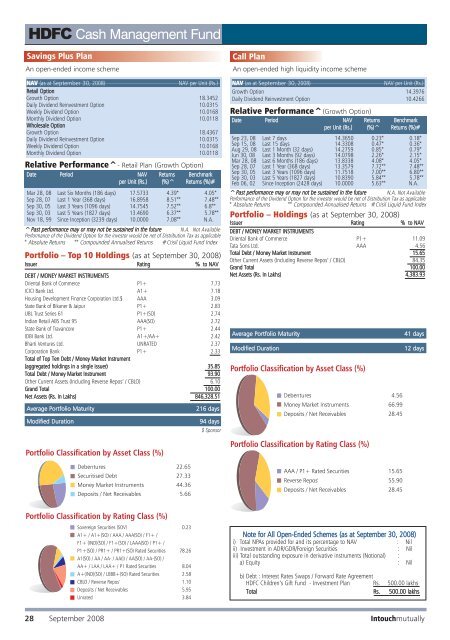

hdfc-dt1.qxd 10/8/20<strong>08</strong> 4:16 PM Page 3<strong>HDFC</strong> Cash Management <strong>Fund</strong>Savings Plus PlanAn open-ended income schemeNAV (as at <strong>Sep</strong>tember 30, 20<strong>08</strong>)NAV per Unit (Rs.)Retail OptionGrowth Option 18.3452Daily Dividend Reinvestment Option 10.0315Weekly Dividend Option 10.0168Monthly Dividend Option 10.0118Wholesale OptionGrowth Option 18.4367Daily Dividend Reinvestment Option 10.0315Weekly Dividend Option 10.0168Monthly Dividend Option 10.0118Relative Per<strong>for</strong>mance^- Retail Plan (Growth Option)Date Period NAV Returns Benchmarkper Unit (Rs.) (%)^ Returns (%)#Mar 28, <strong>08</strong> Last Six Months (186 days) 17.5733 4.39* 4.05*<strong>Sep</strong> 28, 07 Last 1 Year (368 days) 16.8958 8.51** 7.48**<strong>Sep</strong> 30, 05 Last 3 Years (1096 days) 14.7545 7.52** 6.8**<strong>Sep</strong> 30, 03 Last 5 Years (1827 days) 13.4690 6.37** 5.78**Nov 18, 99 Since Inception (3239 days) 10.0000 7.<strong>08</strong>** N.A.^Past per<strong>for</strong>mance may or may not be sustained in <strong>the</strong> future N.A. Not AvailablePer<strong>for</strong>mance <strong>of</strong> <strong>the</strong> Dividend Option <strong>for</strong> <strong>the</strong> investor would be net <strong>of</strong> Distribution Tax as applicable* Absolute Returns ** Compounded Annualised Returns #Crisil Liquid <strong>Fund</strong> IndexPortfolio – Top 10 Holdings (as at <strong>Sep</strong>tember 30, 20<strong>08</strong>)Issuer Rating % to NAVDEBT / MONEY MARKET INSTRUMENTSOriental Bank <strong>of</strong> Commerce P1+ 7.73ICICI Bank Ltd. A1+ 7.18Housing Development Finance Corporation Ltd.$ AAA 3.09State Bank <strong>of</strong> Bikaner & Jaipur P1+ 2.83UBL Trust Series 61 P1+(SO) 2.74Indian Retail ABS Trust 95 AAA(SO) 2.72State Bank <strong>of</strong> Travancore P1+ 2.44IDBI Bank Ltd. A1+/AA+ 2.42Bharti Ventures Ltd. UNRATED 2.37Corporation Bank P1+ 2.33Total <strong>of</strong> Top Ten Debt / Money Market Instrument(aggregated holdings in a single issuer) 35.85Total Debt / Money Market Instrument 93.90O<strong>the</strong>r Current Assets (Including Reverse Repos’ / CBLO) 6.10Grand Total 100.00Net Assets (Rs. In Lakhs) 846,328.51Call PlanAn open-ended high liquidity income schemeNAV (as at <strong>Sep</strong>tember 30, 20<strong>08</strong>)NAV per Unit (Rs.)Growth Option 14.3976Daily Dividend Reinvestment Option 10.4266Relative Per<strong>for</strong>mance^(Growth Option)Date Period NAV Returns Benchmarkper Unit (Rs.) (%)^ Returns (%)#<strong>Sep</strong> 23, <strong>08</strong> Last 7 days 14.3650 0.23* 0.18*<strong>Sep</strong> 15, <strong>08</strong> Last 15 days 14.33<strong>08</strong> 0.47* 0.36*Aug 29, <strong>08</strong> Last 1 Month (32 days) 14.2759 0.85* 0.79*Jun 30, <strong>08</strong> Last 3 Months (92 days) 14.0798 2.26* 2.15*Mar 28, <strong>08</strong> Last 6 Months (186 days) 13.8338 4.