Public Trust - Annual Report 2011 - Crown Ownership Monitoring Unit

Public Trust - Annual Report 2011 - Crown Ownership Monitoring Unit

Public Trust - Annual Report 2011 - Crown Ownership Monitoring Unit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

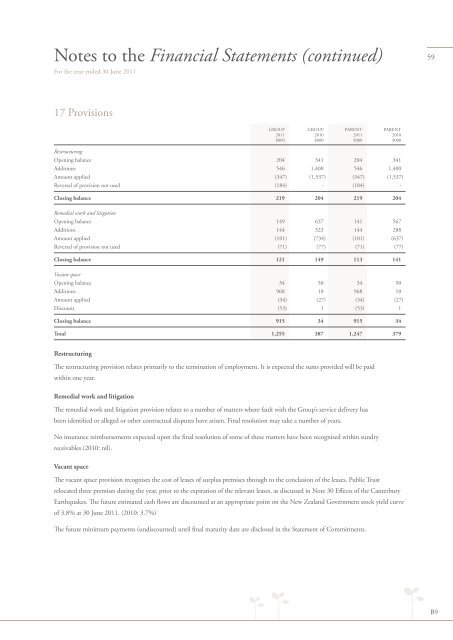

Notes to the Financial Statements (continued)For the year ended 30 June <strong>2011</strong>5917 ProvisionsGROUP<strong>2011</strong>$000GROUP2010$000PARENT<strong>2011</strong>$000PARENT2010$000RestructuringOpening balance 204 341 204 341Additions 546 1,400 546 1,400Amount applied (347) (1,537) (347) (1,537)Reversal of provision not used (184) - (184) -Closing balance 219 204 219 204Remedial work and litigationOpening balance 149 637 141 567Additions 144 323 144 288Amount applied (101) (734) (101) (637)Reversal of provision not used (71) (77) (71) (77)Closing balance 121 149 113 141Vacant spaceOpening balance 34 50 34 50Additions 968 10 968 10Amount applied (34) (27) (34) (27)Discount (53) 1 (53) 1Closing balance 915 34 915 34Total 1,255 387 1,247 379RestructuringThe restructuring provision relates primarily to the termination of employment. It is expected the sums provided will be paidwithin one year.Remedial work and litigationThe remedial work and litigation provision relates to a number of matters where fault with the Group’s service delivery hasbeen identified or alleged or other contractual disputes have arisen. Final resolution may take a number of years.No insurance reimbursements expected upon the final resolution of some of these matters have been recognised within sundryreceivables (2010: nil).Vacant spaceThe vacant space provision recognises the cost of leases of surplus premises through to the conclusion of the leases. <strong>Public</strong> <strong>Trust</strong>relocated three premises during the year, prior to the expiration of the relevant leases, as discussed in Note 30 Effects of the CanterburyEarthquakes. The future estimated cash flows are discounted at an appropriate point on the New Zealand Government stock yield curveof 3.8% at 30 June <strong>2011</strong>. (2010: 3.7%)The future minimum payments (undiscounted) until final maturity date are disclosed in the Statement of Commitments.B9