Full Annual Report (PDF - 5.4MB) - Impala Platinum

Full Annual Report (PDF - 5.4MB) - Impala Platinum

Full Annual Report (PDF - 5.4MB) - Impala Platinum

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

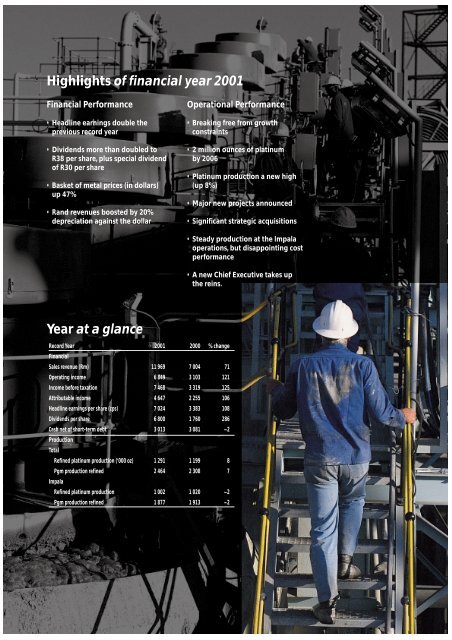

Highlights of financial year 2001Financial Performance• Headline earnings double theprevious record year• Dividends more than doubled toR38 per share, plus special dividendof R30 per share• Basket of metal prices (in dollars)up 47%• Rand revenues boosted by 20%depreciation against the dollarOperational Performance• Breaking free from growthconstraints• 2 million ounces of platinumby 2006• <strong>Platinum</strong> production a new high(up 8%)• Major new projects announced• Significant strategic acquisitions• Steady production at the <strong>Impala</strong>operations, but disappointing costperformance• A new Chief Executive takes upthe reins.Year at a glanceRecord Year 2001 2000 % changeFinancialSales revenue (Rm) 11 969 7 004 71Operating income 6 849 3 103 121Income before taxation 7 468 3 319 125Attributable income 4 647 2 255 106Headline earnings per share (cps) 7 024 3 383 108Dividends per share 6 800 1 760 286Cash net of short-term debt 3 013 3 081 –2ProductionTotalRefined platinum production (‘000 oz) 1 291 1 199 8Pgm production refined 2 464 2 308 7<strong>Impala</strong>Refined platinum production 1 002 1 020 –2Pgm production refined 1 877 1 913 –2

Chairman’s letter to shareholdersGroup structureChief Executive Officer’s reviewFive year statisticsValue-added statementFinancial reviewMarket reviewReview of operations<strong>Impala</strong> <strong>Platinum</strong>WinnaarshoekCrocodile River<strong>Impala</strong> Refining ServicesStrategic holdingsExplorationReserves and resourcesCorporate responsibilityCorporate governanceGlossary of termsManagementDirectorsApproval of the annual financial statements<strong>Report</strong> of the independent auditorsDirectors’ reportIncome statementsBalance sheetsStatements of changes in equityCash flow statementsAccounting policiesNotes to the financial statementsNotice to shareholdersShareholder informationAdministrationProxy3671419212529293537394145495358606364666768747576787984114115116117Contents

3Chairman’s letter to shareholdersDear shareholder,It is my pleasure to present to you this report ona fourth great year in a row for your company.Last year, in recording record earnings anddividends, I rather conservatively forecast "A wellpositioned group, operating strongly andgrowing well in a firmer market suggests evenbetter results next year". While all the goodpresumptions about the company did come topass, the "firmer market" which eventuatedsurprised even the most bullish among us.The extent to which the automotive industry,with its over-dependence on palladium, washostage to Russian ability to manage this marketstruck home during the year, resulting in franticactivity to secure supplies (and to build stock) atalmost any price. Palladium, which historicallyhas traded at about one third of the price ofplatinum, overtook it first in January 2000, goingon a year later to peak, in January of this year at$1 100 per ounce (a premium of 66% to theruling platinum price).Parallel activities by autocatalyst manufacturersto move back from palladium rich to platinum(and rhodium)-based catalysis gatheredmomentum during the latter part of the year.Confidence in these developments and firmerforecasts of future palladium needs resulted insubstantial consumption of their own palladiumstocks by the automotive industry, withcorrespondingly reduced buying levels in thefree market. Palladium has “come off the boil”, asthe market searches for its new equilibrium, andis now trading at a small discount once again toplatinum.The platinum market was caught up in thesentiment surrounding palladium, and while thiswas great on the way up, it is not so much funon the way down. The realities of the platinummarket in its own right should re-assertthemselves in the next few months. Thesecentre around rising autocatalyst demand, andincreased jewellery demand in China (as thedollar price falls), offset by weaker jewellerydemand in an economically depressed Japanand growth in supply from South Africa. Weanticipate these fundamentals supportinghigher long-term prices than those seen in thecurrent market.Implats has often been characterised in the pastas “resource constrained”. While the ability of our<strong>Impala</strong> operations at Rustenburg to produce atone million ounces of platinum per year formany years to come is well known, the group’sgrowth strategy, some years in the building, isnow delivering tangible results as follows:• Owned and managed orebodies – <strong>Impala</strong>,Crocodile River, Kennedy’s Vale we already had,but now there is Winnaarshoek, the site of amajor new mine• Significant stakes in other mining companies,delivering an equity share in the mining andfull ownership of the pgm concentrates –Zimplats, Mimosa and Aquarius• A 27% equity stake in Lonplats, which is in theprocess of expanding by 25%Cents50 00045 00040 00035 00030 00025 00020 00015 00010 0005 0000Jan 98Mar 98May 98Jul 98Sep 98Nov 98Jan 99Mar 99May 99Jul 99Sep 99Nov 99Jan 00Mar 00May 00Jul 00Sep 00Nov 00Jan 01Mar 01May 01Jul 01Share price

chairman’s letter to shareholders• Partnerships with other producers deliveringfull ownership of pgm concentrates – Messina,Kroondal, Marikana and Two Rivers.The successes of this strategy are:• The implied reserve of pgms to be producedand sold by Implats has increased by 60%• The group, currently a 1.3 million ounceplatinum producer, is poised to reach 2 millionounces by 2006 (excluding our participation inLonplats’ growth).Of the business structures outlined above,owning and managing a complete orebody hasthe highest profit margins, but it is also thehighest risk and the most capital intensive. Theother businesses, from their lower profit bases,are equally dynamic when viewed from otherperspectives such as return on investment.The major disappointment of the year was oursafety performance. I regret to record theaccidental deaths of 13 of our number duringthe year, an increase of six on the previous year.After two years in a row where our fatalityfrequency rate (0.09 per million man hours) metthe international benchmark of Ontariostandards, this slippage to 0.16 has shaken theorganisation. Most perplexing is the fact that theunderlying trend of our Lost Time InjuryFrequency Rate has shown huge improvementfrom more than 20 two years ago, to 12.6 lastyear and 8.5 this year. The search for answersand for safer working conditions continues. Ourdeepest sympathies are extended to thebereaved.The financial disappointment of the year wasthe cost escalation at our Rustenburgoperations. Although total Rand costs per ounceof platinum sold increased by a respectable 7%(just about equal to inflation) on-mine costsincreased by 13% per ton milled and 16% perounce of refined platinum. Most of this is rooted:• In the need for more generous wagesettlements in more successful years, (notingthat labour accounts for more than 50% ofour costs), and• In the costs of meeting the new BasicConditions of Employment Act, and• In an alarming metallurgical performance asnew plants have struggled throughcommissioning.We are dismayed that counter-efforts andproductivity improvements have not done moreto contain the effects of the negativedevelopments (as was the case over thepreceding years). A complete review isunderway.Putting together the steady production from<strong>Impala</strong>, the new production from CrocodileRiver, the concentrate bought in from otherminers, the buoyant market conditions, thesparkling performance of Lonplats and the 20%depreciation of the Rand, we had a year where;• Every measure of income, from operating levelthrough to attributable income, is more thandouble last year’s record.• The attributable income this year was morethan the sales revenue of two years ago – ayear that was then described as "fantastic"• The proposed dividend for the year (excludingthe special dividend of R30 paid in February) is11 times the dividend of three years ago.• The dividends for the year, including thespecial dividend, exceed the share price ofthree years ago.The challenges facing the group are theongoing and obvious one of optimising ourcurrent productive base and, from there,continuing to develop and deliver the growthpotential of the group. All this must take placewithin the ever-changing dynamics of the newSouth Africa. We have much to be proud of inour recent history in terms of labour relations,employment equity, adult education and socialupliftment, but more is required. In particular, thedraft Minerals Development bill has evokedmuch debate. Our input thus far to theDepartment of Minerals and Energy has beenaimed at the production of good law, ratherthan challenging the “use it or lose it” provisions,where we are considerably less threatened thanour competitors.

