A Fun Adventure Activity Book - The Great Piggy Bank Adventure

A Fun Adventure Activity Book - The Great Piggy Bank Adventure

A Fun Adventure Activity Book - The Great Piggy Bank Adventure

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A <strong>Fun</strong> <strong>Adventure</strong> <strong>Activity</strong> <strong>Book</strong>PUZZLING PUZZLES • TRICKY CHALLENGES • GOAL SETTING • MAKING WISE CHOICES

Welcome to the Journey to your Dream Goal!Reach your Dream Goaland Become a FinanceSmarty Pants!Everyone dreams of things they want to have,things they want to do, and places they want to go.Some of these dreams are big and some are small.It usually takes planning and making smartdecisions to reach a Dream Goal. But if you playyour cards right, you just might end up living thedream of your lifetime!Let’s take a Journey to your Dream Goal. Withevery step, you’ll learn valuable lessons. You’lllearn about—• Setting a financial goal• Saving and spending wisely• Inflation• Asset allocation• Diversification<strong>The</strong>y’re all part of reaching your Dream Goal,and becoming a Finance Smarty Pants!I’m P.I.G., your PersonalInvestment Guide!I’ll help you learn financial fundamentalsand explain what you need to do at eachstep in your journey.1

Let’s get startedSetting a goal is the first stepSET YOUR DREAM GOAL<strong>The</strong> first step in your adventure is to set a financialgoal. You’ll have many financial goals in life—youmight want to buy a new video game, buy a new car,go to college, or travel to a faraway place.For this financial journey, imagine that your DreamGoal is to buy a cute puppy.How much is that doggie in the window?My Dream GoalADVENTUREACTIVITYBy ______________________________________________________(YOUR NAME)(Choose the correct answers and write them in the blank spaces)My Dream Goal is to buy a cute, cuddly puppy. To reach my goal, I willneed to save a lot of _____________________ . I will have to make___________________ choices with my money.(smart, silly)(time, money, energy)When I see something I want to buy, I will ask myself if it will help me______________________________________ or(reach my goal, do my homework, clean my room)________________________________________ .(waste my money, make me hungry, make a funny face).<strong>The</strong> puppy you want costs a lot of money. To reachyour Dream Goal, you’ll have to earn and save 200coins (assets). Remember to plan for all the thingsyou’ll need to take good care of your puppy.A fi nancial goal might take anywhere from a few ________________to several ________________________ to accomplish. If I spend(friends, years, balloons)my money wisely, I might reach my goal even sooner.(months, movies, magazines)KEEP TRACK OF YOUR COINS IN YOUR SAVINGS ACCOUNT (page 13).You earned 40 coins for completing My Dream Goal 40Go to page 13 to add this sum to your savings account.TOTAL COINS =40Nice start! Ask an adult to check your workand sign on the dotted line. Ask an adult whatkind of money choices they have to make.XI like what I see! (Official Adult Signature)This way to the next adventure!2

Decisions, decisions!Saving and spending wisely can help you find your wayWhen saving for a financialgoal, saving money andspending wisely gohand in hand.Opening a savings accountis a good way to start saving your money.A bank will pay you interest on yourmoney. That means you can earn moremoney by letting your cash sit in yoursavings account!If your financial goal is something youreally want, then save for it instead ofspending your money on lots of otherthings you want less. You may not haveto stop spending money completely, butspending wisely is important for reachingyour financial goals.Tip! Words that appear in bold arevaluable “money words.” Learn what eachmeans in the Money Words Glossary onpage 9.AMAZING MONEY MAZEADVENTURELet’s go! Find your way through the Amazing Money Maze.You already have 40 coins in your pocket. You can spendthem or save them. When you get to the store, makesmart choices about what you buy.ACTIVITYSearch for hidden coinsand add them to yoursavings account on page 13.3

Corner StoreCheck the itemsyou want to buy,then add up howmuch you spent.Corner Store Sales Receipt Ice cream2 COINS Dog collar 10 COINS Pizza slice3 COINS Game controller 35 COINS Teddy bear 5 COINSTA-DA!You’reA-MAZE-ING!Count yourcoins below!Total Spent ______ COINS<strong>The</strong> answer to this puzzle can be found on page 13.LET’S COUNT YOUR MONEY!How many coins did you spend at the store?Subtract the coins you spent at the store from the 40coins you started with. How many do you have left?BONUS: Add 20 coins if you bought the dog collar(a wise spending choice for your puppy goal)Go to page 13 to add this sum to your savings account.TOTAL COINS =Good job! Ask an adult to check your workand sign on the dotted line. Ask the adult whatkind of money choices they have had to make.XYep, looks good! (Official Adult Signature)This way to the next adventure!4

