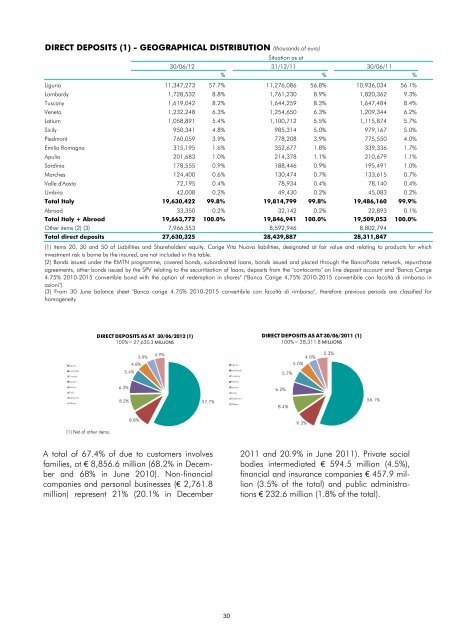

DIRECT DEPOSITS (1) - GEOGRAPHICAL DISTRIBUTION (thousands of euro)Situation as at30/06/12 31/12/11 30/06/11% % %Liguria 11,347,273 57.7% 11,276,086 56.8% 10,936,034 56.1%Lombardy 1,728,532 8.8% 1,761,230 8.9% 1,820,362 9.3%Tuscany 1,619,042 8.2% 1,644,259 8.3% 1,647,484 8.4%Veneto 1,232,248 6.3% 1,254,650 6.3% 1,209,344 6.2%Latium 1,058,891 5.4% 1,100,712 5.5% 1,115,874 5.7%Sicily 950,341 4.8% 985,314 5.0% 979,167 5.0%Piedmont 760,059 3.9% 778,208 3.9% 775,550 4.0%Emilia Romagna 315,195 1.6% 352,677 1.8% 339,336 1.7%Apulia 201,683 1.0% 214,378 1.1% 210,679 1.1%Sardinia 178,555 0.9% 188,446 0.9% 195,491 1.0%Marches 124,400 0.6% 130,474 0.7% 133,615 0.7%Valle d'Aosta 72,195 0.4% 78,934 0.4% 78,140 0.4%Umbria 42,008 0.2% 49,430 0.2% 45,083 0.2%Total Italy 19,630,422 99.8% 19,814,799 99.8% 19,486,160 99.9%Abroad 33,350 0.2% 32,142 0.2% 22,893 0.1%Total Italy + Abroad 19,663,772 100.0% 19,846,941 100.0% 19,509,053 100.0%Other items (2) (3) 7,966,553 8,592,946 8,802,794Total direct deposits 27,630,325 28,439,887 28,311,847(1) items 20, 30 and 50 of Liabilities and Shareholders' equity. <strong>Carige</strong> Vita Nuova liabilities, designated at fair value and relating to products for whichinvestment risk is borne by the insured, are not included in this table.(2) Bonds issued under the EMTN programme, covered bonds, subordinated loans, bonds issued and placed through the BancoPosta network, repurchaseagreements, other bonds issued by the SPV relating to the securitization of loans, deposits from the "contoconto" on line deposit account and "<strong>Banca</strong> <strong>Carige</strong>4.75% 2010-2015 convertible bond with the option of redemption in shares" ("<strong>Banca</strong> <strong>Carige</strong> 4,75% 2010-2015 convertibile con facoltà di rimborso inazioni").(3) From 30 June balance sheet "<strong>Banca</strong> carige 4.75% 2010-2015 convertibile con facoltà di rimborso", therefore previous periods are classified forhomogeneityDIRECT DEPOSITS AS AT 30/06/<strong>2012</strong> (1)100%= 27,630.3 MILLIONSDIRECT DEPOSITS AS AT 30/06/2011 (1)100%= 28,311.8 MILLIONSLiguria3.9%4.8%4.9%Liguria4.0%5.0%5.3%LombardyTuscany5.4%LombardyTuscany5.7%VenetoVenetoLatiumSicily6.3%LatiumSicily6.2%PiedmontOthers8.2%57.7%PiedmontOthers8.4%56.1%(1) Net of other items.8.8%9.3%A total of 67.4% of due to customers involvesfamilies, at € 8,856.6 million (68.2% in Decemberand 68% in June 2010). Non-financialcompanies and personal businesses (€ 2,761.8million) represent 21% (20.1% in December2011 and 20.9% in June 2011). Private socialbodies intermediated € 594.5 million (4.5%),financial and insurance companies € 457.9 million(3.5% of the total) and public administrations€ 232.6 million (1.8% of the total).30

