01.10.2010 Corporate presentation - TAURON Polska Energia

01.10.2010 Corporate presentation - TAURON Polska Energia

01.10.2010 Corporate presentation - TAURON Polska Energia

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

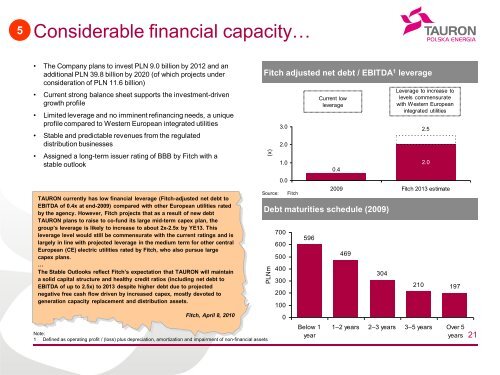

PLNm(x)5Considerable financial capacity…• The Company plans to invest PLN 9.0 billion by 2012 and anadditional PLN 39.8 billion by 2020 (of which projects underconsideration of PLN 11.6 billion)• Current strong balance sheet supports the investment-drivengrowth profile• Limited leverage and no imminent refinancing needs, a uniqueprofile compared to Western European integrated utilities• Stable and predictable revenues from the regulateddistribution businesses• Assigned a long-term issuer rating of BBB by Fitch with astable outlook<strong>TAURON</strong> currently has low financial leverage (Fitch-adjusted net debt toEBITDA of 0.4x at end-2009) compared with other European utilities ratedby the agency. However, Fitch projects that as a result of new debt<strong>TAURON</strong> plans to raise to co-fund its large mid-term capex plan, thegroup’s leverage is likely to increase to about 2x-2.5x by YE13. Thisleverage level would still be commensurate with the current ratings and islargely in line with projected leverage in the medium term for other centralEuropean (CE) electric utilities rated by Fitch, who also pursue largecapex plans.…The Stable Outlooks reflect Fitch’s expectation that <strong>TAURON</strong> will maintaina solid capital structure and healthy credit ratios (including net debt toEBITDA of up to 2.5x) to 2013 despite higher debt due to projectednegative free cash flow driven by increased capex, mostly devoted togeneration capacity replacement and distribution assets.Fitch, April 8, 2010Note:1 Defined as operating profit / (loss) plus depreciation, amortization and impairment of non-financial assetsFitch adjusted net debt / EBITDA 1 leverageSource:3.02.01.00.00.4Debt maturities schedule (2009)7006005004003002001000Fitch596Below 1yearCurrent lowleverage2.02009 Fitch 2013 estimate469304Leverage to increase tolevels commensuratewith Western Europeanintegrated utilities2.5210 1971–2 years 2–3 years 3–5 years Over 5years21