Up, Up, and Away!Inflation makes everything cost moreBecause of inflation,the prices of thingswill go up—a dollar will buy lesstoday than it did years ago.<strong>The</strong> price of most everythingwill be higher in the future.For example, if there’ssomething you want to buysoon, inflation won’t affectthe price of your goal verymuch. But if you have a larger,longer-term goal—like saving forcollege—inflation may increaseits price.It’s smart to invest for yourlonger-term goals so that yourmoney might grow faster thanthe rate of inflation.Look at the chart to the right.Ask an adult what lunch costwhen they were your age.Side SaladTurkey WrapTHE COST OF LUNCH NOW AND IN THE FUTUREHow much it costs todayHow much it might cost20 years from now$3.00 $5.42$6.00 $10.84$1.00 $1.81BeverageThis example represents the average lunch prices across the U.S.,assumes a 3% inflation rate per year, and is for illustrative purposes only.5

COSTLY CROSSWORD PUZZLE OF INFLATIONADVENTUREACTIVITYAs you become a Finance Smarty-Pants, you’ll learnimportant “money words.” You’ll hear and use moneywords a lot when you talk about saving and spendingmoney, especially as you grow older and wiser.Let’s explore some money words now. Read each clueand fill in the blanks to complete the Costly CrosswordPuzzle of Inflation!DOWN1. When you use your money to buysomething you want, you _ _ _ _ _ it.3. One way to save your money is to put itinto a _ _ _ _ _ bank.4. Saving money in a savings accountis safer than keeping it under your_ _ _ _ _ _ _ _.5. Stocks and bonds are other ways to_ _ _ _ _ _ your money.6. Be sure to save and spend your money_ _ _ _ _ _.10. Saving to buy a puppy or a new car areexamples of financial _ _ _ _ _ .ACROSS2. On this Journey to your Dream Goal,you are saving to buy a _ _ _ _ _.7. _ _ _ _ _ _ _ _ _ makes the pricesof things you want go up over time.8. With a savings account, your moneycan earn _ _ _ _ _ _ _ _.9. Retirement is an example of a_ _ _ _-term goal.11. It’s smart to invest your money sothat it might grow _ _ _ _ _ _ thaninflation.12. When saving for something you wantto buy one day, it’s important to knowhow much your money will _ _ _ _over time.13. Inflation also makes the value of adollar _ _ _ _ over time.<strong>The</strong> answers to this puzzle can be found on page 13.CHECK THE ANSWERS ON PAGE 13!Give yourself 1 coin for each correct answerBONUS: Add 25 coins if you got them all right!Go to page 13 to add this sum to your savings account.TOTAL COINS =Way to go! Ask an adult to check your work andsign on the dotted line. To fi nd out more aboutinfl ation, ask them what a soda cost when theywere your age.XI like what I see! (Official Adult Signature)This way to the next adventure!6

That’s a Mouthful!Asset Allo-KAY-shun and Di-vers-i-fi-KAY-shunNow you’ll learn aboutdifferent ways to investyour money.On the Journey to yourDream Goal, you can investyour coins in three different piggy banks.Each can help (or harm) your savings plandifferently, depending on how you decideto invest your coins. Each piggy bank’sname will give you a hint about how itmight affect your savings.Two important money words<strong>The</strong>re are two important money words to know when decidinghow to invest your coins: asset allocation and diversification.Asset allocationAsset allocation is how youdivide up your money betweenyour stocks, bonds, andshort-term investments. Onthis journey, you will investyour coins (or assets) in threedifferent kinds of piggy banks(representing a savings account,bonds and stocks).If you have $100, what wouldbe the best way to invest themoney? It depends on whenyou will spend the money. Ifyou’ll spend it soon, you shouldput all of it into a savingsaccount. In a savings account,your money can earn interest,but the interest earned from asavings account probably won’tbe enough to keep up withinflation.If you’re saving for a long-termgoal, you’ll want to investthe money in something thatcan earn more than a savingsaccount. To maybe increaseyour $100 much faster andkeep up with rising prices, youcan invest in stocks and bonds.Think of these as other types ofpiggy banks.DiversificationHave you heard the saying“Don’t put all your eggs in onebasket”? It means you shouldn’trisk everything you have on justone thing. This saying is alsotrue about the money you saveand invest.For example, if you invest allyour money in fast food stocks,what would happen if peoplestop eating out? You would loseall your money! On the otherhand, if you only invest someof your savings in fast foodrestaurants and you also investin stocks for computers, videogames, and toys—you havediversified your investments.So if the fast food restaurantsgo out of business, your otherinvestments might still earnmoney. Good thing you didn’tput all your eggs in the fast foodbasket!7