5The Royal Bafokeng Nation has taken issue withperceived threats in the draft Bill to theirhistorical rights. While we fully support theBafokeng position, it should be noted that,technically, the Bafokeng’s mineral rights, andImplats’ right to mine are two completelyseparate matters.To face all these challenges I am delighted towelcome Keith Rumble, who joined the groupas Chief Executive and Managing Director at thestart of our new financial year. Keith has joinedus after a dynamic career with Rio Tinto, whichin recent times has seen him move from beingthe Managing Director and CEO of Richards BayMinerals to being the President and CEO of itsparent company, Rio Tinto Iron and Titanium inCanada. Keith’s technical background and hisexperience in metalliferous mining andmarketing position him well for success with us.produce results quite a bit better than theprevious year, which at that time was an all-timerecord high for Implats. This is impressiveenough in itself.Based on the performance reported andanticipated, and in line with the more generousend of the dividend policy the Board hasdeclared a dividend for the year of 6 800 cents,including a final dividend of 2 380 cents, payableon 4 October 2001.Michael McMahonChairmanThe only change that occurred to the Boardduring the financial year was the departure dueto poor health of Steve Kearney as MD and CEOin September last year. Although Steve indicatedsome time previously that there were healthBOTSWANAHarareGreat DykeBulawayoZIMBABWEBushveld Complexproblems, his departure was unexpected. Over a10-year period with Implats Steve rose fromConsulting Engineer to MD and latterly to ChiefJohannesburgExecutive. He was at the very centre of theresurgence of Implats, and the Board wishes toNAMIBIArecord its appreciation of his contribution.SOUTH AFRICAThe company was fortunate to have JohnSmithies to step into the gap caused by Steve’sdeparture. John, then Operations Director, hadpreviously indicated his wish to retire early inBOTSWANACape Town2001, but agreed to continue until a long-termappointee was found. John has now retired, withNorthern Limbthe thanks of a grateful Board for the stability,energy and focus he brought to the position,and for the finalisation of so many of the growthprospects that took place during his tenure.With both the platinum and palladium marketsadjusting to structural shifts against abackground of global economic uncertainty wecan be fairly certain that these results will not berepeated next year. In all probability we willImplatsAquariusAvmin JV<strong>Impala</strong>RustenburgKroondalWestern LimbCrocodile RiverMarikanaJohannesburgSOUTH AFRICAEastern LimbWinnaarshoekKennedy’s ValeTwo RiversEverest NorthEverest SouthN

Group structureImplats’ structure is as follows:GencorSAInstitutionsN AmericanInstitutionsEnglish & WelshInstitutionsOther & unclassified46.1%25.2%15.5%7.6%5.6%<strong>Impala</strong><strong>Platinum</strong>HoldingsLimited(Implats)1 4692 290100%✣100%83%10%45%*40%*35%27%<strong>Impala</strong><strong>Platinum</strong>PlatexcoBarplatsAquariusTwo RiversZimplatsZCE <strong>Platinum</strong>Lonplats<strong>Impala</strong> OperationsMineral ProcessesPrecious MetalsRefineryBase MetalsRefinery1002Winnaarshoek0175Crocodile RiverKennedy’s Vale850Kroondal <strong>Platinum</strong>*14.2%Everest South*32%Everest North*32%*Marikana32%✛Dwars Rivier0110✛NgeziHartley – SMC0100✛Mimosa1668Eastern <strong>Platinum</strong>Western <strong>Platinum</strong>178250105081280Key<strong>Platinum</strong> production: (000 oz)Refined production – 2001Forecast production – 2006Attributable production from Lonplats – 2001Attributable forecast production from Lonplats – 2006100%<strong>Impala</strong> RefiningServices (IRS)289990Total attributable production – 2001Total attributable forecast production – 2006OtherProcessing and refining* <strong>Full</strong>y diluted interest✣Up to 20% to be acquired by empowermentpartnersToll refined184162Messina–55✛Post balance sheet transactions

Deliveringshareholder valueRockbolting underground at <strong>Impala</strong>’s 14 shaft.

9growth in China which offset reduced demandin Japan. <strong>Platinum</strong> benefited from increased usein autocatalysts, particularly in diesel vehiclesand growth in computer hard disc and LCDglass applications. Tightening emission controllegislation should continue to boost platinumdemand thereby ensuring a balanced market inthe short to medium term, albeit at prices lowerthan those achieved during 2001.The palladium market experienced strongdemand particularly from the automotive andelectronics sectors exacerbated by erraticsupplies from Russian sources and demandquickly exceeded supply. As a result, palladiumprices nearly doubled leading up to January2001 before retreating as more product wasreleased out of Russia towards the middle of2001. The high prices have acceleratedpalladium substitution in dental and electronicsapplications as well as the conversion back toplatinum/rhodium autocatalyst systems.Accordingly, Implat’s business plan assumesfurther weakening of palladium demand andprices.The long term oversupply forecast for palladiumwill be particularly problematic for the Russianand North American producers who collectivelyproduce around three ounces of palladium forevery ounce of platinum produced. Conversely,the South African producers only generatearound half an ounce of palladium per ounce ofplatinum produced – a distinct competitiveadvantage in the near future.Group safety a priorityThe group safety record produced a mixedresult for the year. The number of fatalitiesincreased unacceptably to 13 from the level ofseven fatalities experienced in both 1999 and2000. Our sincere condolences are extended tothe families and friends of the deceased. The losttime injury rate per million man hours, however,improved by 32% to 8.5 from the rate of 12.6reported in 2000. Fresh initiatives will clearly berequired to lift <strong>Impala</strong>’s safety performance tomatch at least best international undergroundmining practice.Operational reviewTotal platinum production, which includesmetals sourced from concentrate purchasedfrom third parties, increased by 8% to1.29 million ounces.<strong>Platinum</strong> production from the <strong>Impala</strong> lease areadecreased by 1.7% to 1 million ounces ofplatinum. Tons mined from the <strong>Impala</strong> lease areaincreased by 3.3% on the previous year whiletons milled increased by 1.2%. However, latedelivery of the new UG2 concentrator circuit bythe contractor and subsequent problemsexperienced during commissioning had anegative impact on <strong>Impala</strong>’s performance for theyear. As a result, the ore stockpile grew byaround 210 000 tons to 630 000 at year end.The smelter upgrade comprising two newconverters, the enhanced acid plant and new38MW furnace was successfully completed.However, the furnace refractories developedcracks soon after commissioning and, althoughthis did not affect smelter output in 2001, it maynecessitate premature replacement of therefractory bricks. A claim for damages has beenlodged with the supplier of the refractories.The inherent difficulties attendant oncommissioning any major project werecompounded in the case of two significantprojects during the year.• The challenges of recommissioning oldequipment at Crocodile River mine wereexacerbated by an orebody moreheterogenous than sampling had led us tobelieve.1 450• In the case of the UG2 plant expansion,1 350delivery by the contractor was a month late1 250and although the designed 30% increase in1 150capacity has been achieved, recoveries remain1 050disappointingly below those expected. This is950primarily as a result of equipment unreliability 850in the milling circuit which has prevented the 750plant from achieving steady-state production. 650The solution will most likely involve some5507 0243 3831 929804293FY97 FY98 FY99 FY00 FY01Headline earnings per share6 8001 760880350110FY97 FY98 FY99 FY00 FY01Dividends per sharecircuit re-design. 4501997 1998 1999 2000 2001Basket price – US$/oz Pt

