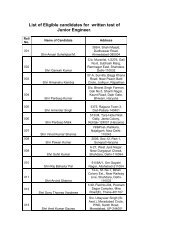

PROFORMA FOR WEBSITE - Daman

PROFORMA FOR WEBSITE - Daman

PROFORMA FOR WEBSITE - Daman

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

9. List and description of the:- As mentioned at Col. No. 8 fromServices/Schemes to the public. Sr. No. 1 to 3 and 610. Major Achievements so far. :-* The list of task/activities. :-* The required procedures for :- All above information aredifferent tasks.* The list of pre-requisites for :- prepared and sent in digital*certain procedures.The required forms (in MS- :-WORD /PDF format) withform/soft copy.(CD enclosed)instructions like how to filland whom to submit etc.* The Visiting hours for public. :- 12 : 00 to 1 : 00 PM11. Any other details of public :- --interest not covered in above.12. Citizen charter of the Department. :- Citizen charter of theDepartment, 2005 for UT of<strong>Daman</strong> & Diu Administration,Diu is enclosed herewith.13. Pictures/Photographs of theDepartment Office/Building.:- Photographs of Collectorate, Diuis enclosed herewith.14. All the Information Sought underRTI Act. Categorically.:- Information sought under RTIAct. Categorically is enclosedherewith. (**)Place :- Office of the Collector, Diu.Date:- /09/2008.(S. D. MODASIA)SUPERINTENDENT,COLLECTORATE, DIUMy Doc. HC/RTI

3.2 Sale Permission CasesU/s 8-B of Diu(abolitionofproprietorship ofVillages) Regulation(Amendment) Act 1968and Rules framed thereunder.iv) Attested copy of Power of Attorney,in cases where applications(s) arefiled by the Power of AttorneyHolder(s)v) Any other documents to showaccess to the plot etc. if required.4 On receipt of application, the Collector’sOffice obtains reports from the followingdepartment:i) Land acquisition Collector, Diu.ii) Superintending Engineer, PWD, Diu.iii) Executive Engineer, PWD, Diu.iv) Architect Planner, Diu.v) Zonal Agriculture Officer, Diu.vi) Mamlatdar, Diu.vii) Enquiry Officer, City Survey, Diu.viii) Executive Engineer, ElectricityDepartment, Diu.5 Thereafter on receipt of report the caseis put up before the Committeeconstituted to scrutinize andrecommend cases pertaining to NAconversion permission etc. After goingthrough the reports received theCommittee of the recommendsclearance/rejection of the application.6 Applicants are offered personal hearingin the matter and decision in the casesis pronounced in the open Court by theCollector, Diu after going through themerits of the case report received fromthe concerned departments andrecommendation of the Committee.7 NA sanad are issued to the Party afterunder going further formalities likepayment of requisite fees etc. from theparty.8 In case of rejection, applicants(s) areinformed in writing and certificate copyof the detailed order is issued to theParties on application and payment ofrequisite fee.1 Applicants/Vendor(s) should apply tothe Collector, Diu for grant ofpermission to sell his/her/their land bygiving the name of the purchaser(s),amount, purpose for which thepurchaser(s) desire to purchase theland reason why the vendors(s) desire tosell the land etc. court fee of Rs. 2/-should be affixed on the application.2 Alongwith the application, the followingdocuments should be submitted:i) Form No. I & XIV of the land inquestion in original plus 2 Xeroxii)copiesSite Plan of the land in question inoriginal plus 2 Xerox copies.iii) Attested copy of NA sanad & Orderin case where sale permission issought for Non Agriculture use.iv)Attested copy of Power of Attorneyin case where application is filed bythe Power of Attorney Holders(s)3 On receipt of application, the Collector’sOffice obtains reports from the followingDepartment:-i) The Mamlatdar, Diu.ii) The Land Acquisition Collector, Diu4 Thereafter on receipt of reports, thecase is put up before the Committeeconstituted to scrutinized and

