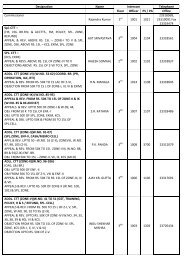

FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...

FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...

FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes :1. Salary includes wages, annuity, pension, gratuity [o<strong>the</strong>r than exempted <strong>under</strong> <strong>section</strong> 10 (10)], fees,commission, bonus, repayment <strong>of</strong> amount deposited <strong>under</strong> <strong>the</strong> Additional Emoluments (CompulsoryDeposit) Act, 1974, perquisites, pr<strong>of</strong>its in lieu <strong>of</strong> or in addition to any salary or wages including paymentsmade at or in connection with termination <strong>of</strong> employment, advance <strong>of</strong> salary, any payment received inrespect <strong>of</strong> any period <strong>of</strong> leave not availed [o<strong>the</strong>r than exempted <strong>under</strong> <strong>section</strong> 10 (10AA)], any annualaccretion to <strong>the</strong> balance <strong>of</strong> <strong>the</strong> account in a recognised provident fund chargeable to tax in accordancewith <strong>rule</strong> 6 <strong>of</strong> Part A <strong>of</strong> <strong>the</strong> Fourth Schedule <strong>of</strong> <strong>the</strong> Income-tax Act, 1961, any sums deemed to be incomereceived by <strong>the</strong> employee in accordance with sub-<strong>rule</strong> (4) <strong>of</strong> <strong>rule</strong> 11 <strong>of</strong> Part A <strong>of</strong> <strong>the</strong> Fourth Schedule <strong>of</strong><strong>the</strong> Income-tax Act, 1961, any contribution made by <strong>the</strong> Central Government to <strong>the</strong> account <strong>of</strong> <strong>the</strong>employee <strong>under</strong> a pension scheme referred to in <strong>section</strong> 80CCD or any o<strong>the</strong>r sums chargeable to incometax<strong>under</strong> <strong>the</strong> head 'Salaries'.2. Where an employer deducts from <strong>the</strong> emoluments paid to an employee or pays on his behalf anycontributions <strong>of</strong> that employee to any approved superannuation fund, all such deductions or paymentsshould be included in <strong>the</strong> statement. ”;

![FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...](https://img.yumpu.com/47160832/2/500x640/form-no16b-see-rule-313a-certificate-under-section-203-of-the-.jpg)

![FORM N [See rule 8B] Application for registration as a ... - Webtel](https://img.yumpu.com/50110806/1/190x245/form-n-see-rule-8b-application-for-registration-as-a-webtel.jpg?quality=85)

![FORM NO. 10BC [See rule 17CA] Audit report under (sub-rule (12 ...](https://img.yumpu.com/48904704/1/190x245/form-no-10bc-see-rule-17ca-audit-report-under-sub-rule-12-.jpg?quality=85)

![Form VAT- N1 [See rule 16(1) table] Notice under section ... - Webtel](https://img.yumpu.com/47558518/1/158x260/form-vat-n1-see-rule-161-table-notice-under-section-webtel.jpg?quality=85)

![FORM VAT-2 [See rule 3,28,32,37 & 46] CHALLLAN A (To be ...](https://img.yumpu.com/47239213/1/158x260/form-vat-2-see-rule-3283237-46-challlan-a-to-be-.jpg?quality=85)