Solomon Moatsae on a dumptruck at the open-cast operationat <strong>Impala</strong>’s Rustenburgoperations. The <strong>Impala</strong> leasearea has sufficient reserves andresources to produce just overone million ounces of platinumper annum until 2030.Growingproduction by10% a year

11Cash operating costs per platinum ouncerefined increased by 16% which is not in linewith <strong>Impala</strong>’s objective of delivering realdecreases in the cost of metal produced. Thiswas mainly as a result of mining costs incurredfor ore which was not processed and lowerrecoveries in the new UG2 circuits. An aboveinflation wage increase of 9% also had anadverse impact on costs as well as the additionalcost to the company of some 3% as a result ofcomplying with the Basic Conditions ofEmployment Act, Skills Development Levy andhigher regional services levies.To get <strong>Impala</strong>’s cash operating costs back ontrack to a level below inflation, the businessimprovement process (Fixco) was revitalised andseveral promising initiatives have beenidentified which should yield sustainablebenefits. A number of noteworthy initiativeshave already resulted in productivity increasingfrom 40m 2 to 41m 2 per employee, with a recordlevel of 43m 2 recorded in the month of June2001.Growth from mining andexplorationImplats has previously stated its objective ofgrowing production by 10% per annum.Undoubtedly 2001 will be seen as the year thatdelivery on this objective gained momentum.During this year alone the company addedalmost 37 million attributable resource ouncesof in situ platinum into its portfolio.Implats’ growth strategy comprises three paths,namely:• Mining projects and exploration;• Strategic investments; and• Processing concentrates to leverageprocessing and refining assets.• The Winnaarshoek project, one of Implats’major new ventures, is a combination of thePlatexco acquisition and mineral rights swapswith Anglo American <strong>Platinum</strong> Limited.Production is expected to commence as earlyas 2002 with full production of 175 0000ounces of platinum per annum by 2004. Theagreement with Mmakau Mining (Pty) Limitedand community-based empowermentparticipants in the Northern Province, isillustrative of Implats’ ability to bring newprojects on stream within the context of SouthAfrica’s proposed Minerals Developmentlegislation.• Barplats Mines Limited’s Crocodile River minewas brought into production duringDecember 2000. The planned mining rate of75 000 tons per month was achieved in March2001, although problems experienced withthe re-commissioning of the concentratorresulted in lower than expected pgmconcentrate production. Recovery of preciousmetals during the first four months ofoperation has been below expectations, buthas improved as operations extend into lessweathered ores. A number of mining andmetallurgical improvements are in hand inorder to ensure that the planned productionof 50 000 ounces of platinum per annum isachieved.• In its exploration strategy Implats continuesto pursue projects and joint ventures both inSouth Africa and internationally, focussing onprimary pgm projects which have thepotential to generate quality deposits. Toachieve this, Implats supports juniorexploration companies, providing funding,expertise and access to smelting and refininginfrastructure. In February 2001, Implatsentered into an alliance with internationalgroup Falconbridge to explore jointly for pgmmineralisation on five continents. This alliancehas already identified a number of prospects,with exploration beginning at Cana Brava inBrazil in mid-2001. Exploration continued atthe Kennedy’s Vale project in South Africa andthe Birch Lake and River Valley projects inNorth America.Growth from strategic investments• Delivery from Implats’ 27% stake in Lonplats interms of both production and contribution toearnings was well in excess of expectations.Lonplats is proceeding with expansions tobecome a one million ounce producer and,

CEO’S review1 4692001 2002 2003 2004 2005 2006Implats growth in platinum production■ Managed operations■ Purchased concentrate (equity stake)■ Purchased concentrate (no equity stake) and toll refining■ Attributable oz from Lonplats (27%)1 4691 5531 5531 6951 6951 9301 9302 1112 1112 2902 2902001 2002 2003 2004 2005 2006Implats growth in platinum production■ <strong>Impala</strong> ■ Barplats ■ Aquarius■ Mimosa ■ Toll refining ■ Zimplats■ Winnaarshoek ■ Two Rivers■ Attributable oz from Lonplats (27%)although capital expenditure will remain high,Implats will continue to benefit from thiscompany’s profitability.• Relationships with Aquarius (Implats 10.1%)remain strong. Kroondal was delisted from theJSE Securities Exchange in early August. Goodperformance was once again achieved atKroondal, with platinum production capacitynow increased to an annual rate of 130 000ounces. The Marikana project, scheduled tobegin production in late 2002, has thepotential to yield 75 000 ounces of platinumper annum.• Implats acquired an effective 40% stake in theNgezi-Hartley assets of the Zimplats group.The first phase of production from the Ngeziopen-cast mine is planned for January 2002,with full production of 180 000 tons permonth from March yielding 40 000 ounces ofplatinum during 2002. The operation has thepotential to grow even further in the future.• The successful acquisition of a 35% stake inMimosa <strong>Platinum</strong>, a low cost producer on theGreat Dyke, is another strategic investment inthis region. Mimosa is proceeding with itsexpansion plans to increase platinumproduction by 50 000 ounces to68 000 ounces by 2003.• Through its effective stakes in Zimplats andMimosa, Implats, together with its partners, hasaccess to about 85% of the primary pgmresource of the Great Dyke, which is thelargest undeveloped pgm resource in theworld, second only in importance to SouthAfrica’s Bushveld Complex.• The Two Rivers joint venture with AnglovaalMining Limited should lead to theestablishment of a 100 000 platinum ouncesper annum mine in 2004. This follows thesuccessful bid by the Implats/Avmin jointventure for the Dwars Rivier reserves. Avminwill operate the project, with technical andother input from Implats, while Implats –through subsidiary IRS – will benefit from alife-of-mine concentrate offtake agreementsigned with Two Rivers.Leveraging processingand refining assetsThe above projects, along with the third partyconcentrate purchases and toll-refiningbusiness, will see IRS continuing to deliverrobust growth both in contributions to incomeand in increasing the total ounces of pgmsproduced in the years ahead.Created in July 1998 as a dedicated vehicle tohouse the tolling and metal purchase contractsbuilt up by the group, the concept behind IRShas become a major strategic thrust and hasdelivered another year of phenomenal growth.Production amounted to some 587 000 ouncesof pgms and 9 534 tons of base metals, ofwhich, 267 000 ounces pgm was purchasedfrom third parties and 320 000 ounces was tollrefined.Growth has been generated as a result of bothexisting business and new projects. Productionin terms of existing agreements, such as withKroondal <strong>Platinum</strong> Mines Limited and A1Specialised Services and Supplies Inc(autocatalyst recycling), has continued duringthe year.Implats’ strategic partnership approach will havethe additional benefit of new sources ofconcentrate. During 2002/2003, the group willbenefit from the first scheduled production fromNgezi Mine (Zimplats) and the Marikana Mine(Aquarius), with which it has entered into life-ofmineconcentrate purchase contracts. TheWinnaarshoek project will come into productionduring 2002 and the Two Rivers project, shouldcome into production in 2004. Further out onthe time horizon are Aquarius’ Everest Southproject and Barplats’ Kennedy's Vale project.Challenges and opportunitiesA number of challenges and opportunities lieahead for Implats.• Safety is an area of primary concern.Following several internal and external audits,a programme of behavioural motivation forboth management and employees is being

