Annual Report 2011 - QuamIR

Annual Report 2011 - QuamIR

Annual Report 2011 - QuamIR

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

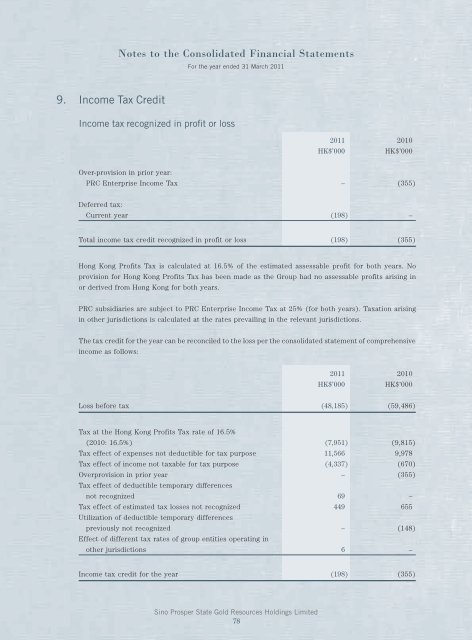

Notes to the Consolidated Financial StatementsFor the year ended 31 March <strong>2011</strong>9. Income Tax CreditIncome tax recognized in profit or loss<strong>2011</strong> 2010HK$’000HK$’000Over-provision in prior year:PRC Enterprise Income Tax – (355)Deferred tax:Current year (198) –Total income tax credit recognized in profit or loss (198 ) (355 )Hong Kong Profits Tax is calculated at 16.5% of the estimated assessable profit for both years. Noprovision for Hong Kong Profits Tax has been made as the Group had no assessable profits arising inor derived from Hong Kong for both years.PRC subsidiaries are subject to PRC Enterprise Income Tax at 25% (for both years). Taxation arisingin other jurisdictions is calculated at the rates prevailing in the relevant jurisdictions.The tax credit for the year can be reconciled to the loss per the consolidated statement of comprehensiveincome as follows:<strong>2011</strong> 2010HK$’000HK$’000Loss before tax (48,185 ) (59,486 )Tax at the Hong Kong Profits Tax rate of 16.5%(2010: 16.5%) (7,951) (9,815)Tax effect of expenses not deductible for tax purpose 11,566 9,978Tax effect of income not taxable for tax purpose (4,337) (670)Overprovision in prior year – (355)Tax effect of deductible temporary differencesnot recognized 69 –Tax effect of estimated tax losses not recognized 449 655Utilization of deductible temporary differencespreviously not recognized – (148)Effect of different tax rates of group entities operating inother jurisdictions 6 –Income tax credit for the year (198 ) (355 )Sino Prosper State Gold Resources Holdings Limited78