Reflections - Cognizant

Reflections - Cognizant

Reflections - Cognizant

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

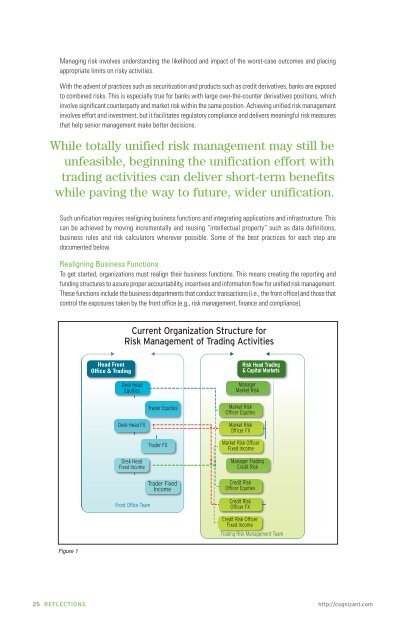

Managing risk involves understanding the likelihood and impact of the worst-case outcomes and placingappropriate limits on risky activities.With the advent of practices such as securitization and products such as credit derivatives, banks are exposedto combined risks. This is especially true for banks with large over-the-counter derivatives positions, whichinvolve significant counterparty and market risk within the same position. Achieving unified risk managementinvolves effort and investment, but it facilitates regulatory compliance and delivers meaningful risk measuresthat help senior management make better decisions.While totally unified risk management may still beunfeasible, beginning the unification effort withtrading activities can deliver short-term benefitswhile paving the way to future, wider unification.Such unification requires realigning business functions and integrating applications and infrastructure. Thiscan be achieved by moving incrementally and reusing “intellectual property” such as data definitions,business rules and risk calculators wherever possible. Some of the best practices for each step aredocumented below.Realigning Business FunctionsTo get started, organizations must realign their business functions. This means creating the reporting andfunding structures to assure proper accountability, incentives and information flow for unified risk management.These functions include the business departments that conduct transactions (i.e., the front office) and those thatcontrol the exposures taken by the front office (e.g., risk management, finance and compliance).Current Organization Structure forRisk Management of Trading ActivitiesHead FrontOffice & TradingDesk HeadEquitiesRisk Head Trading& Capital MarketsManagerMarket RiskTrader EquitiesMarket RiskOfficer EquitiesDesk Head FXMarket RiskOfficer FXTrader FXMarket Risk OfficerFixed IncomeDesk HeadFixed IncomeManager TradingCredit RiskFront Office TeamTrader FixedIncomeCredit RiskOfficer EquitiesCredit RiskOfficer FXCredit Risk OfficerFixed IncomeTrading Risk Management TeamFigure 125 REFLECTIONS http://cognizant.com