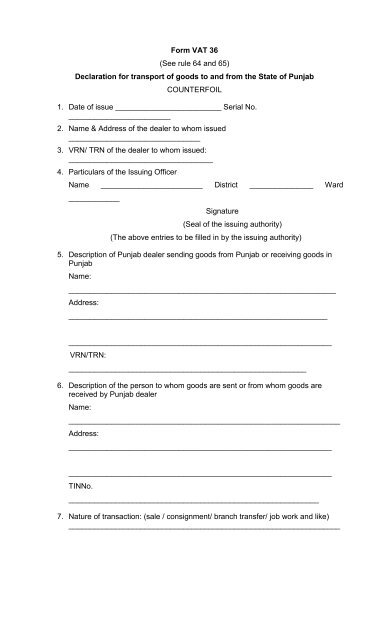

Form VAT 36 (See rule 64 and 65) Declaration for transport of goods ...

Form VAT 36 (See rule 64 and 65) Declaration for transport of goods ...

Form VAT 36 (See rule 64 and 65) Declaration for transport of goods ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Form</strong> <strong>VAT</strong> <strong>36</strong>(<strong>See</strong> <strong>rule</strong> <strong>64</strong> <strong>and</strong> <strong>65</strong>)<strong>Declaration</strong> <strong>for</strong> <strong>transport</strong> <strong>of</strong> <strong>goods</strong> to <strong>and</strong> from the State <strong>of</strong> PunjabCOUNTERFOIL1. Date <strong>of</strong> issue _________________________ Serial No.________________________2. Name & Address <strong>of</strong> the dealer to whom issued_______________________________3. VRN/ TRN <strong>of</strong> the dealer to whom issued:__________________________________4. Particulars <strong>of</strong> the Issuing OfficerName ________________________ District _______________ Ward____________Signature(Seal <strong>of</strong> the issuing authority)(The above entries to be filled in by the issuing authority)5. Description <strong>of</strong> Punjab dealer sending <strong>goods</strong> from Punjab or receiving <strong>goods</strong> inPunjabName:_______________________________________________________________Address:___________________________________________________________________________________________________________________________VRN/TRN:________________________________________________________6. Description <strong>of</strong> the person to whom <strong>goods</strong> are sent or from whom <strong>goods</strong> arereceived by Punjab dealerName:________________________________________________________________Address:____________________________________________________________________________________________________________________________TINNo.___________________________________________________________7. Nature <strong>of</strong> transaction: (sale / consignment/ branch transfer/ job work <strong>and</strong> like)________________________________________________________________

8. Description, Quantity <strong>and</strong> value <strong>of</strong> <strong>goods</strong>SlNo.Description Invoice/ChallanNo. <strong>and</strong> dateCode NameQuantity Value <strong>of</strong> <strong>goods</strong>(Rs.)In Infigures wordsTotal value <strong>of</strong> <strong>goods</strong> _________(Please use the reverse side if the names <strong>of</strong> the commodities are more)9. Name <strong>and</strong> address <strong>of</strong> the <strong>transport</strong> company / owner <strong>of</strong> the vehicle by which the<strong>goods</strong> are consigned:Name: __________________________________________________________Address: ________________________________________________________9A Vehicle No.: ______________________________________________________9B GR No.& Date: ___________________________________________________.COUNTERFOIL (Reverse side <strong>of</strong> <strong>Form</strong> <strong>VAT</strong>- <strong>36</strong>)8. Description, Quantity <strong>and</strong> value <strong>of</strong> <strong>goods</strong>SlDescriptionInvoice/ChallanQuantity Value <strong>of</strong> <strong>goods</strong>No.No. <strong>and</strong> date(Rs.)Code NameInfiguresInwordsTotal value <strong>of</strong> <strong>goods</strong> in figures ______________________In words ____________

