Credit Cards â Bankinginfo

Credit Cards â Bankinginfo

Credit Cards â Bankinginfo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

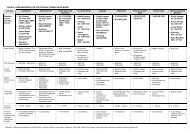

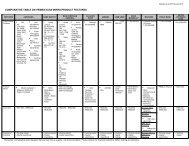

WHAT IS A CREDIT CARD ANDHOW IT WORKS?A credit card is a payment instrumentthat enables you to make purchasesof goods and payment for services insteadof using cash. You can use the credit cardat any merchant, locally or internationally,which displays the same credit card brandas that on your credit card.When you use your credit card, thecredit card issuer will pay the merchanton your behalf first and bill you later.Once you get your monthly statement,you are required to settle at least theminimum repayment amount by the duedate. An interest free period (usually20 days) is granted by the credit card issuerwhere you do not have to pay any intereston the outstanding amount. The creditcard issuer will impose finance charges(interest) on the outstanding amount ifit is not paid by the due date.A credit card can also be used for cashadvances at Automated Teller Machines(ATMs) and at respective credit card issuers’counters. However, a cash advance fee maybe charged for each cash advance transactionon top of the finance charge. There is alsono interest free period for cash advance.The finance charge is calculated from thecash advance date.The credit card issuer will send you amonthly credit card statement with detailsof your purchases including cash advances(if any), the total outstanding balance,the minimum payment amount and thepayment due date.APPLYING FOR A CREDIT CARDYou can apply for a credit card frominstitutions issuing credit cards, as long asyou are 21 years old or above, earn anincome of at least a minimum of RM18,000per year and comply with any otherrequirements set by the credit card issuer.2

To support your application, you maybe required to submit the following:• A photocopy of your Identity Card (IC)• Job appointment letter• Latest income tax statement (Form J)• Bank statements• Previous months pay slipsIf you are self-employed, you may be requiredto submit your business registration detailsand other documentary proof of income,and be subject to other requirements suchas placement of a fixed deposit.APPLICATION PROCESSAn application for a credit card is similarto that for a loan. The credit card issuerwill need to carry out a credit assessmenton you based on the information you haveprovided. The length of time taken toprocess your application would depend onthe credit card issuer’s internal procedures.Once your application has been processed,you will be notified whether your applicationis approved or rejected. If your application issuccessful, the credit card will be sent to youthrough registered mail or you will be requestedto collect the credit card at the credit cardissuer’s head office or branch. You will also begiven a Personal Identification Number (PIN),which for security purposes will be sent to youseparately from the credit card. You will needto use your PIN when you make cash advanceswith your credit card at the ATMs.<strong>Credit</strong> card is apayment instrumentthat promotese-payment3

Read andunderstandthe terms andconditions for the useof the credit cardTERMS AND CONDITIONS (T&C)Normally, the credit card issuer willprovide you with a document on the T&Cof the credit card together with the card.You may be considered to have acceptedthe T&C specified in the document onceyou start using the credit card or uponsigning the acknowledgement of receiptfor the credit card. Therefore, you shouldread and understand the T&C beforesigning the agreement and using yourcredit card as it is a binding documentbetween you and the credit card issuer.Generally, the T&C covers the following:• The types of charges imposed• Rights and responsibilities of thecardholder and the credit card issuer• Usage of the credit card• Terms of repayment and liability forunauthorised transactions• Lodgement procedures for complaints,investigation and resolution• Secrecy of information• OthersConsult your credit card issuer promptlyif you need further clarification on theT&C. If you do not agree with the givenT&C, you may consider cancelling the creditcard by informing the credit card issuerand returning the credit card to the creditcard issuer immediately.UNDERSTANDING THE CHARGESAPPLICABLE FOR CREDIT CARDIt is important for you to understandthe various charges involved in the usageof credit cards. As long as you use yourcredit card wisely and settle payments ontime, you can minimise unnecessarycharges imposed on you. The following arethe common charges that you may incur:4

• Joining fee<strong>Credit</strong> card issuers sometimes imposea one time joining fee for credit cards.The fee may vary depending on the creditcard issuer.• Annual feeThis is a flat fee which is payableannually once you accept the credit card.You will have to pay the fee even thoughyou do not use the credit card. Annual feesmay range from RM60 to RM90 for a classiccard and RM130 to RM195 for a gold card.• Finance charges (Interest charges)These are charges imposed on you bythe credit card issuer on the outstandingbalance which you have not settledwith them after the payment due date.It is usually calculated on a daily rest basis.You are advised to ask your credit cardissuer to explain the method used incalculating the finance charges, as thisamount can be large if you do not makepayments on time.5

