Japan equities â A multi-year story - JP Morgan Asset Management

Japan equities â A multi-year story - JP Morgan Asset Management

Japan equities â A multi-year story - JP Morgan Asset Management

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

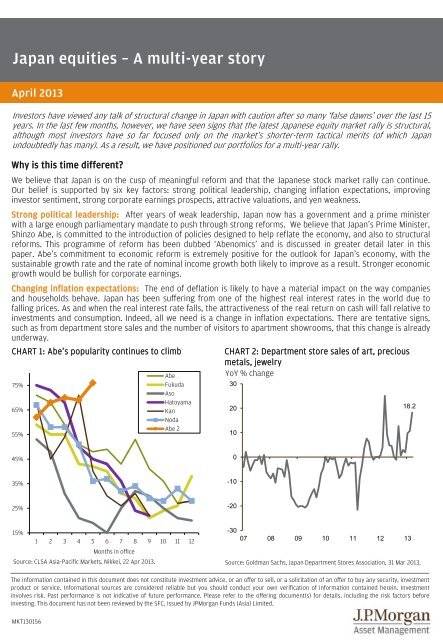

<strong>Japan</strong> <strong>equities</strong> – A <strong>multi</strong>-<strong>year</strong> <strong>story</strong>April 2013Investors have viewed any talk of structural change in <strong>Japan</strong> with caution after so many ‘false dawns’ over the last 15<strong>year</strong>s. In the last few months, however, we have seen signs that the latest <strong>Japan</strong>ese equity market rally is structural,although most investors have so far focused only on the market’s shorter-term tactical merits (of which <strong>Japan</strong>undoubtedly has many). As a result, we have positioned our portfolios for a <strong>multi</strong>-<strong>year</strong> rally.Why is this time different?We believe that <strong>Japan</strong> is on the cusp of meaningful reform and that the <strong>Japan</strong>ese stock market rally can continue.Our belief is supported by six key factors: strong political leadership, changing inflation expectations, improvinginvestor sentiment, strong corporate earnings prospects, attractive valuations, and yen weakness.Strong political leadership: After <strong>year</strong>s of weak leadership, <strong>Japan</strong> now has a government and a prime ministerwith a large enough parliamentary mandate to push through strong reforms. We believe that <strong>Japan</strong>’s Prime Minister,Shinzo Abe, is committed to the introduction of policies designed to help reflate the economy, and also to structuralreforms. This programme of reform has been dubbed ‘Abenomics’ and is discussed in greater detail later in thispaper. Abe’s commitment to economic reform is extremely positive for the outlook for <strong>Japan</strong>’s economy, with thesustainable growth rate and the rate of nominal income growth both likely to improve as a result. Stronger economicgrowth would be bullish for corporate earnings.Changing inflation expectations: The end of deflation is likely to have a material impact on the way companiesand households behave. <strong>Japan</strong> has been suffering from one of the highest real interest rates in the world due tofalling prices. As and when the real interest rate falls, the attractiveness of the real return on cash will fall relative toinvestments and consumption. Indeed, all we need is a change in inflation expectations. There are tentative signs,such as from department store sales and the number of visitors to apartment showrooms, that this change is alreadyunderway.CHART 1: Abe’s popularity continues to climb75%65%55%AbeFukudaAsoHatoyamaKanNodaAbe 2CHART 2: Department store sales of art, preciousmetals, jewelryYoY % change30201018.245%035%-1025%-2015%1 2 3 4 5 6 7 8 9 10 11 12Months in officeSource: CLSA Asia-Pacific Markets, Nikkei, 22 Apr 2013.-3007 08 09 10 11 12 13Source: Goldman Sachs, <strong>Japan</strong> Department Stores Association, 31 Mar 2013.The information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investmentproduct or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein. Investmentinvolves risk. Past performance is not indicative of future performance. Please refer to the offering document(s) for details, including the risk factors beforeinvesting. This document has not been reviewed by the SFC. Issued by <strong>JP</strong><strong>Morgan</strong> Funds (Asia) Limited.MKT130156

