Annual report of Raiffeisen-Landesbank Tirol AG

Annual report of Raiffeisen-Landesbank Tirol AG

Annual report of Raiffeisen-Landesbank Tirol AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>report</strong> <strong>of</strong> <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong><br />

011

Contents<br />

RLB <strong>Tirol</strong> <strong>AG</strong> management board statement 04<br />

Members <strong>of</strong> the management board and supervisory board 06<br />

Statement from the supervisory board chairman 07<br />

<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong> 08<br />

Our employees 10<br />

<strong>Raiffeisen</strong> Banking Group Tyrol 12<br />

Austrian <strong>Raiffeisen</strong> Banking Group 14<br />

<strong>Raiffeisen</strong> has steadfastly supported the regional economy for 125 years<br />

Interview with Dr Hannes Schmid, management board chairman <strong>of</strong> RLB <strong>Tirol</strong> <strong>AG</strong>, and Josef Graber,<br />

director and supervisory board chairman <strong>of</strong> RLB <strong>Tirol</strong> <strong>AG</strong> 16<br />

Management <strong>report</strong> 19<br />

125 years <strong>of</strong> <strong>Raiffeisen</strong> in Austria: on solid foundations<br />

A <strong>report</strong> by Pr<strong>of</strong>essor Kurt Ceipek, publisher <strong>of</strong> <strong>Raiffeisen</strong>zeitung (the Group’s in-house journal) 30<br />

<strong>Annual</strong> financial statements 33<br />

Bank branches 50

4 RLB <strong>Tirol</strong> <strong>AG</strong> management board statement<br />

Reinhard Mayr<br />

Management board director<br />

Dr Hannes Schmid<br />

Management board chairman<br />

Gobert Sternbach<br />

Management board director

RLB <strong>Tirol</strong> <strong>AG</strong> management board statement<br />

RLB <strong>Tirol</strong> <strong>AG</strong> management<br />

board statement<br />

Dear Readers,<br />

2011 was a volatile year marked by political upheaval in many North African countries, the tsunami<br />

in Japan and subsequent nuclear accident, fears <strong>of</strong> sovereign defaults in Europe and the debt<br />

ceiling crisis in the USA, all <strong>of</strong> which led to sharp fluctuations in the financial markets. From the<br />

summer onwards, the European debt crisis assumed disquieting proportions due to events in<br />

Greece, Spain and Italy as well as signs <strong>of</strong> an impending recession. However, the situation was<br />

gradually stabilised through major purchases <strong>of</strong> Italian and Spanish government bonds by the<br />

European Central Bank. Meanwhile, the economy registered strong growth in Austria and as well<br />

as in Tyrol chiefly as a result <strong>of</strong> our close connection with the economic powerhouse <strong>of</strong><br />

Germany.<br />

This positive economic environment in Tyrol was one reason why <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong><br />

<strong>AG</strong> performed so well in 2011. Despite intense competition and various changes in the economic<br />

and regulatory framework, we succeeded in increasing our pr<strong>of</strong>it from ordinary activities to 24.2<br />

million euros. This demonstrates the strength <strong>of</strong> customers’ faith in <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong><br />

<strong>AG</strong> and vindicates our policies <strong>of</strong> unwavering customer focus and risk-oriented growth. The principal<br />

benefit derived from this good result has been the boosting <strong>of</strong> our equity and, with an equity<br />

ratio <strong>of</strong> over 11 per cent, we are already in a good position to satisfy Basel III requirements.<br />

Together with the various Tyrolean <strong>Raiffeisen</strong> banks, we have again succeeded in augmenting<br />

our leading market position in Tyrol. This tried-and-tested partnership makes us by some<br />

distance the region’s largest and most efficient banking group. The comprehensive coverage<br />

provided by the over 262 branches <strong>of</strong> <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong> and the 81 autonomous<br />

<strong>Raiffeisen</strong> banks fully meets all the financial needs <strong>of</strong> the local population and economy.<br />

Moreover, with a workforce <strong>of</strong> over 2,700, we are one <strong>of</strong> the largest and most attractive<br />

employers in Tyrol.<br />

We would like to take this opportunity to thank our customers, partners, owners and employees<br />

for their confidence in us, and we look forward to a continuation <strong>of</strong> our successful collaboration<br />

throughout 2012.<br />

Dr Hannes Schmid<br />

Management board chairman<br />

Reinhard Mayr<br />

Management board director<br />

Gobert Sternbach<br />

Management board director<br />

5

6 Members <strong>of</strong> the management board and supervisory board<br />

Members <strong>of</strong> the management board<br />

and supervisory board<br />

Management board <strong>of</strong> <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong><br />

Dr Hannes Schmid<br />

Management board chairman<br />

Gobert Sternbach<br />

Management board director<br />

Supervisory board <strong>of</strong> <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong><br />

Josef Graber<br />

Chairman<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong> Regional Bank Hall in Tyrol<br />

Peter-Roman Bachler<br />

Deputy chairman<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong> Bank Kitzbühel<br />

Josef Chodakowsky<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong> Bank St Anton am Arlberg<br />

Martin Lorenz<br />

Director <strong>of</strong> Bergbahnen Silvretta Galtür<br />

Meinhard Mayr<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong>-Bezirkskasse Schwaz<br />

Gallus Reinstadler<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong> Bank Pitztal<br />

Deputed by the works council (Betriebsrat)<br />

Reinhard Mayr<br />

Management board director<br />

Dr Hans Unterdorfer<br />

Management board director (until 28 February 2011)<br />

Johannes Gomig<br />

Deputy chairman<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong> Bank Reutte<br />

Berthold Blassnig<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong> Bank Defereggental<br />

Dr Anna Hosp<br />

Employee, Gernot Langes-Swarovski & CO<br />

Andreas Mantl<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong> Bank Wipptal<br />

Dr Michael Misslinger<br />

Manager <strong>of</strong> <strong>Raiffeisen</strong> Bank Wörgl Kufstein<br />

Johann Thaler<br />

Mayor <strong>of</strong> Reith im Alpbachtal<br />

Doris Bergmann, Innsbruck Heinz H<strong>of</strong>er, Lienz<br />

Wolfgang Kunz, Rum Rudolf Staffler, Tristach<br />

Erika Zingerle, Innsbruck Dr Markus Zorn, Rum<br />

State commissioners<br />

State councillor (H<strong>of</strong>rat) Dr Michael Manhard<br />

Federal Ministry <strong>of</strong> Finance, Vienna<br />

AD Andreas Umlauf<br />

Federal Ministry <strong>of</strong> Finance, Vienna

Statement from the supervisory board chairman<br />

Statement from the supervisory board chairman<br />

<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong> can look back on a successful 2011, for which we<br />

are able to present a highly satisfactory set <strong>of</strong> annual financial statements. The<br />

operating income increased, while operating expenses remained at last year’s level<br />

and our risk provision was reduced which, taken together, led to a marked rise in our<br />

pr<strong>of</strong>it from ordinary activities. I view this encouraging performance as a clear expression<br />

<strong>of</strong> our customers’ high levels <strong>of</strong> satisfaction with the outstanding services we<br />

<strong>of</strong>fer.<br />

For Tyrolean <strong>Raiffeisen</strong> banks, <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong> is not only the lead<br />

bank but also the agenda setter and a reliable business partner. This is vitally important,<br />

and never more so than in turbulent times <strong>of</strong> economic volatility, when we face<br />

a constant flow <strong>of</strong> new government regulations. It gives the entire Group the requisite<br />

security and stability.<br />

<strong>Raiffeisen</strong> Banking Group Tyrol is the region’s largest and most efficient banking<br />

institution. Almost half <strong>of</strong> the Tyrolean population places its trust in the quality <strong>of</strong><br />

<strong>Raiffeisen</strong>’s advice and financial services, and <strong>Raiffeisen</strong> is also a reliable and expert<br />

partner for local business enterprises. Together we support the Tyrolean economy<br />

and put in place the overall financial framework needed to successfully put ideas<br />

into practice.<br />

In 2011, the management board and supervisory board enjoyed a highly constructive<br />

working relationship, and this, too, contributed to the positive performance <strong>of</strong> both<br />

<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong> and the <strong>Raiffeisen</strong> Banking Group Tyrol as a whole.<br />

Accordingly, I would like to take this opportunity to sincerely thank the entire manage-<br />

ment board, senior managers, functionaries and all our employees for their<br />

productive joint efforts and great dedication throughout the past year.<br />

Josef Graber,<br />

director and supervisory board chairman<br />

7

8 <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong><br />

<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong><br />

<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong> is the lead bank in <strong>Raiffeisen</strong> Banking Group Tyrol (RBGT).<br />

As well as its strategic agenda-setting role within RBGT, the bank has its own market<br />

presence and runs 17 branches. It also provides a range <strong>of</strong> services, such as IT and product<br />

development, for Tyrol’s <strong>Raiffeisen</strong> banks. Like every Tyrolean <strong>Raiffeisen</strong> bank, RLB <strong>Tirol</strong> <strong>AG</strong><br />

is a byword for security, customer care, trust and community spirit.<br />

RLB <strong>Tirol</strong> <strong>AG</strong> was founded in 1895 as <strong>Raiffeisen</strong>-Zentralkasse <strong>Tirol</strong>.<br />

