Transamerica CI Growth Portfolio - CI Investments

Transamerica CI Growth Portfolio - CI Investments

Transamerica CI Growth Portfolio - CI Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

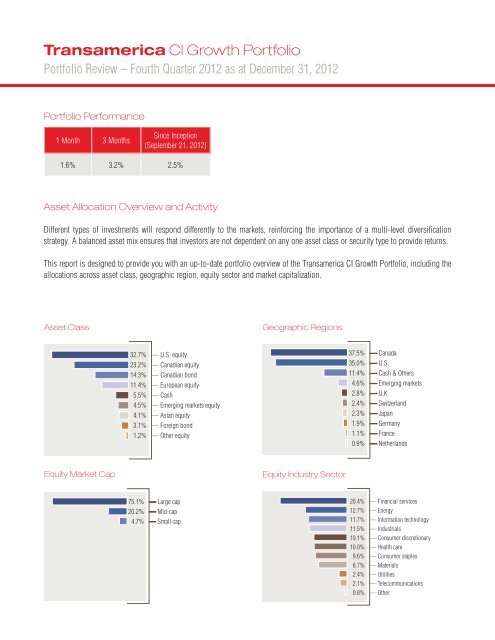

<strong>Transamerica</strong> <strong>CI</strong> <strong>Growth</strong> <strong>Portfolio</strong><strong>Portfolio</strong> Review – Fourth Quarter 2012 as at December 31, 2012<strong>Portfolio</strong> Performance1 Month 3 MonthsSince Inception(September 21, 2012)1.6% 3.2% 2.5%Asset Allocation Overview and ActivityDifferent types of investments will respond differently to the markets, reinforcing the importance of a multi-level diversificationstrategy. A balanced asset mix ensures that investors are not dependent on any one asset class or security type to provide returns.This report is designed to provide you with an up-to-date portfolio overview of the <strong>Transamerica</strong> <strong>CI</strong> <strong>Growth</strong> <strong>Portfolio</strong>, including theallocations across asset class, geographic region, equity sector and market capitalization.Asset ClassGeographic Regions32.7%23.2%14.3%11.4%5.5%4.5%4.1%3.1%1.2%— U.S. equity— Canadian equity— Canadian bond— European equity— Cash— Emerging markets equity— Asian equity— Foreign bond— Other equity37.5%35.0%11.4%4.6%2.8%2.4%2.3%1.9%1.1%0.9%0 5 10 15 20 25 30 35— Canada— U.S.— Cash & Others— Emerging markets— U.K.— Switzerland— Japan— Germany— France— Netherlands0 5Equity Market Cap75.1% — Large cap20.2% — Mid-cap4.7% — Small cap32,7 % — Actions américaines23,2 % — Actions canadiennes14,3 % — Obligations canadiennes11,4 % — Actions européennes5,5 % — Trésorerie4,5 % — Actions de marchés émergents4,1 % — Actions asiatiques3,1 % — Obligations étrangères1,2 % — Autres actionsEquity Industry Sector▲▼■20.4%— Financial services12.7% — Energy11.7% — Information technology37,5 11.5% %35,0 10.1% %11,4 10.0% %4,69.6%%— Industrials Canada— Consumer États-Unis discretionary— Health Trésorerie care et autres— ConsumerMarchés émergentsstaples8.7% — Materials2,8 %Royaume-Uni2.4% — Utilities2,4 %Suisse2.1% — Telecommunications2,3 %Japon0.8% — Other0 10 20 30 40 50 60 70 80 1,9 % — Allemagne▲1,1 %0,9 %— France— Pays-Bas▼0