direct access mda world & mda platinum mastercard - Malaysian ...

direct access mda world & mda platinum mastercard - Malaysian ...

direct access mda world & mda platinum mastercard - Malaysian ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WE CHANGE THE WAY YOU LIVEDIRECT ACCESS MDA WORLD& MDA PLATINUM MASTERCARDA RESERVED INVITATION FOR MDA MEMBERS ONLY

Dear esteemed MDA member,Here is a credit card from Direct Access that is exclusively offered to MDA members only, such as yourself. It carrieswith it all the unparalleled perks and privileges associated with a Direct Access credit card, including a Balance TransferProgramme that comes with a six month tenure, which I personally feel is a very useful feature.And on top of that, it also includes added features that have been tailor-made to complement and recognize your statusas a member of MDA.On that note, I urge that you show your pride of being a MDA member today by registering for a Direct Access MDAWORLD / Platinum MasterCard!Yours truly,Dr Lee Soon BoonPresident

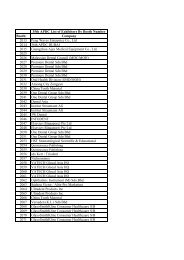

WE CHANGE THE WAY YOU LIVEDIRECT ACCESS MDA WORLD& MDA PLATINUM MASTERCARDA RESERVED INVITATION FOR MDA MEMBERS ONLYFEES AND CHARGESAnnual FeeJoining FeeFREE FOR LIFE.No joining fee.Finance Charges The charges are :(a) 1.125% per month or 13.5% per annum if you have promptly settled your minimum payment due for 12 consecutive months.(b) 1.333% per month or 16% per annum if you have promptly settled your minimum payment due for at least 10 months in a 12-month cycle.(c) 1.458% per month or 17.5% per annum if your payment record is not within either (a) or (b) above. Finance charge for cashtransaction is 1.5% per month or 18% per annum.Government Service TaxCash Advance FeesMinimum Monthly RepaymentLate Payment ChargeRM50 – Each Principal Card • RM25 – Each Supplementary CardThe cash advance fee is 5% of the amount advanced or a minimum of RM15, whichever is higher. This is imposed for each cash advance transaction.5% of the outstanding balance or a minimum of RM50.1% of the total outstanding balance as at statement date or a minimum of RM5, whichever is higher, capped to a maximum of RM50 and willonly be imposed if the minimum payment due is not paid by the third day after relevant due date.Interest-Free PeriodFull payment on previous statement balance.Enjoy an interest-free period of 20 days for allnew retail transactions from statement date.Partial or minimum payment on previous statement balance.No interest-free period.A finance charge will be levied on your unpaid outstanding balanceand all new transactions from the date the transactions are posted.Conversion For Overseas Transactions The conversion rate as determined by MasterCard International and Visa International plus an administrative cost of 1%.THE TRUE COLOURS OF REWARDSBe inspired. Settle for the best that the <strong>world</strong> has to offer.Indulge in exclusive shopping & dining privileges, regional rewards, plus loads of endless rebates & discounts today.Direct Access credit cards, we make the difference.FREE FOR LIFEPay no annual fees.SMART REWARDSEnjoy discounts & privileges with yourpurchases from over 500 merchantsnationwide.BONUS POINTS PROGRAMEvery RM1 spent = 1 Bonus Point, toredeem gifts & vouchers.PAY WITH POINTSUse your Bonus Points to pay for purchasesat participating outlets.WEEKEND REBATESIndulge in shopping with 5% - 10% rebateevery weekend.PETROL REBATESSave on petrol purchases with 2% rebate.MPH REBATESSave on book purchases at MPH with5% rebate and special buys for the GottaHave It! selection.SMART FLEXI-PAY PLAN0% interest for education, insurance andhospital bills for 10 months.SMART i.PAY PLANBuy now, pay later with a low upfrontinterest instalment plan for up to 30months.BALANCE TRANSFERTransfer your balance with no interestand no handling cost for 6 months.ONLINE STATEMENTMonitor your transactions online,anywhere anytime.REGIONAL REWARDSReceive more privileges across borders inSingapore & Indonesia.All these exciting specials, plus other rewarding treats await you!For more information, please log on to www.<strong>direct</strong><strong>access</strong>.com.my

