Debit Card Services Guide - HSBC

Debit Card Services Guide - HSBC

Debit Card Services Guide - HSBC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Explore and experiencethe privileges<strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong>Service <strong>Guide</strong>

•

Dear customer,Welcome to the world of The Hongkong and ShanghaiBanking Corporation Limited, India (<strong>HSBC</strong> India). You willbe pleased to know that you now have an <strong>HSBC</strong> IndiaPremier Platinum <strong>Debit</strong> <strong>Card</strong> that brings you convenienceand privileges.The debit card gives you electronic access to your savingsor current account with <strong>HSBC</strong> India. As part of <strong>HSBC</strong> India’sconstant endeavour to offer its customers enhanced value,the debit card from <strong>HSBC</strong> India offers the added protectionof Chip technology – a global security standard in cards.<strong>Debit</strong> cards from <strong>HSBC</strong> India are classified as ‘Chip and PIN’debit cards.Your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> can be usedat <strong>HSBC</strong> Group ATMs of Visa network and at Visa merchantoutlets.The <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> offers youthe best possible alternative to carrying cash and allowsyou extensive access to your savings or current account,anywhere and anytime.To learn more about the services you can enjoy and theusage of your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>,please read this user guide and <strong>Card</strong>holders Agreementthoroughly.Thank you for giving us the opportunity to serve you. We lookforward to being of service to you and hope you will enjoyusing your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>.Warm regards,Manish SinhaHead - Customer Value Management

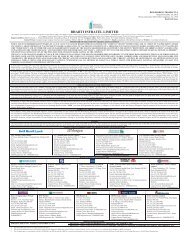

Table of contents• Knowing your <strong>HSBC</strong> IndiaPremier Platinum <strong>Debit</strong> <strong>Card</strong> 1• Important points 3• Getting started with your <strong>HSBC</strong> IndiaPremierPlatinum <strong>Debit</strong> <strong>Card</strong> 5• Benefits of <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> 8• International usage of your <strong>HSBC</strong> IndiaPremier Platinum <strong>Debit</strong> <strong>Card</strong> 9• Safeguarding your <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> 12• <strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong> tariff sheet 13• PhoneBanking numbers 14

Knowing your <strong>HSBC</strong> IndiaPremier Platinum <strong>Debit</strong> <strong>Card</strong>Front1. Chip: The embedded Chip provides the latest insecurity features. The Chip protects your card fromfraudulent usage – especially counterfeiting andskimming card frauds.2. <strong>Debit</strong> card number: This is your exclusive 16-digit cardnumber. Please quote this number in all communication/correspondence with the Bank.3. Your name: Only you are authorised to use your debitcard. Please check to see that your name has beencorrectly printed.4. Electronic usage sign: In case of purchase transactions,the <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> can only beused at merchant outlets with Point Of Sale (POS) swipeterminals. Please do not use your <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> at merchants with ‘paper imprinters’or for Mail/Telephone Order (MOTO) transactions.5. Valid From - Expires End (mm/yy): Your debit card isvalid until the last day of the month of the year indicatedon the debit card.6. Visa Electron/Visa logo and hologram: Any merchantestablishment displaying this logo should accept your<strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>.1236451

Back7. Magnetic stripe: Important information pertaining to your<strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> is encoded here.Please protect your <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> from scratching and exposure tomagnets and magnetic fields as they can damage thestripe.8. Signature panel: Please sign this panel immediatelyon receipt of your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong><strong>Card</strong> with a non-erasable ball point pen (preferably inblack ink). The signature you will use to sign chargeslips at merchant outlets needs to be the same as thissignature.879. Personal Identification Number (PIN): You will receivea confidential PIN for use of your debit card at ATMs.2

