download - South West Alliance of Rural Health

download - South West Alliance of Rural Health

download - South West Alliance of Rural Health

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

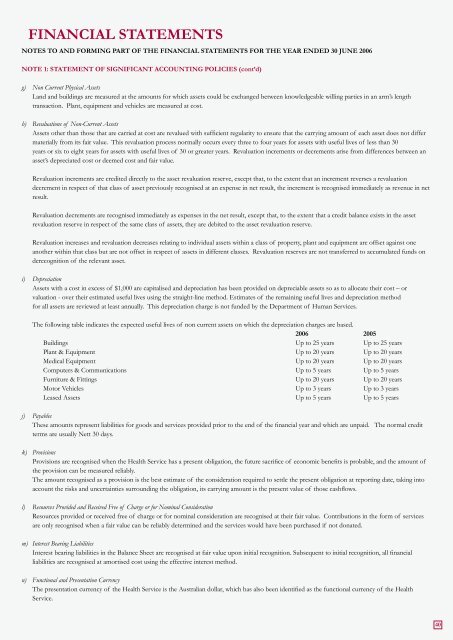

FINANCIAL STATEMENTSNOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE 2006NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES (cont’d)g) Non Current Physical AssetsLand and buildings are measured at the amounts for which assets could be exchanged between knowledgeable willing parties in an arm’s lengthtransaction. Plant, equipment and vehicles are measured at cost.h) Revaluations <strong>of</strong> Non-Current AssetsAssets other than those that are carried at cost are revalued with sufficient regularity to ensure that the carrying amount <strong>of</strong> each asset does not differmaterially from its fair value. This revaluation process normally occurs every three to four years for assets with useful lives <strong>of</strong> less than 30years or six to eight years for assets with useful lives <strong>of</strong> 30 or greater years. Revaluation increments or decrements arise from differences between anasset’s depreciated cost or deemed cost and fair value.Revaluation increments are credited directly to the asset revaluation reserve, except that, to the extent that an increment reverses a revaluationdecrement in respect <strong>of</strong> that class <strong>of</strong> asset previously recognised at an expense in net result, the increment is recognised immediately as revenue in netresult.Revaluation decrements are recognised immediately as expenses in the net result, except that, to the extent that a credit balance exists in the assetrevaluation reserve in respect <strong>of</strong> the same class <strong>of</strong> assets, they are debited to the asset revaluation reserve.Revaluation increases and revaluation decreases relating to individual assets within a class <strong>of</strong> property, plant and equipment are <strong>of</strong>fset against oneanother within that class but are not <strong>of</strong>fset in respect <strong>of</strong> assets in different classes. Revaluation reserves are not transferred to accumulated funds onderecognition <strong>of</strong> the relevant asset.i) DepreciationAssets with a cost in excess <strong>of</strong> $1,000 are capitalised and depreciation has been provided on depreciable assets so as to allocate their cost – orvaluation - over their estimated useful lives using the straight-line method. Estimates <strong>of</strong> the remaining useful lives and depreciation methodfor all assets are reviewed at least annually. This depreciation charge is not funded by the Department <strong>of</strong> Human Services.The following table indicates the expected useful lives <strong>of</strong> non current assets on which the depreciation charges are based.2006 2005Buildings Up to 25 years Up to 25 yearsPlant & Equipment Up to 20 years Up to 20 yearsMedical Equipment Up to 20 years Up to 20 yearsComputers & Communications Up to 5 years Up to 5 yearsFurniture & Fittings Up to 20 years Up to 20 yearsMotor Vehicles Up to 3 years Up to 3 yearsLeased Assets Up to 5 years Up to 5 yearsj) PayablesThese amounts represent liabilities for goods and services provided prior to the end <strong>of</strong> the financial year and which are unpaid. The normal creditterms are usually Nett 30 days.k) ProvisionsProvisions are recognised when the <strong>Health</strong> Service has a present obligation, the future sacrifice <strong>of</strong> economic benefits is probable, and the amount <strong>of</strong>the provision can be measured reliably.The amount recognised as a provision is the best estimate <strong>of</strong> the consideration required to settle the present obligation at reporting date, taking intoaccount the risks and uncertainties surrounding the obligation, its carrying amount is the present value <strong>of</strong> those cashflows.l) Resources Provided and Received Free <strong>of</strong> Charge or for Nominal ConsiderationResources provided or received free <strong>of</strong> charge or for nominal consideration are recognised at their fair value. Contributions in the form <strong>of</strong> servicesare only recognised when a fair value can be reliably determined and the services would have been purchased if not donated.m) Interest Bearing LiabilitiesInterest bearing liabilities in the Balance Sheet are recognised at fair value upon initial recognition. Subsequent to initial recognition, all financialliabilities are recognised at amortised cost using the effective interest method.n) Functional and Presentation CurrencyThe presentation currency <strong>of</strong> the <strong>Health</strong> Service is the Australian dollar, which has also been identified as the functional currency <strong>of</strong> the <strong>Health</strong>Service.40