Indian Shipbuilding - Industrial Products

Indian Shipbuilding - Industrial Products

Indian Shipbuilding - Industrial Products

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

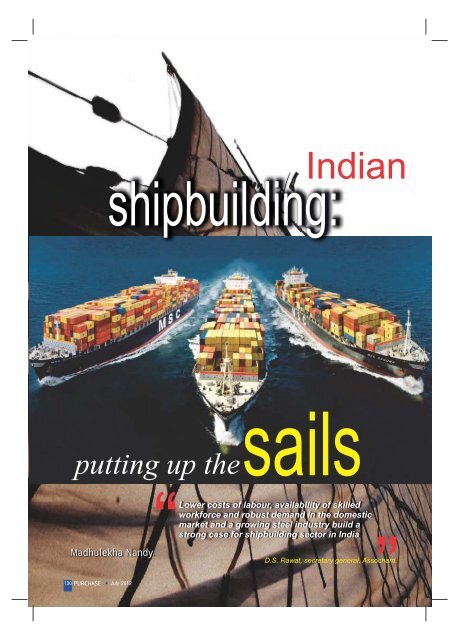

<strong>Indian</strong>shipbuilding:putting up thesailsMadhulekha Nandy130 PURCHASE July 2012“Lower costs of labour, availability of skilledworkforce and robust demand in the domesticmarket and a growing steel industry build astrong case for shipbuilding sector in India”D.S. Rawat, secretary general, Assocham.

<strong>Shipbuilding</strong>A r t i c l eThe <strong>Indian</strong> shipbuilding and ship repairindustry is set to sail. With a projectedsize of Rs 9,200 crores by 2015(currently in excess of Rs 7,310 crores) andwith a CAGR growth of about eight per, theindustry is facing a world of opportunities.Globally, the industry has been growing at aCAGR of 24 per cent, says the AssociatedChambers of Commerce and Industry of India(Assocham), which means there is a greatdeal of catching up to do for India, that onlyhas a small percentage of the custom.Investment opportunityThe Working Group on Shipping & InlandWater Transport for the 12th Plan hasassessed a fund requirement of Rs 90,519crores for the shipping sector. That includesRs 10,499 crores as gross budgetary support;Rs 2,340.00 crores state government funding;and Rs 77,680 as private investment (internaland external budgetary resources).<strong>Indian</strong> shipbuilding is focused around the27 shipyards, eight of them in the publicsector (six under the central government andtwo under the state governments) with 19 inthe private sector. Between them they have20 dry docks and 40 slipways with anestimated capacity of 281,200 DWT.The <strong>Indian</strong> shipbuilders specialize inconstructing offshore vessels but thesize of the dry bulk vessels as againstthe offshore vessels in terms ofcarrying capacity (dwt) being high, theformer vessel category constitutedapproximately 87.5 per cent of the<strong>Indian</strong> order book. In terms of thenumber of vessels on order, theoffshore and specialized vesselsaccounted for 38.7 per cent of the totalorder book as on February 29, 2012. –CARE RatingPublic sector dominationA major share of this capacity is held bythe public sector yards and only CochinShipyard Limited (1,10,00 dwt) and HindustanShipyard Limited (80,000 dwt) have therequired infrastructure and dock to buildlarge vessels. There are many more privateshipyards that are restricted in terms of thecapacity and size of ships that they can build.Many of them are expanding. The 11th Plandocument (this being the final year of theplan) talked of an investment opportunity of$25 billion by 2011-12 in India's shipping andports sectors because the country woulddouble its ports capacity to over 1,500 MT.Segment-wise, it said, ports would provide a$13.75 billion investment opportunity, whileshipping and inland waterways would providea $ 11.25 billion-investment opportunity. TheMinistry of Shipping awarded seven projectsworth over $387 million, to be developedthrough the public-private partnership (PPP)route. In November 2009, another threeprojects worth $1.66 billion were approved,to be developed through the PPP mode. InJanuary 2010, the Public Private PartnershipAppraisalJuly 2012PURCHASE 131