13undertaken. New safety initiatives will beintroduced in order to achieve a step-changereduction in the number of accidents.• Although Lonplats is expected to continue todeliver excellent returns to Implats during theyear ahead, we recognise that the full value ofthis investment is poorly reflected in theImplats share price. Attention to thisunfinished business continues.• The future of the Gencor shareholding isbeing constructively addressed by the ImplatsBoard, in association with the Board of Gencor,to ensure a satisfactory outcome for theshareholders of both companies.• Implats is proactively managing the impactof HIV/AIDS. A recent anonymous bloodtesting study conducted at <strong>Impala</strong>'s 8 Shaft,confirmed an HIV prevalence of 16% which issignificantly below the levels of 25 to 30%currently reported in the industry. Ananonymous attitude survey also producedencouraging findings indicating high levels ofunderstanding and education amongstemployees regarding HIV/AIDS. During theyear Implats commissioned an independentactuarial report to determine the potentialfinancial impact of HIV/AIDS. The reportindicates that costs for medical treatment,absenteeism, training and costs to maintainproductivity, could amount to R86 million peryear at a peak in 2011. However, if currenteducation and intervention programmes aresuccessful in only halving the rate of newinfections amongst employees, there wouldbe a dramatic reduction in HIV/AIDS costs toR46 million at the expected peak of theepidemic in 2011. This is a credible scenario ifprevalence levels amongst <strong>Impala</strong> employeeshave indeed peaked as our research suggests.Implats spent more than R4 million during theyear on various education and interventionprogrammes and will continue to drive thesethrough our collaborative union/managementHIV/AIDS Committee.• Achieving a rating in the market relative toour competitors which fairly reflects theunderlying value and potential of thecompany, is being addressed. Much work hasbeen done in improving disclosure to theinvesting community and in selling theImplats story to international investors. Therehave been some indications of interest fromemerging market and generalist funds andreaching these potential investors inparticularly Europe and North America is a keygoal.The year aheadProspects for the year ahead remain good, withcontinued delivery in terms of operationalperformance and the coming on stream of thevarious growth projects. The upbeat markets ofthe past 12 to 24 months could not be expectedto continue indefinitely. Based on current marketprices, Implats is therefore anticipating earningslower than for the current year but increasedfrom the levels of 2000 which in itself was arecord year. Global economies seem to beresponding sluggishly to stimuli and aprolonged slowdown may impact on pgmdemand to a greater extent than anticipated inour business plan – with further negative impacton prices. In anticipation of this, Implats hasemphasised process enhancements, as well ascost reduction and productivity initiativesduring the year and is well-placed to capitaliseon these going forward.Keith RumbleChief Executive Officer

Five year statisticsIncome statementfor the year ended 30 June ( R million ) 2001 2000 1999 1998 1997Turnover 11 969.1 7 003.6 4 602.0 3 380.6 2 658.2<strong>Platinum</strong> 5 253.2 3 017.2 2 251.6 2 091.6 1 742.1Palladium 3 129.0 1 689.2 1 031.1 621.3 268.9Rhodium 2 199.1 1 218.0 582.2 238.7 156.1Nickel 700.2 600.4 363.5 216.7 285.7Other 687.6 478.8 373.6 212.3 205.4Cost of sales 5 120.3 3 900.8 2 986.8 2 567.7 2 393.7On-mine operations 2 330.1 1 997.6 1 880.4 1 772.7 1 571.8Concentrating and smelting operations 492.5 440.7 415.3 384.7 351.5Refining operations 333.3 307.9 295.6 262.3 266.4Amortisation of mining assets 212.2 139.9 148.7 135.5 113.1Metals purchased 1 968.8 698.8 287.6 – –Other costs 117.1 96.6 83.2 78.7 104.0(Increase)/decrease in inventory (333.7) 219.3 (124.0) (66.2) (13.1)Operating income 6 848.8 3 102.8 1 615.2 812.9 264.5Other income/(expense) 94.5 62.0 14.2 5.9 4.2Net financial income 383.3 228.2 185.9 44.2 1.8Share of pre-taxation income from associates 1 031.4 332.8 204.3 54.4 21.6Royalty expense (890.3) (406.4) (237.4) (93.1) (5.9)Income before taxation 7 467.7 3 319.4 1 782.2 824.3 286.2Taxation 2 815.2 1 061.9 525.2 325.9 105.6Consolidated income after taxation 4 652.5 2 257.5 1 257.0 498.4 180.6Outside shareholders’ interest 5.4 2.5 5.0 (2.9) (1.6)Attributable income 4 647.1 2 255.0 1 252.0 501.3 182.2Earnings per share ( cents )– Basic 7 024 3 422 1 929 794 293– Diluted 6 970 3 388 1 902 784– Headline (basic) 7 024 3 383 1 929 804 293Dividend per share - interim + proposed final (cents) 3 800 1 760 880 350 110Special dividend per share 3 000 – – – –

15Five year statisticsBalance sheetas at 30 June ( R million ) 2001 2000 1999 1998 1997ASSETSNon-current assets 6 547.8 4 230.3 3 488.5 3 037.9 2 980.3Fixed assets 5 230.6 3 357.3 2 822.2 2 431.2 2 353.7Investments and other 1 317.2 873.0 666.3 606.7 626.6Current assets 5 162.3 4 504.3 3 168.3 2 143.6 1 239.4Total assets 11 710.1 8 734.6 6 656.8 5 181.5 4 219.7EQUITY AND LIABILITIESCapital and reserves 6 430.0 5 625.6 4 043.9 2 943.4 2 452.2Outside shareholders' interest 19.2 13.8 46.9 68.7 71.6Non-current liabilities 1 465.2 1 195.1 1 068.4 1 052.4 1 016.2Borrowings 113.1 137.6 162.3 179.3 194.6Deferred taxation 1 156.1 889.7 745.0 746.9 707.5Provision for long-term responsibilities 196.0 167.8 161.1 126.2 114.1Current liabilities 3 795.7 1 900.1 1 497.6 1 117.0 679.7Total equity and liabilities 11 710.1 8 734.6 6 656.8 5 181.5 4 219.7Cash net of short-term borrowings 3 013.1 3 081.4 1864.9 801.8 219.2Cash, net of all borrowings 2 900.0 2 943.8 1702.6 622.5 24.6Current liquidity (net current assets excludinginventories) 587.3 2 164.6 1 014.5 264.8 (16.0)IMPLATS SHARE STATISTICSNo. of shares in issue at year end (m) 66.3 66.1 65.7 64.0 62.3Average number of issued shares 66.2 65.9 64.9 63.1 62.2Number of shares traded 36.4 31.7 30.1 14.7 11.7Highest price traded (cps) 47 300 29 600 17 200 6 800 6 900Lowest price traded 23 980 15 400 5 100 3 450 4 050Year end closing price 40 360 25 220 15 180 5 050 5 075

Five year statisticsUS$ Information (Unaudited)for the year ended 30 June (US$ Million) 2001 2000 1999 1998 1997Turnover 1 572.8 1 108.2 757.2 682.5 618.1Cost of sales 672.8 616.8 491.4 528.4 528.1On-mine operations 306.2 315.9 309.4 364.7 346.8Concentrating and smelting operations 64.7 69.7 68.3 79.2 77.6Refining operations 43.8 48.7 48.6 54.0 58.8Amortisation 27.9 22.1 24.5 27.9 24.9Metals purchased 258.7 110.5 47.3 – –Other costs 15.4 15.3 13.7 16.2 22.9(Increase)/Decrease in metal inventory (43.8) 34.7 (20.4) (13.6) (2.9)Operating Income 900.0 491.3 265.9 154.1 90.0Other income/(expense) 12.4 9.8 2.2 1.2 0.9Net financial income 50.4 36.1 30.6 9.1 0.4Share of pre-taxation income from associates 135.5 52.6 33.6 11.2 4.8Royalty expense (117.0) (64.3) (39.0) (19.1) (1.3)Income before taxation 981.3 525.6 293.3 156.5 94.8Taxation 369.9 167.9 86.4 67.1 23.3Outside shareholders' interest 0.7 0.4 0.8 (0.6) (0.4)Attributable income 610.7 357.3 206.1 90.1 71.8Earnings per share (cents) 923 542 318 143 115* Note: Income and expenditure have been converted at the average exchange rate for the year. Sales revenue reflects actual dollar receipts.

