Reflections - Cognizant

Reflections - Cognizant

Reflections - Cognizant

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

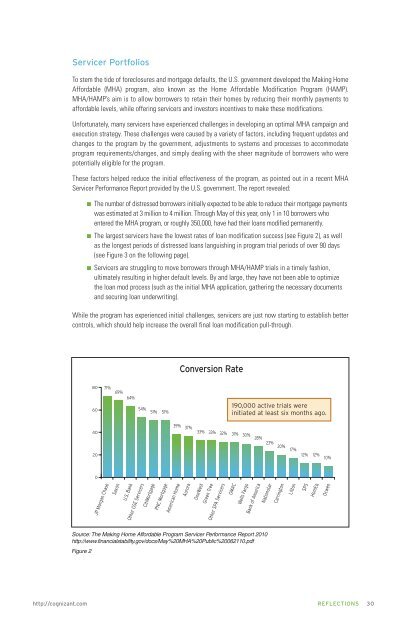

Servicer PortfoliosTo stem the tide of foreclosures and mortgage defaults, the U.S. government developed the Making HomeAffordable (MHA) program, also known as the Home Affordable Modification Program (HAMP).MHA/HAMP’s aim is to allow borrowers to retain their homes by reducing their monthly payments toaffordable levels, while offering servicers and investors incentives to make these modifications.Unfortunately, many servicers have experienced challenges in developing an optimal MHA campaign andexecution strategy. These challenges were caused by a variety of factors, including frequent updates andchanges to the program by the government, adjustments to systems and processes to accommodateprogram requirements/changes, and simply dealing with the sheer magnitude of borrowers who werepotentially eligible for the program.These factors helped reduce the initial effectiveness of the program, as pointed out in a recent MHAServicer Performance Report provided by the U.S. government. The report revealed:■ The number of distressed borrowers initially expected to be able to reduce their mortgage paymentswas estimated at 3 million to 4 million. Through May of this year, only 1 in 10 borrowers whoentered the MHA program, or roughly 350,000, have had their loans modified permanently.■ The largest servicers have the lowest rates of loan modification success (see Figure 2), as wellas the longest periods of distressed loans languishing in program trial periods of over 90 days(see Figure 3 on the following page).■ Servicers are struggling to move borrowers through MHA/HAMP trials in a timely fashion,ultimately resulting in higher default levels. By and large, they have not been able to optimizethe loan mod process (such as the initial MHA application, gathering the necessary documentsand securing loan underwriting).While the program has experienced initial challenges, servicers are just now starting to establish bettercontrols, which should help increase the overall final loan modification pull-through.Conversion Rate8071%69%64%60190,000 active trials wereinitiated at least six months ago.4054% 51% 51%39% 37%33% 33% 32% 31% 30%28%23%2020% 17%12% 12% 10%0JP Morgan ChaseSaxonU.S. BankOther GSE ServicersCitiMortgagePNC MortgageAmerican HomeAuroraOneWestGreen TreeOther SPA ServicersGMACWells FargoBank of AmericaNationstarCarringtonLittonSPSHomEqOcwenSource: The Making Home Affordable Program Servicer Performance Report 2010http://www.financialstability.gov/docs/May%20MHA%20Public%20062110.pdfFigure 2http://cognizant.com REFLECTIONS 30