NAELA_NEWS_june 07_v3.indd - National Academy of Elder Law ...

NAELA_NEWS_june 07_v3.indd - National Academy of Elder Law ...

NAELA_NEWS_june 07_v3.indd - National Academy of Elder Law ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

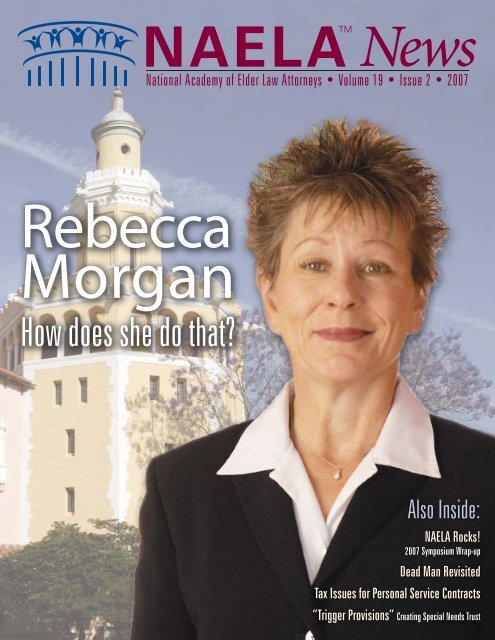

FEATURES41220244 Rebecca Morgan: How Does She Do That?Robert B. Fleming, CELA11 Inaugural <strong>NAELA</strong> <strong>Elder</strong> Leadership Award12 <strong>NAELA</strong> Rocks! 20<strong>07</strong> Symposium Wrap-upEdwin M. Boyer, Esq.14 Special THANKS to the Sponsors andExhibitors <strong>of</strong> the 20<strong>07</strong> <strong>NAELA</strong> Symposium!16 <strong>NAELA</strong> Fellow’s Acceptance SpeechFay Blix, CELA19 John J. Regan Writing Award Recipient19 20<strong>07</strong> Theresa Award in CommunityService Recipient20 Dead Man RevisitedJohn Barry Stutt, MBA22 These Are Really Nice PeoplePr<strong>of</strong>essor Rebecca Morgan24 Stetson Launches Distance Learning LL.M.in <strong>Elder</strong> <strong>Law</strong>Pr<strong>of</strong>essor Rebecca Morgan26 “Trigger Provisions” Creating SpecialNeeds TrustWilliam T. Edy, CELA and Evan H. Farr, CELA27 Where Do We Go From Here?Daniel O. Tully, Esq.30 Tax Issues for Personal Service ContractsDavid Lee Rice,CELAVolume 19 • Issue 2The <strong>NAELA</strong> Newsis published by the<strong>National</strong> <strong>Academy</strong> <strong>of</strong><strong>Elder</strong> <strong>Law</strong> Attorneys, Inc.1604 N. Country Club RoadTucson, AZ 85716-3102520/881-4005Fax: 520/325-7925www.naela.orgPUBLICATIONS CHAIRWendy H. Sheinberg, CELAGarden City, NYEDITORRuth Ratzlaff, Esq.Fresno, CAPUBLICATIONS COORDINATORStacy FobarTucson, AZGRAPHIC DESIGN/LAYOUTKellen CreativeAtlanta, GA33 Rob LaMaster, Managing Director Articles appearing in the <strong>NAELA</strong>EVERY ISSUE5 Presidents Message21 Executive Director’s Message23 <strong>NAELA</strong> Calendar <strong>of</strong> Events25 <strong>NAELA</strong> in the News33 Welcome New CELA’s and FellowsNews may not be regarded as legaladvice. The nature <strong>of</strong> <strong>Elder</strong> <strong>Law</strong>practice makes it imperative that locallaw and practice be consulted beforeadvising clients. Statements <strong>of</strong> fact andopinion are the responsibility <strong>of</strong> theauthor and do not imply an opinionor endorsement on the part <strong>of</strong> the<strong>of</strong>ficers or directors <strong>of</strong> <strong>NAELA</strong> unlessotherwise specifically stated as such.3

FEATURED MEMBERRebecca MorganHow Does She Do That?Robert B. Fleming, CELAYou already knowPr<strong>of</strong>essor RebeccaC. Morgan (almostuniversally, but not here,“Becky”). She (withco-author Pr<strong>of</strong>. DavidEnglish) is responsible formaintenance and update<strong>of</strong> one <strong>of</strong> the legal elderlaw treatises, and the onethat probably sits on thecredenza behind your desk:Tax, Estate & FinancialPlanning for the <strong>Elder</strong>ly,and the companion FormsBook, both publishedby LexisNexis. She hasserved as President <strong>of</strong><strong>NAELA</strong> (1998–1999), andcontinues to be intenselyactive in the organization.She is recognized nationallyas an expert in <strong>Elder</strong><strong>Law</strong>, and has receivedinnumerable awardsevidencing her involvementand impact.But where should one goto really get to know Pr<strong>of</strong>.Morgan? You might start inthe small town <strong>of</strong> Clinton,Missouri—where she wasraised, met and marriedher husband Jay and whereher mother and family stilllive. (If you’re not sure howto find Clinton, you can go to Kansas City and head easttoward Tightwad. Honest.) Her Midwestern, small-townroots explain a lot about her impressive work ethic, herno-nonsense approach to ethics and morality, and heraffection for seniors and other underdogs.You might also try the local outlet (there’s one withina few blocks <strong>of</strong> where you are right now) <strong>of</strong> a nationalc<strong>of</strong>fee emporium. Chances are you might find her there,fueling up on soy chai lattes. Or if you can find your wayto the mountains <strong>of</strong> Colorado, you might find her sittingon a porch, devoted dog and cats surrounding her, orperhaps hiking in the rarefied mountain air.Like all <strong>of</strong> us, Pr<strong>of</strong>. Morgan is more than just hercareer. The career part, however, is pretty impressive. Sheholds the Boston Asset Management Faculty Chair atthe Stetson University College <strong>of</strong> <strong>Law</strong> in St. Petersburg,Florida (little-known fact: the College is actually inGulfport), where she is also the Director <strong>of</strong> the Centerfor Excellence in <strong>Elder</strong> <strong>Law</strong> (http://wwwlaw.stetson.edu/excellence/elderlaw). Even more impressively, she hasspearheaded the development <strong>of</strong> a new and innovativeLLM (Master <strong>of</strong> <strong>Law</strong>s) program in <strong>Elder</strong> <strong>Law</strong> (see thearticle on page 24 for more details), which will enroll itsfirst class this fall.In an academic career spanning three decades, Pr<strong>of</strong>.Morgan has collected a number <strong>of</strong> prestigious awardsand amassed considerable pr<strong>of</strong>essional recognition.Just last year, for example, the <strong>National</strong> Committeefor the Prevention <strong>of</strong> <strong>Elder</strong> Abuse gave her the RosalieWolf Memorial <strong>Elder</strong> Abuse Prevention Award,named in honor <strong>of</strong> the founder <strong>of</strong> the NCPEA. Theyear before that, she and Pr<strong>of</strong>essor Roberta Flowers <strong>of</strong>Stetson received the Florida Supreme Court’s ProjectAward on Pr<strong>of</strong>essionalism for their development <strong>of</strong>their unique series <strong>of</strong> video clips illustrating commonethical and pr<strong>of</strong>essionalism dilemmas encountered by4

PRESIDENT’S MESSAGEThank You, Thank You, Thank You!Donna R. Bashaw, CELAIwrite this on the last week <strong>of</strong> the 2006–20<strong>07</strong> <strong>NAELA</strong>year. The year went incredibly fast (as my predecessor<strong>Law</strong>rence Davidow, CELA said it would) and I write thiscolumn with mixed feelings. As President, it was wonderfulvisiting with chapters and meeting <strong>NAELA</strong> members, some<strong>of</strong> whom have never attended a national conference. Onthe other hand, it will be nice not to travel so <strong>of</strong>ten and toget caught up at the <strong>of</strong>fice and at home.Speaking <strong>of</strong> the <strong>of</strong>fice and home, many thanks are due tomy <strong>of</strong>fice staff and to my family, especially to my husband,Phil. As we all know, we cannot do a job as time consumingas being President <strong>of</strong> <strong>NAELA</strong> without a lot <strong>of</strong> support atthe <strong>of</strong>fice and at home, as well as support from many, many<strong>NAELA</strong> members who served on the board, on committees,on SIGS and on task forces. THANK YOU, THANKYOU, THANK YOU!The time has now come to report on the year. As I saidlast year, <strong>NAELA</strong> is similar to Disneyland and we havemany lands in <strong>NAELA</strong>. What did the 2006–20<strong>07</strong> <strong>NAELA</strong>team accomplish in all <strong>of</strong> these lands this year? Let’s look athow we did with the 2006–20<strong>07</strong> goals.Goal 1. Establish a <strong>Law</strong> Pr<strong>of</strong>essor’s Task Force to increaseawareness <strong>of</strong> <strong>NAELA</strong> in law schools and to provide input ondiversity concerns.An Academic/Diversity Task Force was created, chairedby Kim Dayton, Esq. and Katherine Pearson, Esq. Thetask force is completing recommendations to be presentedto the board later this year on ways to strengthen theconnection between law schools and <strong>NAELA</strong> and how toincrease awareness <strong>of</strong> <strong>Elder</strong> <strong>Law</strong> with students <strong>of</strong> color andethnicity. The committee is also working on the StudentJournal Writing Contest, a law student event to be heldat the 20<strong>07</strong> Institute, compiling a list <strong>of</strong> law pr<strong>of</strong>essors(those in and out <strong>of</strong> <strong>NAELA</strong>) and tweaking the <strong>Elder</strong> <strong>Law</strong>curriculum for law schools.Goal 2. Create a <strong>National</strong> Senior Award to encourage andrecognize seniors who continue to contribute to society in theirlater years.This charge was given to the Public Relations committeechaired by Craig Reaves, CELA. The committee securedAARP and Grand Magazine as co-sponsors with <strong>NAELA</strong><strong>of</strong> the new <strong>NAELA</strong> <strong>Elder</strong> Leadership Award. From anumber <strong>of</strong> nominations four finalists were selected fromwhich Dr. Elbert C. Cole was selectedas the winner. Dr. Cole is the founder<strong>of</strong> the Shepherd’s Centers <strong>of</strong> America—approximately 75 centers, in 21 states,serving thousands <strong>of</strong> elders. The awardwas presented at the Symposiumin Cleveland. The Public RelationsCommittee has also worked on updatingall the <strong>NAELA</strong> brochures and on keep<strong>NAELA</strong> in the public eye through all media sources.Goal 3. Establish an Emeritus Member Category.The Membership Committee, chaired by SteveSilverberg, CELA, looked at this goal. The committeepresented a proposal to confer Emeritus status on retiredmembers who have madesignificant contributionsduring service toAs President, itwas wonderfulvisiting withchapters andmeeting <strong>NAELA</strong>members, some<strong>of</strong> whom havenever attendeda nationalconference.<strong>NAELA</strong>. The committeehas also been asked bythe board to look atthe Retired Membercategory as to thebenefits and privileges<strong>of</strong> this category. Thefinal proposal will bepresented and voted onby the board later thisyear. The committeealso worked on updatingthe All About <strong>NAELA</strong>breakfast session forthe 20<strong>07</strong> Symposiumand worked with Goodand Welfare committeeto welcome new/firsttime attendees.Goal 4. Establish a White House Conference on AgingTask Force.The newly-formed WHCoA Task Force was chairedby Kerry Peck, Esq. All <strong>NAELA</strong> members and <strong>NAELA</strong>staff who attended the 2005 conference were invited tobe on the task force. The task force reviewed the top 50resolutions from the conference and chose the <strong>NAELA</strong> top6

