Transamerica CI Growth Portfolio - CI Investments

Transamerica CI Growth Portfolio - CI Investments

Transamerica CI Growth Portfolio - CI Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

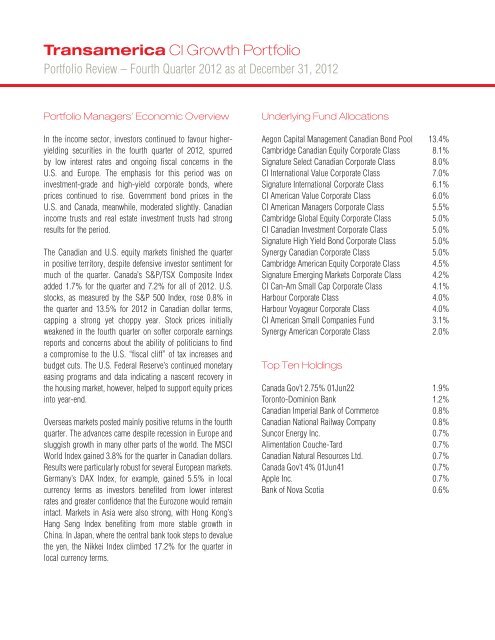

<strong>Transamerica</strong> <strong>CI</strong> <strong>Growth</strong> <strong>Portfolio</strong><strong>Portfolio</strong> Review – Fourth Quarter 2012 as at December 31, 2012<strong>Portfolio</strong> Managers’ Economic OverviewIn the income sector, investors continued to favour higheryieldingsecurities in the fourth quarter of 2012, spurredby low interest rates and ongoing fiscal concerns in theU.S. and Europe. The emphasis for this period was oninvestment-grade and high-yield corporate bonds, whereprices continued to rise. Government bond prices in theU.S. and Canada, meanwhile, moderated slightly. Canadianincome trusts and real estate investment trusts had strongresults for the period.The Canadian and U.S. equity markets finished the quarterin positive territory, despite defensive investor sentiment formuch of the quarter. Canada’s S&P/TSX Composite Indexadded 1.7% for the quarter and 7.2% for all of 2012. U.S.stocks, as measured by the S&P 500 Index, rose 0.8% inthe quarter and 13.5% for 2012 in Canadian dollar terms,capping a strong yet choppy year. Stock prices initiallyweakened in the fourth quarter on softer corporate earningsreports and concerns about the ability of politicians to finda compromise to the U.S. “fiscal cliff” of tax increases andbudget cuts. The U.S. Federal Reserve’s continued monetaryeasing programs and data indicating a nascent recovery inthe housing market, however, helped to support equity pricesinto year-end.Overseas markets posted mainly positive returns in the fourthquarter. The advances came despite recession in Europe andsluggish growth in many other parts of the world. The MS<strong>CI</strong>World Index gained 3.8% for the quarter in Canadian dollars.Results were particularly robust for several European markets.Germany’s DAX Index, for example, gained 5.5% in localcurrency terms as investors benefited from lower interestrates and greater confidence that the Eurozone would remainintact. Markets in Asia were also strong, with Hong Kong’sHang Seng Index benefiting from more stable growth inChina. In Japan, where the central bank took steps to devaluethe yen, the Nikkei Index climbed 17.2% for the quarter inlocal currency terms.Underlying Fund AllocationsAegon Capital Management Canadian Bond Pool 13.4%Cambridge Canadian Equity Corporate Class 8.1%Signature Select Canadian Corporate Class 8.0%<strong>CI</strong> International Value Corporate Class 7.0%Signature International Corporate Class 6.1%<strong>CI</strong> American Value Corporate Class 6.0%<strong>CI</strong> American Managers Corporate Class 5.5%Cambridge Global Equity Corporate Class 5.0%<strong>CI</strong> Canadian Investment Corporate Class 5.0%Signature High Yield Bond Corporate Class 5.0%Synergy Canadian Corporate Class 5.0%Cambridge American Equity Corporate Class 4.5%Signature Emerging Markets Corporate Class 4.2%<strong>CI</strong> Can-Am Small Cap Corporate Class 4.1%Harbour Corporate Class 4.0%Harbour Voyageur Corporate Class 4.0%<strong>CI</strong> American Small Companies Fund 3.1%Synergy American Corporate Class 2.0%Top Ten HoldingsCanada Gov’t 2.75% 01Jun22 1.9%Toronto-Dominion Bank 1.2%Canadian Imperial Bank of Commerce 0.8%Canadian National Railway Company 0.8%Suncor Energy Inc. 0.7%Alimentation Couche-Tard 0.7%Canadian Natural Resources Ltd. 0.7%Canada Gov’t 4% 01Jun41 0.7%Apple Inc. 0.7%Bank of Nova Scotia 0.6%