Today Tyrolean <strong>Raiffeisen</strong> banks own more than 99 per cent <strong>of</strong> the<br />

company and constitute the region’s largest and most efficient<br />

banking group. RBGT is almost 50 per cent customer-owned.<br />

Wide-ranging customer care services<br />

Thanks to their great expertise, our advisers are able to provide<br />

customers with comprehensive advisory care addressing all their<br />

financial concerns.<br />

Unlike a major international bank, we are there for our customers<br />

in the heart <strong>of</strong> the region. We <strong>of</strong>fer innovative products tailored to<br />

the individual needs <strong>of</strong> private and corporate clients alike. In doing<br />

so, the bank can call on a network <strong>of</strong> specialist firms such as<br />

<strong>Raiffeisen</strong> Versicherung, <strong>Raiffeisen</strong> Bausparkasse and <strong>Raiffeisen</strong>-<br />

Leasing, and the establishment <strong>of</strong> the modern Abwicklungs- und<br />

Dienstleistungs Ges.m.b.H. (RAD) has ensured the long-term productivity<br />

and efficiency <strong>of</strong> Tyrolean <strong>Raiffeisen</strong> banks’ management<br />

and support services.<br />

Innovative: the <strong>Raiffeisen</strong>–Tyrol regional bond<br />

One example <strong>of</strong> an innovative product accommodating Tyrolean<br />

people’s wishes and needs for a high-yield yet secure form <strong>of</strong> investment<br />

is the <strong>Raiffeisen</strong>–Tyrol regional bond.<br />

This bond underpins our regionalism and our ties with Tyrol and<br />

the Tyrolean people. The <strong>Raiffeisen</strong>–Tyrol regional bond invests<br />

directly in the region. The funds generated are invested locally or<br />

used directly in Tyrol, for instance, to build residential housing or<br />

public buildings such as nurseries and schools.<br />

Any company wishing to secure future success will have to actively<br />

shape that success through strategic planning. For this reason,<br />

RLB <strong>Tirol</strong> <strong>AG</strong> works together with Tyrolean <strong>Raiffeisen</strong> banks on our<br />

fundamental future strategic alignment. As an agenda setter, RLB<br />

coordinates regional and nationwide committee work.<br />

Important sponsor<br />

Alongside its role as an important local provider <strong>of</strong> a full range <strong>of</strong><br />

modern, customer-oriented banking services, RLB <strong>Tirol</strong> <strong>AG</strong> also<br />

has a long tradition in the region <strong>of</strong> charitable work and educational,<br />

cultural and sports sponsorships.<br />

Here are a few examples: the Red Cross, Caritas, the Tyrolean<br />

hospice movement, a partnership with the University <strong>of</strong> Innsbruck,<br />

RLB Kunstbrücke gallery (staging three exhibitions a year), the<br />

18,000-euro RLB art prize awarded every two years, the New<br />

Orleans Festival, football clubs and many more.<br />

An outstanding employer<br />

RLB <strong>Tirol</strong> <strong>AG</strong> <strong>of</strong>fers around 500 employees an attractive, secure<br />

workplace, making it one <strong>of</strong> the region’s most important employers.<br />

RLB employees remain with the company longer than average,<br />

and their know-how, expertise and personal dedication contribute<br />

to our sustained business success.<br />

The employees’ well-being and good health are assigned the highest<br />

priority by management, and the company’s wide-ranging<br />

training opportunities are ever popular, as is the attractive range <strong>of</strong><br />

activities <strong>of</strong>fered by RLB Vital, our in-house health programme.<br />

Winner <strong>of</strong> multiple awards<br />

For the first time, the testing body TÜV AUSTRIA is awarding a<br />

certificate designed to recognise a bank’s service and advising<br />

quality. In this respect, <strong>Raiffeisen</strong> banks were tested for ‘fair credit’.<br />

The testing focused on flexibility during the terms <strong>of</strong> loans as well<br />

as price and cost transparency. <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong><br />

was among those to be awarded the relevant certificate.<br />

RLB was the first bank in western Austria to be awarded the quality<br />

seal for occupational health promotion by the European network<br />

for promoting health in the workplace Betriebliche Gesundheitsförderung<br />

(BGF). On presentation <strong>of</strong> the award, special praise was<br />

reserved for the RLB Vital company health programme.<br />

The Federal Ministry <strong>of</strong> Economy, Family and<br />

Youth hailed RLB <strong>Tirol</strong> <strong>AG</strong> as an attractive employer<br />

that gave its employees the chance to<br />

reconcile work and family life. In 2011, the bank<br />

was awarded the job and family certificate Audit<br />

berufundfamilie.<br />

The year before, the state <strong>of</strong> Tyrol launched a<br />

competition for the most family-friendly company<br />

in 2011/12. RLB <strong>Tirol</strong> <strong>AG</strong> took part in the<br />

competition with success and was awarded a<br />

certificate.

<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong><br />

Major investments <strong>of</strong> RLB <strong>Tirol</strong> <strong>AG</strong><br />

<strong>Raiffeisen</strong> Zentralbank<br />

Österreich <strong>AG</strong><br />

<strong>Raiffeisen</strong><br />

Capital Management<br />

<strong>Raiffeisen</strong> & Steinmayr<br />

<strong>Tirol</strong> Consult<br />

AlpenBank <strong>AG</strong><br />

<strong>Raiffeisen</strong> Bau <strong>Tirol</strong><br />

PayLife Bank<br />

<strong>Raiffeisen</strong> Bausparkasse<br />

<strong>Raiffeisen</strong> Wohnbaubank<br />

<strong>Raiffeisen</strong>-Leasing GmbH<br />

RACON West S<strong>of</strong>tware GmbH<br />

LOGIS IT Service GmbH<br />

AQUA DOME <strong>Tirol</strong><br />

Therme Längenfeld<br />

Unser Lagerhaus<br />

Warenbeteiligungs GmbH<br />

9

10 Employees<br />

We would like to thank our employees<br />

Manuela ABFALTER, Iris AIGNER, Pauline AIGNER, Luca ALLETTO, Walter ALTSTAETTER, Karin Brigitte AMMER, Hubert AMON, Christian<br />

ANDREATTA, Reinhard ANGERMANN, Sabine ARL, Patricia ASSMAIR, Eva ASTL, Roland AUER, Sibylle AUER, Cornelia AUER, Bernhard<br />

AUGSCHOELL, Marina BABIC, Hildegard BACHMAIR, Stefanie BALLWEBER, Hubert BARBIST, Heinz BAUMANN, Gerald BEER, Petra<br />

BENEDIKTER, Maximilian BERGHAMMER, Doris BERGMANN, Elisabeth BERNHARDT, Verena BERNLOCHNER, Christian BEVELANDER,<br />

Markus BLASSNIG, Claudia BLIEM, Gerhard BLOEB, Stefan BODNER, Susann BOEKDRUKKER, Josef BRANDAUER, Eva Maria BRASCH-<br />

LER, Christian BRAUNEGGER, Vanessa BRENNER, Barbara BRIDA, Richard BRUGGER, Birgit BRUNNER, Karl BRUNNER, Guenther<br />

CHRONST, Gerhard CRAMER, Carolin CZERMAK, Martin DANLER, Andreas DEGENHART, Agnes DEISER, Andreas DIERIGL, Arno<br />

DRAXL, Verena DRESEN, Michaela DUCANOVIC, Elisabeth DUENSER, Markus DUFTNER, Peter DULLNIG, Claudia DULLNIG, Judith<br />

EBNER, Peter ECKERT, Andreas EGGER, Oliver EGGER, Nicole EGGER, Denise EGGER, Herbert EICHHORN, Irene EISENBEUTL,<br />

Christina ELLER, Thomas ELZENBAUMER, Christian ENGL, Elisabeth ENGL, Ilse ERLACHER, Martin EXENBERGER, Genovefa FALKNER,<br />

Sabine FALSCHLUNGER, Daniel FASCHING, Petra FEICHTNER, Meinhard FIDLER, Stephanie FILL, Johann FINK, Helga FINNER, Roland<br />

FRIESS, Thomas FRISCHAUF, Ludwig FROECH, Elke FUERHOLZER, Manuela FUNK, Daniela GABMAIR, Joerg GAMROTH, Wilfried<br />

GANDER, Alfons GANEIDER, Manfred GAPP, Birgit GASSER, Viktoria GASSER, Roland GASSER BERGER, Markus GATT, Walter GAUGG,<br />

Johannes GEILER, Manuela GEILER, Petra GEISSLER, Eleonore GERBER-EICHHORN, Claudia GINER, Hermann GIRSTMAIR, Michael<br />

GLANZ, Marina GLATZL, Stefan GOGL, Peter GOLLER, Martin GOREIS, Helga GRABNER, Dagmar GRANZER, Erich GRISSMANN, Klaus<br />

Michael GROSSGUT, Franz GRUBER, Evi GRUBER, Andrea GRUBER, Christina GRUBER, Manuela GRUBER, Angela GRUENBACHER,<br />

Christian GSCHLIESSER, Julia GSCHWENTNER, Desiree GSPAN, Gerhard GSTREIN, Bernhard GSTREIN, Michael GUNDRUM, Christ<strong>of</strong><br />

GURGISSER, Siegmund GUTTERNIG, Christa HABERKORN, Michael H<strong>AG</strong>ER, Michaela HAIDLER, Elisabeth HAIRER, Gabriele HANDL,<br />

Martin HAPP, Susanne HAUN, Elisabeth HAUSER, Florian HAUSER, Julia HEEL, Sandra HEIDEGGER, Martin HEIDEGGER, Alexander<br />