<strong>Form</strong> <strong>VAT</strong>-<strong>36</strong>(<strong>See</strong> <strong>rule</strong> <strong>64</strong> <strong>and</strong> <strong>65</strong>)<strong>Declaration</strong> <strong>for</strong> <strong>transport</strong> <strong>of</strong> <strong>goods</strong> to <strong>and</strong> from the State <strong>of</strong> PunjabORIGINAL FOIL1. Date <strong>of</strong> issue _____________________ Serial No. _______________________2. Name & Address <strong>of</strong> the dealer to whom issued ___________________________3. VRN/ TRN <strong>of</strong> the dealer to whom issued: _______________________________4. Particulars <strong>of</strong> the Issuing OfficerName ____________________ District _______________ Ward ____________Signature(Seal <strong>of</strong> the issuing authority)(The above entries to be filled in by the issuing authority)5. Description <strong>of</strong> Punjab dealer sending <strong>goods</strong> from Punjab or receiving <strong>goods</strong> inPunjabName: __________________________________________________________Address: __________________________________________________________________________________________________________________VRN/TRN: _______________________________________________________6. Description <strong>of</strong> the person to whom <strong>goods</strong> are sent or from whom <strong>goods</strong> arereceived by Punjab dealerName: __________________________________________________________Address: __________________________________________________________________________________________________________________TIN No. _________________________________________________________7. Nature <strong>of</strong> transaction: (sale / consignment/ branch transfer/ job work <strong>and</strong> like)________________________________________________________________8. Description, Quantity <strong>and</strong> value <strong>of</strong> <strong>goods</strong>SlNo.DescriptionCode NameInvoice/ChallanNo. <strong>and</strong> dateQuantity Value <strong>of</strong> <strong>goods</strong>(Rs.)In Infigures wordsTotal value <strong>of</strong> <strong>goods</strong> _________(Please use the reverse side if the names <strong>of</strong> the commodities are more)9. Name <strong>and</strong> address <strong>of</strong> the <strong>transport</strong> company / owner <strong>of</strong> the vehicle by which the<strong>goods</strong> are consigned:Name: __________________________________________________________

Address: __________________________________________________________________________________________________________________9A Vehicle No.: ______________________________________________________9B GR No.& Date: ___________________________________________________DECLARATIONI / We declare that I / we am / are registered dealer under the Punjab Value Added TaxAct, 2005, holding VRN / TRN ____________________ <strong>and</strong> the statements made arecorrect to the best <strong>of</strong> my/ our knowledge <strong>and</strong> belief.Name <strong>of</strong> the dealerSignature <strong>of</strong> proprietor / partner/authorized person with stamp

ORIGINAL FOIL (Reverse side <strong>of</strong> <strong>Form</strong> <strong>VAT</strong>- <strong>36</strong>)8. Description, Quantity <strong>and</strong> value <strong>of</strong> <strong>goods</strong>SlNo.DescriptionInvoice/ChallanNo. <strong>and</strong> dateQuantity Value <strong>of</strong> <strong>goods</strong>(Rs.)Code NameInfiguresInwordsTotal value <strong>of</strong> <strong>goods</strong> in figures ______________________In words ____________Name <strong>of</strong> the dealer: ________________________________________________Signature <strong>of</strong> Proprietor / partner / authorized person with stamp: _____________Code & Name <strong>of</strong> the In<strong>for</strong>mation Collection CentreDate <strong>of</strong> Endorsement: Date_____________ Month______________ Year______Signature <strong>of</strong> the endorsing <strong>VAT</strong><strong>of</strong>ficer / Inspector(Seal)

<strong>Form</strong> <strong>VAT</strong> -<strong>36</strong>(<strong>See</strong> <strong>rule</strong> <strong>64</strong> <strong>and</strong> <strong>65</strong>)<strong>Declaration</strong> <strong>for</strong> <strong>transport</strong> <strong>of</strong> <strong>goods</strong> to <strong>and</strong> from the State <strong>of</strong> PunjabDUPLICATE FOIL1. Date <strong>of</strong> issue ______________________ Serial No. ______________________2. Name & Address <strong>of</strong> the dealer to whom issued ___________________________3. VRN/ TRN <strong>of</strong> the dealer to whom issued: ______________________________4. Particulars <strong>of</strong> the Issuing OfficerName ______________________ District _____________ Ward ____________Signature(Seal <strong>of</strong> the issuing authority)(The above entries to be filled in by the issuing authority)5. Description <strong>of</strong> Punjab dealer sending <strong>goods</strong> from Punjab or receiving <strong>goods</strong> inPunjabName: __________________________________________________________Address: _________________________________________________________________________________________________________________VRN/TRN: _____________________________________________________6. Description <strong>of</strong> the person to whom <strong>goods</strong> are sent or from whom <strong>goods</strong> arereceived by Punjab dealerName: __________________________________________________________Address: _________________________________________________________________________________________________________________TIN No. __________________________________________________________7. Nature <strong>of</strong> transaction: (sale / consignment/ branch transfer/ job work <strong>and</strong> like)________________________________________________________________

