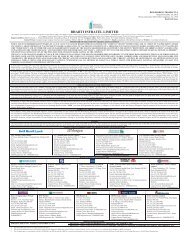

HSBC Westside Classic Credit Card

HSBC Westside Classic Credit Card

HSBC Westside Classic Credit Card

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

25guidelines/rules, these Terms & Conditions shall prevail at all times.13. All and any disputes arising from the Balance Transfer-on-EMI facilityshall be subject to the exclusive jurisdiction of the courts of Mumbai.14. The terms of this offer shall be in addition to and not in derogation ofthe terms contained in the <strong>Card</strong>holder Agreement. This offer is byway of a special facility for select <strong>Card</strong>holders and nothing containedherein shall prejudice or affect the terms and conditions of the<strong>Card</strong>holder Agreement. The words and expressions used herein shallhave the same meaning as in the <strong>Card</strong>holder Agreement.Loan on Phone1. This offer is brought to you by The Hongkong and Shanghai BankingCorporation Limited, India (<strong>HSBC</strong>) and any participation is voluntary.This offer is applicable to only a select <strong>HSBC</strong> <strong>Westside</strong> <strong>Classic</strong> <strong>Credit</strong><strong>Card</strong>holders (hereinafter referred to as the “<strong>Card</strong>holder”).2. Loan on Phone (LOP) is a facility by which the <strong>Card</strong>holder can makepurchases on the <strong>HSBC</strong> <strong>Westside</strong> <strong>Classic</strong> <strong>Credit</strong> <strong>Card</strong> (hereinafterreferred to as “<strong>Credit</strong> <strong>Card</strong>”) and then convert the purchase amountinto instalments. The <strong>Card</strong>holder can make the purchase at anymerchant establishment and post purchase get the transactionconverted into an LOP.3. Loan on Phone facility can be offered only within 15 calendar days ofthe purchase transaction to request for a Loan on Phone on thepurchase transaction.4. The value of the transaction should be greater than Rs. 2000 to beeligible for conversion to a Loan on Phone. Other debit transactionslike cash withdrawals and card fees will not be eligible for this facility.5. For <strong>Classic</strong> <strong>Credit</strong> <strong>Card</strong>holders, the annual rate of interest chargedwill be 23.88% p.a. computed on monthly reducing balance. EquatedMonthly Instalment (EMI) per Rs 1000 will be Rs. 177 for a loantenure of 6 months, Rs. 93.1 for a loan tenure of 12 months, Rs. 65.2for a loan tenure of 18 months and Rs. 51.4 for a loan tenure of24 months.6. A 2% processing fee will be applicable subject to a minimum ofRs. 100. This will reflect along with the first Equated MonthlyInstalment (EMI) amount on the card statement.7. The loan will be offered for a maximum tenure of 24 months withslabs of 6, 12, 18 and 24 months.8. The Equated Monthly Instalment (EMI) amount will be billed tothe <strong>Credit</strong> <strong>Card</strong> every month on the same date as the firstinstalment date.9. Minimum Amount Due: The Loan on Phone EMI due for the monthis included as part of the minimum amount due appearing in the<strong>Card</strong>holder’s monthly statement. The minimum amount dueappearing on the <strong>Card</strong>holder's monthly statement is calculated as apercentage of the total outstanding retail balance + Monthly EMI dueon Loan on Phone EMI. Non-payment of the entire total payment dueon the card by the payment due date will result in the levy ofstandard <strong>Credit</strong> <strong>Card</strong> interest rates on the balance outstanding. IfMinimum Amount Due (as defined above) is paid only, the standard<strong>Credit</strong> <strong>Card</strong> interest rates will be levied on the balance outstanding.However, if such partial payments do not cover the amount of EMIfor the month, the balance EMI would also be subject to standardfinance charge (including the late payment fee).