Important points• Please check the name on your <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> and sign on the signature panel onthe reverse of your <strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong>• Do remember to begin using this debit card only fromits ‘Valid From’ date• To know more on your debit card usage, please referto the Frequently Asked Questions (FAQs) hosted inwww.hsbc.co.in or call <strong>HSBC</strong> PhoneBanking for furtherdetails. For all debit cards issued on or after 1 December2013, customers who have opted for domestic usagewill not be able to make any overseas transactionincluding online transactions on international websites• Please note in absence of usage preference, bank shallissue a debit card with domestic usage only.• To convert the card from domestic usage to internationalor vice versa, you can call <strong>HSBC</strong> PhoneBankingnumbers or submit a ‘Domestic/International <strong>Card</strong>Usage Form’ at the nearest <strong>HSBC</strong> India branch• You will be required to authenticate your purchases atmerchant outlets in India using your 6-digit ATM PINat the Point Of Sale (POS) terminal, to complete thepayment. Please contact us in case you need a newATM PIN to be issued• Since PIN/signature verification is essential for debitcard transactions, you need to be physically presentalong with your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong><strong>Card</strong> at the time of purchase i.e. the <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> cannot be used for Mail Order/Telephone Order (MOTO) transactions• For your safety, the <strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong> sent to you is inactive, for use at merchantestablishments (Please refer to the section ‘Gettingstarted with your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong><strong>Card</strong>’ on page 5 for details on how to activate your card)• A Personal Identification Number (ATM PIN) will beissued to you separately, for using your <strong>HSBC</strong> IndiaPremier Platinum <strong>Debit</strong> <strong>Card</strong> at ATMs and POS terminals• By using your debit card, you accept the terms andconditions stated in the <strong>Card</strong>holder agreement. Theterms and conditions are also uploaded on the<strong>HSBC</strong> India website for <strong>Card</strong>holders information3

• In case you use your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong><strong>Card</strong> as a Power of Attorney (POA) holder (on behalfof the accountholder(s)), we require you to state ‘POAHolder’ or ‘Constituted Attorney’ below your signatureat the time of executing payments at merchantestablishments on the charge slip• We request you to intimate the Bank in case ofchange of residency status as per Foreign ExchangeManagement Act (1999) (FEMA). Please surrender yourdebit card before proceeding overseas on permanentemployment and/or emigrating and/or changing yournationality. Please ensure that use of your debit cardis in accordance with the relevant Exchange ControlRegulations issued and amended by Reserve Bank ofIndia from time to time and adheres with the provisionsunder the Foreign Exchange Management Act, 1999(FEMA). Any violation may hold you liable for action asper the guidelines of the Act• If you are receiving an <strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong> on renewal of your existing debit card, thena new ATM PIN will not be issued. Please use yourexisting ATM PIN for activation of your card• If you have an existing/earlier issued <strong>HSBC</strong> India <strong>Debit</strong><strong>Card</strong> linked to any of the accounts which is linked tothis <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>, it willbe deactivated 30 days from the date of this letter. Toprevent any misuse, please remember to destroy yourearlier debit card by cutting it across the magnetic stripeonce you have used your <strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong>• You only will be able to access only your primaryaccount at merchant establishments whilst transactingon this debit card• You can use your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong><strong>Card</strong> at <strong>HSBC</strong> Group ATMs of Visa network and at Visamerchant outlets worldwide4Please note:<strong>HSBC</strong> India <strong>Debit</strong> <strong>Card</strong> linked to Non-Resident Ordinary(NRO) account or Power of Attorney (POA) debit cardlinked to <strong>HSBC</strong> India NRE Account will have access onlyto <strong>HSBC</strong> India ATMs, ATMs affiliated to the Visa networkand Visa merchant outlets in India.

Getting started with your<strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong>Activating your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>For security reasons, we send you an inactive card. You needto activate your card first before using the card at any merchantestablishment or for online transactions.To activate your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>:1. Use your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> at anyVisa ATM, by entering the ATM PIN. This is applicable onlyto debit cards linked to <strong>HSBC</strong> India Resident and/orNon-Resident External (NRE) account.or2. Use your debit card at POS terminal that supports Chipand PIN capability. You will need to enter your 6 digit ATMPIN after the merchant dips the debit card at the POSterminal.or3. Make a Telephone Banking PIN verified call to our<strong>HSBC</strong> India PhoneBanking numbers to confirm receiptand they will activate your <strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong>. The debit card can also be activated throughPIN verified call on the IVR.A Personal Identification Number (PIN) will be issued to youseparately for using your debit card at ATMs and POS terminalsPlease note:In case your <strong>HSBC</strong> India <strong>Debit</strong> <strong>Card</strong> is linked to Non-ResidentOrdinary (NRO) account or is a Power of Attorney debit cardlinked to <strong>HSBC</strong> India NRE Account, you are requested to usethe debit card at any Visa ATM/merchant outlet in India, byentering the ATM PIN issued by <strong>HSBC</strong> India.Merchant EstablishmentYou need to follow these simple steps to make paymentsat merchant establishments with your <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong>.1. Look for a Visa logo at the merchant establishment.The merchant must have an Point Of Sale (POS) swipeterminal.2. Shop and select the goods you wish to purchase.3. Present your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>to the merchant at the time of making payment. Themerchant will dip the debit card into the card reader in thePOS terminal and enter the amount to be paid by you.4. At the PIN enabled POS outlets, you will be required toenter your ATM PIN on the POS machine.5