3.3 Land gift permissioncase U/s 8-B of Diu(AbolitionofProprietorship ofVillage) Regulation(Amendment) Act, 1968and Rule framed thereunder Rules 2(1) (a) &2(1) (i)recommend cases pertaining to SalePermission etc. After going through thereports received the Committeerecommends clearance/rejection of theapplication.5 Thereafter application(s)/Vendors(s)original occupants(s) of the landPurchaser(s) are offered personalhearing in the matter in the Court ofthe Collector, Diu and decision ispronounced in the open Court by theCollector, Diu. After going through themerits of the cases, reports receivedfrom the concerned Department andland recommendation of the Committee.6 Thereafter Order is issued to theconcerned party.7 In case of rejection, Parties are informedin writing and certified copy of thedetailed order is issued on applicationand payment of requisite fee.1 Applications/Donor(s) should ally to theCollector, Diu for grant to permission togift his/her/their land by giving thename of the Donee (s), relation of thewhich the land will be used by theaffixed to the application.2 Alongwith the application the followingdocuments should be submitted:-i) From No. I & XIV of the land inquestion in original plus 2 Xeroxcopiesii)Site Plan of the land in question inoriginal plus 2 Xerox copies.iii) Attested copy of N.A. Sanad andorder in case where sale permissionis sought for Non agriculture use.iv)Attested copy of Power of Attorneyin case where applications are filedby the Power of Attorney Holder(s)v) NOC from the other legal heirs ofthe Doner.3 On receipt of application the Collector’sOffice obtains reports from the followingDepartments:i) The Mamlatdar, Diu.ii) The land Acquisition Collector, Diu4 Thereafter on receipt of reports, thecase is put up before the Committeeconstituted to scrutinized andrecommend cases pertaining to LandGift permission etc. After going throughthe reports received, the Committeerecommends clearance/rejection of theapplication.5 Thereafter application(s)/Doner(s)Original Occupant(s) of the land andDonee(s) are offered personal hearing inthe matter in the court of the Collector,Diu and decision is pronounce in theopen Court by the Collector, Diu aftergoing through the merits of the cases,reports received from the concernedDepartments recommendation of theCommittee.6 Thereafter Order is issued to theconcerned party.7 In case of rejection, parties are informedin writing and certified copy of thedetailed order is issued on applicationand payment of the requisite fee.

3.6 Division/amalgamationunder Section 62 of theGoa <strong>Daman</strong> & Diu landRevenue Code, 19683.7 Partition U/s 61 of theGoa <strong>Daman</strong> & Diu landRevenue Code, 19683.8 Procedure for issuingnew Arms Licensesmerits of the case and report of theMamlatdar, Diu and recommendation ofthe Committee.6 The approval of the Collector, Diu isconveyed to the applicants by theSuperintendent of the Land Section,Collectorate, Diu1 Applicant should apply to the Collector,Diu on plain paper with court fee stampof Rs. 2/- to be affixed on theapplication with two Xerox copies.2 Alongwith application, the followingdocuments should be submitted:-i) From No. I & XIV of the currentyear in original alongwith 3 Xeroxcopiesii) Site Plan for current year inoriginal plus 3 Xerox copies.iii) Attested copy of N.A. Sanad andorder in triplicate.iv) Lay out plan 9 copies duly signedby the applicant andEngineer/Architect.3 On receipt in the application, the Dy.Collector’s office obtains reports fromthe following offices requesting tosubmit inquiry/reports within 15 days.i) The Architect Town Planer, Diu.ii) The Inquiry Officer, City Survey,DiuAfter receiving reports/comments fromthe above offices the order will beissued within 8 days1 Applications should apply to Collector,Diu on plain paper with Court Feestamps of Rs. 2/- to be affixed on theapplication with two Xerox copies.2 Alongwith application the followingdocuments should be submitted:i) Form No. I & XIV of the current yearin original alongwith four Xerox copies.ii) Site Plan and lay out Plan (partitionof the current year, in originalsalongwith its Xerox copy in triplicate.3 On receipt of application, the DeputyCollector’s Office, Diu obtains reportsfrom the following offices requesting tosubmit inquiry reports within 15 days.i) The Mamlatdar, Diu.ii) The Inquiry Officer, City Survey, Diu4 After receiving the reports/commentsfrom the above offices the statement ofeach applicants will be recorded andorders will be passed.1 License for small Arms only will beissued by the District Magistrate. AlsoLicenses valid entrance territory on allIndia will be issued here.2 Obtain prescribed application form induplicate/triplicate from dealing Asst.3 Submit the application form directly tothe same dealing Asst. and obtainreceipt.4 Application must bear a 50 paisa courtfee stamp.5 Attach 2 passport size photographs withthe application form.6 The applicant can request weaponeither for self protection, crop protectionsports or display.