You need topay yourbills ontime inorder to avoidrunning upsubstantial billsand being in debt• Cash advance feeThis is a fee charged for each cash advancetransaction. This fee, which normallyranges from 3% to 5% of the total cashadvanced, is in addition to the financecharges imposed on the amount ofthe advance given to you. The financecharge is calculated from the transactiondate or when the amount is posted toyour credit card account. There maybe a limit on the amount of cash advanceallowed for each customer.• Late payment chargeThis is a charge imposed when youfail to pay at least the minimum monthlypayment by the due date. If payment ismade after the interest free period,you will be charged both the financecharges (the interest on your outstandingbalance) and late payment chargesfor the minimum monthly repaymentamount due.TIPS ON SHOPPING FOR CREDIT CARDSWith so many credit cards being offered,it is important for you to get the credit cardthat best suits your needs. Here are sometips for shopping for a credit card orevaluating the credit cards you already have:• Promotional giftsThe credit card issuers may offer youpromotional gifts such as hand-phones,leather wallets, etc to promote theircredit cards. However, before you apply,it is important for you to understandthe T&C related to the offer. Pay attentionto the conditions set for the promotionalgifts and the penalties for not complyingwith such conditions.• Teaser ratesIn order to attract you, credit card issuersmay temporarily offer lower fees andfinance charges, or even waive them fora certain period. The promotional materialsmay highlight an attractive and lowintroductory interest rate in a large, easyto read font size, sometimes without6

expiration date. The interest rate in effectafter the promotion period is disclosedmuch less prominently, i.e. in a smaller fontsize and may only appear on the reverseside of the application or on the last pageof a multi-page promotional material.You should understand the T&C for thepromotion and be aware of when thepromotion period expires as you may becharged the regular or substantiallyhigher fees and charges after the promotionperiod ends.• Finance charges, fees and interest free period<strong>Credit</strong> card business generates profits mainlyfrom finance charges. You will be imposedfinance charges if you do not settle youroutstanding balance in full after the interestfree period. However, for cash advance andbalance transfer, you may be charged a fee aswell as finance charges starting from thetransaction date. Pay attention to the fees forcash advance and balance transfer transactions,the finance charges and the interest freeperiod offered by the credit card issuers.7

a.Interest free period<strong>Credit</strong> card issuers offer an interestfree period, usually 20 days, from theposting or statement date up to thedue date, except for cash advance andbalance transfer. Therefore, shop forcredit cards that offer longer interestfree periods to settle your balances infull without incurring finance charges.b.Fees on cash advance/balance transferMost credit card issuers impose a cashadvance fee on top of finance chargeswhen you use your credit card for cashadvance or balance transfer transactions.The cash advance fee may vary between3% to 5% of the amount. Thus, alwaysconsider applying for credit cardswhich has lower cash advance/balancetransfer fees.TIPS ON HOW TO MINIMISE YOURCREDIT CARD CHARGESIt is possible for you to avoid some of thecredit card charges and still have theconvenience of using a credit card. Hereare some tips on how that is possible:• Shop around for the best deal. Some creditcard issuers do not charge any annual feesand joining fees, at least for the first year• Use your ATM card to make cashwithdrawals. Taking cash advances usingyour credit card should be done only as alast resort. Cash advance fees and chargescan be expensive• Avoid unnecessary credit card costs. Makeyour payment before the due date statedin your credit card statement. Be sure toupdate your contact address to ensurethat you receive the statement on time• Paying only the minimum monthlypayment will extend your repaymentperiod and the interest you have to pay.Settle your outstanding balance in fullto avoid paying interest8