5. A charge slip is generated from the electronicswipe terminal.6. Check the amount on the charge slip and sign it. Yoursignature must match that on the <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong>.7. The merchant verifies the signature and returns the<strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> along withcharge slip.8. After a successful authorisation, a hold for the transactionamount will first be placed on your account. Your accountwill subsequently be debited for the transacted amount.9. Please refer to the section titled ‘Important guidelineson international usage’for details on usage of your<strong>HSBC</strong> <strong>Debit</strong> <strong>Card</strong> at merchant establishments locatedoutside India.6Online usage• Your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> can beused for shopping online at websites where Visa cardsare accepted. Whether, it is travel or movie tickets,hotel reservations, shopping for luxuries, paying utilitybills or making investments - you can do it safely fromthe comfort of your home. Your online transactionsare secured by 3-D Secure (3DS) technology, which isan added layer of security for online credit and debitcard transactions. 3DS was developed to improvethe security of online transactions and is offered tocustomers as the Verified by Visa (VbV) service• Please note that, you will not be able to transact onlineother than Verified by Visa (VbV) sites• To shop online with your <strong>HSBC</strong> India <strong>Debit</strong> <strong>Card</strong>, youwould require to authenticate the transaction using anOTP (One-Time-Password). The OTP will be automaticallysent by our system to your registered mobile number viaSMS when you initiate the online transaction. At the VbVauthentication screen you will be required to enter the 6digit OTP to complete the online transaction• Please ensure, you have registered your mobile numberwith the Bank to receive the OTP and authenticate theonline transaction• All merchants in India offering online transaction optionon their websites are required to implement two factorauthentication as per RBI mandate. Therefore, in casean Indian website does not provide VbV service, thetransaction will be declined

• If the website is based abroad and does not provideVbV service, the online transaction will be selectivelyapproved based on the type of purchase transaction andas per <strong>HSBC</strong> India’s policy• You are requested to adhere to the terms of usage ofyour <strong>HSBC</strong> India <strong>Debit</strong> <strong>Card</strong> while undertaking suchonline transactionsAt ATMsAt an <strong>HSBC</strong> ATM, you can perform any of the followingtransactions:1. Cash withdrawal.2. Balance enquiry.3. Obtain a mini account statement - last 8 transactionson your account.4. Transfer funds between <strong>HSBC</strong> Accounts.5. Change PIN.6. Request account statements.7. Request a cheque book.8. Deposit cash/cheque at select ATMs where this facilityis available.Please note:At other bank Visa ATMs, you can only access the primaryaccount linked to your <strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong>.Your Bank account linked to your <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> should have appropriate balance tocarry out any transactions on your debit card.Cash withdrawals and balance enquiries overseas willattract a transaction fee of `120 (per transaction) and `15(per enquiry) respectively.The Bank will charge (w.e.f. 20 July 2009) a cross currencyconversion mark-up of 3.5% of the INR value of thetransaction (service tax extra) on all international transactions(ATM and Point Of Sale) using the <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong>.Service tax and any other cess will be applicable as perthe prevailing rates. Please refer tariff sheet on page 13 forfurther details.Note: <strong>Card</strong>holders who have opted for international use, willbe able to perform the above transactions at international<strong>HSBC</strong> ATMs.7