AN INVITATION RESERVED ONLY FOR MDA MEMBERSThe <strong>Malaysian</strong> DentalAssociation (MDA)www.<strong>direct</strong><strong>access</strong>.com.my03-6204 7979MDA 8 0 0 1I HEREBY APPLY FOR THE DIRECT ACCESS MDA CREDIT CARD (PLEASE ✔) :REQUIREMENTSu WORLD MasterCardu Platinum MasterCardNote : Additional credit cards will share a combined credit line.IncomeWORLD MasterCardPlatinum MasterCard: RM180,000 per annum: RM 24,000 per annum*Documents required, non-returnable :3 A photocopy of I/C (both sides, enlarge) 3 Business Card 3 Income DocumentsMinimum AgePrincipal: 21 years oldMY PERSONAL DETAILSu Mr u Miss u Madam u Dr u OthersFull Name as in NRIC :New I/C No. : Old I/C No. :- -Nationality :M A L A Y S I A NName to appear on Card (Not more than 12 letters) : Membership No. (5 digit) :Race : u Malay u Chinese u Indian u OthersMarital Status : u Single u Married u Widowed u DivorcedSex : u Male u FemaleMY PROFESSIONAL QUALIFICATIONSu ✔ Yes, I am a member of The <strong>Malaysian</strong> Dental Association (MDA)MY HOME ADDRESSResidential Address :MY BILLING AND CARD DELIVERY INSTRUCTIONSPlease Send My Statement To : u Homeu OfficePlease Courier My Card To : u Home u OfficeAUTOMATIC SETTLEMENT OF MDA SUBSCRIPTION FEESu Yes, kindly debit my Direct Access MDA MasterCard for my annual MDA subscription feesEffective Year :I hereby authorise you to debit the subscription fee for such amount as may be specified by MDAupon your receipt of the request from MDA. In the event you cease to be a member of MDA, youmust notify the Bank in writing to cancel your above auto-debit instruction. The Bank shall not beliable for and you shall indemnify the Bank for all losses arising from this auto-debit instruction.OTHER BANKING SERVICESYes, I would like to apply for the following services :u Overdraft Facility (subject to eligibility and minimum income requirement is RM60,000 p.a.)u Credit Card PIN (to <strong>access</strong> ATM and CIMB Clicks online statement)DECLARATION (BY INDIVIDUAL BORROWERS) IN CONNECTION WITH BANK NEGARAGUIDELINES ON CREDIT TRANSACTIONS AND EXPOSURES WITH CONNECTED PARTIESPlease complete this declaration section if any of the below is applicable to you.(No declaration from you denotes that it is not applicable).1. u I am a staff of the CIMB Group 1 .2. u To the best of my knowledge, I have close relative(s) 2 employed under the CIMB Groupor has acted as my guarantor.Particulars of my close relative(s) in CIMB Group :Postcode :Residence is : u Owned - No loan u Owned - With loan u Rentedu Employer’s u Parents / Relatives Years there :Home Tel : Mobile Tel :-E-Mail :-Name I/C No. RelationshipActed As Guarantor(Indicate Yes or No)MY EMPLOYMENT DETAILSName of Company :Address :Position : Office Tel :-MY PERSONAL SECURITY CODEMother’s Maiden Name :Postcode :u Salaried employee u Self-employed Years there :Gross Annual Salary : Other income per annum :R MR M1CIMB Group means CIMB Bank Berhad or CIMB Islamic Bank Berhad or CIMB Investment Bank Berhador other subsidiaries or companies controlled by the aforesaid respective banking institutions.2Close relative(s) include parents / spouse of staff including the spouse’s dependents children / spouseof the children / brother and sister / spouse of brother / sister and any other dependents and personswho may influence / be influenced by the staff.‘DECLARATION’ SECTIONI hereby declare and certify that all the information given by me in this application is true, accurate and complete. Notwithstandingthe generality of the foregoing, I confirm that the Bank is authorised to verify and or make any checks and/or obtain any informationand/or confirmation, with or from any credit reference agencies, and/or from any financial institution, on me and/or any otherperson, individual and/or entity as the Bank may deem fit, for any purposes which the Bank deems fit.I hereby request CIMB Bank to issue, upon approval of this application, the credit card(s) which I have indicated.I acknowledge that the use of the credit card(s) issued to me shall be subject to CIMB Bank’s Cardmember agreement(“Cardmember Agreement”), which will be sent to me with the credit card(s) upon the approval of this application, and agree to bebound by the terms and conditions set forth in the Cardmember Agreement upon issuance or use of the credit card(s).I acknowledge that CIMB Bank reserves the sole and absolute right to decline or reject my application without assigning anyreasons therefore.I also acknowledge that it is a requirement by Bank Negara Malaysia (“BNM”) that all information relating to this application, whethersuccessful or otherwise, must be updated and/or transmitted to the Central Credit Information System (“CCRIS”), a databasemaintained by BNM. In addition thereto, CIMB Bank is hereby irrevocably and unconditionally authorised to disclose any informationor particulars given by me herein to any person(s) in or out of Malaysia and for such purpose(s) as CIMB Bank deems fit, properor necessary at any time. I understand that the credit card(s) when issued shall at all times remain the property of CIMB Bank andmust be duly returned upon request by CIMB Bank.I further agree liability to accept liability for all amount incurred arising from the use of my credit card(s) issued pursuant to thisapplication or at any time thereafter at my request.My Emergency Contact Person (relative/friend not staying with me):Home Tel : Mobile Tel :- -Principal Applicant’s Signature :Date :Please fax or scan the completed application form (together with your I/C (front & back), business card and degree certificate*) to the following:Fax: 03-2381 5533 or E-mail: mktgda@cimb.com*All documents submitted are non-returnable