3.9 Protection for sale ortransfer of the fireArms.3.107 A verification report will be called fromthe police.8 The Mamlatdar will be asked for areport only in case of crop protection.9 Orders for grant/refusal will beintimated within 45 days.10 In case, if granted, required fees willhave to be paid at the Arms Counterand collect order as well as licensebook.1 Application on plain paper to thedealing hand at the counter and obtainreceipt.2 The application should be addressed tothe District Magistrate by both thepurchaser and seller.3 The application should bear a 50 paisacourt fee stamp accompanied by theLicense of the seller as well as thepurchaser.4 In case the purchaser is as arms dealeronly the license of the seller is required.5 Necessary verification will be done withthe help of police and after 45 days, ifthere is no objections, the necessaryendorsement will be made on bothlicenses.6 Collect the license directly form thecounter after the lapse of 45 days.7 In case of refusal, order will becommunicated within 30 days of receiptof the application.1 Submit application on blank paper tothe dealing hand at the Arms Counter.Address the application to DistrictMagistrate.2 Affixed a 50 paisa court fee stamp.3 Enclose arms license alongwith theapplication.4 Pay necessary fee penalty etc. to thearms counter and collect the renewallicense within three days.5. TRANSPORT5.1 Learner’s Licence:-Application on form 2 accompanied by the attested copies of thedocument proving his/her address and his/her age, two passport sizephotographs for each class of vehicle and the certificate/Declaration ofMedical Fitness as mentioned below:Sr.No.Category ofLicence1. Driving Licenceof Non transportvehicles, if theapplicant isbelow the age of40 years2. In all othercasesForm No. Time FeepayableForm No.- From 10.00 am Rs. 10.001Declaration to 1.00 pm on all for eachas to medical working days test.fitness) except, Sunday,tenth and lastday of theForm No. – month. On1A Medical Saturday, tenthCertificate and last day ofduly signed the month, cashby the will be acceptedRegistered during 10.00 amMedical to 11.30 am only.Period ofdisposal

3. Learner’sLicencePractitionerApplicationalongwithForm I or I-Aas the casemay beFrom 2:00 pm to2:30 pm on everyTuesday andFridayTest will beconducted onsane day. 3:00pm onwardsRs. 30.00for eachclass ofvehicleWithinperiod oftwo daysfrom datepaymentof fee5. 2 PERMANENT DRIVING LICENCEThe applicant on completion of one month from the date of issue oflearner’s licence, may submit application for permanent Driving licence.Sr. Category ofNo. Licence1. Permanentdriving licenceFormNo./ProcedureFrom No. 4alongwith twopassport sizephotographsand drivingcertificate informs 5issued by theschool orestablishmentApplicationwith abovementioneddocumentsIf the application does not passthe test, he can re-appear with inseven daysIn case the applicant does notpass the test after threeappearances, he shall not bequalifies to reappear for such testbefore the expiry of a period ofsixty days form date of last suchtest.2. Renewal ofdriving licence3. Issue ofDuplicatelicenceTimeCash counter ofthe TRO officeduring 10:00 amto 1:00 pm on allworking daysexpect Saturday,tenth and lastday of the monthcash will beaccepted during10:00 am to11:30 am.From 2:00 pm to2:30 pm onevery Tuesdayand FridayFeepayableRs. 50/-for cashclass ofvehiclePeriod ofdisposal---- Within aperiod oftwo daysfrom dateofpaymentof feeTest will be Rs. 200/- Withinconducted on for each four dayssame day from class of from date3:00 pm vehicle ofonwardspaymentof fees-- Rs. 50/- --for eachclass ofvehicle-- Rs. 50/-for eachclass ofvehicleForm 9 accompanied by a Medicalcertificate in Form I-A duly signedby the Registered MedicalPractitioner and two Passport sizephotographs.In cases of driving licence in Form7 and From No. 6Application un Form LLD and twopassport size photographs. Incases the original licence is foundin further, the applicant shouldsurrender the duplicate licence tothe authorityRs. 200/-Rs. 50/-Rs. 200/-Withinfour daysfrom thedate ofpaymentof suchfeeWithinfour daysfrom thedate ofpaymentof suchfee