continued from page 6ten resolutions. Of the ten, the task force decided to focus onassisting in the passage <strong>of</strong> the <strong>Elder</strong> Justice Act. The task forcealso identified some resolutions that <strong>NAELA</strong> is supportingwith programs already in place such as the resolution toencourage volunterism with our <strong>Elder</strong> Leadership Award and<strong>NAELA</strong>’s work on long term care concerns which supportsseveral <strong>of</strong> the resolutions.Goal 5. Provide incentives to <strong>NAELA</strong> speakers.This goal was reviewed by the Program Committee chairedby Reginald Turnbull, CELA . A subcommittee lookedat the speaker incentive issue. They took a survey <strong>of</strong> howother pr<strong>of</strong>essional organizations compensate members whospeak at programs. They also looked at the financial impact<strong>of</strong> a variety <strong>of</strong> tiered compensation plans. In reviewing theinformation provided, the Executive Committee requestedthe committee to explore other means <strong>of</strong> providing nonmonetaryrecognition <strong>of</strong> speakers. A further report will bepresented later this year.Goal 6. Focus on the redesign <strong>of</strong> the members’ practices.Again, the Program Committee worked on this goal. As<strong>NAELA</strong> pursues Special Needs <strong>Law</strong> a whole new area opensup for our members. Programming has already begun to <strong>of</strong>fereducation and guidance in this area <strong>of</strong> law. Programming isalso <strong>of</strong>fering classes in litigation, working with upper incomeseniors and expanding into other services and products.A program review task force continued its work this year.It was chaired by Tim Takacs, CELA. Surveying <strong>NAELA</strong>membership resulted in a written proposal which has beenpresented to the board and favorably adopted. This willresult in some major changes in future programing. Anadditional program change occurred as a result <strong>of</strong> membersrequesting lower cost programs, closer to home with little orno travel required. Having many more telephonic programsavailable seemed to be the answer. The Telephonic ProgramSubcommittee, chaired by Fay Blix, CELA, resulted in anincreased number <strong>of</strong> these low cost programs for attorneysand staff which can be accessed in their own <strong>of</strong>fices.Goal 7. Revitalize the Good and Welfare Committee.The committee was co-chaired by John Wargo, CELAand Martha Brown, CELA. They worked on a welcomeprogram for first time attendees at <strong>NAELA</strong> conferences.continued on page 8BOARD OF DIRECTORS: 20<strong>07</strong> – 2008PRESIDENTG. Mark Shalloway, CELAWest Palm Beach, FLVICE PRESIDENTStephen J. Silverberg, CELAEast Meadow, NYSECRETARYEdwin M. Boyer, Esq.Sarasota, FLEXECUTIVE DIRECTORSusan B. McMahon, Esq.Tucson, AZRobert F. Brogan, CELAPoint Pleasant, NJMartha C. Brown, CELASaint Louis, MOA. Kimberley Dayton, Esq.Minneapolis, MNRobert B. Fleming, CELATucson, AZGregory S. French, CELACincinnati, OHBradley J. Frigon, CELAEnglewood, CONancy P. Gibson, Esq.Missoula, MTBrian W. LindbergPublic PolicyWashington, D.C.DIRECTORSEdward E. Zetlin, Esq.Falls Church, VACONSULTANTSPRESIDENT ELECTCraig C. Reaves, CELAKansas City, MOTREASURERRuth A. Phelps, CELAPasadena, CAPAST PRESIDENTDonna R. Bashaw CELALaguna Hills, CAMANAGING DIRECTORRobert K. LaMasterTucson, AZDoris E. Hawks, Esq.Los Altos, CAHoward S. Krooks, CELABoca Raton, FLMichael F. Loring, Esq.Scituate, MATimothy L. Takacs, CELAHendersonville, TNReginald H. Turnbull, CELAJefferson City, MOKathleen T. Whitehead, CELASan Antonio, TXShirley B. Whitenack, Esq.Morristown, NJHugh K. Webster, Esq.Legal CounselWashington, D.C.7

President’s Message continued from page 8They also started the <strong>NAELA</strong> Neighborhood listserv wheremembers can send messages not appropriate for the general<strong>NAELA</strong> listserv. They also are creating “Spotlight <strong>of</strong> a <strong>NAELA</strong>Member” as a regular feature <strong>of</strong> the <strong>NAELA</strong> News.Goal 8. Branding <strong>NAELA</strong>All <strong>of</strong> <strong>NAELA</strong> is charged with branding <strong>NAELA</strong> andestablishing the new logo and tagline. However, the PublicRelations Committee is consciously working at branding<strong>NAELA</strong> through all types <strong>of</strong> media. This effort has been quitesuccessful in that <strong>NAELA</strong>is considered by manyin government and inthe media as experts onsenior topics. There is stillmuch work to be donein branding <strong>NAELA</strong> andefforts will continue.Goal 9. Encourage furtherrecognition <strong>of</strong> the AspirationalStandards.The Pr<strong>of</strong>essionalism andEthics Committee, chairedby Greg French, CELA,have continued serving onthis committee which wasformed in former PresidentStuart Zimring’s, Esq.term. They are helpingmembers to incorporatethese standards in theirpractices. They are presentlyfocusing on producing atool kit to assist members.They are also lookingat perhaps forming anadvisory panel to respondto membership questionsabout ethical issues.A lot <strong>of</strong> work has beendone, and will continue tobe done, to work on theseFor sunlit hoursand visions clear,For all rememberedfaces dear,For comrades <strong>of</strong> asingle day,Who sent usstronger on ourway,For friends whoshared the year’slong road,And bore with usthe common load,For hours thatlevied heavy tolls,But brought usnearer to our goals,For insightswon through toiland tear,We thank thekeeper <strong>of</strong> our year.—For Sunlit Hours byClyde McGeegoals. But, there were also other committees who did atremendous amount <strong>of</strong> work this year.These include:1. Amicus CommitteeThe chair, Victoria Heuler, Esq. and the membersapproved three amicus briefs to be filed in Osborn v.Ohio Dept. Of Job & Family Services, Timm v. MontanaDept. Of Public Health & Human Services, and James v.Richman/Commonwealth Penn. Dept. Of Public Welfare.2. Advanced <strong>Elder</strong> <strong>Law</strong> Review CommitteeCo-chairs K.T. Whitehead, CELA and DennisSandoval, CELA have expanded the course to includemore detailed information in all 13 areas covered bythe certification exam. The program is now also gearedfor an advanced elder law course for experiencedpractitioners who want to update and enhance theirgeneral practice knowledge at an advanced level.3. Chapter Presidents’ CommitteeMichael Loring, Esq. and Frank Dana, CELAcontinue their excellent job as Co-chairs <strong>of</strong> thiscommittee. Chapter presidents serve on thecommittee. Two new chapters, Vermont and Tennesseereceived their charters at the 20<strong>07</strong> Symposium. Thecommittee is also working on providing a chapterwebsite template.4. Council <strong>of</strong> Advanced Practitioners (CAP)CAP was chaired by Baird Brown, CELA until heexperienced a serious medical problem and FrankJohns, CELA graciously agreed to chair in his stead.CAP was formed at the request <strong>of</strong> <strong>NAELA</strong>’s mostexperienced practitioners and provides advancedprograming for its members as well as providingexpertise and a brain trust for <strong>NAELA</strong> and for thepractice <strong>of</strong> <strong>Elder</strong> <strong>Law</strong> in general.5. The Fellows CommitteeThe Fellows Committee was chaired by JudithStein, Esq. Their work resulted in three new Fellowsbing introduced at the Cleveland Symposium: FayBlix, CELA, <strong>Law</strong>rence Frolik, Esq., and ShirleyWhitenack, Esq.8

