Annual Report 2007/2008 - Umalusi

Annual Report 2007/2008 - Umalusi

Annual Report 2007/2008 - Umalusi

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

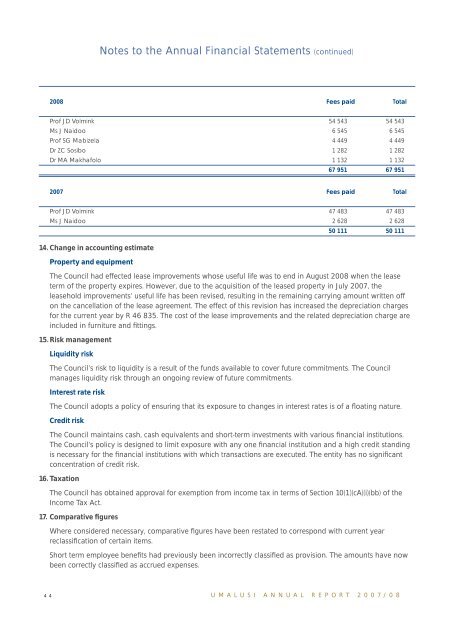

Notes to the <strong>Annual</strong> Financial Statements (continued)<strong>2008</strong> Fees paid TotalProf JD Volmink 54 543 54 543Ms J Naidoo 6 545 6 545Prof SG Mabizela 4 449 4 449Dr ZC Sosibo 1 282 1 282Dr MA Makhafolo 1 132 1 13267 951 67 951<strong>2007</strong> Fees paid TotalProf JD Volmink 47 483 47 483Ms J Naidoo 2 628 2 62850 111 50 11114. Change in accounting estimateProperty and equipmentThe Council had effected lease improvements whose useful life was to end in August <strong>2008</strong> when the leaseterm of the property expires. However, due to the acquisition of the leased property in July <strong>2007</strong>, theleasehold improvements’ useful life has been revised, resulting in the remaining carrying amount written offon the cancellation of the lease agreement. The effect of this revision has increased the depreciation chargesfor the current year by R 46 835. The cost of the lease improvements and the related depreciation charge areincluded in furniture and fittings.15. Risk managementLiquidity riskThe Council’s risk to liquidity is a result of the funds available to cover future commitments. The Councilmanages liquidity risk through an ongoing review of future commitments.Interest rate riskThe Council adopts a policy of ensuring that its exposure to changes in interest rates is of a floating nature.Credit riskThe Council maintains cash, cash equivalents and short-term investments with various financial institutions.The Council’s policy is designed to limit exposure with any one financial institution and a high credit standingis necessary for the financial institutions with which transactions are executed. The entity has no significantconcentration of credit risk.16. TaxationThe Council has obtained approval for exemption from income tax in terms of Section 10(1)(cA)(i)(bb) of theIncome Tax Act.17. Comparative figuresWhere considered necessary, comparative figures have been restated to correspond with current yearreclassification of certain items.Short term employee benefits had previously been incorrectly classified as provision. The amounts have nowbeen correctly classified as accrued expenses.44 U M A L U S I A N N U A L R E P O R T 2 0 0 7 / 0 8