8. Description, Quantity <strong>and</strong> value <strong>of</strong> <strong>goods</strong>SlNo.DescriptionCode NameInvoice/ChallanNo. <strong>and</strong> dateQuantity Value <strong>of</strong> <strong>goods</strong>(Rs.)In Infigures wordsTotal value <strong>of</strong> <strong>goods</strong> _________(Please use the reverse side if the names <strong>of</strong> the commodities are more)9. Name <strong>and</strong> address <strong>of</strong> the <strong>transport</strong> company / owner <strong>of</strong> the vehicle by which the<strong>goods</strong> are consigned:Name: __________________________________________________________Address: _________________________________________________________9A Vehicle No.: ______________________________________________________9B GR No.& Date: ____________________________________________________DECLARATIONI / We declare that I / we am / are registered dealer under the Punjab Value Added TaxAct, 2005, holding VRN / TRN ____________________ <strong>and</strong> the statements made arecorrect to the best <strong>of</strong> my/ our knowledge <strong>and</strong> belief.Name <strong>of</strong> the dealerSignature <strong>of</strong> proprietor / partner/authorized person with stamp

DUPLICATE FOIL (Reverse side <strong>of</strong> <strong>Form</strong> <strong>VAT</strong>- <strong>36</strong>)8. Description, Quantity <strong>and</strong> value <strong>of</strong> <strong>goods</strong>SlNo.DescriptionCode NameInvoice/ChallanNo. <strong>and</strong> dateQuantity Value <strong>of</strong> <strong>goods</strong>(Rs.)In Infigures wordsTotal value <strong>of</strong> <strong>goods</strong> in figures ______________________In words ____________Name <strong>of</strong> the dealer: ________________________________________________Signature <strong>of</strong> Proprietor / partner / authorized person with stamp: ____________Code & Name <strong>of</strong> the In<strong>for</strong>mation Collection CentreDate <strong>of</strong> Endorsement: Date_____________ Month______________ Year______Signature <strong>of</strong> the endorsing <strong>VAT</strong><strong>of</strong>ficer / Inspector(Seal)

PART – AToThe Designated Officer,Place. ___________,District ______________.FORM <strong>VAT</strong>-<strong>36</strong>–A[ <strong>See</strong> <strong>rule</strong> <strong>65</strong> ]Application <strong>for</strong> issue <strong>of</strong> FORM <strong>VAT</strong>- <strong>36</strong>1. I ________________ Proprietor/Managing partner/Managing Director/ GeneralAttorney/Head <strong>of</strong> Department (or any other Joint Officer/Officers duly authorised by himin writing) <strong>of</strong> the below mentioned firm hereby apply on behalf <strong>of</strong> the firm <strong>for</strong> issue <strong>of</strong> __(number) <strong>Form</strong> <strong>VAT</strong>- <strong>36</strong>.2. List <strong>of</strong> the ___ (number) used <strong>Form</strong> <strong>VAT</strong>- <strong>36</strong> from serial number _________ to serial no._______ is attached herewith.3. List <strong>of</strong> the ____ (number) FORM <strong>VAT</strong>- <strong>36</strong> in transit with serial number _______ to serialnumber ______ is also attached herewith.Signature <strong>of</strong> the applicant_____________Name ____________________________Status____________________________Place __________________Date : __________________Name <strong>of</strong> the firm : _____________________________________________________ Address_____________________________________________________________VRN Number ______________________PART – B(To be retained in the <strong>of</strong>fice <strong>of</strong> Designated Officer)1. Number <strong>of</strong> <strong>Form</strong>s <strong>VAT</strong>-<strong>36</strong> in possession <strong>of</strong> the taxable personincluding issued under Punjab General Sales Tax Act, 1948.2. Number <strong>of</strong> <strong>Form</strong>s issued against this application3. Serial Number <strong>of</strong> <strong>Form</strong>s issued From : To:4. Date <strong>of</strong> issue <strong>of</strong> <strong>Form</strong>s5.Total Number <strong>of</strong> <strong>Form</strong>s available with the taxable person.6. Signature <strong>of</strong> the taxable person in token <strong>of</strong> having received the<strong>Form</strong>s mentioned in row 3.7. Counter signature <strong>of</strong> the Designated Officer✂✂PART – C(To be affixed on the Register <strong>of</strong> the taxable person)1. Number <strong>of</strong> <strong>Form</strong>s <strong>VAT</strong>-<strong>36</strong> in possession <strong>of</strong> the taxable person2. Number <strong>of</strong> <strong>Form</strong>s issued against this application3. Serial Number <strong>of</strong> <strong>Form</strong>s issued From : To:4. Date <strong>of</strong> issue <strong>of</strong> <strong>Form</strong>s5.Total Number <strong>of</strong> <strong>VAT</strong>-<strong>36</strong> <strong>Form</strong>s available with the taxableperson.6. Signature <strong>of</strong> the taxable person in token <strong>of</strong> having received the<strong>for</strong>ms mentioned in row 3.7. Counter signature <strong>of</strong> the Designated Officer.