<strong>08</strong>* 4.05*<strong>Sep</strong> 28, 07 Last 1 Year (368 days) 13.3579 7.72** 7.48**<strong>Sep</strong> 30, 05 Last 3 Years (1096 days) 11.7518 7.00** 6.80**<strong>Sep</strong> 30, 03 Last 5 Years (1827 days) 10.8390 5.84** 5.78**Feb 06, 02 Since Inception (2428 days) 10.0000 5.63** N.A.^Past per<strong>for</strong>mance may or may not be sustained in <strong>the</strong> future N.A. Not AvailablePer<strong>for</strong>mance <strong>of</strong> <strong>the</strong> Dividend Option <strong>for</strong> <strong>the</strong> investor would be net <strong>of</strong> Distribution Tax as applicable* Absolute Returns ** Compounded Annualised Returns #Crisil Liquid <strong>Fund</strong> IndexPortfolio – Holdings (as at <strong>Sep</strong>tember 30, 20<strong>08</strong>)Issuer Rating % to NAVDEBT / MONEY MARKET INSTRUMENTSOriental Bank <strong>of</strong> Commerce P1+ 11.09Tata Sons Ltd. AAA 4.56Total Debt / Money Market Instrument 15.65O<strong>the</strong>r Current Assets (Including Reverse Repos’ / CBLO) 84.35Grand Total 100.00Net Assets (Rs. In Lakhs) 4,383.93Average Portfolio MaturityModified Duration41 days12 daysAverage Portfolio MaturityModified Duration216 days94 days$ SponsorNote <strong>for</strong> All Open-Ended Schemes (as at <strong>Sep</strong>tember 30, 20<strong>08</strong>)i) Total NPAs provided <strong>for</strong> and its percentage to NAV : Nilii) Investment in ADR/GDR/Foreign Securities : Niliii) Total outstanding exposure in derivative instruments (Notional) :a) Equity : Nilb) Debt : Interest Rates Swaps / Forward Rate Agreement<strong>HDFC</strong> Children’s Gift <strong>Fund</strong> - Investment Plan Rs. 500.00 lakhsTotal Rs. 500.00 lakhs28 <strong>Sep</strong>tember 20<strong>08</strong> Intouchmutually

hdfc-div.qxd 10/8/20<strong>08</strong> 4:15 PM Page 1Dividend History ^<strong>HDFC</strong> Cash Management <strong>Fund</strong>Savings Plus Plan (Daily Dividend Option) (Last 6 <strong>month</strong>s)Month Record Date Ex-dividend NAV per Unit (Rs.) Aggregate Dividend Per Unit (Re.)<strong>for</strong> <strong>the</strong> <strong>month</strong> Individuals & HUF O<strong>the</strong>rsRetail OptionApril 20<strong>08</strong> Daily 10.0315 0.0549 0.0511May 20<strong>08</strong> Daily 10.0315 0.0527 0.0489June 20<strong>08</strong> Daily 10.0315 0.0545 0.0507July 20<strong>08</strong> Daily 10.0315 0.06<strong>08</strong> 0.0564August 20<strong>08</strong> Daily 10.0315 0.0661 0.0614<strong>Sep</strong>tember 20<strong>08</strong> Daily 10.0315 0.0582 0.0542Wholesale OptionApril 20<strong>08</strong> Daily 10.0315 0.0583 0.0545May 20<strong>08</strong> Daily 10.0315 0.0553 0.0520June 20<strong>08</strong> Daily 10.0315 0.0576 0.0539July 20<strong>08</strong> Daily 10.0315 0.0640 0.0600August 20<strong>08</strong> Daily 10.0315 0.0691 0.0644<strong>Sep</strong>tembe 20<strong>08</strong> Daily 10.0315 0.0603 0.0558Record Cum Div Dividend Per unit (Re.) ForDate