continued from page 86. Member Discount PartnersThis committee was chaired by Brad Frigon, CELA.The committee is constantly researching products andvendors to partner with <strong>NAELA</strong> for member discountsand rebates to NEALA. New vendors include Avis CarRental and Growth Coach.7. Program ChairsThe meat and potatoes <strong>of</strong> <strong>NAELA</strong> are our programs. Theprogram chairs presented outstanding programs this year.Thanks to our chairs and their committees. The chairswere: Institute (Salt Lake)—Barbara Hughes, Esq.;Unprogram—Wendy Sheinberg, CELA; Symposium(Cleveland)—Ed Boyer, Esq.8. Publications CommitteeThe Publications chair was Wendy Sheinberg, CELAwith Bridget O’Brien Swartz, CELA as the Editor-in-Chief <strong>of</strong> the <strong>NAELA</strong> News and <strong>Law</strong>ernce Frolik, Esq. asthe Editor-in-Chief <strong>of</strong> the <strong>NAELA</strong> Journal. We have newlooks for the Journal and the News. Check out all <strong>of</strong> thecolor in the <strong>NAELA</strong> News.9. Public Policy CommitteeNo one works harder or puts in more time then thePublic Policy Committee chaired by Charles Sabatino,Esq. They have done endless work on the DRA with aspecial thanks to Vincent Russo, CELA for all <strong>of</strong> hiswork on the issue. Biran Lindberg keeps us continuallyupdated on what is happening in Washington D.C. Ontop <strong>of</strong> all <strong>of</strong> their other work, the committee has beenupdating the public policy guidelines.10. Synergy SummitSynergy Summit encourages networking by members<strong>of</strong> seven organizations. These organizations are ABA/RPPTS, ABA Tax Section, ACTEC, AICPA, <strong>NAELA</strong>,NAEPC, and SFSP. <strong>NAELA</strong>’s representative is BradFrigon, CELA. The next chair <strong>of</strong> the group is our ownFrank Johns, CELA.11. Long Range Planning Committee (Now called theStrategic Planning Committee)20<strong>07</strong> is the year to begin work on the new Strategic planwhich will run from January 2008 through December2010. This committee was chaired by StuartZimring, Esq. A draft was provided for the board inCleveland to get feed back from the board members.The final report is due at the board retreat thissummer for final consideration.The last group <strong>of</strong> members who have put in alot <strong>of</strong> work this year are the SIG chairs and theirsteering committees:1. Advocacy/Litigation SIG - Chair Shirley Whitenack,Esq., 105 members.2. Guardianship/Capacity SIG - Chair Edward Zetlin,Esq., 215 members.3. Health Care SIG - Chair Mary Berthelot, Esq.,136 members.4. Practice Development/Practice Management SIGChair Timothy Crawford, CELA., 364 members.5. Tax SIG - Chair Timothy Crawford, CELA andVice Chair Robert Anderson, CELA., 172 members.6. Trust and Special Needs Trust SIG - Chair RichardCourtney, CELA and Vice Chair Sharon KovacsGruer, CELA., 442 members.Thanks would never be complete without an extraspecial thank you to the <strong>NAELA</strong> staff and especially toSusan McMahan and Debbie Barnett. These are twogreat ladies. And Debbie, you know how much you willbe missed.What a tremendous amount <strong>of</strong> work has been donethis year. Thank you from me personally and thank youfrom <strong>NAELA</strong>. The quality <strong>of</strong> the volunteers is incredible.Think <strong>of</strong> the value <strong>of</strong> all the hours freely given. THANKYOU, THANK YOU, THANK YOU!<strong>NAELA</strong>’s new President Mark Shalloway is now busyappointing members to all <strong>of</strong> the above positions. It isa big job but so important in determining the quality<strong>of</strong> the 20<strong>07</strong>–2008 year. I am confident it will be a greatyear. Mark will be an outstanding president. He hasmany exciting ideas. As I said in Cleveland, I pass thegavel from Disneyland, located near my <strong>of</strong>fice in OrangeCounty, California, to Disney World, near Mark’s <strong>of</strong>ficein Florida. Here’s to <strong>NAELA</strong>—leading the way.9

Chapter PresidentsMaterialsAvailable On-lineMaterials for the individual sessions from the 20<strong>07</strong><strong>NAELA</strong> Symposium are available on the <strong>NAELA</strong>Web site in our on-line store at http://www.naela.org/applications/store or by calling Terri Anthony in the<strong>National</strong> <strong>of</strong>fice at (520) 881-4005.20<strong>07</strong> Case <strong>Law</strong> Update ............................................................. $20.00A Day in the Life <strong>of</strong> a Geri-Psych Unit ....................................... $20.00Care Planning Along the Long-Term Care Continuum .............. $20.00Challenge for the New Congress:Solving the Health and Long-Term Care Crises ........................ $20.00Envisioning Your Future: Goal Setting and Planningas a Means to Achieve Balance in Practice & Life .................... $20.00Estate Recoveries ..................................................................... $20.00Ethical Issues in Representing Seniors, Personswith Disabilities, and Their Families .......................................... $20.00Income Tax Issues Affecting the <strong>Elder</strong>ly .................................... $20.00Incorporating the New Medicare Into Your Practice,and How to Make Money Doing It ............................................. $20.00Marketing Your Special Needs Trust Practice ........................... $20.00Recognizing and Resolving Nursing Home Problems:Strategies for You and Your Clients ........................................... $20.00Sex, Wards, and Rock n’ Roll .................................................... $20.00Solving the Interstate JurisdictionProblems in Guardianships ....................................................... $20.00The DRA’s New Home and Community-based Care Benefi t:Boon to Consumers or Bust to Medicaid Coverage .................. $20.00The Effect <strong>of</strong> the Uniform Trust Code (UTC)on Special Needs Trusts (SNTs) ............................................... $20.00Trust Reformation ...................................................................... $20.00What’s Special About Medicare Special Needs Plans? ............. $20.00Whys and Wherefores <strong>of</strong> Medical Ethics Committees andParticipation: How it Can Affect Your Practice ........................... $20.00Arizona ChapterSuzanna Goldman, Esq.Phoenix, AZ(602) 254-5992California Chapter -NorthernRuth E. Ratzlaff, Esq.Fresno, CA(559) 226-1540California Chapter -SouthernPatrick Green, Esq.Pasadena, CA(626) 449-8433Colorado ChapterCatherine Anne Seal, CELAColorado Springs, CO(719) 448-<strong>07</strong>34Connecticut ChapterFranklin A. Drazen, CELAMilford, CT(203) 877-7511Florida ChapterMichael A. Pyle, Esq.Daytona Beach, FL(386) 615-90<strong>07</strong>Georgia ChapterDavid G. Carter, Esq.Atlanta, GA(404) 442-6644Illinois ChapterMarguerite Angelari, Esq.Chicago, IL(312) 915-6775Indiana ChapterClaire E. Lewis, Esq.Indianapolis, IN(317) 484-8115Kansas ChapterMolly M. Wood, Esq.<strong>Law</strong>rence, KS(785) 843-0811Maryland/DC ChapterMorris Klein, CELABethesda, MD(301) 652-4462Massachusetts ChapterMark W. Worthington,CELAWorcester, MA(508) 757-1140Missouri ChapterMary R. McCormick, CELALiberty, MO(816) 505-1999New Hampshire ChapterDavid R. Craig, CELANew Boston, NH(603) 487-3915New Jersey ChapterSharon Rivenson Mark,CELAJersey City, NJ(201) 239-0300New Mexico ChapterBarbara J. Buck, Esq.Albuquerque, NM(505) 842-5551New York ChapterBernard A. Krooks, CELANew York, NY(212) 490-2020Ohio ChapterRachel Kabb-Effron, CELABeachwood, OH(216) 831-5222North Carolina ChapterJ. Gregory Wallace, Esq.Raleigh, NC(919) 876-1400Wendy A. Craig, Esq.Black Mountain, NC(828) 669-<strong>07</strong>99South Carolina ChapterMitchell C. Payne, Esq.Rock Hill, SC(803) 329-8656Texas ChapterG. Gaye Thompson, Esq.Austin, TX(512) 335-6800Virginia ChapterJoseph T. Buxton III, CELAUrbanna, VA(804) 958-2244Washington ChapterErv A. DeSmet, Esq.Bellevue, WA(425) 990-451010

Inaugural <strong>NAELA</strong> <strong>Elder</strong> Leadership AwardThe inaugural <strong>NAELA</strong><strong>Elder</strong> Leadership Awardwas presented during theopening remarks at the 20<strong>07</strong>Symposium in Cleveland,Ohio. <strong>NAELA</strong> PresidentDonna R. Bashaw, CELA,presented the award tothe Reverend Dr. ElbertC. Cole, an 89-year oldMissouri minister whohas spent the past 20 yearsmotivating seniors to sharetheir talents and wisdom tomake their communities abetter place for everyoneDr. Cole founded theShepherd’s Centers <strong>of</strong>America in 1975. It isan interfaith, nonpr<strong>of</strong>itorganization that encourages“This has beena labor <strong>of</strong> loveand I’ve beenblessed to seeso many seniorsnow betteringthe lives <strong>of</strong> thecommunities theyserve throughthe Shepherd’sCenters <strong>of</strong>America.”elder involvement on a local basis. In the past two decades,the organization has grown from one center in KansasCity, Missouri, to about 75 centers in 21 states servingtens <strong>of</strong> thousands <strong>of</strong> older adults. The centers partner withall religious groups and are led by independent boards<strong>of</strong> trustees, each sharing the common mission to involveseniors in community improvement efforts.“I’m truly honored to receive the first-ever <strong>Elder</strong>Leadership Award,” said Dr. Cole. “This has been a labor<strong>of</strong> love and I’ve been blessed to see so many seniors nowbettering the lives <strong>of</strong> the communities they serve throughthe Shepherd’s Centers <strong>of</strong> America.”“Elbert Cole embodies the activist spirit we’re hopingto see increase within the nation’s elder community,” saidBashaw. “This award is designed to honor seniors who havegiven back to their communities. We intend that it willalso promote more volunteerism among the senior ranks.”In addition to watching Dr. Cole accept the award,Symposium attendees saw a pr<strong>of</strong>essionally-prepared videopresentation highlighting his life and work. As part <strong>of</strong> thehonor, a monetary donation was made to the Shepherd’sCenters, his chosen charity.The award was co-sponsored by GRAND Magazine,a publication catering to grandparents and retiringBaby Boomers.“It is a great pleasure to be involvedwith this award and to recognize the outstandingcontributions and accomplishments <strong>of</strong> Dr. Cole andthe other finalists,” said Jonathan Micocci, President <strong>of</strong>GRAND Magazine.The <strong>NAELA</strong> <strong>Elder</strong> Leadership Award was thebrainchild <strong>of</strong> President Bashaw, who had the vision <strong>of</strong>honoring seniors who are active and involved members<strong>of</strong> society. Dr. Cole was nominated by Karen H. Weber,Esq., a <strong>NAELA</strong> member from Kansas City, Missouri,where the Shepherd’s Center movement started.Victoria E. Heuler, Esq., chaired the committee thatscreened <strong>NAELA</strong> members’ nominations <strong>of</strong> active andinvolved seniors 65 or older. Heuler’s committee alsocoordinated various aspects <strong>of</strong> the presentation togetherwith <strong>NAELA</strong> staff.Keep an eye open for prospective nominees for the2008 award as you work with elders in your community.Other candidates for the <strong>Elder</strong> Leadership Award, cosponsoredby GRAND Magazine, were:Bess (Budd) Lander Bell, a 91-year-old Floridavolunteer advocate nominated by Twyla L. Sketchley,Esq., a Tallahassee-based <strong>NAELA</strong> Member.Saul Friedman, a long-time Newsday columnistnominated by Ronald A. Fatoullah, CELA, a New Yorkbased<strong>NAELA</strong> Member.Eugene Lehrmann, a former AARP national presidentfrom Wisconsin nominated by Barbara S. Hughes, Esq.,a Madison, Wisconsin-based <strong>NAELA</strong> Member.The four have been outspoken champions for theirrespective causes – whether it involve improving thelives <strong>of</strong> American senior citizens, people with disabilitiesor children – and have served as an inspiration to theircommunities. Each was nominated by a <strong>NAELA</strong> memberand had to be 65 or older.11