A r t i c l e<strong>Shipbuilding</strong>Proposed investment in shipping for the 12 th Plan (Rs crores)Major heads ofexpenditureGBSStategovernmentPrivateinvestment/IEBRTotalShip acquisition - - 60,000 60,000Restructuring ofthe RegulatoryRegime546 - - 546DG (Shipping) 150 - - 150IMU 1,280 - - 1,280Training & Welfare 828 - - 828Seafarers safety 30 - - 30Coastal shipping 2,835 1,200 12,360 16,395Multimodal - - - -transportLighthouses & 790 - - 790LightshipsIWT 4,040 1,140 5,320 10,500Total: 10,499 2,340 77,680 90,519Committee (PPPAC) cleared the proposed$795.59 million mega container terminal atChennai port.Shipping slumpWhile investment opportunities in Indiaremain good, other facets of the businesshave been disappointing with a fall in overallshipping volumes given the global economicslump, though India's exports and importshave grown, providing the right incentives forthe domestic industry. A recently releasedAssocham report: '<strong>Shipbuilding</strong> Industry inIndia: An overview', says that India accountsfor just one per cent of the globalshipbuilding industry that is worth about Rs7.3 lakh crores and is likely to reach Rs 14lakh crores by 2015. The <strong>Indian</strong> shipbuildersare ranked 6th in terms of order books by thebuilder country as on February 29, 2012accounting for 1.36 per cent of the globalorder book, with an aggregated 3.01 mn dwtwith 168 vessels on order as on February 29,2012.Much to be accomplishedGood though these figures seem to be,India is nowhere near the top of the ladder.China, South Korea andJapan are leadingshipbuilding nations thataccount for more than 80per cent of the globalshipbuilding industry butIndia and Vietnam are fastcoming up. To achieve itspotential the industry inIndia needs not justfinancial incentives andphysical infrastructure butresearch and developmentfacilities, designingcapabilities along with anauxiliary base to supportthe mother industry. Theother major problem isaround escalating costsfrom raw material,freight, and governmentlevies. According to theAssocham, these lead to aprice differential of about50 per cent betweenbuilding a ship in Indiaand other countries.These make the overalloutlook for the shippingindustry bleak in India andFitch has given it anegative status, given132 PURCHASEJuly 2012

<strong>Shipbuilding</strong>A r t i c l eMajor Ports:§ West CoastKandla (Gujarat)Mumbai (Maharashtra)Jawaharlal Nehru(Maharashtra)Marmugao (Goa)New Mangalore (Karnataka)Cochin (Kerala)East CoastTuticorin (Tamil Nadu)Chennai (Tamil Nadu)Ennore (Tamil Nadu)Visakhapatnam (Andhra Pradesh)Paradip (Orissa)Kolkata, Haldia (West Bengal)Minor Ports:187States/Union Territories No of MinorPortsGujarat 40Maharashtra 53Goa 5Karnataka 10Kerala 13Diu & Daman 2Lakshadweep Islands 10Pondicherry 1Tamil Nadu 15Andhra Pradesh 12Orissa 2West Bengal 1Andaman & Nicobar 23Islandsthen to 3,000 million tonnes by 2020, to reachthe unfavourable global demand-supplydynamics. These are "driven by relatively lowglobal trading levels and fleet additions acrosssegments, will be a significant drag on therevival of charter rates in 2012”, says Fitch.There is the brighter side though.Assocham projects that the current cargotraffic at major ports in India of about 600million tonnes should more than double1,230 million tonnes by 2015 andgrowing at aCAGR of 20 per cent. This means that Indiahas to create ambient conditions for theindustry to grow. The two main needs of theindustry are land for new ports or shipyards inmaritime states and a governmentcommittment to the industry in terms of apublic-private partnership model. There isequal need for foreign direct investment inthis space.July 2012PURCHASE 133