INVESTMENT DECISION TIMEADVENTUREACTIVITYDraw lines to match thecorrect asset allocationof 100 coins in thedifferent piggy banks foreach goal. Rememberto consider the timehorizon for each goal.<strong>The</strong> first match iscomplete to get youstarted.Howdy! I’m Mellow Yellow<strong>Piggy</strong> <strong>Bank</strong>Investing in me is smart ifyou’re going to spend yourmoney soon. I’m a prettysafe place to save yourmoney for the short term.Meet Three Little <strong>Piggy</strong> <strong>Bank</strong>sHi there! I’m True Blue<strong>Piggy</strong> <strong>Bank</strong>Money invested in me canearn more money, but it canalso lose some.Hello! I’m Red Hot<strong>Piggy</strong> <strong>Bank</strong>I can make the mostmoney over the longterm, but I can also losethe most money in theshort term.++Purchase a kittenTime horizon: 1 year20 COINS50 COINS30 COINS++Purchase a carTime horizon: 4 years0 COINS20 COINS80 COINS++Purchase college tuitionTime horizon: 12 years100 COINS0 COINS0 COINS<strong>The</strong> answers to this puzzle can be found on page 13.ALL DONE? LET’S CHECK YOUR WORK!One correct match, you earn 10 coinsThree correct matches, you earn 25 coinsGo to page 13 to add this sum to your savings account.TOTAL COINS =You’re in the money! Ask an adult to check yourwork and sign on the dotted line.XWow! (Official Adult Signature)This way to the next step in your journey!8