HEINDL, Alexander HEISS, Albert HELL, Helene HELLRIGL, Eric HENSEN, Heidi HINTNER, Christian HIRNER, Erwin HOEGER, Klaus<br />

HOERTN<strong>AG</strong>L, Christian HOERTN<strong>AG</strong>L, Victoria HOERTN<strong>AG</strong>L, Heinz-Johann HOFER, Christine HOFER, Martina HOFER, Gregor HOHEN-<br />

AUER, Stefanie HOLBACH, Hans HOLZKNECHT, Dagmar HOLZMANN, Dietmar HOSP, Astrid HOY, Petra HUBER, Albert HUEBER,<br />

Helmut HUPFAUF, Gerhard HUPFAUF, Lukas HUTER, Elisabeth IGHODARO, Eva JAEKEL, Joachim JAMNIG, Ingrid JANICKI, Christine<br />

JANTSCHER, Maria JEITLER, Monika JENEWEIN, Johann JUNGMANN, Sylvia KAINZ, Daniel KALDINAZZI, Johannes KAMPFER, Markus<br />

KAPFERER, Barbara KAPPACHER, Simone KASTL, Margarita KATSCHNIG, Werner KERBER, Regina KIRCHMAIR, Angelika KIRCHMAIR,<br />

Heidi KIRSCHNER, Andreas KLAUNZER, Johannes KLAUNZER, Ludwig Josef KLEINDL, Roger KLIMEK, Klaus KLINGENSCHMID, Karin<br />

KLINGENSCHMID, Jasmin KLINGENSCHMID, Christian KLOCKER, Katrin KLOTZ, Michael KLUCKNER, Natalie KLUCKNER, Sandra<br />

KNAUS, Mario KOFLER, Robin KOFLER, Peter KOFLER, Werner KOLB, Gabriele KOLLREIDER, Claudia KONRAD-HUBER, Nebojsa<br />

KOSTIC, Juergen KRABACHER, Franz KRANEWITTER, Eva KRAPF, Sandra KRIEGL, Peter KRITZINGER, Waltraud KROELL, Birgit KRUG,<br />

Karoline KUEN, Reinhard KUGLER, Melek KULOGLU, Wolfgang KUNZ, Sandy KUSS, Julia LACHBERGER, Bernhard LADNER, Klaus<br />

LAMPRECHT, Catrin LAMPRECHT, Stefan LANG, Sandra LARCH, Brigitte LARCHER, Karin LARCHER, Sandra LARCHER, Bettina LAX,<br />

Dominik LEBEDA, Martin LECHNER, Manuela LECHNER, Christoph LEIMGRUBER, Andreas LEITINGER, Helga LEITNER, Tamara LENER,<br />

Christiane LEUPRECHT, Renate LEZUO, Gottfried LIRK, Nina LOEFFLER, Thomas LOTRITSCH, Verena LUNG, Konstantin LUTZ, Peter<br />

MACHAT, Claudia MADL-SCARTEZZINI, Martina MAIACHER, Dorothea MAIR, Kurt MAIR, Gregor MARGREITER, Norbert MARGREITER,<br />

Christine MARKSTEINER, Anton MARKT, Josef MARTINER, Ingrid MASSANI, Martin MAURER, Karlheinz MAYR, Reinhard MAYR, Josef<br />

MAYR, Helmut MAYR, Christoph MAYR, Christoph MAYR, Renate MEDINA-HOFER, Margit METZLER, Carola MIGLAR, Manfred MIGLAR,<br />

Daniel MIKULA, Monika MIMM, Bernhard MITTERMAIR, Manfred MLADEK, Stefan MOLL, Hubert MONAI, Markus MOR, Eva MRAK,

Employees<br />

Michael MUEHLBACHER, Werner MUELLER, Hubert MUESSIGGANG, Angelika MUESSIGGANG, Doris MURR, Patrik MUXEL, Susanne<br />

N<strong>AG</strong>ELE, Julia N<strong>AG</strong>L, Josef N<strong>AG</strong>L, Jasmine NEUHAUSER, Birgit NEUNER, Alexander NEUNER, Otto NEUNER, Julia NEURAUTER,<br />

Barbara NEURAUTER, Franziska NIESCHER, Walter NITZLNADER, Ruth NOCKER-LEDERER, Bernd NOEHRER, Barbara OBERDANNER,<br />

Helmut OBERERLACHER, Frank OBERHAUSER, Stefan OBERHOFER, Georg OBERMUELLER, Guenter OBERZAUCHER, Christian<br />

OBEX, Monika OETTL, Monika ORTNER, Michaela ORTNER, Christoph ORTNER, Michaela OSS, Karin OSTERMANN, Marie-Theres<br />

PANCHERI, Konrad PARDELLER, Christina PARTL, Thomas PATSCH, Marina PEDRINI, Julia PENZ, Christian PENZ, Cornelia PERKOUNIGG,<br />

Romina PEROTTI, Sabine PFERSCHI, Martina PFLEGER, Monika PFURTSCHELLER, Birgit PFURTSCHELLER, Marcus PICHLER, Eugenio<br />

PIGNATTI, Arlette PILS, Gabriele PINGGERA, Verena PITTL, Josef PITTRACHER, Karoline PLANK, Markus PLATTNER, Nicole PLATTNER,<br />

Alexandra PLUNGER, Christine POCK, Eveline POLIN, Martin PRANTER, Christian PRUGGER, Monika PUCHER, Nicole PUCKL, Gertraud<br />

PUELACHER, Dietmar PUTSCHNER, Andreas RAASS, Isa RABL, Bettina R<strong>AG</strong>GL, Angela R<strong>AG</strong>GL, Michael R<strong>AG</strong>GL, Sarah RAINER<br />

WIESER, Dieter RASPOTNIK, Christiane RECHEIS, Wolfgang REDL, Marco REGENSBURGER, Karoline REIDER, Petra REISTER-WALL-<br />

NOEFER, Fraenk REITER, Gabriella REUTER, Christina RHOMBERG, Petra RIEDL, Brigitte RIETH, Silvia RIETZLER, Katrin RIHA, Christa<br />

ROESNER, Gerhard ROSENDORFER, Marion ROSINA, Christine ROTTENSTEINER, Monika RUDISCH, Helmuth RUECH, Markus RUECH,<br />

Thomas RUETZ, Bibiane RUETZ, Stefan RUF, Klaus SAIGER, Manfred SAILER, Patricia SANTA, Alexander SANTER, Thomas SATTLEG-<br />

GER, Thomas SAURER, Clemens SAURER, Roman SAUTNER, Sylvia SCHAMBERGER, Sandra SCHANDL, Werner SCHARF, Stefan<br />

SCHARF, Sandra SCHELLHORN, Matthias SCHIESTL, Monika SCHLATTER, Renate SCHLEICH, Markus SCHLENCK, Claudia SCHLIT-<br />

TLER, Ferdinand SCHMID, Michael SCHMID, Hannes SCHMID, Harald SCHMIDER, Karin SCHNAUFERT, Thomas SCHNEEBERGER,<br />

Brigitte SCHNEIDER, Marlies SCHNELL, Richard SCHNELLER, Daniel SCHNIEDERS, Romed SCHOEPF, Marina SCHRANZ, Hannes<br />

SCHREINER, Maria SCHWAIGER, Lisa SCHWARZL, Markus SCHWINGHAMMER, Wolfgang SCHWITZER, Hubert SEDLMAYR, Andrea<br />

SEEHAUSER, Petra SEELAUS, Sophia SEEWALD, Christian SEISER, Peter SENFTER, Rudolf SENN, Kerstin SIEBENHUENER, Caecilia<br />

SILGENER, Alexander SMITH, Emanuel SORAPERRA-AUGUSZTINYI, Renate SPARBER, Soeren SPECHT, Christoph SPOECK, Petra<br />

SPOERR, Armin SPRENGER, Markus STABENTHEINER, Rudolf STAFFLER, Carmen STANGLECHNER, Martin STECHER, Gebhard<br />

STEINACHER, Claudia STEINER, Christian STEINER, Patrick STEINKELLNER, Michael STEINLECHNER, Elisabeth STEINRINGER, Gobert<br />

STERNBACH, Nicole STOISER, Melitta STOLZ, Johannes STOTTER, Patrick STRASSER, Bernadette STRICKNER, Inge STROBL, Doris<br />

STROBL, Karin STROBL, Christa STROBL, Elke STROBL, Elisabeth Charlotte STUBLER, Barbara TAUTSCHER, Peter TAUTSCHER,<br />

Johanna TEMPELE, Johann THALER, Patrizia THALER, Birgit THALER, Jacqueline THALER, Helmut THEYER, Sandra THOENY, Andrea<br />

TOLL, Markus TOLLINGER, Herwig TRAUNER, Christoph TRAUNFELLNER, Dietmar TRIENDL, Othmar TRIENDL, Katrin TROYER-SOCHER,<br />

Christina TSCHAPELLER, Notburga TSCHUGG, Simone UNGERANK, Brigitte UNSINN, Michael UNTERASSINGER, Johannes UNTER-<br />

LUGGAUER, Thomas UNTERPERTINGER, Gerald UNTERRAINER, Margreth UNTERWEGER, Marleen VAN BARMEN T LOO, Andrea<br />