<strong>Japan</strong> <strong>equities</strong> – A <strong>multi</strong>-<strong>year</strong> <strong>story</strong>We believe that wage increases are a necessary condition for ending deflation. The Abe government has emphasisedthe importance of rising nominal wages, and has decided to introduce tax breaks for private-sector firms thatincrease their average nominal wage. In addition, nominal wages in the manufacturing sector have followedcorporate profitability. If we are right and earnings improve strongly in the future, nominal wages are likely to followa similar path.Improving investor sentiment: We believe that investors in general are still sceptical towards <strong>Japan</strong>. We continueto encounter the question: “Is it different this time?” We believe that <strong>Japan</strong> is now in a long reflationary cycle, withsome parallels to historical reflationary cycles in other markets elsewhere, but which will be far longer in durationthan the 2004-2007 cycle under Prime Minister Junichiro Koizumi. In fact, in the recent hi<strong>story</strong> of <strong>Japan</strong>ese politics,no prime minister aside from Koizumi has enjoyed popularity ratings as high as Abe’s.Newly appointed Bank of <strong>Japan</strong> (BoJ) governor Haruhiko Kuroda has demonstrated his commitment to the centralbank’s 2% inflation target by aggressively expanding quantitative easing at a policy setting meeting held on 3-4 April.Equally important is our view that the valuation of the <strong>Japan</strong>ese market does not reflect excessive optimism aboutpotential structural economic reform. In other words, investors are not being asked to pay much to give Abenomicsthe benefit of the doubt.While <strong>Japan</strong>ese investors continue to avoid their own domestic market, we believe that it will only be a matter oftime before they start to re-examine their allocations. Rising wage inflation, stronger market returns, positivesentiment and reforms to encourage domestic investment, such as the administration’s preparations for a <strong>Japan</strong>eseversion of the UK’s Individual Savings Account, will ultimately encourage domestic investors back into the market.Compared to other developed markets, <strong>Japan</strong>ese domestic investors are very overweight cash and underweight<strong>equities</strong>.CHART 3: <strong>Japan</strong>ese individuals are under-allocated to <strong>equities</strong>Financial assets held by householdsBonds 2.2%Investment trusts 3.8%<strong>Japan</strong>(¥1,510trn)Currency and deposits55.6%Insurance and pensionreserves 28.2%Others 4.4%Shares and <strong>equities</strong> 5.8%United States(US$53.6trn)Currency and deposits14.3%Bonds 8.7%Shares and <strong>equities</strong>32.9%Insurance and pensionreserves 28.5%Others 3.3%Investment trusts 12.3%Euro area(€19.0trn)Currency and deposits36.4%Bonds 7.0%Shares and <strong>equities</strong> 14.3%Insurance and pensionreserves 31.8%Others 3.4%Investment trusts 7.0%0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%Source: BoJ, Federal Reserve, ECB, CLSA Asia-Pacific Markets, December 2012.Strong corporate earnings prospects: At the current exchange rate of around 95-100 <strong>JP</strong>Y/USD, the outlook for<strong>Japan</strong>ese companies is dramatically different from six months ago. Many <strong>Japan</strong>ese exporters have worked very hardover the past <strong>year</strong>s to maintain their global competitiveness under a continuously appreciating currency. As a result,we believe that there is a strong chance that the market is underestimating the operational gearing of <strong>Japan</strong>esecompanies to a weaker yen. Chart 4 below shows the impact of a weakening yen on company profits.