Language of MoneyMoney words help you talk dollars and senseDuring thisJourney toyour DreamGoal, you’llencounter a lotof unfamiliar words. Learningthe “language of money” canhelp you make smart financialdecisions and be able to talkabout money with others—likeyour family and adults.MONEY WORDS GLOSSARYAn account is a place to put your money. Youcan have an account at a bank, credit union, orother financial institution. A checking accountor savings account is your personal account foryou to take money out or put more in.An allowance is money given to a person on aregular basis for his or her personal spending.Many kids are given an allowance by theirparents for doing chores at home.An asset is anything that has a financialworth. Cash, savings accounts, stocks, bonds,mutual funds, houses, cars, etc., are assets.Asset allocation is how your money isdivided among stocks, bonds, and short-terminvestments. For instance, you can put someof your money in a savings account and investsome money in stocks, bonds, and mutualfunds. If you have a goal that is a long wayoff, you may want to have most of your moneyinvested in stocks. As the goal gets closer, youmay want to hold less in stocks and more inbonds and short-term investments.A bond is an asset issued by the federalgovernment, state governments, orcorporations. When you buy bonds, you arelending your money to the organization. Bondsgenerally pay interest (usually more than asavings account) every six months and youreceive the original amount you loaned theorganization plus interest earned at the endof a specified time. Unlike a savings accountat a bank or credit union, bonds are subject torisk—which means you could lose some or allof the money you invested.A budget is a plan of how much money a personor business has to spend and how it will bespent. For instance, your home budget mightinclude rent, utilities, food, clothing, healthcare, car payment, pet care, insurance, etc.A credit card is a small plastic card issued bya bank or business that lets you buy goods orservices with the promise that you’ll pay at alater date. When you “charge” goods or serviceson a credit card, you are borrowing someoneelse’s money—and you have to pay it back,usually with interest.Debt is money you owe when you buy on creditor borrow from someone else. Any money youhave to pay back can be considered debt.A deposit is money you put in your account.Diversification means having lots of differentkinds of investments (different types of stocks,different types of bonds, etc.). For example,if you invest in skateboard stock and kidsstop buying skateboards, you could lose allthe money you have invested. Instead, if youinvest money in skateboards, pizza, andcomputers, and kids stop buying skateboards,you might lose only the money you investedin skateboards—not all of it. Diversificationcannot guarantee that your investments willmake money or protect against loss if themarket goes down.Inflation is the general increase in the priceof goods and services. Money loses value dueto inflation, so it will be more expensive to buyproducts in the future. For example, in 1939,a car cost $400. A similar car today would costalmost $30,000 at a 3% rate of inflation.Interest can be an amount of money aninvestment earns or an amount of moneythat is added to money you borrowed. If youhave a savings account, your money can earninterest—and you’ll have even more money.However, if you borrow money (like using acredit card), you will have to pay interest ontop of what you use. That’s expensive.You invest by putting money into assets (likestocks, bonds, mutual funds, etc.) to help youreach your financial goals.An investment is anything that you buy inhopes that it will increase in value.A loan is money that’s borrowed and isexpected to be repaid, usually with addedinterest.A luxury is something you don’t need. It canbe a material object or service that you want,but could live without. For example, you needshoes to wear, but you don’t need to buy themost expensive pair or a new pair every month.A mutual fund combines the money of manyinvestors who have common financial goalsinto a professionally managed portfolio. Mutual9funds take the money and buy many differentstocks, bonds, and/or short-term investments(depending on what kind of mutual fund itis), giving small investors access to a welldiversifiedportfolio. Each investor shares in thegain or loss of money in the mutual fund.Needs are basic things necessary to live or doyour job (such as a place to live, food, clothes,transportation to work, etc.). Needs are oftenconfused with wants. For instance, you mayneed transportation to work and school, butyou don’t need a $40,000 sports car. You maywant a sports car, but you don’t need it.A portfolio is a group of investments ownedby a person, investment company, or financialinstitution. Your portfolio should includedifferent types of investments.A return is the gain (or loss) of money from aninvestment in a particular time period.Risk comes in many different forms. Two risksare the risk of losing money and the risk of notgaining enough to reach your goal. Your assetallocation helps you keep the right balance ofthese risks for your goal. Another risk you’llface is having most or all of your money in aninvestment that does worse than your otherchoices. Diversification helps reduce how muchof this risk you have.A savings account is one place to put yourmoney to help achieve your financial goals.When you put your money in a savingsaccount, the bank “borrows” your money andpays you interest.A stock is a share of a company that is soldto the public. Companies sell stocks to raisemoney to finance business operations. Stockprices can change daily. As an investment,stocks have produced the highest longtermreturns over the past several decades.<strong>The</strong>y also have had the biggest swings inperformance and are subject to much greatershort-term risk of losing money. Of course,just because something happened in the pastdoesn’t mean it will happen again.<strong>The</strong> stock market is where shares of stock ofdifferent companies are bought and sold.A stockholder (or shareholder) is a personwho owns stock (shares) in a company.Time horizon is the number of years untilyou will spend your money. This determineshow your money should be divided betweenstocks, bonds, and short-term investments.Wants are things you don’t need to live or doyour job. For example, you might want to eatout everyday, but you don’t need to. A want canalso be considered a luxury.

MONEY WORD SEARCHRead through the Money WordsGlossary, then circle as many moneywords as you can find in the MoneyWord Search.Find 20 hidden money words andearn more coins toward reachingyour Dream Goal!Money WordsACCOUNTALLOCATIONALLOWANCEASSETBONDBUDGETCREDIT CARDDEBTDEPOSITDIVERSIFICATIONINFLATIONINTERESTLOANNEEDSPORTFOLIORISKRETURNSTOCKSTOCKHOLDERWANTSADVENTUREACTIVITYC R E D I T C A R D E G D RS AA I N F L A T I O N U W T S YT S I N T E R E S T X N S E IS K W E P I D G F H A E Y R NR U S T O C K Z V W T Q T QT N VD I V E R S I F I C A T I O NE H M A T E S F L Q C E O W SP F E V F K T L L K C G D A TO R S L O A N U O H O D U N MS K J M L W E E R O U U P T EI T O E I F E W E N N B C S NT C O H O J D U T D T D E B TR E D L O H K C O T S E S T MA Y A L L O C A T I O N L A EO B O N D S E C N A W O L L A<strong>The</strong> answers to this puzzle can be found on page 13.HOW MANY MONEY WORDS DID YOU FIND?Give yourself 1 coin for each correct answerBONUS: Add 15 coins if you got them all right!Go to page 13 to add this sum to your savings account.TOTAL COINS =You’re in the money! Ask an adult to checkyour work and sign on the dotted line.X<strong>The</strong> kid’s a natural money manager!(Official Adult Signature)This way to the next adventure!10