VERDROSS, Olivia VESELY, Benjamin VOGLER, Alfred VOLDERAUER, Veronika VOLDERAUER, Sylvia VOTAVA, Kerstin WALKER,<br />

Christine WALLNOEFER, Stephan WALSER, Sonja Fernanda WANKMUELLER, Thomas WASS, Sabine WASS, Philipp WEBER, Thomas<br />

WEIDINGER, Michael WEISS, Sonja WEITZER, Christine WEIXLER, Evelin WENDE, Wolfgang WENINGER, Detlev WENKO, Manuela<br />

WENTZ, Ramona WERTH, Daniel WHITE, Markus WIDMANN, Ulrike WIDMOSER, Johannes WIESER, Harald WIESER, Melanie WILD,<br />

Urban WINDBICHLER, Regina WINKLER, Andrea WITTING, Thomas WOEBER, Maria WOLF, Martina WOMBACHER, Andreas WOPFNER,<br />

Claudia WOTZEL, Maria WURZER, Hubert WURZER, Hannes ZACCHIA, Patrick ZANGERL, Andrea ZANKL, Elfriede ZECHNER, Petra<br />

ZEILLINGER, Aegidius ZETTINIG, Werner ZIMA, Stefan ZIMMER, Renate ZIMMERMANN, Gabriele ZIMMERMANN, Erika ZINGERLE,<br />

Sabine ZOEHRER, Christian ZOLLER, Markus ZORN, Markus ZWIEFELHOFER<br />

11

12 <strong>Raiffeisen</strong> Banking Group Tyrol<br />

<strong>Raiffeisen</strong> Banking Group Tyrol<br />

Many people have been disquieted by the economic and political<br />

events in the recent past. It is precisely at times like these that the<br />

local milieu becomes so important, because properly functioning<br />

regional structures provide solid ground and security.<br />

That is one reason why every second Tyrolean puts their trust in<br />

<strong>Raiffeisen</strong> when it comes to financial matters. Among young<br />

people the proportion is even greater, with two out <strong>of</strong> three young<br />

people aged between 10 and 27 being members <strong>of</strong> the <strong>Raiffeisen</strong><br />

Club <strong>Tirol</strong>.<br />

This trust in <strong>Raiffeisen</strong> can be expressed in figures: with a customer<br />

share <strong>of</strong> 47 per cent, <strong>Raiffeisen</strong> is the region’s clear leader. As <strong>of</strong><br />

the 31 December 2011, RBGT’s aggregate balance sheet total was<br />

17.8 billion euros. The year before, the Tyrolean <strong>Raiffeisen</strong> banks<br />

managed initial deposits, comprising instant-access, time and<br />

savings deposits, totalling 8.5 billion euros. The fact that there is<br />

no credit squeeze at <strong>Raiffeisen</strong> is shown by an increase <strong>of</strong> 1.9 per<br />

cent in loans to private and corporate clients.<br />

For over 125 years, the <strong>Raiffeisen</strong> values <strong>of</strong> security, customer<br />

care, trust and community spirit have provided solid foundations<br />

for business enterprise. Tyrolean <strong>Raiffeisen</strong> banks stand for<br />

sustainable, responsible commercial dealings. They ensure that<br />

ZÜRICH<br />

240 KM<br />

MAILAND<br />

360 KM<br />

economic power and wealth creation remain in the region, thus<br />

benefiting local people. The money entrusted to them is invested<br />

in the region, being loaned for such purposes as building houses,<br />

buying a home or for doing home improvement work.<br />

With 262 branches in Tyrol, the 81 independent <strong>Raiffeisen</strong> banks<br />

and <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong> provide comprehensive services<br />

that meet all the needs <strong>of</strong> the local population and economy.<br />

Decisions are made locally and autonomously, with no detours.<br />

However, in the service <strong>of</strong> its customers, <strong>Raiffeisen</strong> Bank can also<br />

bring to bear the <strong>Raiffeisen</strong> Banking Group’s worldwide network.<br />

With 2,800 attractive, secure jobs, <strong>Raiffeisen</strong> numbers among the<br />

region’s biggest employers. As businesses that employ trainees,<br />

Tyrolean <strong>Raiffeisen</strong> banks create jobs for young people, <strong>of</strong>fering<br />

vocational training courses as qualified bank clerks. Four out <strong>of</strong><br />

every five Tyrolean bank trainees receive their training from <strong>Raiffeisen</strong>.<br />

<strong>Raiffeisen</strong> banks are also important customers for industry, for<br />

instance, in the field <strong>of</strong> renovations and new buildings, where<br />

orders are placed with local and regional companies. This protects<br />

jobs and boosts the local economy, even in cases where ‘cheaper’<br />

<strong>of</strong>fers are on the table.<br />

OBERAU<br />

MÜNCHEN<br />

90 KM

<strong>Raiffeisen</strong> Banking Group Tyrol<br />

<strong>Raiffeisen</strong> is the bank for the people <strong>of</strong> Tyrol<br />

Unlike anonymous major banks with head <strong>of</strong>fices somewhere far<br />

away, <strong>Raiffeisen</strong> is present in the heart <strong>of</strong> the community. These<br />

local roots are also clear from the fact that, as cooperative banks,<br />

Tyrolean <strong>Raiffeisen</strong> banks are owned by their members, some<br />

120,000 Tyrolean men and women.<br />

The spirit <strong>of</strong> cooperative sponsorship is deeply rooted in the entire<br />

<strong>Raiffeisen</strong> Banking Group, and is every bit as alive today as it was<br />

when the first <strong>Raiffeisen</strong> banks were founded in Tyrol.<br />

The <strong>Raiffeisen</strong>–Tyrol regional bond<br />

The regional bond: focusing on Tyrol<br />

For Tyrolean <strong>Raiffeisen</strong> banks, their ties with the Tyrolean population<br />

are the practical expression <strong>of</strong> a deeply held philosophy.<br />

This is also apparent from innovative products such as the<br />

<strong>Raiffeisen</strong>-Tyrol regional bond. This is an <strong>of</strong>fer made by Tyroleans<br />

That is why Tyrolean <strong>Raiffeisen</strong> banks have traditionally used some<br />

<strong>of</strong> their pr<strong>of</strong>its to sponsor social concerns, educational institutions<br />

and local cultural and sports clubs. In the last four years alone,<br />

over 20 million euros have been made available to clubs, associations<br />

and institutions. Through the <strong>Raiffeisen</strong> Club <strong>Tirol</strong>, <strong>Raiffeisen</strong><br />

assists young people in learning to handle their finances, and the<br />

associated <strong>Raiffeisen</strong> Club card <strong>of</strong>fers attractive discounts on the<br />

best concerts and with hundreds <strong>of</strong> cooperation partners throughout<br />

Tyrol.<br />

for Tyroleans, and as such embodies the concept <strong>of</strong> regionalism.<br />

Every euro invested in these bonds will be spent in Tyrol for<br />

Tyrol, for instance, to enable a Tyrolean company to construct a<br />

new production hall, a new residential block or a new nursery.<br />

13

14 Austrian <strong>Raiffeisen</strong> Banking Group<br />

Austrian <strong>Raiffeisen</strong> Banking Group<br />

The Austrian <strong>Raiffeisen</strong> Banking Group is by some way Austria’s<br />

largest and most efficient banking group. It has a three-tier<br />

structure.<br />

The 513 autonomous, locally active <strong>Raiffeisen</strong> banks and their<br />

1,689 branches form the first tier, while also being the owners <strong>of</strong><br />

the <strong>Raiffeisen</strong> regional banks for their federal state.<br />

It is these eight <strong>Raiffeisen</strong> regional banks that form the second tier,<br />

and within their spheres <strong>of</strong> influence provide liquidity pooling and<br />

other central services for the <strong>Raiffeisen</strong> banks, as well as acting<br />

as independent universal banks. They hold about 89 per cent <strong>of</strong><br />

RZB’s ordinary shares.<br />

<strong>Raiffeisen</strong> Zentralbank Österreich <strong>AG</strong> (RZB), the lead bank in the<br />

<strong>Raiffeisen</strong> Banking Group, and makes up the third tier.<br />

Structure <strong>of</strong> the RZB Group<br />

<strong>Raiffeisen</strong> Zentralbank Österreich <strong>AG</strong> (RZB) is the central enterprise<br />

in the RZB Group. Founded in 1927, RZB is Austria’s thirdlargest<br />

bank and the lead bank in the Austrian <strong>Raiffeisen</strong> Banking<br />

Group (RBG), which is the country’s largest banking group in<br />

terms <strong>of</strong> balance sheet total.<br />

RBG constitutes around a quarter <strong>of</strong> Austria’s domestic banking<br />

industry, with over 2,200 independent banks and branches giving<br />

it the country’s densest network <strong>of</strong> branches and employing over<br />

25,000 people.<br />

<strong>Raiffeisen</strong> Zentralbank took on its current form in October 2010.<br />

Large portions <strong>of</strong> <strong>Raiffeisen</strong> Zentralbank’s operational business –<br />

in particular its corporate client business, the product areas and the<br />

investment banking – were hived <strong>of</strong>f and merged with <strong>Raiffeisen</strong><br />

International, leading to the formation <strong>of</strong> today’s <strong>Raiffeisen</strong> Bank<br />

International <strong>AG</strong>.<br />

<strong>Raiffeisen</strong> in central and eastern Europe<br />

Through its 78.5 per cent holding in <strong>Raiffeisen</strong> Bank International<br />