17Five year statisticsOperating Statisticsfor the year ended 30 June 2001 2000 1999 1998 1997Gross refined production<strong>Platinum</strong> ('000 oz) 1 291 1 199 1 181 1 052 1 002Palladium ('000 oz) 681 636 651 557 497Rhodium ('000 oz) 164 155 159 131 141Nickel ('000 t) 14.0 13.8 14.9 7.7 7.7<strong>Impala</strong> refined production<strong>Platinum</strong> ('000 oz) 1 002 1 020 1 065 1 052 1 002Palladium ('000 oz) 481 493 516 557 497Rhodium ('000 oz) 128 131 143 131 141Nickel ('000 t) 7.0 7.2 7.7 7.7 7.7IRS refined production<strong>Platinum</strong> ('000 oz) 289 179 116 – –Palladium ('000 oz) 200 143 135 – –Rhodium ('000 oz) 36 24 16 – –Nickel ('000 t) 7.0 6.6 7.2 – –IRS returned metal<strong>Platinum</strong> ('000 oz) 164 102 84 – –Palladium ('000 oz) 116 93 104 – –Rhodium ('000 oz) 21 17 8 – –Group consolidated statisticsExchange rate:(R/US$)Closing rate on 30 June 8.06 6.92 6.00 5.48 4.51Average rate achieved 7.68 6.40 6.08 4.94 4.29Free market price index ($/oz) 1 266 914 631 611 532Achieved price index ($/oz) 1 254 855 625 609 576Prices achieved<strong>Platinum</strong> ($/oz) 586 428 358 409 418Palladium ($/oz) 773 465 311 223 130Rhodium ($/oz) 2 001 1 223 719 358 271Nickel ($/ton) 6 951 7 500 4 466 6 062 7 179Sales volume<strong>Platinum</strong> ('000 oz) 1 177 1 209 1 076 1 030 992Palladium ('000 oz) 543 656 585 551 491Rhodium ('000 oz) 145 171 140 129 137Nickel ('000 t) 14.1 14.0 14.9 7.5 7.8

Five year statisticsOperating Statistics (continued)for the year ended 30 June 2001 2000 1999 1998 1997Gross margin achieved (%) 57.2 44.3 35.1 24.0 10.0Return on equity (%) 82.6 55.8 43.7 20.9 7.8Return on assets (%) 71.0 53.3 34.7 16.5 5.9Debt equity ratio 1:47 1:34 1:19 1:14 1:10Current ratio 1.4:1 2.4:1 2.1:1 1.9:1 1.8:1Tons milled ex- mine ('000 tons) 15 184 14 662 14 638 14 509 13 775Pgm refined production ('000 oz) 2 464 2 308 2 299 1 960 1 888Capital expenditure (Rm) 2 090 783 431 248 266(US$m) 275 124 71 51 61<strong>Impala</strong> business segmentTons milled ex- mine ('000 tons) 14 840 14 662 14 638 14 509 13 775Total cost per ton milled 1 (R/ton) 213.2 188.6 179.6 172.2 166.5($/ton) 28.0 29.8 29.5 35.4 36.7Pgm refined production ('000 oz) 1 877 1 913 1 978 1 960 1 888Cost per pgm ounce refined 1 (R/oz) 1 685 1 445 1 329 1 275 1 215($/oz) 221 229 219 262 268Cost per platinum ounce refined 1Total cost of operations (R/oz) 3 156 2 711 2 471 2 369 2 281($/oz) 415 429 407 487 503Net of revenue received for other metals (R/oz) (1 879) (510) 617 1 144 1 366($/oz) (247) (81) 102 235 301Capital expenditure (Rm) 978 732 425 248 266(US$m) 129 116 70 51 61Total <strong>Impala</strong> labour complement ('000) 28.0 28.3 28.7 29.5 31.01. The cost of mining, concentrating, smelting, refining, marketing, head office and insurance claim as expressed per unit

19Value added statementfor the year ended 30 June (R million) 2001 % Change 2000Group sales revenue 11 969.1 70.9 7 003.6Net cost of products and services 3 138.5 42.3 2 206.2Value added by operations 8 830.6 84.1 4 797.4Income from investments and interest 1 521.1 135.6 645.7TOTAL VALUE ADDED 10 351.7 90.2 5 443.1Applied as follows to:Employees as salaries, wages and fringe benefits 1 734.7 13.1 1 534.3The state as direct taxes 2 815.2 165.1 1 061.9Royalty recipients 925.2 116.8 426.8Providers of capital 3 885.0 441.8 717.1Financing costs 17.3 31.3 25.2Dividends 3 867.7 459.0 691.9TOTAL VALUE DISTRIBUTED 9 360.1 150.3 3 740.1Re-invested in the group 991.6 41.8 1 703.0Amortisation and depreciation 212.2 51.7 139.9Reserves retained 779.4 50.1 1 563.110 351.7 90.2 5 443.1(36.1%)(16.8%)(9.6%)(27.4%)(28.2%)(37.5%)(13.2%)(31.3%)2001 2000■ Employer costs ■ Retained for future growth ■ Capital providers ■ Taxation and royalties

Rockdrill operator Robert Mohohloat <strong>Impala</strong> <strong>Platinum</strong>’s12 shaft. Production efficienciesrose during the year from 40m 2 peremployee to 41m 2 per employee,which equals <strong>Impala</strong>’s recordachieved in 1999.Exceptionalyear for Implats

21Financial reviewImplats continues to provide exceptionaloperating margins with positive cash flowsbeing generated. This combination enabled thegroup to return R4.5 billion to shareholders inthe form of dividends.Results for the yearSales revenue (or turnover) grew byR5.0 billion (up 71%) to R12.0 billion. Thisexceptional increase was on the back of:• An average basket of dollar prices ofUS$1 254 per platinum ounce which was47% higher than the previous financial year• A 20% depreciation in the South African Randagainst the US dollar.Both of these factors combined to provide animprovement of 74% in the average Rand pricesachieved for the major metals. Implats hasbenefited tremendously from the majority of itsrevenue stream being US dollar denominatedwhile the majority of costs are incurred in Rands.Group attributable income (or net profit) ofR4.6 billion increased by 106% fromR2.2 billion the previous year.As the group continues to expand, thecontributions to attributable income from thevarious components are changing.Attributable Income (Rm)2001 2000 Variance<strong>Impala</strong> <strong>Platinum</strong> 3 724 1 905 1 819<strong>Impala</strong> Refining Services 300 117 183Crocodile River (Barplats) (24) 13 (37)Lonplats 647 220 427Total 4 647 2 255 2 392The <strong>Impala</strong> lease area still contributes most ofthe attributable income, but reliance on this asthe major contributor will reduce over time asthe recently announced projects begin to feedthrough to the bottom line.IRS continues to play a central role in thegroup's growth strategy and contributedR300 million, up 156% on last year's figureof R117 million.The slower than anticipated start up at CrocodileRiver mine had a negative impact, and theadjusted attributable income contributionreflects the group's accounting policy on theelimination of any unrealised profit on intercompanytransactions. This should reverse inthe next financial year.Our shareholding in the Lonplats group hasreaped significant benefits with attributableincome rising from R220 million to R647 million,an increase of 194%.This figure represents theequity accounted earnings for the year up toMarch 2001. For the most part that attributableincome was received in the form of R542 millionin cash dividends. This cash is earmarked forinvestment in the recently announced Zimplats,Mimosa and Two Rivers <strong>Platinum</strong> projects whichin turn will deliver significant contributions tothe group’s attributable income in the future.The cost performance during the period underreview was not in line with the group'sphilosophy of ensuring single digit unit costincreases. Cash operating cost per ounce ofrefined platinum rose by 16% to R3 156 (or indollar terms decreased by 3% to US$415). Theeffective cost of producing an ounce ofplatinum, net of by product revenue was a creditof R1 879 per ounce, which was 268% betterthan the previous year. The table belowillustrates the <strong>Impala</strong> cost performance and iscalculated as the cost of mining, concentrating,smelting, refining, marketing and head officecosts divided by the relevant platinumproduction units.Cash operating costRand 2001 2000 % VarianceR/ton milled 213 189 (13)R/oz pge refined 1 685 1 445 (17)R/oz platinum refined 3 156 2 711 (16)The group has, in US dollar terms, benefitedgreatly as a result of the depreciation of theRand against the US dollar and US dollar costshave actually decreased for the period underreview.