FORM <strong>VAT</strong>- <strong>36</strong>–B[ <strong>See</strong> <strong>rule</strong> <strong>65</strong> ]Register Showing Account <strong>of</strong> the <strong>Form</strong> <strong>VAT</strong>-<strong>36</strong>.1. Place: District :2. Registration Number :3. Name & Address <strong>of</strong> the taxable person:Sr.No.Name <strong>and</strong>address <strong>of</strong> thedealer <strong>of</strong> the otherStateRegistrationcertificateNo. <strong>of</strong> thedealermentionedin Col. 2Particulars <strong>of</strong>the goodimported /exportedBillNo.<strong>and</strong>dateValue <strong>of</strong><strong>goods</strong>imported /exportedSerial No.<strong>of</strong> <strong>VAT</strong>-<strong>36</strong><strong>Form</strong>sissuedDate<strong>of</strong>issue1. 2. 3. 4. 5. 6. 7. 8. 9.Remarks

FORM <strong>VAT</strong>-<strong>36</strong>C[ <strong>See</strong> <strong>rule</strong> <strong>65</strong> ]INDEMNITY BONDKnow all men by these presents that I/We______________ (Full address <strong>of</strong> the taxableperson)_______________________ registered under the Punjab Value Added Tax Act, 2005 under registration No.______________ dated ______________ In the state <strong>of</strong> Punjab (hereinafter called the Obliger) am/are held <strong>and</strong> firmly bound up toGovernment <strong>of</strong> Punjab (hereinafter called the Government) in the sum <strong>of</strong> ______________ (rupees in words) (hereinafter referred toas “the said sum”) to be paid to the Government on dem<strong>and</strong> <strong>for</strong> which payment well <strong>and</strong> truly be made. I/we bind myself/ourselves<strong>and</strong> my/our heirs, executors administrators, legal representatives <strong>and</strong> assigns <strong>and</strong> the persons <strong>for</strong> the time being having control overmy/our assets <strong>and</strong> affairs by these presents.Signed this ______________day <strong>of</strong> ______________ two thous<strong>and</strong> <strong>and</strong> ____________________________Whereas clause (e) <strong>of</strong> sub <strong>rule</strong> (2) <strong>of</strong> Rule 52 <strong>of</strong> the Punjab Value Added Tax Rules, 2005 requires that in the event ablank or a duly completed <strong>for</strong>m <strong>VAT</strong>-<strong>36</strong> is lost while it is in the custody <strong>of</strong> the purchasing dealer or the selling dealer or in transit asthe case may be, is required to furnish an indemnity bond. In the case <strong>of</strong> the dealer registered in the State <strong>of</strong> Punjab, the indemnitybond is to be furnished to the Assessing Officer from whom the said <strong>for</strong>m was obtained <strong>and</strong> in the case <strong>of</strong> a dealer <strong>of</strong> other State tothe notified authority <strong>of</strong> his State.And whereas the obliger herein is a taxable person <strong>of</strong> Punjab/ other State.And whereas the obliger has lost the declaration <strong>Form</strong> <strong>VAT</strong>-<strong>36</strong> bearingNo___________________________________________ which was blank/duly completed <strong>and</strong> was issued by Designated Officer__________________ <strong>and</strong> which was issued by me/us to ___________________ (taxable person <strong>of</strong> other State) / received by me/usfrom __________________ (name <strong>of</strong> the taxable person <strong>of</strong> Punjab) in respect <strong>of</strong> the <strong>goods</strong> mentioned below:Sr.No. No. <strong>of</strong> bill / invoice / challan DateDescription <strong>of</strong> <strong>goods</strong> Quantity