<strong>NAELA</strong> ROCKS!<strong>NAELA</strong> Rocks! 20<strong>07</strong> Symposium Wrap-upEdwin M. Boyer, Esq.The Cleveland 20<strong>07</strong> Symposium steering committee andI would like to thank all <strong>of</strong> the presenters and nearly 300attendees who helped “<strong>NAELA</strong> Rocks” in Cleveland, May3–6 20<strong>07</strong>. Many <strong>of</strong> the presentations will certainly becomepart <strong>of</strong> the “Best <strong>of</strong> <strong>NAELA</strong>” tapes. If you were unable toattend you can still order the session audio recordings in CD orMP3 format to add to your pr<strong>of</strong>essional library by visiting the<strong>NAELA</strong> store on-line at www.naela.org/applications/store/.We opened the Symposium with our first ever <strong>NAELA</strong> <strong>Elder</strong>Leadership Award Presentation sponsored by AARP, and GrandMagazine. This award, a long time dream <strong>of</strong> President DonnaBashaw, CELA, was designed to encourage and promoteactivism and involvement by elders for the betterment <strong>of</strong>lives <strong>of</strong> others. Our keynote speaker on Thursday was formerUnited States Senator (D-GA), and the youngest administratorever <strong>of</strong> the Veteran’s Administration, Joseph “Max” MaxwellCleland. In his speech titled “The Moral Test <strong>of</strong> Government,”Senator Cleland inspired us with the challenge to protect theinterests <strong>of</strong> the forgotten and most vulnerable <strong>of</strong> our citizens,our children, those with disabilities and the elderly.The Symposium also featured the ever-popular andinformative case law update by Robert Fleming, CELAand Pr<strong>of</strong>essor Rebecca Morgan. The rock music andflower arrangements were a new creative addition totheir presentation.Our keynote speaker for Saturday was Senator SherrodBrown (D-OH). Senator Brown shared with us his insightson the new Congress, and his vision for the future, withparticularly focus on issues <strong>of</strong> great import to <strong>NAELA</strong>.Saturday’s general session was filled to capacity for anexcellent presentation by Bill Browning, CELA and FrankJohns, CELA on cases and strategies in estate recoveryissues. A highlight <strong>of</strong> the afternoon breakout sessions was thepresentation by Pr<strong>of</strong>essor Rebecca Morgan and Mary AliceJackson, Esq. on “Sex, Wards, and Rock n’ Roll.”At Sunday’s closing session, a stellar panel <strong>of</strong> medicalpr<strong>of</strong>essionals and attorneys gave a marvelous and well-preparedpresentation on the workings <strong>of</strong> hospital medical ethicscommittees and the importance <strong>of</strong> attorney involvement.At our business meeting, we welcomed this year’s newFellows, Fay Blix, CELA, Pr<strong>of</strong>essor <strong>Law</strong>rence Frolik andShirley Whitenack, Esq. Donna Bashaw’s President’s awardwent to Stu Zimring, Esq. for his continuing contributionsto <strong>NAELA</strong>. The 20<strong>07</strong> John J. Regan writing award waspresented to Kathryn L. Tucker, Esq, for her <strong>NAELA</strong> Journalarticle “Oregon’s Landmark Death with Dignity <strong>Law</strong>.” At alater session, the “Theresa Award” was presented to Emily S.Starr, CELA, for her endless dedication to people with specialneeds. We congratulate all new Fellows and award recipientsfor their achievements.Thursday evening, over 90 members enjoyed dinner anddancing on the Goodtime III dinner cruise, a fund raisingevent sponsored by the <strong>NAELA</strong> SR-PAC. The luxury shiptoured the lakefront and explored the winding the CuyahogaRiver. Sunset over the Cleveland skyline was beautiful.Friday evening was our farewell appreciation dinner for<strong>NAELA</strong>’s Managing Director, since 1992, Debbie Barnett.A hilarious but <strong>of</strong>ten poignant program was coordinated by<strong>NAELA</strong> Past Presidents and Staff. Debbie has always been anintegral part <strong>of</strong> the <strong>NAELA</strong> family, and we wished her well onher retirement.A special thanks goes to the dedicated group whovolunteered for the traditional <strong>NAELA</strong> community serviceproject. We repackaged a full pallet <strong>of</strong> breakfast cereal at theCleveland Food Bank, and presented them with a check forover $1,000 representing contributions from our members.The Cleveland Food Bank has distributed over 19 millionpounds <strong>of</strong> food for over 450 member programs, and itsupplies a majority <strong>of</strong> the food used in local soup kitchens,shelters, and food pantries in northeast Ohio. The Food Banksaves an estimated $800,000 a year by using volunteers to dovarious jobs at the Food Bank.The steering committee responsible for the Symposiumdeserves a huge thank you. The very talented committeeincluded Linda Anderson, CELA, Betsy Angevine, Esq.,Bob Brogan, CELA, Bill Browning, CELA, Frank Dana,CELA, Greg French, CELA, Rachel Kabb-Effron, CELA,Pr<strong>of</strong>essor Rebecca Morgan, Dennis Sandoval, CELA, andKristi Vetri, Esq. Thanks also to our track committee chairs,Pr<strong>of</strong>essor Rebecca Morgan and Bill Browning, CELA(Advocacy Litigation Track), Bob Brogan, CELA and KristiVetri, Esq. (Practice Management/Practice Development),and Rachel Kabb Effron, CELA (Special Needs DisabilitiesTrack). Brian Lindberg was instrumental in maintainingour focus on hot topics, and Greg French, CELA helped usinclude ethical issues in our presentations. Thanks also to ourSIG Chairs, Shirley Whitenack, Esq. (Advocacy/ Litigation),Ed Zetlin, Esq. (Guardianship/Capacity), Tim Crawford,CELA (Practice Development/Practice Management andTax), Mary T. Berthelot, Esq. (Health Care), and RichardCourtney, CELA (Trust and Special Needs Trust).12

Ed Boyer working hard at the Cleveland Food Bank.Getting ready to ride the Goodtime IIIEnjoying the company on the Goodtime III.Robert FlemingRebeccaMorgan andSenator MaxCleland13