financial reviewCash operating costUS$ 2001 2000 % VarianceUS$/ton milled 28 30 7US$/oz pge refined 221 229 4US$/oz platinum refined 415 429 3economy of scale benefits to be realised andreduce the fixed cost recovery on <strong>Impala</strong>mined metals. This is estimated atapproximately a 20% reduction in fixed costrecovery based on present throughput.With respect to margins, the Implats groupderives its income from three separate revenuestreams, namely :• Mine-to-market where Implats owns andmanages the operations, such as <strong>Impala</strong><strong>Platinum</strong>, Crocodile River mine and, in thefuture, the Winnaarshoek project.• Income from associated companies such asLonplats and in the future from Zimplats,Mimosa, Two Rivers <strong>Platinum</strong> and the Aquariusgroup.• Income from the processing of third partymaterial through IRS.The margins vary between different businessunits from 65% at the mine-to-market <strong>Impala</strong>model to approximately 19% from IRS activities.Implats believes that the philosophy ofoptimising its refining capacity through securingtoll refining contracts and, in addition, acquiringsignificant minority equity shareholdings, is anoptimal strategy. It recognises that this businesswill produce lower margins than the traditionalmine-to-market models. The comparison isskewed, however, if the focus is on one side ofthe risk/reward equation only. The measure oftotal risk/return is a combination of weighingthe project risks against the project rewardswhere the Implats group model delivers certainkey benefits to shareholders :• Reduced exposure to mining risk• Lower investments (in terms of both capexand equity)• Reduced payback periods• Comparable return on investment to themine-to-market model as metal pricesdecrease. This is as a result of fixed percentagereturns on the IRS contracts.• Exploitation of smaller deposits enabledbecause of the symbiotic relationshipbetween the miner and the processor.• Increased process throughput allowingThe margins on production from the <strong>Impala</strong>lease area can be summarised as follows:Operating marginRand 2001 2000 % VarianceRevenue per platinumounce sold 9 433 5 883 60Cost of sales per platinumounce sold 3 283 3 055 7Operating profit per platinumounce sold 6 150 2 828 117Gross margin 65 48 36Further details are contained in the segmentalreporting note 1 in the <strong>Annual</strong> FinancialStatements.Earnings per shareHeadline earnings per share for the year at7 024 cents were 108% ahead of the previousyear's 3 383 cents. The previous year's earningsper share were adjusted for the change inaccounting for the final dividend. The adoptionof this statement had a positive impact on thecurrent year’s attributable income whichincreased by an amount of R55 million. This iscovered in more detail in note 11 to the <strong>Annual</strong>Financial Statements.The weighted average number of shares in issuewas 66 158 million in the current year comparedwith 65 891 million in the prior year, an increaseof less than half a percent. The increase in sharesduring the current financial year was mainly as aresult of shares issued in terms of the shareoption scheme. (Details are outlined in thedirectors' report and note 20 to the <strong>Annual</strong>Financial Statements).DividendsThe board has proposed a final dividend of2 380 cents per share, bringing the total

23declared and proposed dividends for the year tooptimal. Consideration is being given to utilising6 800 cps. This includes the special dividend ofpart of the capacity for future projects in an3 000 cps. The increase in interim and finalappropriate manner, but taking into account thedividends represents a 116% increase over theexposure to US dollar commodity prices andprevious financial year.Rand/US dollar exchange rates.Dividends are covered 1,9 times by earnings perImplats maintains a strong balance sheet inshare. This is in line with the board's statedorder to meet working capital requirements anddividend policy. The dividend cover philosophyprovide internal funding for the majority ofis underpinned by an awareness of returningfuture capital projects.excess cash to shareholders. This was confirmedby the special dividend payment announced inThe group generated R5.7 billion during theFebruary 2001.period under review. This was sufficient to fundCurrencycapital expenditure programmes, the significantdividends paid and the payment for PlatexcoThe average Rand/US dollar exchange rateInc. Despite this, Implats’ closing cash positionachieved was 7.68 this year, some 20% lowerwas similar to that of the previous financial year.than last year's 6.40 achieved. Implats is wellpositioned to benefit from this weakening in theImplats’ cash position for the next financialexchange rate as most of the group's earningsperiod is anticipated to be substantially lowerare denominated in US dollars.than the closing position as at the end of June2001.This is mainly due to:Implats' policy remains to be unhedged to- Payment for recent acquisitions (Zimplats,fluctuations in the Rand/US dollar exchange rateMimosa and Two Rivers)movement but in certain circumstances forward- Potentially lower metal pricesexchange contracts are entered into to hedge- Increased final dividend paymentanticipated future transactions.- Ongoing capex on the <strong>Impala</strong> lease area,Crocodile River mine and Winnaarshoek.R/$ for last 5 years2001 2000 1999 1998 1997Capital expenditureR/$ 7.68 6.40 6.08 4.94 4.29Group capital expenditure was recorded atShareholder valueR2 090 million, of which R950 million related tothe purchase of the Winnaarshoek mineralWe believe that the best measurement ofrights. Capital expenditure at <strong>Impala</strong> <strong>Platinum</strong> ofshareholder value is the total return toR978 million for the year was R246 millionshareholders (TSR) method.This is a combinationhigher than 2000, with expenditure on the9of the appreciation in share price, plus dividendsreturned to shareholders. Implats’ TSR from thedecline projects at 1 shaft (R129 million), 12 shaft(R56 million), 14 shaft (R261 million) and 11 shaft8end of the 1998 financial year to the end of the(R116 million) accounting for more than half7period under review has seen the group deliver aphenomenal return of 890%.of that.6Balance sheet structure andcash flowCapex (adjusted for the Winnaarshoek purchase)is expected to increase by R890 million, toR2 001 million in 2002. Of this, R870 million is for54Implats maintains a low gearing ratio and hassubstantial debt capacity. As a result the group'sweighted average cost of capital (WACC) is notcontinued expenditure on the decline projects,R640 million for the Winnaarshoek project andR132 million at Crocodile River mine.31996 1997 1998 1999 2000 2001SA Rand – US dollar

Pieter de Bruin filingplatinum ingot at <strong>Impala</strong>’sRefinery in Springs. TheEnhanced Precious MetalsRefinery is arguably thelowest cost primaryrefinery in the world.Robustmarket for ourmetals

Market review25Fundamentals reassertedThe year under review was witness to immensevolatility in the prices of our main metals withplatinum exceeding $600 and palladium pricessoaring to over $1 000 per ounce. These pricesled to a 47% increase in the price indexachieved to $1 254 per ounce, the highest ever.Despite almost record deliveries of Russianplatinum during calendar year 2000, and ameaningful decline in Japanese jewellerydemand, the platinum market remainedresilient. Deteriorating economic conditions in2001 are expected to pressurise the market butthis should be countered by a robustautomotive sector and stable jewellery demandoutside of Japan, leaving an essentially balancedmarket for the year.<strong>Platinum</strong> supply and demandCalendar years 2001 2000(’000 ounces) EstimateDemandAutomobile 1 980 1 925Jewellery (excl China) 1 550 1 740Jewellery (China) 1 100 1 100Industrial 1 485 1 450Investment (30) (60)Net demand 6 085 6 155SupplySouth Africa 4 185 3 775Russia 850 1 150Other 510 395Recycling 580 545Net supply 6 125 5 865Surplus/(Deficit) 40 (290)As forecast, substitution of palladium in theautomotive and electronic industries, acceleratedby the dramatic price movements of the metaland a significant slowdown in the informationtechnology sector, will see demand shrinkingfrom 2001.These fundamentals have beenfurther exacerbated by consumer de-stockingand excessive Russian deliveries during thefirst quarter of 2001, possibly exceeding4.0 million ounces, resulting in a near halvingof the price.The contraction of business conducted in theforward markets of Tocom and Nymex haslimited the ability of producers and consumersto hedge themselves, while simultaneouslyreducing the speculative activity of the mainlyJapanese general public. Without the influenceof these forward markets, short-term supply anddemand considerations are likely to have agreater influence on prices, as witnessed byactivity in the daily London fixes.<strong>Platinum</strong>Demand for platinum in jewellery fell marginally(by 1%) to 2.84 million ounces, the first decreasesince 1983. This was due to a sharp decline inthe Japanese market, which outweighed stronggrowth in both China and the US.The ongoing weak economic conditionscoupled with a surging price took its toll onfabrication in Japan, which fell by 20% to1.06 million ounces in 2000. In terms of pieces,sales declined by only 4% compared with theprevious year, due mainly to the fact that manymanufacturers used this period to reduce metalstocks to alleviate difficult trading conditions.Sales in the lower price brackets were the worstaffected as mainly younger buyers switched tomore affordable alternatives.China surpassed Japan as the world’s leadingconsumer of platinum jewellery as another yearof growing demand, albeit at lower rates than inprevious years, resulted in sales increasing by16% to 1.1 million ounces. This was despite thehigh and sometimes volatile price, resulting inthe erosion of manufacturers’ margins. At pricesabove $600 many manufacturers haltedproduction resulting in a shortage of product atthe retail level. The move by the Chinese taxauthorities to tighten up on the payment oftaxes, also restricted fabrication. In the US, pricewas less of an issue as the market is dominatedby the bridal and “upmarket” sectors. Stronggrowth in the first half of the year was temperedby weakening consumer confidence in the latterhalf as the economy began to slow. Demand3 0002 5002 0001 5001 00050065060055050045040035030001990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001Jewellery demand – 000 oz■ Japan ■ North America ■ Europe ■ Other ■ China1996 1997 1998 1999 2000 2001<strong>Platinum</strong> – US$/oz