Benefits of <strong>HSBC</strong>IndiaPremier Platinum<strong>Debit</strong> <strong>Card</strong>Your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> entitles youto a host of privileges:• Transaction LimitsFor <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>holders,the daily ATM cash withdrawal limit and purchasetransaction limit are `1,50,000 per day, subject to thebalances held in the account.• Enjoy 24x7 Access to <strong>HSBC</strong> India PhoneBanking/Customer <strong>Services</strong>To activate your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong><strong>Card</strong> or for any queries regarding your <strong>HSBC</strong> IndiaPremier Platinum <strong>Debit</strong> <strong>Card</strong>, please call <strong>HSBC</strong> IndiaPhoneBanking. To know the <strong>HSBC</strong> India PhoneBankingnumbers in your city, please refer to the section‘PhoneBanking Numbers’.• 24x7 Concierge ServiceAs a privileged <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong><strong>Card</strong>holder, enjoy 24-hour access to a wide range ofspecial assistance services, making your life simpler.To avail of the concierge services from India, just dial000 117 followed by 866 765 9643. This number isaccessible only from a phone which has internationaldialing facility. This is a toll-free number from India andyou will not be charged for this call.• Additional <strong>Card</strong>sAdditional <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong>swill be issued to joint accountholders of the account,provided the operating instructions for the accountare ‘Anyone or Survivor’. To know how to apply foradditional cards, please call <strong>HSBC</strong> India PhoneBanking.• Effective Money Management ToolAll transactions on your <strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong> including those on additional cards willreflect along with the relevant details on your regularbank account statement sent periodically.• Lost <strong>Card</strong> Liability protectionYou are protected from any financial liability, arisingfrom purchase transactions done on your card, forupto 30 days prior to reporting the loss to <strong>HSBC</strong>. Themaximum liability cover per card is `1,00,000.• Visa Platinum OffersEnjoy Visa Platinum privileges.Visit www.visaplatinum.com for more details andterms and conditions.8

International usage of your<strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong>[Applicable to debit cards issued on Resident andNRE accounts if opted for international usage]Your <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong> <strong>Card</strong> can be usedat Visa ATMs overseas for cash withdrawals and at Visamerchant establishments overseas for purchases. However,it is not valid for making transactions in currencies otherthan the local currencies of India, Nepal and Bhutan whentravelling in Nepal and Bhutan.To enhance security on your transactions, debit cardsissued on or after 1 December 2013 will have an option ofinternational or domestic usage facility. <strong>Card</strong>holders whochoose domestic usage facility will not be able to carry outthe following kinds of transactions –• POS (Point Of Sale) transactions outside India• E-commerce transactions on international websites• Transactions at ATMs located outside IndiaSteps for usage of the debit card will be the same as usagein India. Your transaction will be in foreign currency butyour account will be debited in Indian Rupees. The rate ofexchange will be determined by <strong>HSBC</strong> India.All international transactions on your <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> will be reflected in your bank accountstatement.Please note that you will be able to access only your primaryaccount while transacting at Visa ATMs and merchantestablishments overseas.Please note:The Bank will charge (w.e.f. 20 July 2009) a crosscurrency conversion mark-up of 3.5% of the INR valueof the transaction (service tax extra) on all international*transactions (ATM and Point Of Sale) using the <strong>HSBC</strong> IndiaPremier Platinum <strong>Debit</strong> <strong>Card</strong>.Visa Global Customer Assistance <strong>Services</strong> (VGCAS)<strong>HSBC</strong> India <strong>Debit</strong> <strong>Card</strong>holders can receive global assistance24 hours a day, and 7 days a week when they traveloverseas from Visa Global Customer Assistance <strong>Services</strong>.Please note that the services are charged as follows:Miscellaneous enquiry: US $5 per call.9

