Reflections - Cognizant

Reflections - Cognizant

Reflections - Cognizant

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

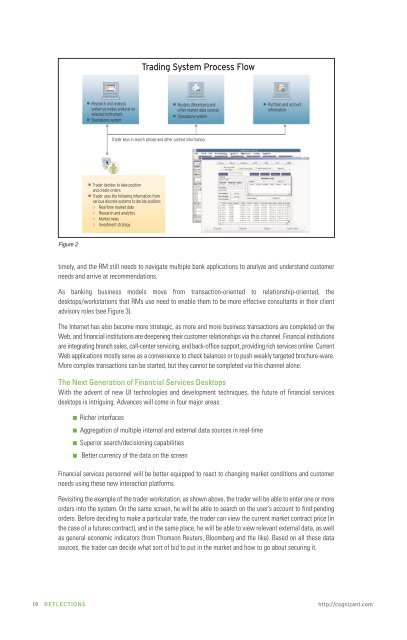

Trading System Process Flow■ Research and analysissystem provides analysis onselected instrument■ Standalone system■ Reuters, Bloomberg andother market data sources■ Standalone system■ Portfolio and accountinformationTrader keys in search phrase and other context information■ Trader decides to take positionand create orders■ Trader uses the following information fromvarious discrete systems to decide position:> Real-time market data> Research and analytics> Market news> Investment strategyFigure 2timely, and the RM still needs to navigate multiple bank applications to analyze and understand customerneeds and arrive at recommendations.As banking business models move from transaction-oriented to relationship-oriented, thedesktops/workstations that RMs use need to enable them to be more effective consultants in their clientadvisory roles (see Figure 3).The Internet has also become more strategic, as more and more business transactions are completed on theWeb, and financial institutions are deepening their customer relationships via this channel. Financial institutionsare integrating branch sales, call-center servicing, and back-office support, providing rich services online. CurrentWeb applications mostly serve as a convenience to check balances or to push weakly targeted brochure-ware.More complex transactions can be started, but they cannot be completed via this channel alone.The Next Generation of Financial Services DesktopsWith the advent of new UI technologies and development techniques, the future of financial servicesdesktops is intriguing. Advances will come in four major areas:■ Richer interfaces■ Aggregation of multiple internal and external data sources in real-time■ Superior search/decisioning capabilities■ Better currency of the data on the screenFinancial services personnel will be better equipped to react to changing market conditions and customerneeds using these new interaction platforms.Revisiting the example of the trader workstation, as shown above, the trader will be able to enter one or moreorders into the system. On the same screen, he will be able to search on the user’s account to find pendingorders. Before deciding to make a particular trade, the trader can view the current market contract price (inthe case of a futures contract), and in the same place, he will be able to view relevant external data, as wellas general economic indicators (from Thomson Reuters, Bloomberg and the like). Based on all these datasources, the trader can decide what sort of bid to put in the market and how to go about securing it.19 REFLECTIONS http://cognizant.com