Oh, no—a test!Are you ready to become a Finance Smarty Pants?You’re learning alot of useful ideasand words duringthis Journey toyour Dream Goal.<strong>The</strong> more you learn, the moreof a Finance Smarty Pants youbecome. And every step movesyou closer to reaching your goalof getting a cute, cuddly puppy.But first, you must take theTricky Trivia Challenge (it’s reallynot that tricky).TRICKY TRIVIA CHALLENGEAnswer each question aboutsomething you’ve learned duringyour journey. Every question you getright will earn you 2 coins!Goal Setting1. _____ is the MOST important step in financial planning.A. Throwing dollar bills into the airB. Opening a savings accountC. Setting a goalBonus: Answer all 16 questionscorrectly and you’ll earn an extra 7coins (25 total)!Ready? Set? GO!ADVENTUREACTIVITY2. You’ll reach your financial goal sooner if you _____ more moneyeach month.A. saveB. spendC. eat3. Carrie wants to be a writer. To reach her goal, she should _____.A. save up for a writing classB. buy nice pensC. type very loudlySaving & Spending Wisely4. You spend $8 a week on movies, but you want to buy a $40 jacket.How many movies must you skip to buy the jacket?A. 4 moviesB. 3 moviesC. 5 movies5. You are saving to buy a new outfit. To spend wisely and save moremoney, you can stop _____.A. buying sodas every dayB. eating lunch for a weekC. paying your cell phone bill11

6. You are too young to start saving money.A. True B. False7. You should buy what you need before you buywhat _____.A. wantB. deserveC. earn8. Searching for a similar item that costs lessmoney is _____.A. a good idea for saving moneyB. a good way to relaxC. a waste of time9. Pick an example of wasteful spending if you’resaving for a new bike:A. Buying a book for classB. Buying lots of candy barsC. Buying school lunchesInflation10. Most things cost _____ than they did 10 yearsago.A. moreB. lessC. the same11. Over time, the same amount of money canbuy ______ of something.A. the same amountB. moreC. less12. If someone wants to buy a new truck intwo years, the price will probably be _____because of inflation.A. cut in halfB. higherC. lowerAsset Allocation and Diversification13. <strong>Fun</strong>ky Fresh Clothing can sell more clothesto different people if they offer _____.A. a variety of stylesB. all clothes in orangeC. rock band shirts only14. Pick the pet collection with the largestvariety of animals:A. A tarantula, a goldfish, and a hamsterB. A boy hamster and a girl hamsterC. A goldfish and a clown fish15. Pick the best method to start a drink stand:A. Sell only lemonade because it’s popularB. Make a jingle to sing and attractcustomersC. Sell different kinds of drinks to pleasedifferent customers16. You need to buy school supplies. Pick thewisest way to spend your money and be fullyprepared for the new school year:A. Buy notebooks, binders, pens, and pencilsB. Buy small and large notebooksC. Buy a very nice pen<strong>The</strong> answers to this puzzle can be found on page 13.HOW DID YOU DO?Give yourself 2 coins for each correct answerBONUS: Add 7 coins if you got them all right!Go to page 13 to add this sum to your savings account.TOTAL COINS =You’re a Finance Smarty Pants! Ask an adultto check your work and sign on the dotted line.X<strong>Great</strong> work—you’re a genius!(Official Adult Signature)This way to the next adventure!12