<strong>AG</strong> (RBI), RBG is not only one <strong>of</strong> the leading commercial banks<br />

in Austria but also a universal bank in central and eastern Europe<br />

(CEE). RBI views Austria and CEE as its domestic market. It has<br />

been active in CEE for almost 25 years, thus giving it pioneering<br />

status in the region. Today RBI has a dense network <strong>of</strong> subsidiary<br />

banks, leasing companies and a wide variety <strong>of</strong> specialised financial<br />

services companies in 17 CEE countries. As a universal bank,<br />

it numbers among the top five banks in 13 <strong>of</strong> the region’s countries,<br />

and also has a strong position in Russia. It is supported in its<br />

endeavours by the <strong>Raiffeisen</strong> name, which is one <strong>of</strong> the region’s<br />

best-known brands.<br />

In comparison with western Europe, CEE countries are characterised<br />

by higher economic growth rates, and RBI benefits both from<br />

this sustained growth and the business potential generated by the<br />

region’s pent-up demand for banking services. At the end <strong>of</strong> 2011,<br />

a workforce <strong>of</strong> 56,114 people in 2,915 branches catered to the<br />

banking needs <strong>of</strong> around 13.8 million customers across CEE.<br />

Apart from the major local and international clientele who are<br />

looked after by the Vienna <strong>of</strong>fice, the RBI’s clear focus is on the<br />

countries <strong>of</strong> central and eastern Europe, a region which in<br />

recent years has been viewed with suspicion, particularly in the<br />

media, due to the alleged credit risk faced by foreign banks operating<br />

there. However, this view generally overlooks the fact that the<br />

region is anything but a single homogeneous economic unit. In<br />

fact, the various countries differ just as much in their levels <strong>of</strong><br />

development, potential and risk as in any other growth region. This<br />

diversity means that there is a variety <strong>of</strong> different opportunity–risk<br />

pr<strong>of</strong>iles and that the overall risk is smoothed out across the region<br />

as a whole.<br />

As one <strong>of</strong> the few international banks with a presence in virtually<br />

every central and eastern European country, RBI’s diversification<br />

by markets entails a natural reduction in the level <strong>of</strong> risk inherently<br />

associated with the banking business. Thus, high-yield markets and<br />

banks compensate for reverses <strong>of</strong> the kind currently being experienced<br />

in Hungary. Meanwhile, the enduring strength <strong>of</strong> our<br />

Austrian business further contributes to this spreading <strong>of</strong> risk.<br />

Niche player in international markets<br />

In international markets outside CEE, RBI’s presence is that <strong>of</strong> a<br />

niche player <strong>of</strong>fering a product range tailored to customers’<br />

specific needs through a variety <strong>of</strong> agents and branch <strong>of</strong>fices.<br />

Its <strong>of</strong>fices in Singapore, Beijing and Xiamen, plus agencies in<br />

Harbin, Hong Kong, Zhuhai, Seoul, Mumbai and Ho Chi Minh City,<br />

give RBI the strongest presence in Asia <strong>of</strong> any Austrian bank.<br />

Further branches in New York and London, a bank in Malta and<br />

agencies in Brussels, Frankfurt am Main, Paris, Madrid, Milan,<br />

Stockholm, Chicago and Houston mean RBI is also well positioned<br />

in various international financial centres, underpinning its role as a<br />

gateway linking East and West.

Austrian <strong>Raiffeisen</strong> Banking Group<br />

Corporate responsibility at RZB<br />

As a signatory <strong>of</strong> the UN Global Compact, RZB takes responsibility<br />

for people, society and the environment. It <strong>report</strong>s separately<br />

on its corporate responsibility activities, and in so doing complies<br />

with the internationally recognised standards <strong>of</strong> the global <strong>report</strong>ing<br />

initiative.<br />

Peace <strong>of</strong> mind thanks to <strong>Raiffeisen</strong> deposit<br />

protection<br />

<strong>Raiffeisen</strong> Banking Group is responsible for the security <strong>of</strong> the<br />

customer funds entrusted to it.<br />

Austria’s statutory deposit protection safeguards savings up to<br />

a maximum <strong>of</strong> 100,000 euros. However, <strong>Raiffeisen</strong> has put in place<br />

an additional safety net whose provisions go far beyond<br />

statutory requirements: deposits with <strong>Raiffeisen</strong> are protected by<br />

the <strong>Raiffeisen</strong> Deposit Guarantee Association.<br />

Structure <strong>of</strong> the <strong>Raiffeisen</strong> Banking Group<br />

Investments in Austrian financial<br />

institutions<br />

<strong>Raiffeisen</strong> Capital Management, UNIQA,<br />

Notartreuhandbank, card complete,<br />

PayLife, HOBEX, Valida, <strong>Raiffeisen</strong>-<br />

Leasing, <strong>Raiffeisen</strong> Informatik, <strong>Raiffeisen</strong><br />

Bausparkasse, <strong>Raiffeisen</strong> Factor Bank,<br />

<strong>Raiffeisen</strong> evolution, OeKB, <strong>Raiffeisen</strong><br />

Wohnbaubank<br />

Special settlement companies<br />

1.7 million members<br />

513 <strong>Raiffeisen</strong> banks<br />

8 <strong>Raiffeisen</strong> regional banks and other shareholders<br />

Investments<br />

<strong>Raiffeisen</strong> Centrobank, Kathrein & Co, F. J.<br />

Elsner & Co, <strong>Raiffeisen</strong> Malta Bank, <strong>Raiffeisen</strong><br />

Property Holding, <strong>Raiffeisen</strong> Investment,<br />

CEESEG <strong>AG</strong> (Vienna Stock Exchange),<br />

<strong>Raiffeisen</strong> Leasing International, Zuno Bank<br />

Through the introduction <strong>of</strong> the <strong>Raiffeisen</strong> Customer Guarantee<br />

Association Austria, the <strong>Raiffeisen</strong> Banking Group has played a<br />

pioneering role in the field <strong>of</strong> deposit protection. This association<br />

<strong>of</strong> participating <strong>Raiffeisen</strong> banks and regional banks, as well as<br />

<strong>Raiffeisen</strong> Zentralbank Österreich <strong>AG</strong> (RZB) and <strong>Raiffeisen</strong> Bank<br />

International <strong>AG</strong> (RBI), guarantees all customer deposits and<br />

securities issues by participating banks, irrespective <strong>of</strong> their<br />

amount, up to the total joint economic capacity <strong>of</strong> the institutions<br />

involved.<br />

The deposit guarantee association has a two-tier structure, with<br />

the <strong>Raiffeisen</strong> Deposit Guarantee Association Tyrol at state level<br />

and the <strong>Raiffeisen</strong> Deposit Guarantee Association at federal level.<br />

Thus it provides protection going beyond or in addition to Austrian<br />

statutory deposit protection, safeguarding 100 per cent <strong>of</strong><br />

customer deposits.<br />

The distinctive gable cross logo <strong>of</strong> the <strong>Raiffeisen</strong> Banking Group<br />

thereby stands as a symbol <strong>of</strong> the protection given to money<br />

entrusted to the bank, as well as customer care and customer faith<br />

in <strong>Raiffeisen</strong>.<br />

Never at a any time in the 125-year history <strong>of</strong> the <strong>Raiffeisen</strong><br />

Banking Group in Austria has a customer lost a single cent <strong>of</strong> any<br />

money deposited or saved with <strong>Raiffeisen</strong>.<br />

CEE network<br />

15 network banks<br />

with over 15 million<br />

customers<br />

21.5% widely held stock<br />

Foreign branch<br />

<strong>of</strong>fices and investments<br />

15

16 Interview with Dr Hannes Schmid and Director Josef Graber<br />

Because we know each other<br />

<strong>Raiffeisen</strong> has provided the regional economy with<br />

steadfast support for 125 years.<br />

‘We know our customers by name – and they know us,’ explain Dr Hannes Schmid,<br />

management board chairman, and Josef Graber, director and supervisory board chairman.<br />

<strong>Raiffeisen</strong> is there locally, and even during times <strong>of</strong> crisis the Tyrolean <strong>Raiffeisen</strong> banks have<br />

kept the regional economy afloat. And now there are new challenges to be faced.<br />

Every second Tyrolean is a <strong>Raiffeisen</strong> customer. What do<br />

you put that down to?<br />

Dr Schmid: We are the local bank throughout the region. We<br />

know our customers by name and our customers know us. We<br />

have grown together with the local infrastructure, our employees<br />

live and work locally, we grew up together and our children go to<br />

the same schools. And so our relationships with customers have<br />

grown organically. That is the human factor at <strong>Raiffeisen</strong>: our<br />

togetherness.<br />

Mr Graber: We can rapidly and directly address our customers’<br />

individual needs. On the ground, that means that decisions are<br />

taken locally, and not in some head <strong>of</strong>fice in Vienna or abroad.<br />

Our employees live locally, and not just as bank clerks. For instance,<br />

our research shows that Tyrolean <strong>Raiffeisen</strong> employees<br />

do 170,000 hours unpaid work a year for the community in clubs<br />

and associations.<br />

Meeting Basel III requirements such as the increased<br />

equity ratio: what does that mean for RLB? What direct<br />

impact could it have on your customers?<br />

Dr Schmid: Our customers really won’t notice the equity ratio increase<br />

because we already meet this requirement right now. <strong>Raiffeisen</strong>’s<br />

established structures <strong>of</strong>fer security and sustainability.<br />

<strong>Raiffeisen</strong> and its customers have long since been an important<br />

part <strong>of</strong> Tyrol’s economic strength. We are part <strong>of</strong> the regional economy,<br />

and that is the cornerstone <strong>of</strong> our success: deposits remain in<br />

the region and are reinvested there, for instance, in the local economy,<br />

for residential buildings, in energy-efficient renovation measures<br />

and much more besides.<br />

Mr Graber: The risk for <strong>Raiffeisen</strong> customers is minimal. We have<br />

our regional <strong>Raiffeisen</strong> banks and also <strong>Raiffeisen</strong>-<strong>Landesbank</strong>, and<br />

together we can deal with issues and requirements on a scale that<br />

would cause difficulties for a regional bank operating alone. That<br />

means that customers will not notice these requirements at all. We<br />

operate according to the basic principle <strong>of</strong> subsidiarity.