10These services are available to you at the followingtoll-free numbers:Australia: 1/800-450346 Canada: 866-639-1911Hong Kong: 800-900-782 United Kingdom: 0800-169-5189Singapore: 1/800-4481-250 United States: 866-765-9644For any other country, please log on to the Visa websitewww.visa-asia.comImportant guidelines on international usage• All Chip debit cards issued on or after 1 December 2013will be enabled for Domestic or International usage asper the preference of the <strong>Card</strong>holder at the time of debitcard application• In case you use your <strong>HSBC</strong> <strong>Debit</strong> <strong>Card</strong> internationallywhere the merchant does not have a Chip enabled POSterminal, the magnetic stripe on your debit card is thenutilised for that international transaction. A limit ofUSD 750 per transaction will apply subject to the‘purchase transaction limit’ (as defined in the Tariffschedule) and available balance on your linked<strong>HSBC</strong> account• <strong>Card</strong>holders have the option to change the statusof their debit cards either to domestic usage orinternational usage during the life of the card. To convertthe card you can call <strong>HSBC</strong> PhoneBanking numbers orsubmit a ‘Domestic/International <strong>Card</strong> Usage Form’ atthe nearest <strong>HSBC</strong> India Branch• All expenses including cash withdrawals incurredoverseas must be strictly in accordance withthe relevant guidelines of the Foreign ExchangeManagement Act, 1999 (FEMA)Please note:That the aggregate expenses you incur overseas(i.e. through cash/traveller’s cheques/your bank account/debit card/credit card) should not exceed the limit set byRBI from time to time. For more details on your foreignexchange entitlement, please visit your nearest <strong>HSBC</strong>branch or call <strong>HSBC</strong> India PhoneBanking/CustomerService representatives in your city• Any violation of the exchange control regulationsarising out of utilisation of this <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong> is the responsibility of theindividual <strong>HSBC</strong> India Premier Platinum <strong>Debit</strong><strong>Card</strong>holder (primary/additional) and he/she shall beliable for action under the provisions of the ForeignExchange Management Act (FEMA), 1999, and anyother regulations in force from time to time

• The onus of ensuring compliance with the regulationsis with the holder of the internationally valid <strong>HSBC</strong>India Premier Platinum <strong>Debit</strong> <strong>Card</strong>• Your account statement reflects both domestic andinternational debit card transactions. Each internationaltransaction will show the amount in the transactioncurrency together with the correspondingRupee equivalent• To track your overseas spends in order to ensure thatthey are within permissible RBI limits, you will have toconvert the equivalent Rupee amount shown on yourstatement for each overseas transaction to USD, usingthe day’s telegraphic transfer selling rate, which can beobtained from your authorised dealer• All transactions (domestic and international) incurredby your additional debit <strong>Card</strong>holders will also bereflected on your account statement. Additional debit<strong>Card</strong>holders also must ensure that the expenses theyincur overseas are strictly in accordance with theExchange Control Regulations of the RBI• In case the debit card is used for both businessand personal expenses, the two must be trackedseparately to ensure that you comply with boththe Basic Travel Quota and Basic Travel Allowancepermissible limits• The <strong>Card</strong>holder will intimate <strong>HSBC</strong> India in case ofchange of residency status as per Foreign ExchangeManagement Act, (1999) (FEMA). The <strong>Card</strong>holder shallsurrender <strong>Card</strong>holder debit card before proceedingoverseas on permanent employment and/or emigratingand/or changing nationality. Please ensure that useof card is in accordance with the relevant ExchangeControl Regulations issued and amended by ReserveBank of India from time to time and adheres with theprovisions under the Foreign Exchange ManagementAct, 1999 (FEMA). Any violation of FEMA will renderthe <strong>Card</strong>holder liable for action thereunder• In case your debit card is lost/stolen or if you suspectthat your debit card has been used fraudulently, callthe <strong>HSBC</strong> India PhoneBanking numbers immediatelyto report the loss. The Bank will block the cardimmediately. In case you need your debit card to bere-issued, you can place a request through the<strong>HSBC</strong> India PhoneBanking numbers11

Safeguarding your <strong>HSBC</strong>India Premier Platinum<strong>Debit</strong> <strong>Card</strong>Do’sTreat your debit card like cashand keep it with you always.Your debit card is for yourexclusive use only.When you destroy your cardupon card expiry or closureof your account, cut it intoseveral pieces through themagnetic stripe.Please memorise yourATM Personal IdentificationNumber (PIN) and destroy allphysical evidence of the PIN.It is recommended thatyou change the ATM PINto a number of your choiceas soon as possible and atregular intervals (at least oncein three months thereafter).Always ensure that the debitcard is used in your presencewhen transacting at merchantestablishments.Please promptly notify <strong>HSBC</strong>India in writing of any changesin your telephone number ormailing address.Dont’sNever leave your debit cardunattended.Never surrender your debitcard to anyone other than adesignated Bank Officer atthe <strong>HSBC</strong> branch and that tooafter destroying it.Never reveal or surrender yourVisa ATM PIN to anyone.Never keep a written copy ofATM PIN in proximity of yourdebit card.When transacting at amerchant outlet, never sign anincomplete charge slip.Do not attempt to use yourdebit card at merchantestablishments that do notpossess Point Of Sale swipeterminals.Do not attempt to useyour debit card for makingpurchases via telephone/mail,on the internet or in any other‘<strong>Card</strong> not present’ situation.<strong>HSBC</strong> India aims to give you the highest level of service andkeep you informed of products and services that may beof interest to you. If you require any assistance or are notsatisfied with our services, please call our PhoneBankingnumbers or write to your Branch Manager. Details areavailable on <strong>HSBC</strong> India website www.hsbc.co.in12