5. 3 REGISTRATION OF MOTOR VEHICLESr.No.Procedure Documents required Period ofDisposal1. For registration 1 Sale certificate in Form 21of MotorVehicle. In 2 Valid insurance certificateForm 20 to the 3 Copy of the proceedings of the StateRegisteringauthority withinTransport Authority/Concerned Authorityfor the purpose of approval of the designa period of in case of trailer or a semi trailerseven days from 4 Original sale certificate from thedate of takingdelivery of suchconcerned authorities. In Form 21 in caseof ex-army vehicles.vehicle.5 Proof of address by way of any one of thedocuments referred to in the Annexure Iattached to this charter6 Temporary registration certificate7 Road worthiness certificate in Form 22from the manufacturer and Form 22-Afrom the body-builders8 Custom’s clearance certificate in case ofimproved vehicles along with licence andbond if any5. 4 FEE PRESCRIBED <strong>FOR</strong> REGISTRATION OF VEHICLESr. No. Class of Vehicle Amount Fee1. Invalid carriage Rs. 20/-2. Motor Cycle Rs. 60/-3. Light Motor Vehicle Rs. 200/-4. Light Commercial Vehicle Rs. 300/-5. Medium Goods Vehicle Rs. 400/-6. Medium Passenger Motor Vehicle Rs. 400/-7. Heavy Goods Vehicle Rs. 600/-8. Heavy Passenger Vehicle Rs. 6000/-9. Imported Motor Vehicle Rs. 800/-10. Imported Motor Cycle Rs. 200/-5. 5 RENEWAL OF CERTIFICATE OF REGISTRATION:Sr.No.Category ofLicence/Person1. Registrationcertificate forperiod of 5years2. Alteration ofMotorVehicle3. Transfer ofOwnershipForm No./Procedure Fee payable Period ofdisposalApplication in Form 25 to theRegistering Authority not morethan sixty days before the dateof expiryNotice in Form BTI to theRegistering Authority. Afteralteration the registration formaking necessary entries. Afternecessaryverification/inspection of thevehicle, the registeringauthority shall make entriesthereof in the registrationrecords.Application in Form 29 and 30alongwith.a) Certificate of Registration.b) Certificate of Insurance.c) Proof of Residenced) Valid PUC CertificateAs per therateprescribedforregistrationof vehicleRs. 50/-Fee at therate of halfof the fee asprescribedAfternecessaryinspectionof motorvehicleApproval ofalterationshall begiven theRegisteredownerwithin sevendaysWithin fivedays fromthe date ofpayment4. Assignment Application for registration in Fee at the Within