Interview with Dr Hannes Schmid and Director Josef Graber<br />

The Basel III requirements affect all banks, including the<br />

ones that were not in any way at fault. How do you view<br />

that as a regional bank?<br />

Mr Graber: During the crisis in 2008, <strong>Raiffeisen</strong> was a stabilising<br />

factor for the Tyrolean economy which enabled the regional economy<br />

to come through the crisis unscathed. On the one hand, we<br />

had savings deposits; on the other, we made loans to Tyrolean<br />

companies. Put simply, <strong>Raiffeisen</strong> did not speculate or invest in<br />

foreign institutions; rather we made secure investments in the<br />

region. But despite this these requirements are now hitting us hard<br />

and above all undeservedly. Because <strong>of</strong> the new requirements,<br />

we’ll have to absorb a rise in personnel costs. And one thing I’m<br />

sure <strong>of</strong> is this: everything being introduced now cannot prevent the<br />

same kind <strong>of</strong> disaster happening in future because it was human<br />

error, not systemic failure, which caused the crisis.<br />

Dr Schmid: I can understand that legislators felt that there was<br />

a need to act, but unfortunately no distinction was made between<br />

international investment banks and regional banks like us. And yet<br />

it was purely us regional banks who kept the regional economy<br />

ticking over. In the media, our traditional reliability gets as little<br />

coverage as the fact that we are the real pillars <strong>of</strong> the economy.<br />

But despite that, the same regulations apply to us as to global<br />

banks. At <strong>Raiffeisen</strong> in Tyrol, we’ve never needed state aid, quite<br />

simply because we do business in a sustainable and responsible<br />

way. And even this year our lead bank, <strong>Raiffeisen</strong>-<strong>Landesbank</strong>,<br />

was again able to post a sustainable pr<strong>of</strong>it. The fact is, despite<br />

being totally blameless, we nevertheless come <strong>of</strong>f worse!<br />

Josef Graber, director<br />

In light <strong>of</strong> the <strong>Raiffeisen</strong> values <strong>of</strong> security and sustainability,<br />

which forms <strong>of</strong> investment do you regard as best?<br />

Mr Graber: Investments are an individual and personal matter and<br />

the advice given should also be <strong>of</strong> that nature. Our employees<br />

know their customers, their risk appetites, the resources they have<br />

to invest, their desires and goals.<br />

Dr Schmid: The choice <strong>of</strong> investment is geared to individual<br />

needs. People trust the advice we give them more and more. Over<br />

the past year, deposits with us grew by 2.1 per cent, because deposits<br />

with <strong>Raiffeisen</strong> are safe! Two major financial crises have<br />

caused neither us nor our customers any difficulties because we<br />

uphold security in all money-related matters.<br />

To what do you attribute the huge success <strong>of</strong> the<br />

<strong>Raiffeisen</strong>–Tyrol regional bond?<br />

Dr Schmid: We designed this product for customers who didn’t<br />

want to invest in risk-oriented products but rather in a semi-<br />

direct way in Tyrol itself, and this went down very well with the<br />

Tyrolean people. The fact is, the terms and conditions alone are<br />

not the only factors affecting customers’ decision, but also knowing<br />

what’s done with the money. That’s a strong argument for the<br />

regional bond, because the invested money is used exclusively in<br />

Tyrol! Our employees are also 100 per cent behind this product.<br />

Our guiding principles <strong>of</strong> fairness, clarity, transparency and<br />

ethical action all find expression in this product. And that has been<br />

rewarded!<br />

Mr Graber: Regional banks have the advantage that we can react<br />

to market needs and also <strong>of</strong>fer customers something in the<br />

medium term, thereby also being able to <strong>of</strong>fer better terms.<br />

On the subject <strong>of</strong> saving, is saving in general back ‘in’?<br />

17<br />

‘We are<br />

the stabilising factor<br />

in the regional<br />

Tyrolean economy.’<br />

Dr Hannes Schmid<br />

Management board chairman <strong>of</strong> RLB Tyrol<br />

Dr Schmid: Absolutely! The simple transparency and clear<br />

security orientation <strong>of</strong> the <strong>Raiffeisen</strong> savings book satisfy people’s<br />

desire for straightforwardness when it comes to the bewildering<br />

array <strong>of</strong> financial products available today. In Tyrol, saving has<br />

traditionally been afforded a special place. People like to put their<br />

money in the savings book, with shares and capital market investments<br />

supplementing their savings.<br />

Mr Graber: In Tyrol, saving money counts as one <strong>of</strong> the traditional<br />

values, and on top <strong>of</strong> that the savings book is something you can<br />

pick up, something you can hold in your hand. Having said that,<br />

I’d like to point out that online saving with <strong>Raiffeisen</strong> is also booming,<br />

as customers take the opportunity to save in the comfort <strong>of</strong><br />

their own homes. ➜

18 Interview with Dr Hannes Schmid and Director Josef Graber<br />

Dr Hannes Schmid<br />

<strong>Raiffeisen</strong> is also number one among corporate clients.<br />

How has your working relationship with the Tyrolean economy<br />

developed? Are you expecting a credit squeeze?<br />

Dr Schmid: Traditionally, Tyrol’s SMEs and <strong>Raiffeisen</strong> were practically<br />

joined at the hip.<br />

Now in the wake <strong>of</strong> the crisis, regional Tyrolean enterprises are<br />

turning back to their local financial service providers. Where it used<br />

to be more about the terms and conditions, today it’s also about<br />

the partnership-based relationship with <strong>Raiffeisen</strong> and the continuity<br />

that brings. There never was any credit squeeze at <strong>Raiffeisen</strong><br />

and in future we shall be continuing to loan our customers<br />

money the same as we always have!<br />

Mr Graber: The Tyrolean business community has good reason to<br />

trust our <strong>Raiffeisen</strong> banks. Rather than just running branches, we<br />

bring our entire expertise to bear at the local level. Our employees<br />

are able to assess the situation personally and make a quick<br />

decision, and it is this <strong>Raiffeisen</strong> philosophy <strong>of</strong> independent<br />

regional banks that differentiates us from our rivals. We’re not<br />

expecting a credit squeeze at <strong>Raiffeisen</strong> now or in the future.<br />

Liquidity is paramount, and at <strong>Raiffeisen</strong> it is in safe hands, as the<br />

growth figures in our latest operating results demonstrate.<br />

On the subject <strong>of</strong> social commitment, RLB sponsors<br />

and supports culture, sport, education, social issues and<br />

regional projects. Why do you do so much, and is it going<br />

to stay that way?<br />

Mr Graber: At five million euros a year, the bulk <strong>of</strong> our regional<br />

sponsorship activities are organised via the Tyrolean <strong>Raiffeisen</strong><br />

banks. We support clubs and initiatives and through them local<br />

development. We didn’t have to cut our marketing budget in the<br />

wake <strong>of</strong> the crisis and have kept up all our payments. That is<br />

another <strong>Raiffeisen</strong> promise: sustainability. However, that doesn’t<br />

mean that our sponsoring always remains constant. The sum <strong>of</strong><br />

five million euros, yes, but every year we decide afresh how to<br />

distribute it.<br />

Dr Schmid: We are there where Tyroleans like to spend their<br />

leisure time, for instance, doing sport or in social areas where they<br />

need our help. We also have a traditional commitment to youth.<br />

We provide support both individually or where our sponsoring can<br />

benefit others, and none <strong>of</strong> that will change in future.<br />

One example is our long-term sponsorship <strong>of</strong> young climbers.<br />

Currently climbing is THE in sport for young athletes, and, after all,<br />

you can hardly imagine Tyrol without climbing and mountains.<br />

All that is part <strong>of</strong> the strength <strong>of</strong> our brand and shows what we stand for.<br />

Turning to the future, how do you view your social responsibility<br />

in relation to your employees and customers?<br />

Dr Schmid: Our role as one <strong>of</strong> Tyrol’s largest private employers,<br />

with a workforce <strong>of</strong> 2,800, heaps a good deal <strong>of</strong> responsibility<br />

on the shoulders <strong>of</strong> all our senior management. Our employees<br />

appreciate the conditions at <strong>Raiffeisen</strong>, the cooperative working<br />

environment and ties with local communities, and we are one <strong>of</strong><br />

the few banks whose workforce is still growing.<br />

On top <strong>of</strong> that, we believe in young people: we’ve launched a<br />

trainee <strong>of</strong>fensive, and today 80 per cent <strong>of</strong> all bank trainees in Tyrol<br />

are employed by <strong>Raiffeisen</strong>.<br />

Mr Graber: A total <strong>of</strong> 82 <strong>Raiffeisen</strong> banks throughout Tyrol are<br />

good local employers. We view ourselves here as local providers,<br />

investing locally, <strong>of</strong>fering work and thus boosting wealth creation.<br />