<strong>Japan</strong> <strong>equities</strong> – A <strong>multi</strong>-<strong>year</strong> <strong>story</strong>Attractive valuations: Despite the rally since the fourth quarter of last <strong>year</strong>, <strong>Japan</strong> continues to offer attractivevaluations relative to other markets. The TOPIX is still 40% below the 2007 peak prior to the Lehman crisis. In 2007,the yen exchange rate fell as far as 124 against the US dollar. Today the rate is 98 <strong>JP</strong>Y/USD. <strong>Japan</strong> also offers someof the fastest earnings growth opportunities over the 2012-2014 period.EUR/<strong>JP</strong>YCHART 4: Corporate earnings sensitivity to yenTopix: FY3/14 YoY net profit growth based on arange of currency forecastsYen weakness: Our base-case scenario is that the yen will depreciate against the US dollar on a medium-term viewfor the following reasons:1. The BoJ’s commitment to double the monetary base over the next two <strong>year</strong>s (Chart 6) is more aggressive thanthe US Federal Reserve’s (Fed’s) pace of easing.2. We believe that the Fed is likely to withdraw its monetary stimulus earlier than the BoJ as the US economycontinues to improve.3. Although the yen’s fall from highs of around 77 <strong>JP</strong>Y/USD in 2012 to the current 98 level is significant, it isimportant to put this into longer-term context. As already explained, before the Lehman crisis took hold in 2007,the yen was trading as low as 124 to the US dollar.We also believe that any further fall in the yen exchange rate against the US dollar will be gradual. This is becausethe most significant catalyst for yen weakness has already happened – namely the BoJ’s aggressive policy response.A further sharp fall in the yen-dollar rate from the current level could start to have a negative impact on both theeconomy and corporate profitability in the form of rising import prices.We would like to emphasise that our positive stance towards <strong>Japan</strong>ese <strong>equities</strong> is not contingent upon the yen’sfurther weakness. We believe <strong>Japan</strong> offers strong earnings growth potential as well as compelling valuations at thecurrent exchange rate.CHART 6: Central bank balance sheetsCHART 7: The yen – a long term perspective% of nominal GDP USD/<strong>JP</strong>Y70%60%50%40%USD/<strong>JP</strong>Y95 100 105 110 115120 47% 51% 55% 58% 62%130 50% 53% 57% 61% 65%140 52% 56% 59% 63% 67%150 54% 58% 62% 65% 69%Source: Nomura Securities, April 2013.Universe is Topix 1st section.BoJFedBoEECBProjectionsCHART 5: Valuations remain attractive320270220EPS Growth P/E P/E P/BFY3/14E FY3/15E FY3/14E FY3/15E FY3/14E<strong>Japan</strong> 51% 15% 13.6x 11.9x 1.2xUS 11% 8% 14.4x 13.4x 2.4xEurope 9% 12% 13.0x 11.6x 1.8xAsia (ex. <strong>Japan</strong>) 12% 15% 12.2x 11.1x 1.6xSource: Toyo Keizai estimates, GS Global ECS Research calculations, March 2013.Note: <strong>Japan</strong>ese universe is TSE1. US universe is S&P500. European universe is GScovered firms which are part of DJ Stoxx 600 (excluding financials). P/E for US isbased on GS Global ECS Research operating EPS forecasts, and P/E for Europe is ona pre-amortization basis. Asia excluding <strong>Japan</strong> universe is MSCI US$ basis marketindex (local currency) and is based on FactSet and I/B/E/S estimates. As of March2013.30%20%10%1701200%70'08 '09 '10 '11 '12 '13 '14'76 '79 '82 '85 '88 '91 '94 '97 '00 '03 '06 '09 '12Source: Datastream, Eurostat, BoJ, US Federal Reserve, BoE, March 2013. Source: Bloomberg, March 2013.

<strong>Japan</strong> <strong>equities</strong> – A <strong>multi</strong>-<strong>year</strong> <strong>story</strong>Abenomics – why has the change in political leadership had such a galvanising effect?Shinzo Abe became Prime Minister for the second time in December 2012. After an ineffectual first stint in office in2007, Abe won a landslide victory in the Lower House elections at the end of last <strong>year</strong>. Abe’s large parliamentarymajority has enabled him to push forward with his reform policies. The term ‘Abenomics’ is being widely used inmedia circles to describe these reforms, primarily focusing on monetary and fiscal policies to encourage economicgrowth.Three arrows: An Agenda for a <strong>Japan</strong>ese economic revivalAbe aims to bring the <strong>Japan</strong>ese economy to a sound, sustainable growth path through three policy initiatives, knownas the “three arrows of Abenomics”.1. Structural reform (long term): Abe has set up an Industrial Competitiveness Council, whose task is to providethe Prime Minister with growth strategies. The Council members include such high-profile industry figures asMasahiro Sakene, chairman of Komatsu, Yasuchika Hasegawa, Chief Executive of Takeda, and Hiroshi Mikitani,Chairman and Chief Executive of Rakuten. The council is scheduled to submit their recommendations in June.This is the next event that is likely to come under scrutiny as investors determine whether this ‘time is different’.It is also worth highlighting that the Prime Minister has committed to engage in the Trans Pacific Partnership(TPP) trade negotiations. This has been one of the most controversial parts of the political agenda, and mostpoliticians have avoided the issue in the past. As such, this to us is another piece of evidence that PM Abe isdifferent from his predecessors.2. Monetary policy (short-to-medium term): Monetary policy is expected to play a key role in boosting economicgrowth. At its policy setting meeting on 3-4 April, the BoJ fired a ‘bazooka’ by adopting both quantitative andqualitative monetary easing measures that governor Kuroda described as a ‘new dimension in monetary easing’.This was the BoJ’s first policy meeting under Kuroda’s leadership, and market expectations had risen so high thatit had become difficult for the central bank to surprise to the upside. In the event, the BoJ did positively surprisethe market with measures that comfortably exceeded even the most bullish expectations. The keyannouncements from the BoJ so far have been:• New monetary base target – The BoJ changed its operational target for the monetary base from theovernight call rate, such that the monetary base is projected to increase at an annual pace of <strong>JP</strong>Y 60-70trillion. That compares to a <strong>JP</strong>Y 13.4 trillion increase in 2012 and a <strong>JP</strong>Y 15.6 trillion increase in 2011. Thistherefore represents a major historical change in BoJ policy.• A two-<strong>year</strong> timeframe to hit its inflation goal – The BoJ indicated that the 2% inflation target shouldbe achieved in around two <strong>year</strong>s, which is aggressive given that <strong>Japan</strong> has not experienced headlineinflation of 2% in over 20 <strong>year</strong>s.• More <strong>Japan</strong>ese quantitative easing – The BoJ will increase its <strong>Japan</strong>ese Government Bond (JGB)purchases to <strong>JP</strong>Y 50 trillion a <strong>year</strong> from the current <strong>JP</strong>Y 20 trillion a <strong>year</strong>.• Larger duration target – The BoJ will extend the maturity of its JGB purchases to 40 <strong>year</strong>s, with anextension of the average maturity of JGBs purchased to seven <strong>year</strong>s from the current three <strong>year</strong>s.• More purchases of different types of asset class – The BoJ will increase its annual purchases ofexchange traded funds and real estate investment trusts (J-REITs).3. Fiscal policy (short term): Because structural reform takes time to have an impact on the economy, Abe isdetermined to stimulate growth in the short term using fiscal policy. However, it has to be stressed that fiscalstimulus is only being used to bridge the gap until monetary stimulus and structural reform start to have animpact on the economy.