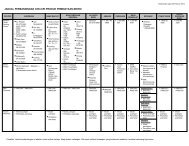

• Limit the number of credit cards basedon your needs and payment capability• Be alert of the changes in policies andrates. For example, your credit card issuermay raise its fees and charges or varysome of its T&CHOW TO AVOID BEING TRAPPED ASA BORROWER<strong>Credit</strong> card marketing strategies havebecome more aggressive and innovativeto entice credit cardholders not to payBe aware of theconsequencesof paying only theminimumrepaymentamount each monththe outstanding amounts in full and to continue carrying forwardthe outstanding balances each month. These borrowers or ‘revolvers’may think that it is beneficial and convenient to just pay only theminimum payment each month, but it is just the opposite.You should be aware of the consequences of paying only theminimum repayment amount by the due date of each month. Notonly will you incur more interest charges but also lengthen the timetaken to repay your balance. Many people do not realise the impactof accumulating their monthly credit card balances and end up withhuge debts.Below is an illustration of the repayment period and the totalinterest charged if you pay only the minimum monthly paymenteach month, i.e. 5% of the outstanding balance. For example, ifyour outstanding balance is RM1,000 and you pay only the minimummonthly payment, it will take you about 5.8 years to settle yourtotal debt and would cost you RM382 in interest charges, based onan interest rate of 18% per annum.OUTSTANDING AMOUNTSRM500 RM1,000 RM5,000 RM10,000Years Interest Years Interest Years Interest Years Interest(RM) (RM) (RM) (RM)4.2 168 5.8 382 9.6 2,097 11.2 4,2409

Alwayssafeguardyour card andcheckyour transactionsHOW TO PREVENT CREDIT CARD FRAUDPotential fraud is a real threat that allconsumers face in using credit cards. <strong>Credit</strong>card fraud can cost you and the credit cardissuer huge losses. <strong>Credit</strong> card issuers arealways on alert for fraudulent scams andhave taken security measures to protectyou against such possible frauds. However,you should also take the necessary steps tominimise the risk of being a victim of fraud.• Safeguard your credit card– Sign on your credit card immediatelyafter you receive it– Keep your credit card in the sameplace in your wallet or purse so thatyou will notice immediately if it islost or stolen– Do not lend your credit card to anyone– Do not provide your credit card details,(i.e. card number and expiration date)to an unknown party as they may useit to make purchases via telephone, mailor Internet– Memorise your PIN number and donot write down your PIN number onthe back of the credit card or keepit in your wallet, or disclose it to anyone– Keep the telephone number of yourcredit card issuer so that you canimmediately report lost/stolen cards,unauthorised transactions or disclosureof PIN to a third party10

• – Make sure you cut your expired credit cardsinto two when you get the new oneCheck your credit card transactions– Check all details on the charge slip beforesigning or confirming the transaction– Keep all your charge slips and check it againstyour credit card statement as soon as youreceive it– Notify your credit card issuer immediately ofany error or possible unauthorised transactionsin relation to your credit card or PIN andfollow-up in writing as soon as possible– Destroy all your charge slips before you throwthem away11

FREQUENTLY ASKED QUESTIONSWhat are the various types ofcredit cards?What is a co-branded credit card?What are other types of paymentcards available in Malaysia?&AIn general, there are three types of credit cards, namely Classic, Gold and Platinum.These credit cards are issued based on your income level and other criteria set by thecredit card issuer.A co-branded credit card is a card which is issued jointly by a credit card issuer and amerchant under a well-known brand name. The merchant usually offers additionalbenefits to the cardholders, such as discount on certain products and reward points forpurchases. Examples of co-branded credit cards include Maybank-Sogo Visa and PublicBank-Esso Visa.Besides credit cards, there are other types of payment cards available in Malaysia suchas debit, charge and stored-value cards (SVC).A debit card is a payment card where the transaction amount is deducted immediatelyfrom your savings and/or current accounts, upon authorisation. There are several typesof debit cards available in Malaysia. For example, Maybank Kawanku e-POS. There arealso international debit cards such as VISA Electron and MasterCard Electronic, whichcan be used at merchants wherever their logos are displayed.A charge card is also used in the same manner as a credit card, except that you mustsettle in full any outstanding amount in your monthly bill by the due date. AmericanExpress and Diners are well-known examples of charge card brands available in Malaysia.A SVC is a prepaid card. The card contains a monetary value, which has beenpre-loaded by the issuer. Some SVC schemes may allow the cardholder to reload theamount in the card. The value will be automatically deducted from the amountstored in the card whenever purchases are made.12