A r t i c l e<strong>Shipbuilding</strong>• The National Maritime Development Plan seeks to improvefacilities at India's 12 major ports and plans an expenditureof around $12.4 billion plus another $9.07 billion for 111shipping sector projects by 2015.• Hundred per cent foreign direct investment under theautomatic route is permitted for port development projects.• Hundred per cent income tax exemption is provided for aperiod of 10 years for port developmental projects.• Government has opened up all the areas of port operationfor private sector participation.Revive subsidyThere is a felt need for a revival of thesubsidy scheme, ease tax related regulationsand for shipbuilding to be declared a'strategic industry'. According to CARE Rating,the <strong>Indian</strong> shipbuilding industry has beenaffected by the Union budget 2012-13withdrawal of the '<strong>Shipbuilding</strong> subsidyscheme' with no announcement of anyrenewal. The <strong>Indian</strong> shipyards are renderedcost ineffective, compared to their globalpeers. Further, the absence of 'infrastructureindustry' status to the industry places it at adisadvantage, compared to the major globalshipbuilding nations such as South Korea,China…” says CARE (See chart on impact ofBudget 2012-13 on shipbuilding). The shippingministry itself has been arguing for a revivalof the subsidy scheme for shipbuilders toovercome the declining market share in globalshipbuilding that currently stands at a meagre0.01 per cent. The ministry has argued thatever since the subsidy scheme has expired,India's share is declining and has come downto 0.01 per cent from 1.24 per cent.There are other issues too. Reuters,reporting in Firstpost.com, also points outthat <strong>Indian</strong> shipping firms will find it difficultto obtain replacement insurance coverage tocontinue importing Iranian crude oil after newEuropean Union sanctions come into effect.The “state-run Shipping Corporationof India, the largest tanker owner in India,will lose its E.U. insurance coverage for its oiltankers operating in Iran from July 1, whenEuropean insurers will be prohibited fromindemnifying ships carrying Iranian oil”. Thismeans that <strong>Indian</strong> maritime firms may bebadly affected by the sanctions as the othertwo major Asian buyers, China and Japan, donot rely on European insurers but are coveredby domestic providers. India, China and Japanare Iran's three biggest crude oil buyers.While these problems are beingaddressed by government and industry, theMinistry of Shipping has working on a MaritimeAgenda 2010-20 that provides a road map forcomprehensive development of the maritimesector and to navigate and steer itrealistically into the premier maritime nationsof the world. It also envisages an increaseIndia's share in global ship building to five percent, to secure 10 per cent share in worldship repair and generate 2.5 millionadditional jobs. The plan is ready; it is actiontime now.Data on major ports for 2009-10; %age growth over 2008-09 (Source – <strong>Indian</strong> Ports Association):NameKolkata (Kolkata DockSystem & Haldia DockComplex)Cargohandled2010:'000 tns%riseover2009Vesseltraffic2009-10% riseover2008-09ContainerTraffic2009-10:'000 Teus% rise2008-0946,295 -14.61% 3,462 07.50% 502 17.01%Paradip 57,011 22.84% 1,531 -0.32% 4 100.00%Visakhapatnam 65,501 2.49% 2,406 2.51% 98 13.65%Chennai 61,057 6.20% 2,131 2.5% 1,216 6.38%Tuticorin 23,787 8.07% 1,414 -7.21% 440 0.22%Cochin 17,429 14.45% 872 15.19% 290 11.11%New Mangalore Port 35,528 -3.17% 1,186 0.16% 31 6.89%Mormugao 48,847 17.19% 465 6.89% 17 21.42%Mumbai 54,543 5.14% 1,639 1.67% 58 -36.95%J.N.P.T. 60,746 6.03% 3,096 4.13% 4,062 2.78%Ennore (corporate) 10,703 -6.93% 273 9.2% -- --Kandla 79,521 10.10% 2,776 10.29% 147 6.52%All <strong>Indian</strong> Ports 560,968 5.74% 21,251 02.82% 6,8654.25%134 PURCHASEJuly 2012

<strong>Shipbuilding</strong>A r t i c l eLabour costs in shipbuildingCountryChina 729Indonesia 1008India 1192Philippines 2450Thailand 2705Malaysia 3429Korea 10743Singapore 21317Labour costs($per annum)Source: Ministry of Commerce &IndustryJuly 2012PURCHASE 135