<strong>NAELA</strong> ROCKS!Special THANKS to the Sponsors andExhibitors <strong>of</strong> the 20<strong>07</strong> <strong>NAELA</strong> Symposium!Without their support andparticipation, <strong>NAELA</strong> would not beable to provide many <strong>of</strong> the events andbenefits throughout each conference!If you didn’t attend the Symposiumand would like to learn more about theservices and products each organizationhas to other, please reach out to thecompany contact listed as follows.Special Thanks to Our SponsorsGOLD Sponsor–Thursday and Saturday C<strong>of</strong>fee BreaksMerrill LynchContact: Christopher Sullivan1700 Merrill Lynch Drive (B1-73)Pennington, NJ O8534Phone: (609) 274-1542Fax: (609) 274-0032Email: chris_sullivan@ml.comWeb site: www.totalmerrill.com/specialneedsGOLD Sponsor–Saturday LuncheonWealthCounsel, LLCContact: Anita Trudeau6115 SW Virginia Ave.Portland, OR 97239Phone: (888) 659-4069Fax: (888) 292-6126Email: Anita.trudeau@wealthcounsel.comWeb site: www.wealthcounsel.comSpecial Thanks to Our20<strong>07</strong> <strong>NAELA</strong> Symposium Exhibitors!<strong>Academy</strong> Of Special Needs PlannersContact: Mark Miller11 S. Angell St., Ste. 341Providence, RI O2906Phone: (866) 2670947Fax: (401) 351-2642Email: mark@elderlawanswers.comWeb site: www.specialneedsplanners.comAsset Preservation StrategiesContact: Cheryl FletcherP.O. Box 5877DePere, WI 54115Phone: (888) 605-4222Fax: (877) 523-<strong>07</strong>83Email: christina@assetpreservationstrategies.comWeb site: www.assetpreservationstrategies.comCarolina Academic PressContact: Kenny Hegland700 Kent St.Durham, NC 27701Phone: (919) 493-7486Fax: (919) 493-5688Email: jgilchrist@cap-press.comWeb site: www.cap-press.com<strong>Elder</strong><strong>Law</strong> AnswersContact: Mark Miller11 S. Angell St., Ste. 341Providence, RI 2906Phone: (866) 267-0947Fax: (401) 351-2642Email: mark@elderlawanswers.comWeb site: www.elderlawanswers.comEuropean Expert Care AgencyContact: Yolanta Khalil110 Norman Ave.Brooklyn, NY 11222Phone: (718) 349-0099Fax: (718) 389-0172Email: mail@eecare.comWeb site: www.eecare.comInteractive Legal SystemsContact: Nicole Splitter100 Highland Park Village,Ste. 200, Dallas, TX 75205Phone: (888) 315-0872Fax: (866) 249-6649Email: nsm@ilsdocs.comWeb site: www.ilsdocs.comInterim HealthCareContact: Meredith Millman1601 Sawgrass Corp. Pkwy.Sunrise, FL 33323Phone: (954) 858-2882Fax: (954) 858-2870Email: mmillman@interim healthcare.comWeb site: www.interimhealthcare.comInternational Genealogical SearchContact: Jennifer Meyer2985 Virtual Way, 4th FlrVancourver, BC V5M 4X7Phone: (604) 654-6766Fax: (604) 654-6706Email: Jennifer.meyer@heirsearch.comWeb site: www.heirsearch.comJ.G. WentworthContact: John Zepeda40 Morris Ave., 3rd FlrBryn Mawr, PA 19010Phone: (866) 410-8898Fax: (800) 543-1269Email: johnz@jgwentworth.comWeb site: www.jgwentworth.comKrause Financial ServicesContact: Dale Krause1120 Red Wing TrailDe Pere, WI 45115Phone: (920) 330-0190Fax: (920) 330-0191Email: dalekrause@new.rr.comWeb site: www.Medicaidannuity.comLegal ResourcesContact: Meg Rudansky36 Woodvale St.Sag Harbor, NY 11963Phone: (631) 725-4778Fax: (631) 725-8685Email: mrudansky@legalresourcesllc.comWeb site: www.legalresourcesllc.comLexisNexisContact: Karen Lynam555 Middle Creek Pkwy.Colorado Springs, CO 80921Phone: (719) 481-7426Fax: (719) 488-5028Email: Karen.lynam@lexisnexis.comWeb site: www.lexisnexis.comMedicaid Planning SystemsContact: Colleen Caruso509 S Lenola Rd., Bldg. 7Lenola, NJ 8057Phone: (781) 396-3235Fax: (781) 396-3647Email: tlinc02155@aol.comWeb site: www.medicaidplanningsystems.comMedicaid Practice SystemsContact: Phillip Miner555 French Rd.New Hartford, NY 13413Phone: (315) 866-7461Fax: (315) 732-6857Email: pminer@medicaidpractice.comWeb site: www.medicaidpractice.comMelville CapitalContact: Douglas Himmel1636 Abbot Kinney Blvd.Venice, CA 90291Phone: (310) 581-6141Fax: (631) 390-2422Email: dhimmel@melvillecapital.comWeb site: www.melvillecapital.comMerrill LynchContact: Christopher Sullivan1700 Merrill Lynch Drive (B1-73)Pennington, NJ O8534Phone: (609) 274-1542Fax: (609) 274-0032Email: chris_sullivan@ml.comWeb site: www.totalmerrill.com/specialneeds14

continued from page 14<strong>National</strong> Guardianship AssociationContact: Patricia Heuser526 Brittany Dr.State College, PA 16803-1420Phone: (877) 326-5992Fax: (814) 238-7051Email: info@guardianship.orgWeb site: www.Guardianship.orgPremier S<strong>of</strong>twareContact: Tom Caffrey1230 Brace Rd.Cherry Hill, NJ 8034Phone: (856) 429-3010Fax: (856) 429-3559Email: tcaffrey@premiers<strong>of</strong>tware.comWeb site: www.premiers<strong>of</strong>tware.com<strong>Law</strong> Office <strong>of</strong> John M. PrestonContact: Nick Preston12396 World Trade Dr., Ste. 212San Diego, CA 92128Phone: (800) 698-6918Fax: (858) 675-4045Email: jmplaw@msn.comWeb site: www.prestonestateplanning.comRight at HomeContact: Pat Stemmermann11949 Q St., Ste.100Omaha, NE 68137Phone: (402) 697-7537Fax: 402) 697-7536Email: pats@rightathome.netWeb site: www.rightathome.comSeniorBridgeContact: Beth Jackson845 Third Ave.New York, NY 100222Phone: (212) 994-6167Fax: (212) 994-4260Email: bjackson@seniorbridge.netWeb site: www.seniorbridge.netSmart MarketingContact: Michelle Buckley3033 Riviera Dr., Ste. 103Naples, FL 34103Phone: (239) 403-7755Fax: (239) 403-7556Email: mark@smartmarketingnow.comWeb site: www.smartmarketingnow.comStetson University College <strong>of</strong> <strong>Law</strong>Contact: Cathy Fitch1401 61St St., SouthGulfport, FL 337<strong>07</strong>Phone: (727) 526-7815Fax: (727) 347-5692Email: fitch@law.stetson.eduWeb site: www.law.stetson.eduThe Center For Special Needs TrustAdministration, Inc.Contact: Marilyn Davis4912 Creekside Dr.Clearwater, FL 33760Phone: (877) 766-5331Fax: (727) 894-4036Email: marilyn@bostonassetmanagement.comWeb site: www.sntcenter.orgWealthCounsel, LLCContact: Anita Trudeau6115 SW Virginia Ave.Portland, OR 97239Phone: (888) 659-4069Fax: (888) 292-6126Email: Anita.trudeau@wealthcounsel.comWeb site: www.wealthcounsel.comWolters Kluwer <strong>Law</strong> & BusinessContact: Lisa Olsen2700 Lake Cook Rd.Riverwoods, IL 60015Phone: (847) 267-2190Fax: (847) 267-2873Email: Lisa.olsen@wolterskluwer.comWeb site: www.wolterskluwer.comSponsor-Krause Financial ServicesGold Sponsor- WealthCounselVeterans Information Services, Inc.Contact: Jay Mclntyre643 Springharbor Dr.Woodstock, GA 30188Phone: (866) 869-2777Fax: (866) 512-9013Email: aspsjay@yahoo.comVSA, Inc.Contact: Valerie Schlitt441 Station Ave.Haddonfield, NJ O8033Phone: (856) 429-5<strong>07</strong>8Fax: (856) 428-3678Email: valerie.schlitt@vsaprospecting.comWeb site: www.vsaprospecting.comGold Sponsor-Merril Lynch15

<strong>NAELA</strong> ROCKS!<strong>NAELA</strong> Fellow’s Acceptance SpeechFay Blix, CELAVincent Russo, Steve Silverberg and Rolf NelsonThank you.To be honored by one’s peers is especially meaningful.But one does not arrive here alone.There have been many along my personal pathway who havemade a difference.<strong>NAELA</strong> Staff, <strong>NAELA</strong> leaders, <strong>NAELA</strong> members...particularly your president, Donna Bashaw, with whom I haveshared the <strong>Elder</strong> <strong>Law</strong> Center in Laguna Hills for almost 15 years.A little less than two years ago, I lost my only sister at theage <strong>of</strong> 59.Three years previous to that, I lost my only brother at theage <strong>of</strong> 57.I dedicate this award especially to them this afternoon, fortwo reasons:One, their absence is painful as Ireceive this honor, butTwo, their deaths have given mea gift—their deaths have taught meto live my life mindful <strong>of</strong> itstemporariness.Mortality changespriorities.Every momentbecomes precious.I want toknow mylife hasmattered.I want to leave behind something <strong>of</strong> value... something<strong>of</strong> beauty...The practice <strong>of</strong> elder law is such a gift...Caring for people when they are most vulnerable can beone <strong>of</strong> the most gratifying experiences possible.It takes a lot out...It puts a lot in.I love to look at my clients’ hands.The wrinkles.The large veins.The liver spots.The gnarled knuckles.There is history in those hands.Senator Sherrod Brown with Rajiv NagaichHard work.Courage in callouses.Those hands represent a lifetime <strong>of</strong> commitment—Diapers changed...Meals prepared...Children disciplined...Households sustained...Needy neighbors helped...Communities comforted...Country and nation secured...And I love to watch those hands as they sign thedocuments I have prepared.I love to watch their signatures <strong>of</strong> purpose, willing thosestiff fingers and swollen joints to the finish line...I watch my client whose perfect Palmer penmanship hasbeen pummeled by Parkinsons rise to the challenge...16 16Debbie Barnett and family

Donna Bashaw and Betsy AngivineI watch my client with macular degeneration devisecarefully crafted creative ways to ensure the signature lands onthe line despite the holes in his vision...I watch my client freshly diagnosed with Alzheimer’sDisease sign with the courage <strong>of</strong> his convictions, doggedlydetermined to protect and prepare for his family before braindarkness falls...I love those hands...I want to hold those hands...I want to receive from those hands what they have to give...I don’t want those hands to be hurt...to be bruised and battered by abuse...to be stripped <strong>of</strong> dignity...to be rendered useless...to be completely impoverished by costs <strong>of</strong> care...And then I look at my hands...I want my hands to construct...to contribute...to comfort...to care...Inaction is a luxury this nation cannot afford.Harry Moody <strong>of</strong> AARP describes these timesas “a moment <strong>of</strong> call.” 1And so, I look at my hands...And I look at your hands...Together, we have an extraordinary pool <strong>of</strong> social andhuman capital.To those who have given us a lifetime <strong>of</strong> commitment,we can return something <strong>of</strong> value...<strong>of</strong> beauty...Let us not be discouraged by the setbacks such as DRA or theslowness <strong>of</strong> the implementation <strong>of</strong> the <strong>Elder</strong> Justice Act.Thomas Merton once said to an advocate despondent andweary while engaging in protest <strong>of</strong> the Vietnam war,“Do not depend on the hope <strong>of</strong> results...Concentrate on the value... the truth <strong>of</strong> the work itself.” 2And what a value... what a truth this work <strong>of</strong> elder law is—Senator Sherrod Brownwith Rachel Efron KabbBut together we can do more...In the words <strong>of</strong> Marge Piercy—“It goes on one at a timeIt starts when you careto act, it starts when you doit again after they said noit starts when you say WeAnd know who you mean and eachday you mean one more.” 3We canWe will make a difference!Thank you again for giving me this honor.1 Harry R. Moody, et al., The Five Stages <strong>of</strong> the Soul, Anchor Books, 1998.2 William H. Shannon, editor, “Letter to Jim Forest, dated February 21, 1966,”The Hidden Ground <strong>of</strong> Love: Letters by Thomas Merton, Farrar, Straus,Giroux, 1990.3 Marge Piercy, The Moon Is Always Female, Alfred A. Knopf, Inc., 1980.Craig Gordonand Fay Blix17

