HSBC Westside Classic Credit Card

HSBC Westside Classic Credit Card

HSBC Westside Classic Credit Card

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

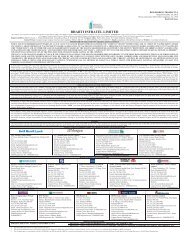

4. When the credit card account has an outstanding balance, <strong>HSBC</strong> willsend a monthly itemised statement of account. This statement willprovide details on:a) The amount outstanding as at the statement billing date - "netoutstanding balance" (note that the Current OutstandingBalance may be a lesser or greater balance depending on entriesposted to the credit card account but not yet billed).b) The Minimum Payment Due (at rates applicable from time totime and as advised by <strong>HSBC</strong> in its tariff sheet).c) The Payment Due Date (the date by which payment must bereceived by <strong>HSBC</strong>. If payment is made by cheque, the fundsmust be realised in the card account by the due date).d) Any Amount Past Due (minimum payments due, that areoutstanding from previous statements and the AmountOverlimit, if any).e) Non-receipt of statement would not affect the cardholder'sobligations and liabilities.5. A purchase and a subsequent credit for cancellation of goods /serviceslike air/rail tickets are two separate transactions. You must pay for thepurchase transaction as it appears on your statement to avoid thecharging of any fee. The refund will only be credited to your credit cardaccount (less cancellation charges) as and when received from themerchant. If the credit is not posted to your credit card account within30 days from the date of refund, you must notify <strong>HSBC</strong>.6. It is also necessary that a copy of the credit note should be sentalong with your notification to <strong>HSBC</strong>.7. All charges incurred in foreign currency will be billed in the creditcardholder's billing statement in Indian Rupees. You hereby authorise<strong>HSBC</strong> and VISA <strong>Card</strong> to convert charges incurred in a foreign currencyto the Indian Rupee equivalent thereof at such rate as <strong>HSBC</strong> and VISA<strong>Card</strong> may from time to time designate.8. To report billing grievances, please contact K C Mahesh, Manager,<strong>Credit</strong> <strong>Card</strong> Services, Ambal House, 610, Anna Salai, Chennai 600 006.If you wish to escalate the grievance, please contact Mrs. SathyaSrinivasan, Nodal Officer, The Hongkong and Shanghai BankingCorporation Limited, No. 96, Dr. Radhakrishnan Salai, Mylapore,Chennai 600 004. The Reserve Bank of India has appointed anOmbudsman who can be approached for redressing customergrievances if they have not already been redressed by <strong>HSBC</strong>. Thecustomer can approach the Ombudsman if he does not receive aresponse within 60 days or if he is not satisfied with the response.Payment1. Cheques/Drafts forwarded to <strong>HSBC</strong> for clearance of dues must bedrawn on/payable at any city where <strong>HSBC</strong> has a branch. Cheques/Drafts drawn or deposited outside these areas are subject to acollection charge at the then prevailing rate. Payments will becredited to the credit card account on receipt, but should thepayment instrument subsequently be dishonoured, the credit cardaccount may be suspended, the credit card cancelled and the fulloutstanding balance will become immediately due and payable.<strong>HSBC</strong> will, at its sole discretion, take necessary measures to recoverthe money and this may include filing a criminal case under theNegotiable Instruments Act.15