NAV (Rs.) Individuals & HUF O<strong>the</strong>rsRetail PlanApr 07, <strong>08</strong> 10.0298 0.0138 0.0129Apr 15, <strong>08</strong> 10.0309 0.0148 0.0138Apr 21, <strong>08</strong> 10.0269 0.0113 0.0105Apr 28, <strong>08</strong> 10.0289 0.0131 0.0122May 05, <strong>08</strong> 10.0290 0.0131 0.0122May 12, <strong>08</strong> 10.0287 0.0129 0.0120May 20, <strong>08</strong> 10.0313 0.0151 0.0141May 26, <strong>08</strong> 10.0270 0.0114 0.0106Jun 02, <strong>08</strong> 10.0296 0.0136 0.0127Jun 09, <strong>08</strong> 10.0291 0.0133 0.0123Jun 16, <strong>08</strong> 10.0295 0.0136 0.0126Jun 23, <strong>08</strong> 10.0294 0.0135 0.0126Jul 07, <strong>08</strong> 10.0297 0.0138 0.0128Jul 14, <strong>08</strong> 10.0300 0.0140 0.0131Jul 21, <strong>08</strong> 10.0302 0.0142 0.0133Jul 28, <strong>08</strong> 10.0306 0.0145 0.0135Aug 04, <strong>08</strong> 10.0306 0.0145 0.0135Aug 11, <strong>08</strong> 10.0309 0.0148 0.0138Aug 18, <strong>08</strong> 10.0313 0.0151 0.0141Aug 25, <strong>08</strong> 10.0310 0.0148 0.0138<strong>Sep</strong> 01, <strong>08</strong> 10.0310 0.0149 0.0139<strong>Sep</strong> <strong>08</strong>, <strong>08</strong> 10.0312 0.0151 0.0140<strong>Sep</strong> 15, <strong>08</strong> 10.0312 0.0150 0.0140<strong>Sep</strong> 22, <strong>08</strong> 10.0323 0.0160 0.0149<strong>Sep</strong> 29, <strong>08</strong> 10.0323 0.0160 0.0149Weekly Dividend Option (Last 6 <strong>month</strong>s)Record Cum Div Dividend Per unit (Re.) ForDate NAV (Rs.) Individuals & HUF O<strong>the</strong>rsWholesale PlanApr 07, <strong>08</strong> 10.03<strong>08</strong> 0.0147 0.0136Apr 15, <strong>08</strong> 10.0321 0.0159 0.0148Apr 21, <strong>08</strong> 10.0276 0.0119 0.0111Apr 28, <strong>08</strong> 10.0299 0.0139 0.0129May 05, <strong>08</strong> 10.0299 0.0139 0.0129May 12, <strong>08</strong> 10.0295 0.0136 0.0127May 20, <strong>08</strong> 10.0323 0.0161 0.0149May 26, <strong>08</strong> 10.0277 0.0120 0.0111Jun 02, <strong>08</strong> 10.0305 0.0145 0.0135Jun 09, <strong>08</strong> 10.0299 0.0140 0.0130Jun 16, <strong>08</strong> 10.0304 0.0144 0.0134Jun 23, <strong>08</strong> 10.0304 0.0144 0.0134Jul 07, <strong>08</strong> 10.0306 0.0146 0.0136Jul 14, <strong>08</strong> 10.0310 0.0149 0.0139Jul 21, <strong>08</strong> 10.0312 0.0150 0.0140Jul 28, <strong>08</strong> 10.0315 0.0153 0.0143Aug 04, <strong>08</strong> 10.0314 0.0153 0.0143Aug 11, <strong>08</strong> 10.0318 0.0156 0.0145Aug 18, <strong>08</strong> 10.0319 0.0157 0.0146Aug 25, <strong>08</strong> 10.0317 0.0155 0.0144<strong>Sep</strong> 01, <strong>08</strong> 10.0318 0.0156 0.0145<strong>Sep</strong> <strong>08</strong>, <strong>08</strong> 10.0322 0.0160 0.0149<strong>Sep</strong> 15, <strong>08</strong> 10.0318 0.0157 0.0146<strong>Sep</strong> 22, <strong>08</strong> 10.0327 0.0164 0.0152<strong>Sep</strong> 29, <strong>08</strong> 10.0328 0.0165 0.0154Monthly Dividend Option (Last 6 <strong>month</strong>s)Record