20<strong>07</strong> <strong>National</strong> <strong>Academy</strong> <strong>of</strong> <strong>Elder</strong> <strong>Law</strong> Attorneys Symposium <strong>NAELA</strong> Rocks!Renaissance Hotel / Cleveland, Ohio / May 3-6, 20<strong>07</strong>EducationalAudio RecordingsSPECIAL PRE-CONFERENCE SESSION: 1/1-6. Special Pre-Session: Fundamentals <strong>of</strong> <strong>Elder</strong> <strong>Law</strong> sold as a set only$48.00 plus $9.75 postage, not sold in series.........X 6EDUCATIONAL AUDIO RECORDINGS: 2. The Moral Test <strong>of</strong> Government Joseph Maxwell Cleland 3. Challenge for the New Congress: Solving the Health andLong-Term Care Crises Judith Feder 4. Trust Reformation Richard Davis; Patricia E. Dudek &Shirley B. Whitenack 5. Incorporating the New Medicare Into Your Practice, andhow to Make Money Doing It Norman Harrison;Doris E. Hawks; Sanford J. Mall; Debra K. Schuster;Timothy L. Takacs & Morris Klein 6. The DRA’s New Home and Community Based CareBenefit: Boom to Consumers or Bust? Gene C<strong>of</strong>fey 7. The Challenges Facing Long-Term Care Reform: AARP and<strong>NAELA</strong> Perspective Mary Alice Jackson; Robert A. Jackson;Brian W. Lindberg; Sarah Lenz Lock & Kathryn Tefft-Keller 8. Envisioning Your Future: An Interactive Introduction toGoal Setting and Planning Robert F. Brogan; Kevin Shulman 9. Solving the Interstate Jurisdiction Problems inGuardianships David M. English, Terry W. Hammond &Sally Balch Hurme 10. Care Planning Along the Long-Term Care ContinuumDavid L. McGuffey; Thomas A. Minetree; Rajiv Nagaich &Antoinnette Williams 11. The Effect <strong>of</strong> the Uniform Trust Code (UTC) on SpecialNeeds Trusts(SNTs): A Panel From Both SidesI. Mark Cohen; Randy E. Drewett & Douglas W. Stein 12. 20<strong>07</strong> Case <strong>Law</strong> Update Robert B. Fleming &Rebecca C. Morgan 13. Estate Recoveries A. Frank Johns & William J. Browning 14. Recognizing and Resolving Nursing Home Problems:Strategies for You and Your Clients Edwin M. Boyer &Eric M. Carlson 15. Ethical Issues in Representing Seniors, Persons WithDisabilities, and Their Families Stuart D. Zimring 16. What’s Special About Medicare Special Needs Plans?Vicki Gottlich; Alissa Eden Halperin & Patricia B. Nemore 17. Sex, Wards, and Rock ‘n Roll Mary Alice Jackson &Rebecca C. Morgan 18. Income Tax Issues Affecting the <strong>Elder</strong>ly Ben A. Neiburger 19. Marketing Your Special Needs Trust PracticeRobert W. Fechtman; Ruthann P. Lacey & Janet L. Lowder 20. Whys and Wherefores <strong>of</strong> Medical Ethics CommitteeParticipation: How It Can Affect Your Practice &Community Fay Blix; Phebe Saunders Haugen;Edward W. Long & D. Jamieson Long, Jr.(Sessions Numbered in Bold are More Than 1 CD)CDs ARE $10 EACH—SPECIAL—FOR EVERY 10 CDs PURCHASED, YOU’LL RECEIVE 1 COMPLIMENTARYTHE 20<strong>07</strong> <strong>NAELA</strong> SYMPOSIUM (19 CDs—WITH ALBUM—ONLY $171.00 *Session #1 not included in seriesTHE COMPLETE <strong>NAELA</strong> SERIES ON 2-MP3 AUDIO DISKS, INCLUDES SPECIAL PRE-SESSION #1—ONLY $159.00 plus $5.75 postage American Express Master Charge VISA DiscoverBank Credit Card _______________________________________Exp. Date____________Signature _________________________________________________________________Name ____________________________________________________________________Firm _____________________________________________________________________Sub TotalPOSTAGE:1st CD - Include $4.75Each Additional CD $1.00Maximum 13 CDs - $16.75Shipped byPRIORITY MAILAmount DueU.S. FUNDS___________________________________________________Address ___________________________________________________________________City/State/Zip _____________________________________________________________Area Code/Telephone No. ____________________________________________________PAYMENT MUST ACCOMPANY ORDERMAKE CHECKS PAYBLE TO: ADC Services69013 River Bend Drive, Covington, LA 70433ADCTape@AOL.COMTO FAX ORDER: 985-892-997518

John J. Regan Writing Award RecipientThe 20<strong>07</strong> John J. Regan Writing Award is presentedto Kathryn L. Tucker, Esq. for her article “Oregon’sLandmark Death with Dignity <strong>Law</strong>,” which waspublished in the <strong>NAELA</strong> Journal, volume II, number II.Kathryn L. Tucker, a graduate <strong>of</strong> GeorgetownUniversity <strong>Law</strong> School, is Director <strong>of</strong> Legal Affairs forCompassion & Choices, a national nonpr<strong>of</strong>it publicinterest organization dedicated to improving end-<strong>of</strong>lifecare and expanding and protecting the rights <strong>of</strong> theterminally ill. Ms. Tucker practiced law with the Seattlebasedlaw firm, Perkins Coie, LLP, prior to movingto C & C. She is an Adjunct Pr<strong>of</strong>essor <strong>of</strong> <strong>Law</strong> at theUniversity <strong>of</strong> Washington School <strong>of</strong> <strong>Law</strong> and SeattleUniversity School <strong>of</strong> <strong>Law</strong>, teaching in the areas <strong>of</strong> healthlaw and policy. Ms. Tucker served as co-counsel to thepatient plaintiffs/respondents in Gonzales v. Oregon.The <strong>NAELA</strong> Regan Writing Award is presented on anannual basis to the best original article published in the<strong>NAELA</strong> Journal during that year. The award is namedafter, and was established, in memory <strong>of</strong> John J. Regan, along-time <strong>NAELA</strong> member, Fellow and pioneer in <strong>Elder</strong><strong>Law</strong>. Articles considered for the award must be original,in-depth articles exploring a single topic which has animpact on the field <strong>of</strong> <strong>Elder</strong> <strong>Law</strong>.20<strong>07</strong> Theresa Award in CommunityService RecipientCongratulations to Emily S. Starr, CELA — who washonored for her endless dedication to people with specialneeds by being presented with the 20<strong>07</strong> Theresa Awardin Community Service. The award was established inmemory <strong>of</strong> Theresa Alessandra Russo, the daughter <strong>of</strong><strong>NAELA</strong> Past President Vincent and Sussan Russo, andis funded through a grant from the Theresa AlessandraRusso Foundation. Emily was recognized at theSymposium on Friday, May 4th before the general sessionbegan and honored at the Theresa Foundation’s Annualdinner in New York on Friday, May 18, 20<strong>07</strong>. Formore information about the Theresa Alessandra RussoFoundation and recipients <strong>of</strong> this award, contact (516)432-0200 or online at www.theresafoundation.org.The Peabody Hotel149 Union AveMemphis, TN 38103(901) 529-4000 Phonewww.peabodymemphis.comRates: $175.00 Single/DoubleFor reservations, call 1-800-PEABODY (Press 2) andreference <strong>NAELA</strong> no laterthan September 14, 20<strong>07</strong>and be sure to mention thatyou are with <strong>NAELA</strong> to receivethis special conferencerate. Navigant Internationalis available to assist you withyour travel needs (800) 229-8731. Please note: As with alltravel agencies, a service feewill apply.A full conference brochure willbe available by August, 20<strong>07</strong>.Early Bird Registration availableuntil September 14, 20<strong>07</strong>! Formore information, contact the<strong>NAELA</strong> Office at (520) 881-4005or visit the <strong>NAELA</strong> website atwww.naela.org.Mark yourCalendars!November 1–420<strong>07</strong>19