Similarly, we always engage regional companies when we need to<br />

renovate existing buildings or build new ones, thus ensuring that<br />

the money also stays here. In addition, the trainee project is a<br />

successful initiative by Dr Schmid. I’d like to mention here that we<br />

also <strong>of</strong>fer the option <strong>of</strong> vocational training coupled with the school<br />

leaving exam.<br />

Currently everyone is talking about the euro crisis, and the<br />

situation on the financial markets is tense. Do you believe<br />

in the survival <strong>of</strong> the euro, something <strong>of</strong>ten discussed at<br />

the moment?<br />

Dr Schmid: Yes, without a doubt! What we’re going through at the<br />

moment is not a euro crisis but rather a crisis <strong>of</strong> governments and<br />

politics. I view it as half-hearted to define the currency union purely<br />

in terms <strong>of</strong> the euro. Europe’s economy, apart maybe from a few<br />

southern countries, is perfectly competitive! However, without unity<br />

in European politics there will also be no economic union. If we<br />

can unite, then Europe, and with it the euro, will be one <strong>of</strong> the three<br />

strongest economic powers in the world.<br />

Mr Graber: Essentially what we are facing is a political crisis<br />

that has been further whipped up by negative <strong>report</strong>ing in the<br />

media. But there is no economic crisis! If there was, why for example<br />

would the big car companies be registering massive pr<strong>of</strong>its?<br />

The figures relating to the euro are always <strong>report</strong>ed as more<br />

negative than they actually are. We simply ought to remember who<br />

triggered the crisis in 2008: not Europe, but the USA. I believe in<br />

Europe and am pro-Europe through and through. The euro will<br />

survive!<br />

●<br />

2<br />

M<br />

r

011<br />

anagement<br />

eport

20 Management <strong>report</strong><br />

2011 macroeconomic conditions<br />

Capital markets<br />

The first half <strong>of</strong> 2011 was a turbulent time on the financial markets<br />

as political upheaval in various North African countries and consequent<br />

oil price rises, and above all the tsunami and subsequent<br />

nuclear accident in Japan, led to severe short-term market<br />

volatility. However, the financial markets eventually got over these<br />

shocks, and by July some stock markets were again registering<br />

levels close to their highs for the year, or in some cases even<br />

exceeding them. The capital markets were much harder hit by the<br />

resurgence <strong>of</strong> the debt crisis, particularly when the USA became<br />

embroiled in it towards the end <strong>of</strong> July and into August. First <strong>of</strong> all,<br />

the dispute over raising the US debt ceiling fuelled fears <strong>of</strong> a<br />

technical default by the USA. Shortly afterwards rating agency<br />

S&P downgraded the US credit rating from AAA to AA+.<br />

Bonds and equities<br />

During August, the European debt crisis also assumed more<br />

serious proportions. The trouble started when the bond yields<br />

demanded by investors for some larger eurozone countries,<br />

namely Italy and Spain, soared to levels high enough to jeopardise<br />

their long-term solvency. This went hand in hand with a dramatic<br />

flight by investors to safe havens such as German government<br />

bonds, and as a result yields on ten-year bonds fell to an all-time<br />

low <strong>of</strong> 1.7 per cent. The situation was gradually brought under<br />

control through massive purchases <strong>of</strong> Italian and Spanish government<br />

bonds by the European Central Bank (ECB).<br />

On the equity markets, escalating fears <strong>of</strong> sovereign defaults,<br />

followed by a deep recession, led to sharp falls as the DAX shed<br />

a good third <strong>of</strong> its value between its July high point and September<br />

nadir. Against this backdrop, Europe’s leaders held summit<br />

after summit. Finally, at the end <strong>of</strong> October agreement was reached<br />

involving debt restructuring for Greece (a 50 per cent write-down<br />

on bonds held by banks), boosting the size <strong>of</strong> the bailout fund for<br />

ailing eurozone countries and a prophylactic increase in the<br />

equity requirements imposed on major European banks from 2012<br />

onwards.<br />

The summer slump on the financial markets went hand in hand<br />

with fears that the US economy would slip back into recession.<br />

After growth <strong>of</strong> just one per cent during the first half, many feared<br />

an even sharper downturn during the second half <strong>of</strong> the year.<br />

Instead, from October onwards, US data improved sharply, with<br />

surprise third quarter GDP growth <strong>of</strong> no less than 2.5 per cent.<br />

Coupled with hopes <strong>of</strong> progress in overcoming the debt crisis,<br />

this made a significant contribution to the financial market recovery<br />

towards the end <strong>of</strong> October.<br />

Currency<br />

The debt crisis also hit the euro exchange rate hard, particularly<br />

as compared with the Swiss franc, with capital inflows from the<br />

eurozone briefly bringing the euro–franc exchange rate to a historic<br />

low <strong>of</strong> just over parity. However, the pressure exerted by the soaring<br />

franc on the Swiss economy finally forced the Swiss National<br />

Bank (SNB) to intervene, setting a floor <strong>of</strong> 1.20 Swiss francs to the<br />

euro. This enabled the SNB to eventually curb speculation against<br />

the euro.<br />

Gold<br />

Gold, meanwhile, once again confirmed its safe-haven status when<br />

times get hard. Amid general jitters throughout August, it reached<br />

a record high <strong>of</strong> 1,911 US dollars per ounce, with the high-water<br />

mark in euro terms being the 1,360 euros per ounce reached in<br />

September. This trend was exacerbated by central bank purchases,<br />

above all from China, coupled with low interest rates.<br />

The capital markets received support from the ECB at the end<br />

<strong>of</strong> the year as it responded to the flagging European economy by<br />

reducing the base rate by 0.25 per cent in both November and<br />

December, taking it to a record low <strong>of</strong> just one per cent.

Management <strong>report</strong><br />

Austrian economic trends<br />

In 2011, the Austrian economy expanded strongly, with the current<br />

forecast for 2011 predicting real-terms GDP growth <strong>of</strong> 3.2 per cent.<br />

This puts Austria well ahead <strong>of</strong> the EU as a whole, where average<br />

GDP growth was just 1.5 per cent. However, due to a sharp deterioration<br />

in external economic conditions and the collapse in confidence,<br />

in 2012 growth is expected to be just 0.7 per cent.<br />

The most important pillar <strong>of</strong> the Austrian economy was exports,<br />

which were up 6.9 per cent in 2011. However, they will be most<br />

strongly affected by the downturn. Foreign orders have been falling<br />

steadily since last May, but there are signs that this trend is now<br />

bottoming out. In 2011, Austria drew considerable benefit from the<br />

economic strength <strong>of</strong> Germany, which is also our country’s biggest<br />

trading partner. Of Austrian exports, 33 per cent are destined for<br />

Germany, whereas Austria’s second-biggest trading partner, Italy,<br />

accounts for just eight per cent <strong>of</strong> all exports.<br />

As recovery set in, the investment cycle slowly began turning in<br />

2010, but had already lost impetus by mid-2011. The excess<br />

capacity still available up to mid-2011 is indicative <strong>of</strong> the fact that<br />

the capital expenditure undertaken up to then was chiefly to<br />

replace old plants and equipment rather than to expand production<br />

capacity. Nevertheless, gross plant and equipment investments<br />

rose by 3.7 per cent. In the construction industry, a slight recovery<br />

is expected for 2012, as indicated by increasing numbers <strong>of</strong> building<br />

permits and recent sharp rises in property<br />

prices. Civil engineering recovered somewhat earlier than<br />

construction, but clear signs <strong>of</strong> an upswing are lacking, with no<br />

additional impetus coming from the public sector. At 1.7 per cent,<br />

public sector consumption made a below-average contribution to<br />

GDP growth, while private consumption in 2011 faltered in the face<br />

<strong>of</strong> high inflation rates, rising by just 0.9 per cent. Despite strong<br />

growth in employment, real disposable household incomes barely<br />

rose at all.<br />

In Tyrol, too, the economic recovery was very much led by the<br />

export sector. Though final figures are not yet available, 2011<br />

appears to have been a record year for exports, beating the pre-<br />

vious record set in 2010. The Italian market takes a relatively<br />

high proportion <strong>of</strong> Tyrol’s exports, making it more important than<br />

for Austria as a whole, in view <strong>of</strong> which the prevailing uncertainty<br />

as to how the debt crisis will play out in our southern neighbour<br />

generates a significant but imponderable level <strong>of</strong> additional risk.<br />

A stabilising factor for Tyrol is the strength <strong>of</strong> the tourism industry,<br />

which is <strong>of</strong> major importance to the state’s economy. In terms <strong>of</strong><br />

overnight stays, Tyrol is Austria’s number one federal state for<br />

tourism.<br />

Due to sharp rises in the prices <strong>of</strong> services, foodstuffs and energy,<br />

2011 HICP inflation rose to 3.5 per cent, significantly above the<br />

EU average <strong>of</strong> 3.1 per cent. In 2012, falling commodity prices are<br />

expected to bring about a marked fall in inflation to 2.1 per cent<br />

(two per cent for the EU).<br />

21<br />

In both 2010 and the portion <strong>of</strong> 2011 for which we have figures,<br />

the labour market served up a welcome surprise, as new jobs were<br />

created in virtually all economic sectors. However, since mid-2011<br />

various key leading indicators have been signalling a turnaround<br />

on the Austria labour market. In 2011, the unemployment rate fell<br />

to 4.1 per cent, but the economic downturn in 2012 means that the<br />

rate is set to rise back up to 4.5 per cent. However, this still leaves<br />

Austria with the lowest unemployment rate in the EU, where the<br />

average 2011 unemployment rate was 9.9 per cent.<br />

Meanwhile, the labour market situation in Tyrol is even better.<br />

At 2.8 per cent, the 2010 unemployment rate was well below the<br />

the Austrian average <strong>of</strong> 4.4 per cent, and although no final 2011<br />

figures for Tyrol were available at the time <strong>of</strong> going to press, the<br />

provisional figures indicate a further fall in unemployment, maintaining<br />

the positive picture <strong>of</strong> previous years.