Can anyone get a supplementarycard?Who is responsible for thepayment of the purchases madeon the supplementary card?What is a credit limit?It is up to the principal cardholder to nominate his/her supplementary cardholdersdepending on the T&C of the credit card issuer.The principal cardholder is primarily held responsible to pay for the purchases madeby the supplementary cardholder and also his/her own purchases made on the creditcards. However, you should check the T&C on whether the supplementary cardholderwould also be held liable for the credit card debt.The credit limit is the maximum credit extended to you by the credit card issuer.The limit set is based on the assessment of the information provided in yourapplication form. The credit limit may be changed over time depending on yourspending pattern and payment capability. You should have a credit limit thatmatches your repayment capacity to avoid spending unnecessarily and to minimiseyour liability in the case of fraud.How can I make cash advancesusing my credit card?You can make cash advances over the counter of the participating credit card issuersor via ATMs, which display the logo of your credit card brand. Other restrictions maybe applicable.Why does a merchant need toget authorisation beforeaccepting my credit card?A merchant will require authorisation from your credit card issuer in ensuring that theamount of purchase does not exceed your credit limit. Your transaction will be rejecteddue to reasons such as exceeding your approved limit. You may wish to contact yourcredit card issuer if you encounter such a situation.13

What measures should I takewhen making purchases at amerchant?Do I have to pay additional coststo the merchant if I use mycredit card to make purchases?Never lose sight of your credit card. When making payment in the merchant outlets,hotels or restaurants make sure your credit card is swiped in front of you. Someone couldcopy your credit card details by swiping your credit card through a skimming device.There is no additional cost of using credit card for making purchases. If you are beingcharged, you may wish to contact your credit card issuer for clarification.Are there any differencesin terms of authorisation process,fees and charges imposed whenI use my credit card to makepurchases locally or overseas?How is the exchange ratedetermined?The authorisation process, fees and charges are the same when you make purchasesusing your credit card regardless of your location. However for purchases madeoverseas, the transaction amount is subjected to the exchange rate determined bythe credit card payment schemes (eg. Visa and MasterCard). The conversion ofcurrencies will be done automatically when the transactions are made. The exchangerate is normally determined based on the mid-point of the prevailing buying andselling rates of the exchange of foreign currency against Ringgit.What should I do if someoneknows my PIN?Is it necessary for me to monitormy credit card statements?If you believe that your PIN has been compromised, you should refer to your creditcard issuer.Yes. You must make it a practice to check your credit card statements regularly forany discrepancies or unauthorised transactions. Taking a few minutes to reviewthe information in your credit card statement is an important and effective way todetect unauthorised use of your credit card.14

Will I be liable for theunauthorised charges if mycredit card has been stolenor lost?What should I do if I find an errorin my credit card statement?You must always use reasonable precautions to prevent the loss of your credit card.If you do so, you will not be held liable for the transactions occurring after you havereported the loss to your credit card issuer, verbally or in writing. However, for verbalnotification, some credit card issuers may require you to provide written confirmationand a police report to them. On the other hand, if there is an unauthorised use of yourcredit card before the report is made, you may be held liable up to a certain amount,depending on the T&C of the credit card issuer.You should notify your credit card issuer immediately of any error in the monthlystatement or possible unauthorised transactions in relation to your credit card or PINverbally, and to follow-up in writing as soon as possible.For credit card issuers that are banking institutions, information on the contact person oremail address is available on Bank Negara Malaysia’s website at www.bnm.gov.myIn addition, for unauthorised transactions, if you are not satisfied with the responsegiven by your banking institution, you can also write to the Banking Mediation Bureau:The MediatorBanking Mediation Bureau5th FloorMUI PlazaJalan P. Ramlee50250 Kuala LumpurFor more information on how to make a complaint against banking institutions,please read the booklet on “Making a Banking Complaint.”15

GLOSSARY<strong>Credit</strong> Card IssuerOrganisations such as financial institutions,which issue the credit cards.<strong>Credit</strong> Card Payment SchemeA credit card association (e.g. Visa andMasterCard) which provides the necessarycredit card infrastructure that facilitatesauthorisation and settlement of credit cardtransactions.Expired <strong>Credit</strong> CardA credit card on which the embossed, encodedor printed expiration date has passed.MerchantAny business that accepts credit cards as one ofthe payment modes for the purchase of theirproducts/services.PINPersonal Identification Number – A sequenceof digits used to verify the identity of thecardholder. It is a kind of password.RevolverCardholder who keeps paying at least theminimum amount of payment required by thecredit card issuer but not fully repaid the totaloutstanding balance.Fraudulent TransactionA transaction unauthorised by the cardholder.Such transactions may occur as a consequenceof credit cards that are lost, stolen, not received,issued on a fraudulent application, counterfeitor other fraudulent conditions as defined bythe credit card issuer.16

Design Copyright © 2003 by Freeform Design Sdn Bhd. All rights reserved.

FOR MORE INFORMATIONLOG ON TOwww.bankinginfo.com.myOR VISIT OUR KIOSK AT MOST BANKSFirst Edition