The Value of Mortgage Insurance - PMI Group, Inc.

The Value of Mortgage Insurance - PMI Group, Inc.

The Value of Mortgage Insurance - PMI Group, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

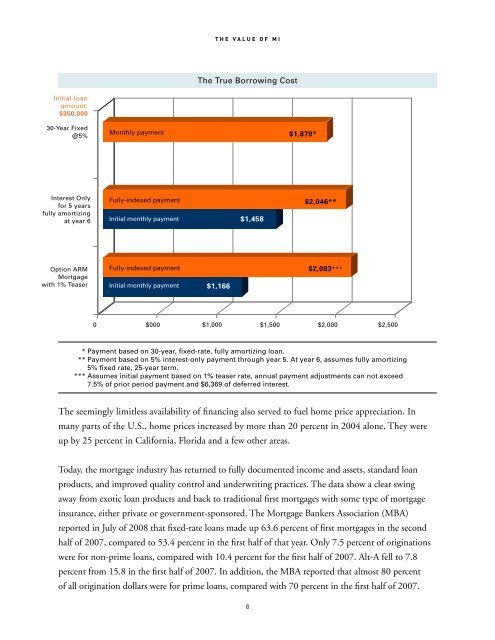

T h e V a l u e o f M I<strong>The</strong> True Borrowing CostInitial loanamount:$350,00030-Year Fixed@5%30 YR FixedMonthly payment$1,879*Interest Onlyfor 5 yearsInterest fully amortizing Onlyat year 6Fully-indexed paymentInitial monthly payment$1,458$2,046**Option ARM<strong>Mortgage</strong>with 1% TeaserOption ARMFully-indexed paymentInitial monthly payment$1,166$2,083***0 500 $1,000 1000 $1,500 1500 $2,000 2000 $2,500 25000 $000* Payment based on 30-year, fixed-rate, fully amortizing loan.** Payment based on 5% interest-only payment through year 5. At year 6, assumes fully amortizing5% fixed rate, 25-year term.*** Assumes initial payment based on 1% teaser rate, annual payment adjustments can not exceed7.5% <strong>of</strong> prior period payment and $6,369 <strong>of</strong> deferred interest.<strong>The</strong> seemingly limitless availability <strong>of</strong> financing also served to fuel home price appreciation. Inmany parts <strong>of</strong> the U.S., home prices increased by more than 20 percent in 2004 alone. <strong>The</strong>y wereup by 25 percent in California, Florida and a few other areas.Today, the mortgage industry has returned to fully documented income and assets, standard loanproducts, and improved quality control and underwriting practices. <strong>The</strong> data show a clear swingaway from exotic loan products and back to traditional first mortgages with some type <strong>of</strong> mortgageinsurance, either private or government-sponsored. <strong>The</strong> <strong>Mortgage</strong> Bankers Association (MBA)reported in July <strong>of</strong> 2008 that fixed-rate loans made up 63.6 percent <strong>of</strong> first mortgages in the secondhalf <strong>of</strong> 2007, compared to 53.4 percent in the first half <strong>of</strong> that year. Only 7.5 percent <strong>of</strong> originationswere for non-prime loans, compared with 10.4 percent for the first half <strong>of</strong> 2007. Alt-A fell to 7.8percent from 15.8 in the first half <strong>of</strong> 2007. In addition, the MBA reported that almost 80 percent<strong>of</strong> all origination dollars were for prime loans, compared with 70 percent in the first half <strong>of</strong> 2007.8