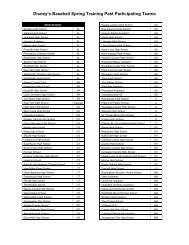

Each activity in this funadventure can move youcloser to your Dream Goal ofbuying a cute, cuddly puppy!So make good decisions anddo your best.My Savings AccountPAGEADVENTURE ACTIVITYLESSONLEARNEDCOINSEARNEDWhen you finish an activity,write down the number ofcoins you earn on this DreamGoal Savings Account.When you’ve completedthem all, add up your totalcoins to see if you earnedenough to buy that puppy.2 SET YOUR DREAM GOAL Goal Setting 403 AMAZING MONEY MAZE6COSTLY CROSSWORDPUZZLE OF INFLATION8 INVESTMENT DECISION TIMESaving & SpendingWiselyPlanning forInflationAsset Allocation &Diversification10 MONEY WORD SEARCH Financial Terms11 TRICKY TRIVIA CHALLENGE Financial ConceptsAwe, so cute!You’ll need 200 coins tobuy this puppy!BONUS! Add the number ofhidden coins you found on pages 4 and 5TOTAL COINS =ANSWERS:DOWNACROSSCOSTLY CROSSWORD PUZZLEOF INFLATIONC R E D I T C A R D E G D R AA I N F L A T I O N U W T S Y1. spend2. puppyT S I N T E R E S T X N S E IS K W E P I D G F H A E Y R NR U S T O C K Z V W T Q T N V3. piggy4. mattress5. invest6. wisely7. inflation8. interest9. longMONEY WORD SEARCH++Purchase a kittenTime Horizon: 1 year20 COINS50 COINS30 COINSPurchase a carTime Horizon: 4 years0 COINS+20 COINS+80 COINS11. faster++D I V E R S I F I C A T I O N10. goals12. earnPurchase college tuitionTime Horizon: 12 years100 COINS0 COINS0 COINSE H M A T E S F L Q C E O W S13. lessAMAZING MONEY MAZEP F E V F K T L L K C G D A TO R S L O A N U O H O D U N MTRICKY TRIVIA CHALLENGE1. C9. BS K J M L W E E R O U U P T E2. A10. A2Corner Store10I T O E I F E W E N N B C S NT C O H O J D U T D T D E B T3. A4. C5. A11. C12. B13. A35R E D L O H K C O T S E S T M6. B14. A3A Y A L L O C A T I O N L A E7. A15. C5O B O N D S E C N A W O L L A8. A16. A13INVESTMENT DECISIONS

Congratulations!You’re a Finance Smarty Pants!Certified Finance Smarty-Pants(write your name here)OFFICIALFINANCESMARTY PANTSYou did it! You learnedsome valuable financiallessons. You learned about thepower of setting financial goals,the importance of saving andspending wisely, the effects ofinflation, and the benefits ofasset allocation and diversification. And you learnedwhat it takes to reach your Dream Goal!Share What You LearnedNow that you’re an official Finance Smarty-Pants,share what you learned with others. Talk with friendsand adults about what you’ve learned. You just mighthelp them make wise financial decisions, too!Play <strong>The</strong> <strong>Great</strong> <strong>Piggy</strong> <strong>Bank</strong> <strong>Adventure</strong> ® Online GameTake another fun financial journey by playing <strong>The</strong> <strong>Great</strong><strong>Piggy</strong> <strong>Bank</strong> <strong>Adventure</strong> ® online game and learn even moreabout planning, saving, and investing. It’s fun—and free!Visit greatpiggybankadventure.com.Explore <strong>The</strong> <strong>Great</strong> <strong>Piggy</strong> <strong>Bank</strong> <strong>Adventure</strong> ® ExhibitHere’s an idea for a fun Dream Goal: Visit the <strong>Great</strong> <strong>Piggy</strong><strong>Bank</strong> <strong>Adventure</strong> ® at INNOVENTIONS at Epcot ® at theWalt Disney World ® Resort in Florida. <strong>The</strong> interactive exhibitbrings important money concepts to life through a series ofentertaining, hands-on games!14

Helping families talk aboutsaving and spending wiselyTalking with children about money and good financialhabits is perhaps more important than ever.As part of our longstanding commitment to financialeducation, T. Rowe Price works with families, schools,and organizations to teach children and help familiescommunicate more effectively about money.We collaborated with Walt Disney Parks & ResortsOnline to create <strong>The</strong> <strong>Great</strong> <strong>Piggy</strong> <strong>Bank</strong> <strong>Adventure</strong> ®online game. This unique experience is designed toteach kids about setting financial goals and accomplishingthem through smart planning, saving, andinvesting.To learn more, visit the T. Rowe Price Family Centeronline at troweprice.com/trowefamilycenter.T. Rowe Price and Disney Enterprises, Inc., are not affiliated companies.<strong>The</strong> <strong>Great</strong> <strong>Piggy</strong> <strong>Bank</strong> <strong>Adventure</strong> ® is an online game and interactive exhibit at INNOVENTIONS at Epcot ® at the WaltDisney World ® Resort in Florida that is a fun way for families to learn the fundamentals of saving and spending wisely.06209-43 104869 5/11