Dead Man RevisitedAdead man’s statute, or dead man’s rule, is drastic. Thereis no typical or uniform dead man’s statute. FelixFrankfurter gave the best advice: “Read the statute.”A dead man statute is a law derived from English commonlaw that prohibits an interested party witness from testifyingabout communications or transactions with a decedent unlessthere is an exception.For generations, these rules have perplexed lawyers as wellas judges. Benham criticized the rule as being “blind andbrainless.” Because <strong>of</strong> the harshness <strong>of</strong> these rules, courtshave diluted them or given them strict scrutiny.One method <strong>of</strong> dilution is requiring an opponent <strong>of</strong>the rule to provide corroboration by evidence. The overallworkability <strong>of</strong> the corroboration requirement is suspect.Wigmore feels that the requirement is misguided.A second way <strong>of</strong> diluting the rule is to permit testimonyto prevent injustice. A third method is to permit theintroduction <strong>of</strong> hearsay or other writings <strong>of</strong> the decedent.What is the foundation for exclusion <strong>of</strong> evidence ortestimony? You must read your statute. There are no typicalstatutes.The federal law does not have a counterpart. Diversity caseshave the only application <strong>of</strong> a state’s dead man’s statute infederal court.Keep in mind that there are different formal objectionsto the statute. For example, in Wisconsin, the appropriateobjection is not to state the inadmissibility <strong>of</strong> evidence, butto state specifically that the objection is to the “competency”<strong>of</strong> the witness.What is the formula to introduce evidence incontravention <strong>of</strong> the dead man’s rule?Often, it is to assert that the other party opened a door forevidence. A second way to introduce evidence is to find anexception to your state rule.A third way <strong>of</strong> introducing evidence is to assert waiver <strong>of</strong>the rule by a cross-examination <strong>of</strong> one <strong>of</strong> your witnesses byyour opponent. A fourth way to introduce testimony is touse a third party, who was familiar with the transaction butwho has no self-interest in the transaction. Another way tointroduce evidence is to present letters or other documentaryevidence from the decedent.An additional tactic to introduce evidence is to find aninterested witness to testify on behalf <strong>of</strong> the side <strong>of</strong> thedecedent. Such availability is then going to permit theintroduction <strong>of</strong> your testimony.John Barry Stutt, Esq., MBAIt is estimated that there are fewer than a dozen statesthat have these statutes. Consider reading the Report to theBoyd-Graves Conference, located at http://www.vba.org/section/civil/civil/bgevid.pdf, for an excellent discussion <strong>of</strong> theweaknesses <strong>of</strong> a dead man’s statute.Roy R. Ray, Pr<strong>of</strong>essor <strong>of</strong> <strong>Law</strong>, Southern MethodistUniversity, is to be saluted for his critical dissection <strong>of</strong> the deadman’s statute in his article in the 1963 Ohio State <strong>Law</strong> Journal:“(1) The statutes are based upon a fallacious philosophy, i.e.,that the number <strong>of</strong> dishonest men is greater than the number<strong>of</strong> honest ones; and that self-interest makes it probable thatmen will commit perjury.“(2) The statutes create an intolerable injustice by preventingpro<strong>of</strong> <strong>of</strong> honest claims and defenses. In seeking to avoid thepossibility <strong>of</strong> injustice to one side, they work a certain injusticeto the other. It is difficult to understand why all the concern isfor the possibility <strong>of</strong> unfounded claims against the estate. Whyis there no concern for a loss by the survivor who finds himselfunable to prove as valid claim against decedents estate? Surely alitigant should not be deprived <strong>of</strong> his claim merely because hisadversary dies. It cannot be more important to save dead men’sestates from false claims, than it is to save living man’s statesfrom the loss by lack <strong>of</strong> pro<strong>of</strong>.”“(4) The statutes fail to accomplish their purported purposesince they suppress only a small part <strong>of</strong> the opportunities forperjured testimony. They blocked the testimony <strong>of</strong> a witnessonly as a certain subjects, leaving him free to testify falsely asto other matters if he sees fit to do so. Furthermore, a witnesswho will not stick at perjury will not hesitate to suborn perjuryby getting a third person to testify as to those matters as towhich his own testimony is barred.“(5) The statutes impede the search for truth. The realhazard in shaping any exclusionary rule is that the jury cannotbe expected to make sensible findings when it is deprived <strong>of</strong>substantial parts <strong>of</strong> available evidence bearing on the issue indispute. The great danger lies in the suppression <strong>of</strong> truth.“(6) The statutes underestimate the efficacy <strong>of</strong> crossexaminationin exposing falsehood and the abilities <strong>of</strong> thejudge and the jury to separate the false from the true. Thesesafeguards have proved adequate in other situations involvingthe testimony <strong>of</strong> parties and interested persons. Why not here?“(7) The statutes burden the parties with uncertainties andappeals. For hundreds <strong>of</strong> years or more, our courts have beenstruggling with the interpretation <strong>of</strong> the statutes. The result isa labyrinth <strong>of</strong> decisions, which have <strong>of</strong>ten brought confusion20

continued from page 18Executive Director’s MessageSusan McMahon, Esq.rather than clarity. The statutescontinue to mystify able judges andlawyers in endless complexities <strong>of</strong>interpretation and application. ”The reader is advised that whenthe next judge revisits the deadman’s statute, it will be with ajaundiced eye.Attorney John Barry Stutt, Esq.has been certified in Civil TrialAdvocacy by the <strong>National</strong> Board<strong>of</strong> Trial Advocacy, which has beenapproved as the Sole CertifyingOrganization for Civil Trial <strong>Law</strong>yersby the American Bar AssociationEndnotes1. Henry J. Friendly, Benchmarks 202 (1967).2. Charles Tilford McCormick, McCormickon Evidence § 65 (6th ed. West Pub. Co.2003).3. Va. Code § 8.01-396 (2006).4. See generally Report to the Boyd-GravesConference, http://www.vba.org/section/civil/civil/bgevid.pdf (fall 2005).5. 7 John H. Wigmore, Wigmore on Evidence§ 2065 (4th ed. Aspen Pub. 2006).6. See United States v. Diehl, 460 F. Supp.1282 (S.D. Texas 1978), affd., 586 F. 2d1080 (5th Ct. 1978.); Troutman v. ValleyNations Bank, 826 P. 2nd, 810 (Ariz. Ct.App. 1992).7. In Matter <strong>of</strong> Estate <strong>of</strong> Reist, 91 Wis. 2d209, 222-24 (1979).8. Botka v. Estate <strong>of</strong> Hoerr, 105 Wash. App.974, 21 P. 3d 723 (Wash. Ct. App. 2001).9. Estate <strong>of</strong> Molay, 46 Wis. 2d 450, 460, 462(1970).10. Estate <strong>of</strong> Nale, 61 Wis. 2d 654, 659-60(1974).11. Daniels, Executor v. Foster, 26 Wis. 2d 686,691-92 (1870); Epes’ Adm’r v. Hardaway,135 Va. 80, 90, 115 S.E. 712 (1923);Corporate Dissolution <strong>of</strong> Ocean ShoresPark, Inc. v. Rawson-Sweet, 134 P. 3d 1188,132 Wash. App. 903 (Wash. Ct. App. 2006).12. Johnson v. Raviotta, 264 Va. 27, 563 S.E.2d 727 (2002); Paul v. Gomez, 118 F. Supp.2d, 694, 696 (W.D. Va. 2000).13. Report to the Boyd-Graves Conference,supra n. 4.24 Ohio St. L.J. 89, 108 (1963).Ahis has been an exciting and productive year for <strong>NAELA</strong>. Iwould like to tell you about some <strong>of</strong> the things which haveoccurred that you may not be aware <strong>of</strong>.The Good and Welfare Committee has established the<strong>NAELA</strong> Neighborhood, a listserve for members to share nonlegalinformation, job postings and personal concerns (http://lists.naela.com/neighbor/). The committee has also initiateda “Spotlight on a <strong>NAELA</strong> member” as a regular feature <strong>of</strong> theNews. Please let staff know <strong>of</strong> anyone who you believe shouldbe a spotlight.After taking a short breather, the Pr<strong>of</strong>essionalism and Ethics Committee is nowdeveloping tools to assist members in incorporating the Aspirational Standards intotheir practices.The Telephonic Program Committee, chaired by Fay Blix, has done a wonderfuljob <strong>of</strong> expanding the training opportunities for our members. Please tell them abouttopics or speakers you would like for them to consider. Our first ethics Webinar hastaken place and we hope to expand into this medium.Our Special Needs and <strong>Elder</strong> <strong>Law</strong> Brochures are all being redesigned and updated.Three are available now for purchase. The CMS Task Force and the Trust and SpecialNeeds Trust SIG have drafted additional brochures to expand the series.The Council <strong>of</strong> Advanced Practitioners has become a valuable resource for ouradvanced members. These long term <strong>NAELA</strong> members regularly give their timeand talents to <strong>NAELA</strong> as was evidenced by the large number who were involved inmaking the Cleveland Symposium a success (including Ed Boyer, the SymposiumChair).The <strong>National</strong> Conference on Uniform State <strong>Law</strong>s (NCUSL) has designated <strong>NAELA</strong>as Advisors. As a result NCUSL will be contacting <strong>NAELA</strong> when they address issuesthat fall within the expertise <strong>of</strong> <strong>NAELA</strong> members to request participation in theirdrafting committees.Certainly you all noticed that we utilized Votenet for the first time this year toelectronically administer the <strong>NAELA</strong> elections. This step resulted in a significantsavings both in direct expenses and staff time. Hopefully in the years to come youwill all take advantage <strong>of</strong> this expedient means <strong>of</strong> voting.The Long Range Planning Committee has begun the development <strong>of</strong> what willnow be referred to as the <strong>NAELA</strong> Strategic Plan covering January 2008 to December2010. The plan includes several new initiatives including increased support for<strong>NAELA</strong> Chapters and integration <strong>of</strong> Special Needs <strong>Law</strong> into the activities <strong>of</strong> the<strong>Academy</strong>. You will receive more details as the Strategic Plan is finalized.<strong>NAELA</strong> has many wonderful volunteers who are working hard to support thedevelopment <strong>of</strong> <strong>NAELA</strong>. If you are interested in volunteering please contact<strong>NAELA</strong>’s new account manager, Rob LaMaster (rlamaster@naela.com), and tell himwhat committee you would like to work with. We will forward your name to the newcommittee chair to get you more involved with your organization.21