<strong>HSBC</strong> India Premier Platinum<strong>Debit</strong> <strong>Card</strong> tariff sheetServiceAnnual feeAdditional card<strong>HSBC</strong> ATM cash withdrawaland balance enquiry (India)Non-<strong>HSBC</strong> Visa ATM cashwithdrawal (India)Balance enquiry at anynon-<strong>HSBC</strong> Visa ATM (India)ATM cash withdrawal(Outside India)Balance enquiry at anyATM (Overseas)<strong>Card</strong> replacement fee(India/Overseas)PIN replacementCharge slip retrieval/Charge back processing feeATM cash withdrawallimit (per day)Purchase transactionlimit (per day)Transfer limits (to accountslinked to or not linked to card)(per day)Account statementTransaction declined due toinsufficient funds at an ATMPer transaction limit for cashwithdrawal at other bankATMs in IndiaFeesFreeFreeFreeFreeFree`120 per transaction`15 per enquiryFreeFree`225`1,50,000`1,50,000`1,50,000Monthly - FreeFree`10,000Service tax and any other cess applicable as per the prevailing rates.Note:1. Tariff structure is subject to change from time to time.Changes will be made with prospective effect giving notice ofone month.2. Use of debit card at petrol pumps would invite a surcharge of2.5% of the petrol purchase value or `10 (whichever is higher).3. The Bank will charge (w.e.f. 20 July 2009) a cross currencyconversion mark-up of 3.5% of the INR value of thetransaction (service tax extra) on all international transactions(ATM and Point Of Sale) using the <strong>HSBC</strong> India PremierPlatinum <strong>Debit</strong> <strong>Card</strong>.13

PhoneBanking numbersNRI PhoneBanking numbers in IndiaBahrain : 8000 4619 (Toll Free)Canada : 011 800 177 36666 (Toll Free)Hong Kong : 001 800 177 36666 (Toll Free)Indonesia : 001 8030176404 (Toll Free)Kuwait : 965 22230782 (Local Rates)Malaysia : 00 800 177 36666 (Toll Free)New Zealand : 00 800 177 36666 (Toll Free)Oman : 968 24762789 (Local Rates)Qatar : 974 4366852 (Local Rates)Saudi Arabia : 8008 140089 (Toll Free)Singapore : 001 800 177 36666 (Toll Free)Thailand : 001 800 177 36666 (Toll Free)UK : 00 800 177 36666 (Toll Free)United Arab Emirates : 8000 177023 (Toll Free)United States of America : 1 800 952 7145 (Toll Free)<strong>HSBC</strong> India PhoneBanking numbers in IndiaToll-free : 1800 103 4722(PAN India)Ahmedabad : 98983 77315Bengaluru : 4118 6515Chandigarh : 98769 37315Chennai : 4200 8715Coimbatore : 98944 77315Gurgaon : 99107 97315Hyderabad : 6667 4715Indore : 98931 77315Jaipur : 99280 37315Jodhpur : 99280 37315Kochi : 98954 77315Kolkata : 2213 9915Lucknow : 99367 97315Ludhiana : 98769 37315Mumbai : 6666 8815Mysore : 99809 27315Nagpur : 98909 47315New Delhi : 4149 0715Noida : 99107 97315Patna : 99313 97315Pune : 2600 1115Raipur : 98931 77315Thiruvananthapuram : 98954 77315Vadodara : 98983 77315Visakhapatnam : 98496 77315Calls to toll-free numbers from a mobile phone are chargeable.14

15•

Issued by The Hongkong and Shanghai Banking Corporation Limited, (<strong>HSBC</strong> India).Incorporated in Hong Kong SAR with limited liability.PREM SG 10/13