FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...

FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...

FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

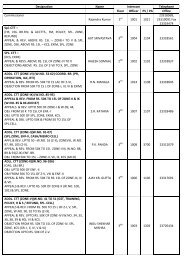

<strong>Certificate</strong> No.“<strong>FORM</strong> <strong>NO.16B</strong>[<strong>See</strong> <strong>rule</strong> <strong>31</strong>(<strong>3A</strong>)]<strong>Certificate</strong> <strong>under</strong> <strong>section</strong> <strong>203</strong> <strong>of</strong> <strong>the</strong> Income-tax Act, 1961 for tax deducted at sourceLast updated onName and address <strong>of</strong> <strong>the</strong> Deductor(Transferee/Payer/Buyer)Name and address <strong>of</strong> <strong>the</strong> Deductee(Transferor/Payee/Seller)PAN <strong>of</strong> <strong>the</strong> Deductor PAN <strong>of</strong> <strong>the</strong> Deductee Financial Year <strong>of</strong> deductionS. No. Unique AcknowledgementNumberSummary <strong>of</strong> Transaction (s)Amount Paid/CreditedDate <strong>of</strong> payment/credit(dd/mm/yyyy)Amount <strong>of</strong> tax deducted anddeposited in respect <strong>of</strong> <strong>the</strong>deducteeTotal (Rs.)DETAILS OF TAX DEPOSITED TO THE CREDIT OF THE CENTRAL GOVERNMENT FOR WHICH CREDIT IS TO BE GIVEN TO THEDEDUCTEES. No.Challan Identification number (CIN)Amount <strong>of</strong> tax deposited in respect <strong>of</strong>Deductee (Rs.)1.2.Total (Rs.)BSR Code <strong>of</strong> <strong>the</strong>Bank BranchVerificationDate on which taxdeposited (dd/mm/yyyy)Challan SerialNumberI,…………….., son/daughter <strong>of</strong> …………. in <strong>the</strong> capacity <strong>of</strong> ……. (designation) do hereby certify that a sum <strong>of</strong> (Rs.) ………….. [Rs. ………….(inwords)] has been deducted and deposited to <strong>the</strong> credit <strong>of</strong> <strong>the</strong> Central Government. I fur<strong>the</strong>r certify that <strong>the</strong> information given above is true, completeand correct and is based on <strong>the</strong> books <strong>of</strong> account, documents, challan-cum-statement <strong>of</strong> deduction <strong>of</strong> tax, TDS deposited and o<strong>the</strong>r available records.PlaceDateFull Name:(Signature <strong>of</strong> person responsible for deduction <strong>of</strong> tax)

Notes :1. Salary includes wages, annuity, pension, gratuity [o<strong>the</strong>r than exempted <strong>under</strong> <strong>section</strong> 10 (10)], fees,commission, bonus, repayment <strong>of</strong> amount deposited <strong>under</strong> <strong>the</strong> Additional Emoluments (CompulsoryDeposit) Act, 1974, perquisites, pr<strong>of</strong>its in lieu <strong>of</strong> or in addition to any salary or wages including paymentsmade at or in connection with termination <strong>of</strong> employment, advance <strong>of</strong> salary, any payment received inrespect <strong>of</strong> any period <strong>of</strong> leave not availed [o<strong>the</strong>r than exempted <strong>under</strong> <strong>section</strong> 10 (10AA)], any annualaccretion to <strong>the</strong> balance <strong>of</strong> <strong>the</strong> account in a recognised provident fund chargeable to tax in accordancewith <strong>rule</strong> 6 <strong>of</strong> Part A <strong>of</strong> <strong>the</strong> Fourth Schedule <strong>of</strong> <strong>the</strong> Income-tax Act, 1961, any sums deemed to be incomereceived by <strong>the</strong> employee in accordance with sub-<strong>rule</strong> (4) <strong>of</strong> <strong>rule</strong> 11 <strong>of</strong> Part A <strong>of</strong> <strong>the</strong> Fourth Schedule <strong>of</strong><strong>the</strong> Income-tax Act, 1961, any contribution made by <strong>the</strong> Central Government to <strong>the</strong> account <strong>of</strong> <strong>the</strong>employee <strong>under</strong> a pension scheme referred to in <strong>section</strong> 80CCD or any o<strong>the</strong>r sums chargeable to incometax<strong>under</strong> <strong>the</strong> head 'Salaries'.2. Where an employer deducts from <strong>the</strong> emoluments paid to an employee or pays on his behalf anycontributions <strong>of</strong> that employee to any approved superannuation fund, all such deductions or paymentsshould be included in <strong>the</strong> statement. ”;

![FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...](https://img.yumpu.com/47160832/1/500x640/form-no16b-see-rule-313a-certificate-under-section-203-of-the-.jpg)

![FORM N [See rule 8B] Application for registration as a ... - Webtel](https://img.yumpu.com/50110806/1/190x245/form-n-see-rule-8b-application-for-registration-as-a-webtel.jpg?quality=85)

![FORM NO. 10BC [See rule 17CA] Audit report under (sub-rule (12 ...](https://img.yumpu.com/48904704/1/190x245/form-no-10bc-see-rule-17ca-audit-report-under-sub-rule-12-.jpg?quality=85)

![Form VAT- N1 [See rule 16(1) table] Notice under section ... - Webtel](https://img.yumpu.com/47558518/1/158x260/form-vat-n1-see-rule-161-table-notice-under-section-webtel.jpg?quality=85)

![FORM VAT-2 [See rule 3,28,32,37 & 46] CHALLLAN A (To be ...](https://img.yumpu.com/47239213/1/158x260/form-vat-2-see-rule-3283237-46-challlan-a-to-be-.jpg?quality=85)