<strong>Japan</strong> <strong>equities</strong> – A <strong>multi</strong>-<strong>year</strong> <strong>story</strong><strong>JP</strong><strong>Morgan</strong> <strong>Japan</strong> (Yen) Fund• The Fund invests primarily in <strong>Japan</strong>ese securities and other securities whose performance is linked to that of the<strong>Japan</strong>ese economy.• The Fund is therefore exposed to diversification, currency and equity risks.• Investors may be subject to substantial losses.• Investors should not solely rely on this document to make any investment decision.A key feature about the fund is that it can gear. The fund is currently around 20% geared, close to the maximumallowed. It was increased from zero at the end of 2011 on the back of low valuations and from 10% at the end of2012 following Abe’s decisive election victory. The high level of gearing reflects our very bullish view on themarket. The key themes discussed earlier in this document are played through a number of positions:• Yen depreciation and <strong>Japan</strong>ese exporter competitivenessMachinery & Autos: As mentioned earlier a weaker yen has helped exporters in <strong>Japan</strong> and has had a positiveimpact on earnings. However, this is more than a <strong>story</strong> of yen weakness, with <strong>Japan</strong>ese companies still globalleaders in industries like autos and factory automation, where they are key beneficiaries of the emerging marketgrowth <strong>story</strong>.• Domestic reflationFinancial & Real Estate: Our portfolios are very overweight financials (around 40% of the portfolio). Banks willbenefit from increased loan demand as well as from being able to sell more investment products. Real estatecompanies will benefit as the improved economic outlook pushes down vacancy rates and drives up rents. Wealso expect housing and apartment sales to improve.• Consumption growthRetailers & Services: The improved outlook for export companies thanks to the weaker yen will feed directlythrough to the domestic economy in the form of higher profits and in turn higher wages. Eventually, we expectwages to rise as the economy improves, which should in turn increase demand for discretionary goods. Ourportfolios are therefore overweight retailers. We also have an overweight position in companies that will benefitfrom the new government’s plan to increase public works spending. We think that the changes in <strong>Japan</strong> arestructural and long-term in nature, and therefore our portfolios are positioned to take advantage of this.• Underweight sectors: defensive sectors, such as electric utilities and pharmaceuticals, which we believe willunderperform due to a poor earnings outlook and unattractive valuations. We are also underweight consumerelectronics and steel as we believe they have long term competitive issues that will not be remedied by theweaker Yen.Fund Performance (USD)(%) YTD 6 Months 1 Year 2 Years 3 Years<strong>JP</strong><strong>Morgan</strong> <strong>Japan</strong> (Yen) Fund +18.4 +21.4 +17.9 +14.6 +17.3TOPIX (Net) +11.4 +17.5 +8.4 +9.7 +12.1Excess Return +7.0 +3.9 +9.5 +4.9 +5.22008 2009 2010 2011 2012<strong>JP</strong><strong>Morgan</strong> <strong>Japan</strong> (Yen) Fund -34.0 -1.3 +16.0 -10.8 +5.9As at 28 Mar 2013.Source: J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong>/Thomson Reuters Datastream (NAV to NAV in USD with income reinvested).Portfolio ManagerNicholas WeindlingFor more information, please call us at:Tel: (852) 2265 1188 Fax: (852) 2868 5013 www.jpmorganam.com.hkThe information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investmentproduct or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein. Investmentinvolves risk. Past performance is not indicative of future performance. Please refer to the offering document(s) for details, including the risk factors beforeinvesting. This document has not been reviewed by the SFC. Issued by <strong>JP</strong><strong>Morgan</strong> Funds (Asia) Limited.