Cum Div Dividend Per unit (Re.) ForDate NAV (Rs.) Individuals & HUF O<strong>the</strong>rsRetail OptionApril 28, <strong>08</strong> 10.0697 0.0531 0.0494May 26, <strong>08</strong> 10.0691 0.0526 0.0490July 28, <strong>08</strong> 10.0737 0.0567 0.0527August 25, <strong>08</strong> 10.0768 0.0594 0.0553<strong>Sep</strong>tember 29, <strong>08</strong> 10.0973 0.0773 0.0720Wholesale OptionApril 28, <strong>08</strong> 10.0735 0.0565 0.0526May 26, <strong>08</strong> 10.0725 0.0556 0.0517July 28, <strong>08</strong> 10.0776 0.0601 0.0559August 25, <strong>08</strong> 10.<strong>08</strong>01 0.0623 0.0579<strong>Sep</strong>tember 29, <strong>08</strong> 10.1006 0.<strong>08</strong>02 0.0747^ Past per<strong>for</strong>mance may or may not be sustained in <strong>the</strong> future.All dividends are on face value <strong>of</strong> Rs.10 per Unit. After payment <strong>of</strong> <strong>the</strong> dividend, <strong>the</strong> per Unit NAV will fall to<strong>the</strong> extent <strong>of</strong> <strong>the</strong> payout and statutory levy.<strong>HDFC</strong> Cash Management <strong>Fund</strong>Savings Plan (Daily Dividend Reinvestment Option) (Last 6 <strong>month</strong>s)Month Record Date Ex-dividend NAV per Unit (Rs.) Aggregate Dividend Per Unit (Re.)<strong>for</strong> <strong>the</strong> <strong>month</strong> Individuals & HUF O<strong>the</strong>rsApril 20<strong>08</strong> Daily 10.6364 0.0555 0.0555May 20<strong>08</strong> Daily 10.6364 0.0577 0.0577June 20<strong>08</strong> Daily 10.6364 0.0563 0.0563July 20<strong>08</strong> Daily 10.6364 0.0591 0.0591August 20<strong>08</strong> Daily 10.6364 0.0655 0.0655<strong>Sep</strong>tember 20<strong>08</strong> Daily 10.6364 0.0623 0.0623Record Cum Div Dividend Per unit (Re..) ForDate NAV (Rs.) Individuals & HUF O<strong>the</strong>rsApr 04, <strong>08</strong> 10.6428 0.0141 0.0141Apr 11, <strong>08</strong> 10.6411 0.0128 0.0128Apr 21, <strong>08</strong> 10.6491 0.0190 0.0190Apr 25, <strong>08</strong> 10.6340 0.0073 0.0073May 02, <strong>08</strong> 10.6410 0.0127 0.0127May 09, <strong>08</strong> 10.6410 0.0127 0.0127May 16, <strong>08</strong> 10.6415 0.0131 0.0131May 23, <strong>08</strong> 10.6415 0.0131 0.0131May 30, <strong>08</strong> 10.6419 0.0134 0.0134Jun 06, <strong>08</strong> 10.6417 0.0100 0.0100Jun 13, <strong>08</strong> 10.6419 0.0100 0.0100Jun 20, <strong>08</strong> 10.6422 0.0100 0.0100Jun 27, <strong>08</strong> 10.6425 0.0100 0.0100Weekly Dividend Option (Last 6 <strong>month</strong>s)Record Cum Div Dividend Per unit (Re.) ForDate NAV (Rs.) Individuals & HUF O<strong>the</strong>rsJul 04, <strong>08</strong> 10.6421 0.0136 0.0136Jul 11, <strong>08</strong> 10.6423 0.0137 0.0137Jul 18, <strong>08</strong> 10.6422 0.0137 0.0137Jul 25, <strong>08</strong> 10.6431 0.0143 0.0143Aug 01, <strong>08</strong> 10.6429 0.0142 0.0142Aug <strong>08</strong>, <strong>08</strong> 10.6433 0.0145 