download - South West Alliance of Rural Health

download - South West Alliance of Rural Health

download - South West Alliance of Rural Health

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

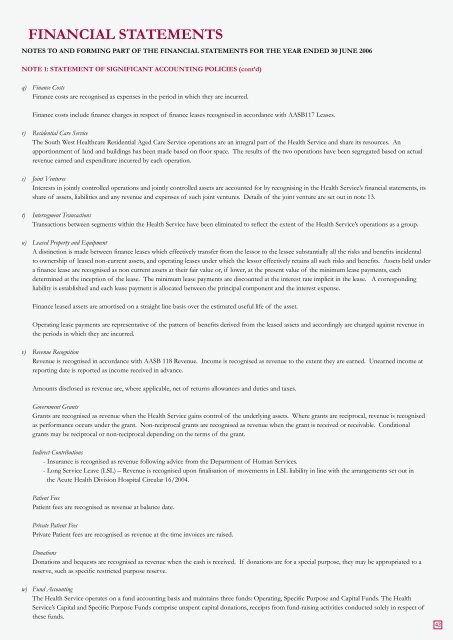

FINANCIAL STATEMENTSNOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE 2006NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES (cont’d)q) Finance CostsFinance costs are recognised as expenses in the period in which they are incurred.Finance costs include finance charges in respect <strong>of</strong> finance leases recognised in accordance with AASB117 Leases.r) Residential Care ServiceThe <strong>South</strong> <strong>West</strong> <strong>Health</strong>care Residential Aged Care Service operations are an integral part <strong>of</strong> the <strong>Health</strong> Service and share its resources. Anapportionment <strong>of</strong> land and buildings has been made based on floor space. The results <strong>of</strong> the two operations have been segregated based on actualrevenue earned and expenditure incurred by each operation.s) Joint VenturesInterests in jointly controlled operations and jointly controlled assets are accounted for by recognising in the <strong>Health</strong> Service’s financial statements, itsshare <strong>of</strong> assets, liabilities and any revenue and expenses <strong>of</strong> such joint ventures. Details <strong>of</strong> the joint venture are set out in note 13.t) Intersegment TransactionsTransactions between segments within the <strong>Health</strong> Service have been eliminated to reflect the extent <strong>of</strong> the <strong>Health</strong> Service’s operations as a group.u) Leased Property and EquipmentA distinction is made between finance leases which effectively transfer from the lessor to the lessee substantially all the risks and benefits incidentalto ownership <strong>of</strong> leased non-current assets, and operating leases under which the lessor effectively retains all such risks and benefits. Assets held undera finance lease are recognised as non current assets at their fair value or, if lower, at the present value <strong>of</strong> the minimum lease payments, eachdetermined at the inception <strong>of</strong> the lease. The minimum lease payments are discounted at the interest rate implicit in the lease. A correspondingliability is established and each lease payment is allocated between the principal component and the interest expense.Finance leased assets are amortised on a straight line basis over the estimated useful life <strong>of</strong> the asset.Operating lease payments are representative <strong>of</strong> the pattern <strong>of</strong> benefits derived from the leased assets and accordingly are charged against revenue inthe periods in which they are incurred.v) Revenue RecognitionRevenue is recognised in accordance with AASB 118 Revenue. Income is recognised as revenue to the extent they are earned. Unearned income atreporting date is reported as income received in advance.Amounts disclosed as revenue are, where applicable, net <strong>of</strong> returns allowances and duties and taxes.Government GrantsGrants are recognised as revenue when the <strong>Health</strong> Service gains control <strong>of</strong> the underlying assets. Where grants are reciprocal, revenue is recognisedas performance occurs under the grant. Non-reciprocal grants are recognised as revenue when the grant is received or receivable. Conditionalgrants may be reciprocal or non-reciprocal depending on the terms <strong>of</strong> the grant.Indirect Contributions- Insurance is recognised as revenue following advice from the Department <strong>of</strong> Human Services.- Long Service Leave (LSL) – Revenue is recognised upon finalisation <strong>of</strong> movements in LSL liability in line with the arrangements set out inthe Acute <strong>Health</strong> Division Hospital Circular 16/2004.Patient FeesPatient fees are recognised as revenue at balance date.Private Patient FeesPrivate Patient fees are recognised as revenue at the time invoices are raised.DonationsDonations and bequests are recognised as revenue when the cash is received. If donations are for a special purpose, they may be appropriated to areserve, such as specific restricted purpose reserve.w) Fund AccountingThe <strong>Health</strong> Service operates on a fund accounting basis and maintains three funds: Operating, Specific Purpose and Capital Funds. The <strong>Health</strong>Service’s Capital and Specific Purpose Funds comprise unspent capital donations, receipts from fund-raising activities conducted solely in respect <strong>of</strong>these funds.42