22 Management <strong>report</strong><br />

Review <strong>of</strong> operations in 2011<br />

<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong> can look back on a successful 2011, in which we chalked up a significant increase in our pr<strong>of</strong>it from<br />

ordinary activities. This was chiefly due to our success in slightly raising our operating income, while managing to keep operating<br />

expenses at last year’s level and significantly reducing the fair-value measurement.<br />

Balance sheet total in millions <strong>of</strong> euros<br />

31.12.2004 31.12.2005 31.12.2006 31.12.2007 31.12.2008 31.12.2009 31.12.2010 31.12.2011<br />

5,086 4,882 4,758 5,047 6,654 7,296 7,182 7,356<br />

Origin <strong>of</strong> funds and capital structure<br />

Liabilities to<br />

banks<br />

Millions <strong>of</strong><br />

euros<br />

31.12.2011 31.12.2010 Change<br />

Per cent Millions <strong>of</strong><br />

euros<br />

Per cent Millions <strong>of</strong><br />

euros<br />

Per cent<br />

3,952.41 53.7% 4,012.30 55.9% –59.89 –1.5%<br />

Current account deposits 847.10 11.5% 797.06 11.1% 50.04 6.3%<br />

Savings account deposits 610.92 8.3% 606.78 8.4% 4.14 0.7%<br />

Liabilities evidenced by<br />

paper<br />

1,379.18 18.7% 1,188.18 16.5% 191.00 16.1%<br />

Equity 360.12 4.9% 350.85 4.9% 9.27 2.6%<br />

Other liabilities 205.98 2.8% 226.78 3.2% –20.80 –9.2%<br />

Total liabilities 7,355.71 100.0% 7,181.95 100.0% 173.76 2.4%<br />

The 2.4 per cent increase in balance sheet liabilities by 173.76 million euros to 7,355.71 million euros is chiefly due to an increase in<br />

liabilities evidenced by paper, which rose by 16.1 per cent, or 191 million euros, to 1,379.18 million euros. Current account deposits are<br />

also up by 6.3 per cent, or 50.04 million euros, to 847.10 million euros. Equity is up by 2.6 per cent, or 9.27 million euros, to 360.12 million<br />

euros. And savings deposits increased 0.7 per cent by 4.14 million euros to 610.92 million euros. Meanwhile, liabilities to banks have<br />

fallen by 1.5 per cent, or 59.89 million euros, to 3,952.41 million euros, and other liabilities by 9.2 per cent, or 20.80 million euros, to<br />

205.98 million euros.

Management <strong>report</strong><br />

Appropriation <strong>of</strong> funds and asset structure<br />

Receivables from<br />

banks<br />

Millions <strong>of</strong><br />

euros<br />

The rise in balance sheet assets is chiefly due to increases in securities held beneficially and receivables from banks. Securities held<br />

beneficially increased 9.4 per cent by 143.36 million euros to 1,663.35 million euros, and receivables from banks rose by 3.0 per cent,<br />

or 81.75 million euros, to 2,830.99 million euros. Also slightly up are other assets by 4.7 per cent, or 5.87 million euros, to 131.79 million<br />

euros, and participating interests including investments in affiliated companies grew 1.0 per cent by 2.05 million euros to 210.97 million<br />

euros. Meanwhile, receivables from customers have fallen slightly by 2.3 per cent, or 59.27 million euros, to 2,518.61 million euros.<br />

At the end <strong>of</strong> 2011, receivables from customers broke down as follows:<br />

31.12.2011 31.12.2010 Change<br />

Per cent Millions <strong>of</strong><br />

euros<br />

Per cent Millions <strong>of</strong><br />

euros<br />

23<br />

Per cent<br />

2,830.99 38.5% 2,749.24 38.3% 81.75 3.0%<br />

Receivables from customers 2,518.61 34.2% 2,577.88 35.9% –59.27 –2.3%<br />

Securities 1,663.35 22.6% 1,519.99 21.2% 143.36 9.4%<br />

Participating interests,<br />

including<br />

shares in<br />

affiliated companies 210.97 2.9% 208.92 2.9% 2.05 1.0%<br />

Other assets 131.79 1.8% 125.92 1.8% 5.87 4.7%<br />

Total assets 7,355.71 100.0% 7,181.95 100.0% 173.76 2.4%<br />

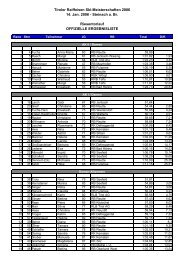

RLB <strong>Tirol</strong> <strong>AG</strong> 2011 breakdown by sector<br />

Thousands <strong>of</strong><br />

euros<br />

2011 2010 Change Proportion <strong>of</strong><br />

total loans<br />

Thousands <strong>of</strong><br />

euros<br />

Per cent Per cent<br />

Agriculture, forestry and cooperatives 22,839 23,168 –1.4% 0.9%<br />

Transport 127,412 140,342 –9.2% 5.1%<br />

Trade 531,209 539,897 –1.6% 21.1%<br />

Manufacturing industry 147,096 161,978 –9.2% 5.8%<br />

Employed persons, private 493,107 486,748 1.3% 19.6%<br />

Tourism and leisure industry 361,780 352,049 2.8% 14.4%<br />

Public sector and social insurance 187,335 203,562 –8.0% 7.4%<br />

Self-employed persons 55,210 55,185 0.0% 2.2%<br />

Commerce 154,665 149,464 3.5% 6.1%<br />

Others (residential building associations and other non-banks) 437,958 465,491 –5.9% 17.4%<br />

Total 2,518,610 2,577,884 –2.3% 100.0%

24 Management <strong>report</strong><br />

Regulatory capital pursuant to Section 23 BWG<br />

31.12.2011 31.12.2010 31.12.2009 Change<br />

Thousands <strong>of</strong> Thousands <strong>of</strong> Thousands <strong>of</strong> Thousands <strong>of</strong> Per cent<br />

euros<br />

euros<br />

euros<br />

euros<br />

Subscribed capital 84,950 84,950 84,950<br />

Reserves 275,170 265,899 258,587<br />

Intangible assets 0 0 –3<br />

CORE CAPITAL 360,120 350,849 343,534 9,271 2.6%<br />

Subordinate capital 13,752 13,752 13,752<br />

SUPPLEMENTARY CAPITAL 13,752 13,752 13,752 0 0.0%<br />

REGULATORY CAPITAL before deductions 373,872 364,601 357,286 9,271 2.5%<br />

Deduction pursuant to Section 23 (13) BWG –2 –2 –2<br />

Short-term subordinate capital 0 0 0<br />

TOTAL REGULATORY CAPITAL 373,870 364,599 357,284 9,271 2.5%<br />

In the year under review, <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> <strong>AG</strong>’s regulatory capital rose by 2.5 per cent, or 9.27 million euros, to 373.87 million<br />

euros.<br />

Income statement<br />

2011 2010 Change<br />

Millions <strong>of</strong> Millions <strong>of</strong> Millions <strong>of</strong> Per cent<br />

euros<br />

euros<br />

euros<br />

Net interest income<br />

Income from securities<br />

57.03 55.63 1.40 2.5%<br />

and participating interests 15.22 14.28 0.94 6.6%<br />

Commission income 23.55 24.16 –0.61 –2.5%<br />

Pr<strong>of</strong>it/loss from financial transactions 3.24 3.07 0.17 5.5%<br />

Other operating income 11.54 11.83 –0.29 –2.5%<br />

OPERATING INCOME 110.58 108.97 1.61 1.5%<br />

Personnel costs –36.67 –38.13 –1.46 –3.8%<br />

Other administrative costs<br />

(operating expenses) –24.66 –23.87 0.79 3.3%<br />

Impairment losses on<br />

assets –3.05 –3.38 –0.33 –9.8%<br />

Other operating costs –1.79 –1.20 0.59 49.2%<br />

TOTAL OPERATING COSTS –66.17 –66.58 –0.41 –0.6%<br />

OPERATING PROFIT 44.41 42.39 2.02 4.8%<br />

Net expense for<br />

impairment losses on receivables –21.02 –19.98 1.04 5.2%<br />

Net expense for<br />

impairment losses on securities and participating interests 0.82 –4.78 5.60 –117.2%<br />

Pr<strong>of</strong>it from ordinary activities 24.21 17.63 6.58 37.3%<br />

In 2011, our operating income rose by 1.5 per cent, or 1.61 million euros, to 110.58 million euros. This was due to a slight increase in net<br />

interest income <strong>of</strong> 2.5 per cent, or 1.40 million euros, to 57.03 million euros. Our income from securities and participating interests also<br />