0.0145Aug 18, <strong>08</strong> 10.6521 0.0213 0.0213Aug 22, <strong>08</strong> 10.6356 0.0<strong>08</strong>5 0.0<strong>08</strong>5Aug 29, <strong>08</strong> 10.6435 0.0147 0.0147<strong>Sep</strong> 05, <strong>08</strong> 10.6438 0.0149 0.0149<strong>Sep</strong> 12, <strong>08</strong> 10.6436 0.0147 0.0147<strong>Sep</strong> 19, <strong>08</strong> 10.6440 0.0151 0.0151<strong>Sep</strong> 26, <strong>08</strong> 10.6443 0.0153 0.0153<strong>HDFC</strong> Cash Management <strong>Fund</strong> (Call Plan)Daily Dividend Reinvestment Option (Last 6 <strong>month</strong>s)Month Record Date Ex-dividend NAV per Unit (Rs.) Aggregate Dividend Per Unit (Re.)<strong>for</strong> <strong>the</strong> <strong>month</strong> Individuals & HUF O<strong>the</strong>rsApril <strong>08</strong> Daily 10.4266 0.0381 0.0381May <strong>08</strong> Daily 10.4266 0.0478 0.0478June <strong>08</strong> Daily 10.4266 0.0503 0.0503July <strong>08</strong> Daily 10.4266 0.0543 0.0543August <strong>08</strong> Daily 10.4266 0.0598 0.0598<strong>Sep</strong>tember <strong>08</strong> Daily 10.4266 0.0633 0.0633<strong>HDFC</strong> Liquid <strong>Fund</strong>(Daily Dividend Reinvestment Option) (Last 6 <strong>month</strong>s)Month Record Date Ex-dividend NAV per Unit (Rs.) Aggregate Dividend Per Unit (Re.)<strong>for</strong> <strong>the</strong> <strong>month</strong> Individuals & HUF O<strong>the</strong>rsApril 20<strong>08</strong> Daily 10.1982 0.0529 0.0529May 20<strong>08</strong> Daily 10.1982 0.0554 0.0554June 20<strong>08</strong> Daily 10.1982 0.0543 0.0543July 20<strong>08</strong> Daily 10.1982 0.0576 0.0576August 20<strong>08</strong> Daily 10.1982 0.0621 0.0621<strong>Sep</strong>tember 20<strong>08</strong> Daily 10.1982 0.0591 0.0591<strong>HDFC</strong> Liquid <strong>Fund</strong>Monthly Dividend Option (Last 6 <strong>month</strong>s)Record Date Cum Dividend NAV (Rs.) Dividend Per unit (Re.) ForIndividuals & HUFO<strong>the</strong>rsApr 28, <strong>08</strong> 10.3273 0.0501 0.0501May 26, <strong>08</strong> 10.3274 0.0502 0.0502July 28, <strong>08</strong> 10.3323 0.0540 0.0540Aug 25, <strong>08</strong> 10.3342 0.0555 0.0555<strong>Sep</strong> 29, <strong>08</strong> 10.3535 0.0704 0.0704<strong>HDFC</strong> Liquid <strong>Fund</strong> - Premium Plan(Daily Dividend Option) (Last 6 <strong>month</strong>s)Month Record Date Ex-dividend NAV per Unit (Rs.) Aggregate Dividend Per Unit (Re.)<strong>for</strong> <strong>the</strong> <strong>month</strong> Individuals & HUF O<strong>the</strong>rsApril 20<strong>08</strong> Daily 12.2598 0.0643 0.0643May 20<strong>08</strong> Daily 12.2598 0.0672 0.0672June 20<strong>08</strong> Daily 12.2598 0.0640 0.0640July 20<strong>08</strong> Daily 12.2598 0.0696 0.0696August 20<strong>08</strong> Daily 12.2598 0.0751 0.0751<strong>Sep</strong>tember 20<strong>08</strong> Daily 12.2598 0.0719 0.0719Intouchmutually<strong>Sep</strong>tember 20<strong>08</strong> 29