of newRegistrationmarks5. No. objectionCertificateForm 27 alongwith.a) Proof of residenceb) Declaration in Form FTrate asprescribedForm No. 28 alongwitha) Certificate of Registration.b) Copy of the certificate of insurancec) Evidence of payment of motor vehicle taxupto dated) Valid PUC certificateIn case of a transport vehicle, in addition ofthe above documents documentary evidencemay be furnished :a) That the vehicle is not covered by anypermitb) Sum of money agreed upon to be paid bythe holder of the permit under sub-section (5)and (6) of Section 86, if any no pendingrecovery.c) Evidence of payment to tax on passengersand goods.seven daysfrom thereceipt ofconfirmationfromconcernedRTONo objectioncertificatewill beissuedwithin 7days fromthe receiptof suchpoliceclearance.6. Change inresidence7. Endorsementof hirepurchaseagreement:8. Terminationhirepurchaseagreement:9. RegistrationParticulars:10. CancellationofRegistrationOn receipt of such application, a report willbe obtained from Police Department that oncase relation to the theft of motor vehicleconcerned has been reported or is pending asrequired under sub section (5) of section 48 ofthe Motor Vehicle Act, 1988.From 33 alongwith an Rs. 20/- 7 days ofapplication for recording areceipt ofchange in the residence in thesuchcertificate of registration ofapplication.motor vehicle and certificate ofregistration and proof ofresidence.An application for making an Rs. 100/- Within fiveentry of hire purchase, lease orworking dayshypothecation agreement in theof receiptcertificate of registration of amotor vehicle in Form 34 dulysigned by the registered ownerand financier and shall beaccompanied by the certificateof registration, valid PYCForm 35 duly signed by theregistered owner and thefinancier and accompanied bythe certificate of registration.Issuance of particulars ofregistration and licenceRs. 100/- The entry ofhire purchaseagreement willbe cancelledwithin fiveworking datefrom the dateof suchapplicationand fee.Rs. 20/- Within threedays of receiptof a writtenrequestIf a motor vehicle has been destroyed or has been renderedpermanently incapable of use, the owner shall, withinfourteen days or as soon as may by, report the fact to theRegistering Authority with a request to cancel theregistration of the vehicle and shall forward the certificate ofregistration to that authority. After verification of the meritof the application and inspection of the motor vehicle, ifrequired, the Registering Authority shall cancel theregistration of such vehicle

5. 6 ISSUE RENEWAL OF CERTIFICATE OF FITNESS:Sr.No.Class/Category of VehicleFee forconducting testFee forgrant orrenewal offitnessTotal1. Two/ Three wheeled vehicle Rs. 100/- Rs. 100/- Rs. 200/-2. Light Motor Vehicle Rs. 200/- Rs. 100/- Rs. 300/-3. Medium Motor Vehicle Rs. 300/- Rs. 100/- Rs. 400/-4. Heavy Motor Vehicle Rs. 400/- Rs. 100/- Rs. 500/-The vehicle should be produced for inspection and the certificate offitness shall be issued on the same day.5. 7 NECESSARY <strong>FOR</strong> PERMITS:A permit granted by the Regional Transport Authority or StateTransport Authority is necessary for use of a vehicle as a transport vehiclein any public place. No vehicle shall be used as Transport vehicle withouta valid permit except in cases specified under the provisions of the Motorvehicle Act, 1988 and Rule made there under. The application for permitmay be made in the following forms to the State Transport Authority orRegional Transport Authority as the case nay be and accompanied by thefee mentioned below:No permit is necessary for any goods vehicles, the gross vehicleweight of which dose not exceed 3,000 kilograms.Sr.No.Type of PermitApplicationFormFee forapplicationFormFee forgrant ofPermit1. Stage Carriage P.S.T.S.A Rs. 100/- Rs. 100/-2. Contract Carriage P. Co. P. A. Rs. 100/- Rs. 100/-3. Goods Carriage P, Gd. C. A. Rs. 100/- Rs. 100/-4. Temporary Permit P. Tem. A -- Rs. 20/-5. Privet Service Vehicle P. Pr. S. A. Rs. 100/- Rs. 100/-6. Special Permit P. Co. Sp. T. A. -- Rs. 20/-7. Tourist Vehicle P. Co. T. A. Rs. 200/- Rs. 100/-8. National Permit N. P. Gd. C. P. Rs. 200/- Rs. 100/-Permit will be granted within 3 days from the date of sanction by theState Transport Authority subject to production of the valid documentsand vehicle by the applicant. However, the Temporary Permits will begranted on the very next day of the application and payment of fee.Applications for Temporary permit shall be submitted in the precedingmonth from 25 th to the end of the month.5. 8 TEMPORARY CERTIFICATE OF REGISTRATION:The allocation for Temporary certificate of registration will beaccompanied by (a) Copy of Insurance (b) Sale Certificate (c) Taxes