market review’000oz10 0008 0006 0004 0002 00001990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001Autocatalyst demand■ Pt ■ Pd ■ Rh1 1001 0009008007006005004003002001001996 1997 1998 1999 2000 2001Palladium – US$/ozincreased by 15% to 380 000 ounces. In Europedemand remained firm with the strongestgrowth coming from the United Kingdomwhere the number of pieces hallmarkedincreased by 29%.The global expansion of the platinum jewellerymarket took another important step forward lastyear with the launch, in September, by the<strong>Platinum</strong> Guild International (PGI), of a platinumjewellery campaign in India. The launch waslimited to a small number of authorisedmanufacturers and retailers in Delhi andMumbai. Market response has been very positiveand the campaign will be extended to othercities during the year ahead. Given that India isthe world’s largest gold market, it has thepotential to be another significant market forplatinum. Increased promotional spending bythe PGI will bolster demand in the majormarkets, except Japan, which is expected todecline further next year.Demand for platinum in autocatalysts continuedto benefit from the ongoing tightening ofemission legislation worldwide. The growingdesire by automakers to reduce theirdependence on palladium by moving toplatinum-based systems began to gathermomentum due to concerns about availabilityand price. The combined effect was thatdemand increased by 2.5% to 1.93 millionounces. Despite a 2% decline in European carsales, platinum demand benefited from a furthersurge in the sales of diesel vehicles and theintroduction of Euro III legislation. The legislation,which applies to all new models from January2000, requires higher platinum loadings forcatalyst use with diesel engines. This sector willbenefit further in 2001 when Euro III legislationis extended to cover all new vehicles.In the US, there was a marginal increase inplatinum demand as automakers reverted toplatinum. With full compliance required this yearwith the Low Emission Vehicle standards, therequirements of which favoured palladium-richsystems, manufacturers are focusing on thenext set of standards. This new series of morestringent emission legislation in both Europe(Euro IV) and the US (Tier 2), which places strongemphasis on carbon monoxide and oxides ofnitrogen emissions will benefit platinumdemand. In addition, platinum usage will befurther increased by the Tier 2 standards whichalso require light duty trucks to meet the samestringent standards as cars, starting in 2004.Elsewhere in the world, 2000 saw the adoptionof tighter emission legislation by variouscountries. These included Japan, China, India,South Korea and several smaller south east Asiancountries.PalladiumDemand increased by almost 4% to a record8.86 million ounces primarily as a result of afurther surge in automotive usage. Consumptionby automakers rose by 11% to 5.38 millionounces. Palladium is the most effective metal forthe control of hydrocarbon emissions, the maintarget of the most recent legislation. With thephase-in of these standards all but completed,automakers are now looking at reducing theirdependence on palladium. Although this metalwill remain a key ingredient in futureformulations, usage will be cut by thriftingprogrammes and by moving toplatinum/rhodium systems. These changes areexpected to cut palladium usage by the autoindustry by 30% over the next five years.The strong move away from palladium to nickelbasedmulti-layer ceramic capacitors in theelectronics industry continued with less than50% of capacitors produced containingpalladium. The substitution trend is forecast tocontinue and the shift will become morepronounced as production declines with thecurrent economic slowdown.Although usage in its two major applications isforecast to decline, the market will requireRussian sales from stock to satisfy demand forthe next few years. Thereafter, the market willreturn to a natural supply/demand balance tothe benefit of both supplier and consumer.

27Palladium supply and demandCalendar years 2001 2000(’000 ounces) EstimateDemandAutomobile 5 155 5 380Dental 745 820Electronics 1 865 2 140Other 535 520Net demand 8 300 8 860SupplySouth Africa 2 050 1 840Russia * 4 750 5 200Other 1 180 950Recycling 320 265Net supply 8 300 8 255Surplus/(Deficit) – (605)* Supplies required to balance the market in 2001NickelDespite weakening consumption, the nickelmarket remained in deficit due to a combinationof production cutbacks, disruptions andoperating difficulties. The slowdown in stainlesssteel demand that emerged during the secondhalf of 2000 has carried into 2001. Withproduction continuing to expand through acombination of brownfield and greenfieldexpansions, the market is forecast to move intosurplus this year.RhodiumThe rhodium market remained underpinned bystrong demand from its main user, theautomotive industry. Demand for autocatalystsrose by 17% to 579 000 ounces. A combinationof more stringent emission legislation and thedesire by automakers to thrift palladium werethe main drivers of growth. This trend isexpected to continue and will gain moreimpetus through new emission legislation, afeature of which is tighter limits for N0x forwhich rhodium is better suited.2 5002 0001 5001 00050001996 1997 1998 1999 2000 2001Rhodium – US$/ozRhodium supply and demandCalendar years 2001 2000(’000 ounces) EstimateDemandAutomobile 585 579Other 89 92Net demand 674 671SupplySouth Africa 439 411Russia* 80 80Other 21 21Recycling 101 91Net supply 641 603Surplus/(Deficit) (33) (68)* Excludes significant off-market transactions which have beenplaced in inventories1 1 00010 0009 0008 0007 0006 0005 0004 0003 0001996 1997 1998 1999 2000 2001Nickel – US$/ton

One millionPt ounces by“theengine”Sinking of the newventilation shaft at<strong>Impala</strong>’s 14 shaft decline.<strong>Impala</strong>’s capital efficientdecline programme willextend the lives of existingshaft systems.

