonable possible change in market prices.At 31 December 2008, if market prices of AIM/PLUS quoted securities had been 10% higher or lower and with all othervariables held constant, the increase or decrease in net assets attributable to Ordinary Shareholders for the year wouldhave been £164,000 (2007: £368,000) due to the change on valuation of financial assets at fair value through profitor loss.At 31 December 2008, if market prices of listed or AIM/PLUS quoted securities had been 10% higher or lower and with allother variables held constant, the increase or decrease in net assets attributable to S Ordinary Shareholders for the yearwould have been £272,000 (2007: £344,000) due to the change on valuation of financial assets at fair value through profitor loss.44 <strong>Aberdeen</strong> <strong>Growth</strong> <strong>Opportunities</strong> <strong>VCT</strong> 2 <strong>PLC</strong>

Notice of MeetingThis document is important and requires your immediate attention. If you are in any doubt as to what action youshould take, you are recommended to seek your own financial advice from your stockbroker or other independentadviser authorised under the Financial Services and Markets Act 2000. If you have sold or transferred all of yourshares in <strong>Aberdeen</strong> <strong>Growth</strong> <strong>Opportunities</strong> <strong>VCT</strong> 2 <strong>PLC</strong>, please forward this document, together with the accompanyingdocuments, as soon as possible to the purchaser or transferee or to the stockbroker, bank or other agent throughwhom the sale or transfer was effected for transmission to the purchaser or transferee.Notice is hereby given that the fifth Annual General Meeting of <strong>Aberdeen</strong> <strong>Growth</strong> <strong>Opportunities</strong> <strong>VCT</strong> 2 <strong>PLC</strong> will be held onThursday 14 May 2009 at 10.30 a.m. at One Bow Churchyard, London EC4M 9HH to transact the following business:Ordinary BusinessTo consider and, if thought fit, pass the following as Ordinary Resolutions:1. To receive the Directors’ Report and audited financial statements for the year ended 31 December 20082. To approve the Directors’ Remuneration Report3. To approve the payment of a final dividend of 1.3p to Ordinary Shareholders and a final dividend of 1.8p to S OrdinaryShareholders4. To re-elect Mr I D Cormack as a Director.5. To re-elect Mr M Graham-Wood as a Director.6. To elect Mr W R Nixon as a Director.7. To re-appoint Deloitte LLP as Auditors.8. To authorise the Directors to fix the remuneration of the Auditors.Special Business9. To consider and, if thought fit, pass the following Resolution as an Ordinary Resolution:THAT the Directors be and are hereby generally and unconditionally authorised pursuant to Section 80 of the CompaniesAct 1985 to exercise all the powers of the Company to allot relevant securities (as defined in that section) up to anaggregate nominal amount of £78,351 (representing 10% of the total Ordinary share capital in issue on 31 March 2009)and £49,724 (representing 10% of the S Ordinary share capital in issue on 31 March 2009) during the period expiring(unless previously revoked, varied, or extended by the Company in general meeting) on the date of the next AnnualGeneral Meeting or on the expiry of fifteen months from the passing of this Resolution, whichever is the first to occur,save that the Company may make offers or agreements before such expiry which would or might require relevantsecurities to be allotted after such expiry.10. To consider and, if thought fit, pass the following Resolutions as Special Resolutions:THAT, subject to passing of Resolution numbered 9 set out above, the Directors be and are hereby empowered, pursuantto Section 95 of the Companies Act 1985 (“the Act”), to allot equity securities (as defined in Section 94 of the Act)pursuant to the authority given in accordance with Section 80 of the Act by the said Resolution numbered 9 as if Section89(1) of the Act did not apply to such allotment, provided that this power shall be limited to allotments:(a) during the period expiring on the earlier of the date of the next Annual General Meeting of the Company or on theexpiry of fifteen months from the passing of this Resolution, whichever is the first to occur, but so that this power shallenable the Company to make offers or agreements which would or might require equity securities to be allotted afterthe expiry of this power; and(b) of Ordinary shares up to an aggregate nominal amount of £78,351 and S Ordinary shares up to an aggregate nomimalamount of £49,724.11. THAT the Company be and is hereby generally and, subject as here and after appears, unconditionally authorised inaccordance with Section 166 of the Companies Act 1985 (“the Act”) to make market purchases (within the meaning ofSection 163(3) of the Act) of Ordinary shares of 10p each in the capital of the Company:provided always that:(a) the maximum number of shares hereby authorised to be purchased is 783,516 Ordinary representing 10% of theCompany’s issued Ordinary share capital as at 31 March 2009; and 497,245 representing 10% of the issued S Ordinaryshare capital at that date;(b) the minimum price which may be paid for a share shall be 10p per share;<strong>Aberdeen</strong> <strong>Growth</strong> <strong>Opportunities</strong> <strong>VCT</strong> 2 <strong>PLC</strong> 45