Manual for Scrutiny of Service Tax Returns 2009 - Central Excise ...

Manual for Scrutiny of Service Tax Returns 2009 - Central Excise ...

Manual for Scrutiny of Service Tax Returns 2009 - Central Excise ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

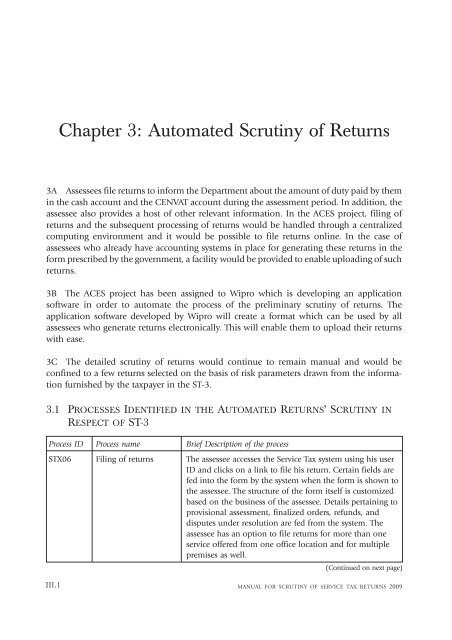

Chapter 3: Automated <strong>Scrutiny</strong> <strong>of</strong> <strong>Returns</strong>3A Assessees file returns to in<strong>for</strong>m the Department about the amount <strong>of</strong> duty paid by themin the cash account and the CENVAT account during the assessment period. In addition, theassessee also provides a host <strong>of</strong> other relevant in<strong>for</strong>mation. In the ACES project, filing <strong>of</strong>returns and the subsequent processing <strong>of</strong> returns would be handled through a centralizedcomputing environment and it would be possible to file returns online. In the case <strong>of</strong>assessees who already have accounting systems in place <strong>for</strong> generating these returns in the<strong>for</strong>m prescribed by the government, a facility would be provided to enable uploading <strong>of</strong> suchreturns.3B The ACES project has been assigned to Wipro which is developing an applications<strong>of</strong>tware in order to automate the process <strong>of</strong> the preliminary scrutiny <strong>of</strong> returns. Theapplication s<strong>of</strong>tware developed by Wipro will create a <strong>for</strong>mat which can be used by allassessees who generate returns electronically. This will enable them to upload their returnswith ease.3C The detailed scrutiny <strong>of</strong> returns would continue to remain manual and would beconfined to a few returns selected on the basis <strong>of</strong> risk parameters drawn from the in<strong>for</strong>mationfurnished by the taxpayer in the ST-3.3.1 PROCESSES IDENTIFIED IN THE AUTOMATED RETURNS’ SCRUTINY INRESPECT OF ST-3Process ID Process name Brief Description <strong>of</strong> the processSTX06 Filing <strong>of</strong> returns The assessee accesses the <strong>Service</strong> <strong>Tax</strong> system using his userID and clicks on a link to file his return. Certain fields arefed into the <strong>for</strong>m by the system when the <strong>for</strong>m is shown tothe assessee. The structure <strong>of</strong> the <strong>for</strong>m itself is customizedbased on the business <strong>of</strong> the assessee. Details pertaining toprovisional assessment, finalized orders, refunds, anddisputes under resolution are fed from the system. Theassessee has an option to file returns <strong>for</strong> more than oneservice <strong>of</strong>fered from one <strong>of</strong>fice location and <strong>for</strong> multiplepremises as well.(Continued on next page)III.1MANUAL FOR SCRUTINY OF SERVICE TAX RETURNS <strong>2009</strong>