These Are Really Nice PeoplePr<strong>of</strong>essor Rebecca Morganare really nice people.” One <strong>of</strong> my colleagueshad come with me to a <strong>NAELA</strong> program to copresentat a breakout session. This was a few“Theseprograms back and the location and session escape menow. Those details are not really importantto this story anyway. I do not even rememberexactly where we were—at a reception, inthe hallway between sessions, or walking toour rooms—when my colleague made thecomment. I do remember the comment...and the surprise in her voice... that these<strong>NAELA</strong> members were really nice people.Her comment surprised me. Of coursethese are really nice people. <strong>Elder</strong> <strong>Law</strong>Attorneys, and <strong>NAELA</strong> members inparticular, are really nice people. They havealways been nice people, and perhaps that iswhy they are drawn to <strong>Elder</strong> <strong>Law</strong>.I have never known <strong>NAELA</strong> membersto be anything but nice, so I was reallysurprised by her observation. I do not takethe niceness for granted; instead I take it asa given.I know that there are lawyers who mightnot be described as nice people and in somepractice areas, attorneys may be not ascollegial or as willing to help their peers. Perhaps we in<strong>NAELA</strong> have gotten accustomed to being around thesenice people so that we forget that we are nice people, andthat those new to <strong>NAELA</strong> might actually be surprisedby this.<strong>NAELA</strong> members always help their clients, their clients’families and each other. Just read the listserv and see howhelpful members are to each other, by answering questions,providing advice, providing documents, pointing out ahelpful case, celebrating members’ personal milestones andconsoling them in their sorrows.Conversations in the hallways at a program, thesharing <strong>of</strong> documents, writing <strong>of</strong> articles and presentingat programs all help members. Service to the <strong>Academy</strong>benefits all <strong>of</strong> us, and so many members give unselfishly<strong>of</strong> their time to the <strong>Academy</strong> to make it a more valuableorganization for us. The DRA Task Force, and all <strong>of</strong> the<strong>Elder</strong> <strong>Law</strong>Attorneys, and<strong>NAELA</strong> membersin particular,are really nicepeople. Theyhave alwaysbeen nice people,and perhapsthat is why theyare drawn to<strong>Elder</strong> <strong>Law</strong>.time the task force members put into their analysis <strong>of</strong> theDRA and drafting the White Paper, is just a recent example.The <strong>NAELA</strong> programs and publications all help us stayinformed and keep us on the cutting edge <strong>of</strong> developments.<strong>NAELA</strong> members are nice people.Because <strong>NAELA</strong> is a member-drivenorganization, that niceness is reflected inall that <strong>NAELA</strong> does. <strong>NAELA</strong> reaches outto members in times <strong>of</strong> disaster and loss,whether a hurricane or a house fire, lettingmembers know that <strong>NAELA</strong> is there forthem and willing to help. <strong>NAELA</strong> membersenthusiastically participate in communityservice projects at the Symposiums. Forexample, in 2004, <strong>NAELA</strong> membersworked with the Programs for ExceptionalPeople (“PEP”) on Hilton Head Island,South Carolina. In 2005, <strong>NAELA</strong> membersworked with the On Lok (PACE) programin San Francisco. At the 20<strong>07</strong> Symposium,members had the opportunity to volunteerat the Cleveland Community Food Bank.When my colleague and I returned fromthe <strong>NAELA</strong> program, someone at workasked us about our trip. My colleague said22

continued from page 20<strong>NAELA</strong> Calendar <strong>of</strong> Eventswithout hesitation: “Those <strong>NAELA</strong> people are really nice.” Then shefollowed that observation with another one (unsurprising to those <strong>of</strong>us in <strong>NAELA</strong>): “And boy are they hard-working. They meet all thetime, all day long.” We do put in long days at the <strong>NAELA</strong> programs.Meetings start at 7:30 in the morning, and go non-stop until day’send and then we are not finished. We <strong>of</strong>ten go late into the night, atreceptions, over dinner, at the dine-arounds and the optional events.We would go longer if we could figure out how to do without sleep!And if we happen to be on the same plane flights home, we still keepgoing. Isn’t it great!Although the hours are long, it is not work. Hang out with a bunch<strong>of</strong> nice people who share the common goal <strong>of</strong> doing well by doinggood, and realize how energizing the <strong>NAELA</strong> experience is for us. A<strong>NAELA</strong> program is an opportunity to exchange information, meetpeople, network, learn new practice tips and changes to the law, getrevved up and make friends. Sit down at a lunch at a <strong>NAELA</strong> programwith a group <strong>of</strong> strangers and by the time lunch is over, you have abunch <strong>of</strong> friends. I have so many elder law attorneys whom I callfriends who I have met through <strong>NAELA</strong> and all <strong>of</strong> whom I know willbe there to help if I call.When I get calls from attorneys who tell me they want to startpracticing elder law and want to know how to get started, I alwaystell them the same two things: one, join <strong>NAELA</strong> and two, go to theprograms. I do not care how busy someone is; going to the programsis a must! I tell them “These are really nice people who will be veryhelpful to you.” I tell the elder law attorney “wannabes” that the<strong>NAELA</strong> members will be willing to share documents, to mentor andto help get them going in an elder law practice. No kidding... because,after all, they are really nice people.Some months after my colleague’s visit to <strong>NAELA</strong>, my colleaguecame back from a meeting <strong>of</strong> attorneys who practice in another area<strong>of</strong> law. When I asked my colleague about the meeting, my colleaguesaid “I want to go to the <strong>NAELA</strong> meetings with you. Those <strong>NAELA</strong>members are really nice people.”Since that program, I have had other colleagues accompany me tosome <strong>NAELA</strong> programs. Their reactions are always the same. I am nolonger surprised by it.I have grown accustomed to expecting it. I am never disappointed.At some point during the few days <strong>of</strong> the <strong>NAELA</strong> meeting, mycolleague will turn to me and say, “These are really nice people.” Ismile, nod and say: “Yes, they are.These <strong>NAELA</strong> members are really nice people.”July 27–29, 20<strong>07</strong>Tennessee Bar Association/<strong>NAELA</strong>20<strong>07</strong> <strong>Elder</strong> <strong>Law</strong> BasicsNashville, TNAugust 24–25, 20<strong>07</strong>Council <strong>of</strong> Advanced Practitioners 20<strong>07</strong> ProgramHotel Monaco ChicagoChicago, ILNovember 01–04, 20<strong>07</strong>20<strong>07</strong> Advanced <strong>Elder</strong> <strong>Law</strong> Institute<strong>Elder</strong> <strong>Law</strong> and Advocacy - It’s Now or NeverThe Peabody HotelMemphis, TNJanuary 25–27, 20082008 <strong>NAELA</strong> UnProgramEmbassy Suites Outdoor WorldGrapevine, TXMay 14–18, 20082008 <strong>NAELA</strong> Symposium20th Anniversary CelebrationHyatt Regency Maui Resort & SpaLahaina, Maui HIFall, 20082008 Advanced <strong>Elder</strong> <strong>Law</strong> InstituteKansas City, MOStay tuned for more information on ALL NEW<strong>NAELA</strong> Programming beginning in 2009!!January 25–27, 20082008 <strong>NAELA</strong> UnProgramEmbassy Suites Outdoor WorldGrapevine, TXSpring, 20092009 <strong>NAELA</strong> Annual MeetingWashington, DC23

<strong>NAELA</strong> in the NewsStetson Launches DistanceLearning LL.M. in <strong>Elder</strong> <strong>Law</strong>Pr<strong>of</strong>essor Rebecca MorganStetson University College <strong>of</strong> <strong>Law</strong> has launched anonline LL.M. in <strong>Elder</strong> <strong>Law</strong>. The degree requires thecompletion <strong>of</strong> twenty-four credits <strong>of</strong> study from a list<strong>of</strong> required and elective courses. Each course is a mix <strong>of</strong>video-taped lectures and a “virtual” classroom throughon-line discussion.The courses are <strong>of</strong>fered “on demand” to give studentsthe flexibility <strong>of</strong> watching the course lectures andparticipating in the class electronic discussions withina time frame that is convenient to the students, ratherthan requiring students to be on-line at a scheduledtime. The courses are taught by full-time faculty andsome adjunct pr<strong>of</strong>essors.New students will be admitted each fall for the LL.M.Prospective students are those who received their firstlaw degree from a U.S. law school or at a law schoolapproved by the appropriate authority in a countryother than the United States.The full course load is three courses per semester.Students taking the full course load will graduate inthree semesters. Students may apply for permission totake a partial (one or two) course load for each semester.The first class is scheduled to graduate with the LL.M.in December <strong>of</strong> 2008.Attorneys who are interested in taking courses withoutseeking the degree can apply for permission to auditcourses. For more information about the Stetson LL.M.in <strong>Elder</strong> <strong>Law</strong>, visit www.law.stetson.edu/excellence/elderlaw/llm or email elderlaw@ law.stetson.edu.<strong>NAELA</strong> was mentioned as aresource and/or <strong>Elder</strong> <strong>Law</strong>was prominently noted in:• “Sandwich Generation:Survive the Tug <strong>of</strong> War/TheWeb Sites, Books, PeopleThat Can Help You to BeBoth a Good Kid and aGood Parent,” which waspublished in the February20, 20<strong>07</strong> issue <strong>of</strong> CNN/Money Magazine.• “Tailor Will, Power <strong>of</strong>Attorney for MultipleStates,” which waspublished in the March10, 20<strong>07</strong> issue <strong>of</strong> The WallStreet Journal.• “Online Resources,” whichwas published in the March25, 20<strong>07</strong> issue <strong>of</strong> TheWashington Post.• “Parents Aging orIncapacity Can PutFamilies in a TerribleBind if Documents Aren’tAvailable to Let VitalDecisions be Made,”which was published in theApril 2, 20<strong>07</strong> issue <strong>of</strong> TheWashington Post.<strong>NAELA</strong> Membersin the News:• Jean Galloway Ball,CELA, Charles P.Sabatino, Esq., andSally Hurme, Esq., werequoted in “Parents Agingor Incapacity Can PutFamilies in a TerribleBind if Documents Aren’tAvailable to Let VitalDecisions be Made,”which was published in theApril 2, 20<strong>07</strong> issue <strong>of</strong> TheWashington Post.• William J. Browning,CELA, was quoted in“Should Grandma DivorceGrandpa? Senior Couplesare Splitting Up in RecordNumbers, and a MedicaidSystem that Leaves OneSpouse in Poverty asthe Other is Dying maybe a Reason,” whichwas published in theFebruary 15, 20<strong>07</strong> issue <strong>of</strong>MSN Money.• William J. Browning,CELA, was quotedin “How to Pay forOld-Age Care,” whichwas published in theMarch 26, 20<strong>07</strong> issue<strong>of</strong> Newsweek.• Tim E. Casserly, Esq.,was quoted in “SandwichGeneration: Survive theTug <strong>of</strong> War/The WebSites, Books, People ThatCan Help You to BeBoth a Good Kid and aGood Parent,” which waspublished in the February20, 20<strong>07</strong> issue <strong>of</strong> CNN/Money Magazine.• Kevin B. Rack, Esq.,was quoted in “AnInterview with Kevin B.Rack, Chair, VirginiaBar Association’s <strong>Elder</strong><strong>Law</strong> Section,” which waspublished in the October2006 issue <strong>of</strong> BIFOCAL,the e-newsletter publishedby the ABA’s Commissionon <strong>Law</strong> and Aging.• Harry S. Margolis, Esq.,was quoted in “TailorWill, Power <strong>of</strong> Attorneyfor Multiple States,” whichwas published in theMarch 10, 20<strong>07</strong> issue <strong>of</strong>The Wall Street Journal.24