Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

Aberdeen Growth Opportunities VCT 2 PLC - Aberdeen Asset ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

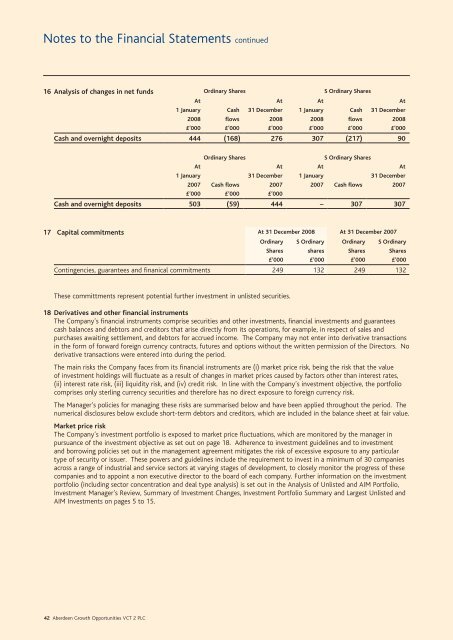

Notes to the Financial Statements continued16 Analysis of changes in net funds Ordinary Shares S Ordinary SharesAt1 January2008CashflowsAt31 December2008At1 January2008CashflowsAt31 December2008£’000 £’000 £’000 £’000 £’000 £’000Cash and overnight deposits 444 (168) 276 307 (217) 90Ordinary SharesS Ordinary SharesAt1 January2007 Cash flowsAt31 December2007At1 January2007 Cash flowsAt31 December2007£’000 £’000 £’000Cash and overnight deposits 503 (59) 444 – 307 30717 Capital commitments At 31 December 2008 At 31 December 2007OrdinarySharesS OrdinarysharesOrdinarySharesS OrdinaryShares£’000 £’000 £'000 £'000Contingencies, guarantees and finanical commitments 249 132 249 132These committments represent potential further investment in unlisted securities.18 Derivatives and other financial instrumentsThe Company’s financial instruments comprise securities and other investments, financial investments and guaranteescash balances and debtors and creditors that arise directly from its operations, for example, in respect of sales andpurchases awaiting settlement, and debtors for accrued income. The Company may not enter into derivative transactionsin the form of forward foreign currency contracts, futures and options without the written permission of the Directors. Noderivative transactions were entered into during the period.The main risks the Company faces from its financial instruments are (i) market price risk, being the risk that the valueof investment holdings will fluctuate as a result of changes in market prices caused by factors other than interest rates,(ii) interest rate risk, (iii) liquidity risk, and (iv) credit risk. In line with the Company’s investment objective, the portfoliocomprises only sterling currency securities and therefore has no direct exposure to foreign currency risk.The Manager’s policies for managing these risks are summarised below and have been applied throughout the period. Thenumerical disclosures below exclude short-term debtors and creditors, which are included in the balance sheet at fair value.Market price riskThe Company’s investment portfolio is exposed to market price fluctuations, which are monitored by the manager inpursuance of the investment objective as set out on page 18. Adherence to investment guidelines and to investmentand borrowing policies set out in the management agreement mitigates the risk of excessive exposure to any particulartype of security or issuer. These powers and guidelines include the requirement to invest in a minimum of 30 companiesacross a range of industrial and service sectors at varying stages of development, to closely monitor the progress of thesecompanies and to appoint a non executive director to the board of each company. Further information on the investmentportfolio (including sector concentration and deal type analysis) is set out in the Analysis of Unlisted and AIM Portfolio,Investment Manager’s Review, Summary of Investment Changes, Investment Portfolio Summary and Largest Unlisted andAIM Investments on pages 5 to 15.42 <strong>Aberdeen</strong> <strong>Growth</strong> <strong>Opportunities</strong> <strong>VCT</strong> 2 <strong>PLC</strong>