AmountNow the condition <strong>of</strong> the above written bond is such that the obliger shall in the event <strong>of</strong> a loss suffered by theGovernment (in respect <strong>of</strong> which the decision <strong>of</strong> the Government or the authority appointed <strong>for</strong> the purpose, shall be final <strong>and</strong>bonding on the obliger) as a result <strong>of</strong> the misuse <strong>of</strong> the <strong>for</strong>m, pay to the Government on dem<strong>and</strong> <strong>and</strong> without demur the said sum <strong>of</strong>Rs______________ Rupees (in words)________________________ <strong>and</strong> shall otherwise indemnity <strong>and</strong> Government as a result <strong>of</strong> themisuse <strong>of</strong> such <strong>for</strong>m, then the above written bond shall be void <strong>and</strong> <strong>of</strong> on effect but otherwise shall remain in full <strong>for</strong>ce effect <strong>and</strong>virtue. The obliger further undertakes to mortgage/charge to properties specified in the schedule here under written by execution <strong>of</strong>proper deed <strong>of</strong> mortgage/charge <strong>for</strong> the Payment <strong>of</strong> the said sum.SCHEDULE(Give details <strong>of</strong> properties mortgaged/charged)And these presents also witnesseth that the liability <strong>of</strong> the obliger hereunder shall not be impaired or discharged byreason <strong>of</strong> any <strong>for</strong>bearance, act or omission <strong>of</strong> the Government or <strong>for</strong> any time being granted or indulgence shown by theGovernment.The Government agrees to bear the stamp duty, if any, chargeable on these presents.In witness where<strong>of</strong> the obliger has set his h<strong>and</strong>/has caused these presents executed by his authorised representatives onthe day month <strong>and</strong> year above written in the presence <strong>of</strong>: -1. ________________________2. ________________________(Obliger’s Signature)Accepted <strong>for</strong> <strong>and</strong> on behalf <strong>of</strong> the Governor <strong>of</strong> Punjab by name <strong>and</strong> designation <strong>of</strong> the <strong>of</strong>ficer duly authorised in pursuance<strong>of</strong> Article 299 (1) <strong>of</strong> the Constitution <strong>of</strong> India, to accept the Bond <strong>for</strong> <strong>and</strong> on behalf <strong>of</strong> the Governor <strong>of</strong> Punjab. In the presence <strong>of</strong>: -1. ________________________2. ________________________(Signature <strong>of</strong> the Designated <strong>of</strong>ficer with name,designation <strong>and</strong> seal

![FORM N [See rule 8B] Application for registration as a ... - Webtel](https://img.yumpu.com/50110806/1/190x245/form-n-see-rule-8b-application-for-registration-as-a-webtel.jpg?quality=85)

![FORM NO. 10BC [See rule 17CA] Audit report under (sub-rule (12 ...](https://img.yumpu.com/48904704/1/190x245/form-no-10bc-see-rule-17ca-audit-report-under-sub-rule-12-.jpg?quality=85)

![Form VAT- N1 [See rule 16(1) table] Notice under section ... - Webtel](https://img.yumpu.com/47558518/1/158x260/form-vat-n1-see-rule-161-table-notice-under-section-webtel.jpg?quality=85)

![FORM VAT-2 [See rule 3,28,32,37 & 46] CHALLLAN A (To be ...](https://img.yumpu.com/47239213/1/158x260/form-vat-2-see-rule-3283237-46-challlan-a-to-be-.jpg?quality=85)

![FORM NO.16B [See rule 31(3A)] Certificate under section 203 of the ...](https://img.yumpu.com/47160832/1/190x245/form-no16b-see-rule-313a-certificate-under-section-203-of-the-.jpg?quality=85)