(quarterly) as per the taxation schedule attached to this Charter and (d)the fee as mentioned below:1. For two wheelers : Rs. 100/-2. For all other vehicle : Rs. 200/-Temporary certificate of registration will be issued on the same day.5. 9 PAYMENT OF TAXES:Motor Vehicle Tax :-Tax shall be levied according to the taxationschedule attached to this Charter subject to an application inform Iappended to the Goa, <strong>Daman</strong> and Diu Motor Vehicle (Taxation) Act/Rule,1974 accompanied by :1. Certificate of Registration.2. Copy of Insurance.3. Valid PUC Certificate.Road Tax ca be paid quarterly, half yearly and annually. Tax postingwill be done on the same day.Taxes on Passengers and Goods :- Tax shall be levied according tothe taxation schedule attached to this Charter subject to anapplication/declaration in Form I or Form II (as the case may be)appended to the Goa, <strong>Daman</strong> & Diu Motor Vehicle (Taxation onPassengers and Goods) Rule, 1975 accompanied:1. Certificate of registration2. Copy of Insurance.3. Valid PUC Certificate.ANNEXURE – IEvidences as to the correctness of address:1. For Company/Firm Vehicle2. For PersonalVehicle(a) Electricity or Telephone Bill(b) Sale Tax paid or Income tax paid receipts,Central Excise Tax receipts alongwith letter ofMunicipality or Gram Panchayat for residentproof/(c) Valid certificate of shop and establishmentissued by labour Department.(d) Sales Tax Registration(a) Ration Card(b) Election Identity Card(c) Other documents specified under Rule 4 ofCentral Motor Vehicle Rules, 1989.ANNEXURE – IITAXATION SCHEDULE :A) ROAD TAX :-Sr.No.Type of Vehicle Specification for Taxation Road Taxper annumRemarks

1. Two wheelers a) Upto 50ccb) More than 50ccFor every side car attached2. Auto Rickshaws i) upto 3 seaters used forprivate purpose.ii) Upto 3 seaters used forhire3. Taxis i) up to 3 seatsii) up to 4 seatiii) up to 5 seatsiv) For every additional seat4. Goods vehicles(including threewheeler pick-upvans)upto maximum 7 seatsi) Driven on fuel other thandiesel for every 100 Kgs ofregistered laden weight orpart thereof .ii) Drive on Diesel for every100 kgs. Of registered ladenweight or part thereof.5. Buss i) up to 18 seasFor every additional seatover 18 seats6. Motor vehiclesother than thosecovered above i.e.LMV/Cars/Jeepsetc.a) upto 850 kgs. Unladedweightb) over 850 kgs upto 1200kgsc) over 1200 kgs upto 2500kgsd) over 2500 kgs upto 5000kgse) For every 1000 kgs orpart thereof in excess of5000 kgs(Rs)1560560902252502702515186003520025035040060(inadditionto ratesspecifiedas above)B) GOODS TAX:Sr.No.Type of Vehicle Specification for taxation Rate of GoodsTax per month1. All transport vehiclesincluding thee wheelersUpto 1000 kgs of RLW Rs. 37.50/-2. All transport vehiclesincluding three wheelersMore than 1000 kgs of RLW Rs. 60/-C) PASSENGER TAX :-Sr. Type of Vehicle Specification Rate of Goods Tax per monthNo.for taxation1. All buses All buses Rs. 1.50 per sear annually perkm of the total daily kmspermitted or Rs. 24/- per seatper month at the option ofoperator