DIRECT DEPOSITS (1) - DISTRIBUTION BY BUSINESS SEGMENT (thousands of euro)Situation as at30/06/12 31/12/11 30/06/11% % %Public Administration 232,591 1.8% 506,831 3.8% 514,330 3.9%Financial and insurance businesses (2) 457,907 3.5% 322,185 2.4% 285,926 2.2%Non-financial businesses and personal businesses 2,761,755 21.0% 2,699,372 20.1% 2,776,523 20.9%Private social bodies and non classified entities 594,511 4.5% 579,628 4.3% 571,483 4.3%Households 8,856,625 67.4% 9,147,824 68.2% 9,024,516 68.0%Total residents 12,903,389 98.2% 13,255,841 98.9% 13,172,777 99.3%Rest of the world 231,807 1.8% 153,835 1.1% 96,422 0.7%Total distribution by business segment 13,135,196 100.0% 13,409,676 100.0% 13,269,199 100.0%Repurchase agreements 2,969,094 2,509,926 2,366,965Total due to customers 16,104,290 15,919,602 15,636,164Securities issued 10,668,463 11,616,164 11,399,971Financial liabilities designated at fair valuethrough profit and loss857,572 904,121 1,275,712Total direct deposits 27,630,325 28,439,887 28,311,847(1) Items 20, 30 and 50 of Liabilities and Shareholders' equity. <strong>Carige</strong> Vita Nuova liabilities, designated at fair value and relating to products for whichinvestment risk is borne by the insured, are not included in this table.(2) Borrowing repurchase agreements are shown separately, for a homogenous comparison previous periods have therefore been reclassified.Indirect deposits amounted to € 22,868.7 million,down over both the last half (-3%) and overthe year (-5.8%). The negative trend in assetsunder administration continued, whichamounted to € 13,208.7 million, down by 6%and 6.3% respectively over six and twelvemonths; in particular, the reduction was due tothe trend in bonds (-13% and -19.7% in six andtwelve months) and shares (-23.2% and -32.5%), also due to the trend in prices. The item“Other”, amounting to € 4,083.7 million, madeup almost entirely of assets under administrationof insurance companies, fell by 0.8% in the halfand increased by 0.9% YoY.Assets under management, amounting to €9,660 million, fell by 5.2% over June 2011, butwere up 1.4% over December 2011.Mutual funds totalled € 4,769.8 million, downby 0.2% in six months and 10.4% in twelvemonths.Around 70% of the funds refer to the subsidiary<strong>Carige</strong> A.M. SGR, whose management was affectedby the difficult market conditions, althoughit stood out for the quality of the resultsachieved.The bank-insurance products amounted to €4,250.3 million (+2.4% in the last half and+0.9% compared to June 2011).Assets managed amounted to € 639.9 million,up 7.9% in the last half, bucking the trend recordedin the previous half (down 1.5% YoY).INDIRECT DEPOSITS (thousands of euro)Situation as at Change %30/06/<strong>2012</strong> 31/12/2011 30/06/2011 06/12 06/1212/11 06/11Total (A+B) 22,868,695 23,571,160 24,280,660 -3.0 -5.8Assets under management (A) 9,659,963 9,523,339 10,185,110 1.4 -5.2Mutual funds and unit trusts 4,769,817 4,781,017 5,321,548 -0.2 -10.4Assets management 639,875 593,050 649,662 7.9 -1.5<strong>Banca</strong>ssurance products 4,250,271 4,149,272 4,213,900 2.4 0.9Assets under administration (B) 13,208,732 14,047,821 14,095,550 -6.0 -6.3Government securities 5,597,543 5,653,318 5,313,928 -1.0 5.3Bonds 2,075,387 2,386,239 2,585,106 -13.0 -19.7Shares 1,452,137 1,889,972 2,149,758 -23.2 -32.5Other 4,083,665 4,118,292 4,046,758 -0.8 0.931