29<strong>Impala</strong> <strong>Platinum</strong>Known colloquially as “the engine”, Implats’ majoroperational unit, <strong>Impala</strong> <strong>Platinum</strong>, comprises 13shaft systems and Mineral Processes(concentrating and smelting activities) locatednear the towns of Phokeng and Rustenburg onthe world-renowned Bushveld Complex, as wellas the company’s Precious Metals and BaseMetals Refineries some 200 kilometres away,near Springs in Gauteng. These operationsemployed 27 979 people during 2001.The emphasis for the year to follow is onensuring that:• management accepts accountability for thesafety culture of the organisation• risk assessments take place• new, inexperienced crew captains receivefurther best practice training• contractors’ health, safety and environmentalmanagement systems and training are alignedwith those of <strong>Impala</strong>.SafetyThe tragic loss during the year of 13 employeesin work-related accidents was a devastatingreversal of the previous year’s significant successin making the business of mining lesshazardous. The fatality rate of 0.16 per millionman hours reflects the second worst year since1997.Falls of ground accidents remain the biggestcause of fatalities and claimed four lives thisyear; followed by scraper and winch operationrelated accidents; explosive accidents; and rockhandling accidents. Two fatalities also occurredat the 14 shaft project.A root cause analysis by International RiskControl Africa (IRCA) of these accidents revealedthat too much effort is being placed onmanaging the consequences of accidents ratherthan preventing them, indicating a need toaddress the safety culture of the company.Safety was further compromised by the loss ofexperienced crew captains during the course ofthe year.On the positive side, internal and external auditshave indicated that safety programmes andtraining are in place and this is reflected in theimproving trend of the lost time injury frequencyrate. This year’s rate of 8.5 lost time injuries permillion man hours is the best ever, and shows animprovement of 32% compared to last year. Twoshafts achieved two million fatality free shiftsand a further five achieved one million shiftsduring the course of the year. The operations asa whole achieved this milestone twice.During the year:• Good progress was made with training at alllevels. An additional 1 642 safetyrepresentatives completed a safetyrepresentative training programme. Some500 crew captains completed a riskmanagement programme and 580 passed aprinciples of supervision programme.• Four CAP (Common Audit Process measureagainst ISO standards) were conducted andan external audit of the code of practice tocombat rock falls and rockburst accidents wasconcluded.• A joint Health, Safety and Environmentsummit was held with participation from allstakeholders.<strong>Impala</strong> Refineries achieved its lowest ever losttime injury frequency rate of 0.8 per million manhours. The Refineries achieved a NOSCAR ratingduring 1999 and has maintained it since then.During the coming year Implats will:• Improve support standards in stoping anddevelopment areas• Improve action-plan implementationfollowing risk assessments and routine processmeasurement audits• Formalise a monitoring programme for actionplanimplementation to ensure continuousimprovement• Develop a process for accumulating correctiveand preventative action resulting from audits,inspections and other managementmeasurementssystems0.141997 1998 1999 2000 200120.50.20Fatality accident rate(per million man hours)21.20.09 0.0910.912.68.51997 1998 1999 2000 2001Lost time injury frequency rate(per million man hours)0.16

eview of operations – <strong>Impala</strong>925 915 9138707425803761661999 2000 2001 2002 2003 2004 2005 2006Mining projects – capital cash flow andforecast (R million)MiningTons mined increased by 3.3% on last year to15.05 million. Headgrade declined slightly,however, to 4.9 g/t owing to a narrowing of theMerensky channel and an increase in pre- andredevelopment. Headgrade should improve inthe year ahead as more ore will be mined fromthe Merensky reef.On-mine cost per ton mined increased fromR137 to R154 (12%) mainly as a result of anabove inflation wage increase of 9% and anadditional 3% as a result of the implementationof the Basic Conditions of Employment Act. Anincrease (6%) in on-reef development from210 700 metres in 2000 to 224 200 metres in2001 also had an adverse effect on costs.Problems in the concentrator resulted in210 000 tons of ore being added to the live orestockpile, again adding to costs. Costperformance on a tons milled basis thereforeincreased from R136 to R156 (14.7%).Decline projects<strong>Impala</strong> aims to maintain production at the onemillion ounce level until 2030 at an affordableannual capital cost. To achieve this, <strong>Impala</strong>embarked on a programme to extend the livesof the third generation shafts by means ofdecline shafts or shaft systems that utiliseexisting infrastructure. Five decline shafts and avertical shaft to link in with 12 shaft are currentlyin progress at a total capital cost of R4 billion(US$486 million). Excellent progress has beenmade during the year with productionbeginning at several declines as scheduled:10 shaft: Development of the 10 shaft declinebegan in 1993. Mining at this triple declinesystem began in 1997 and the first three levelsare already producing. Development of the finallevel station is in progress and full productionshould be achieved by October 2001.1 shaft: This project commenced in 1997.Production from the first level was achieved inJuly 2000. Rock weakness led to somemodifications to this decline that will nowcomprise four rather than six levels. Productionwill be unaffected as the change has allowedearlier mining than originally planned. <strong>Full</strong>production will be achieved in the 2004financial year.11 shaft: Sinking commenced at this tripledecline system in 1999. Stoping will commencein 2002 and full production will be attained in2007. The ventilation shaft has beencommissioned and sinking of the seconddowncast man and material shaft will start in2001.12 shaft south: The start-up development ofthis three level, twin-shaft decline is welladvanced. The first level was accessed in March2001 and full production should be attained in2004.12 shaft north: Work on this vertical shaftsystem commenced in June 2001. The systemcomprises a downcast man and material shaft12 N #12 # 14 #11 #10 #1 #and an upcast ventilation shaft. The first ore fromthis project will be processed in the 2004financial year. This shaft is the first at theRustenburg operations to embrace the "pillarand stall" mining method, using tracklessmachinery and conveyor belts for moving ore.Location of shafts on the <strong>Impala</strong> <strong>Platinum</strong> lease area14 shaft: This project comprises thedevelopment of a five-level decline and theupgrading of infrastructure for increased

31Decline ProjectsProject Start of mining Maximum production Reserves Reefs mined Capex (R million) Life of shaft (years)/month (m 2 )(‘000t)10# decline 2000 28 000 20 675 Merensky 171 291# decline 2000 45 000 25 761 Merensky and UG2 726 1611# decline 2001 45 000 15 001 Merensky and UG2 721 1412# south decline 2002 18 000 5 151 Merensky 256 814# decline 2004 45 000 37 922 Merensky and UG2 1 656 2512 # north decline 2004 15 000 8 263 Merensky 471 10tonnages. Development commenced in 1999and good progress was made to establish theaccess ways. Shaft sinking of a verticalventilation shaft is also underway. Final projectcompletion is scheduled for 2006.reduction. Work to balance the volumes throughthe high grade and low grade circuits toimprove recoveries is in progress. The highervolume through the UG2 plant will enable moremills to be dedicated to Merensky ore in theMetallurgical processing<strong>Impala</strong> continues to dedicate significantattention and resources to its metallurgicaloperations with a capital expenditureprogramme of R280 million in 2001 formain plant, allowing for a finer grind and thusimproved recoveries. Stabilisation andoptimisation of the Merensky flotation plant hascontinued but further optimisation is required inorder to achieve design recoveries.concentrating and smelting. This will reduce toR100 million in 2002.The net impact of these difficulties has been a2.5% drop in metallurgical recoveries comparedto the previous year.ConcentratorTons milled for the year were 14.84 million,210 000 tons less than tons mined, mainly dueto an additional public holiday and a three daystoppage at the UG2 plant owing to an electricsubstation failure.Smelter<strong>Impala</strong>’s smelting operation continued itsexcellent performance during the year. Thesmelter expansion project was deliveredtimeously and within the R230 million budget.The expected benefits of capital efficiency, by farProblems were also experienced with the startup of the UG2 ore separation project. The plantwas commissioned two months late andthe lowest costs in the industry, and increasedflexibility and contingency have been realised.recoveries were not at expected levels.Throughput improved to acceptable levels anda 30% increase in plant capacity was realised byyear-end. Initial results indicate a 3% cost per tonHowever, the refractory bricks of the newfurnace housing started to crack soon aftercommissioning, apparently as a result of aproblem with the brick manufacture. Although39.640.539.640.7<strong>Impala</strong> mining statistics2001 2000 1999 1998 1997Tons milled (’000) 14 840 14 662 14 638 14 509 13 775% UG2 milled 49.6 50.6 48.1 45.9 45.6Headgrade (g/t 5 PGE + Au) 4.90 4.97 5.31 5.17 5.22M2 per stoping employee 41 40 41 40 36Tons per employee 53 51 51 48 44Number of employees (working cost) (’000) 28.0 28.3 28.7 29.5 31.036.034.0FY96 FY97 FY98 FY99 FY00 FY01Productivity in centares per panel man

eview of operations – <strong>Impala</strong>the furnace itself is stable and extensivecondition monitoring continues, operating lifewill be shortened. A spare furnace lining has alsobeen ordered from Austria which will arrive inOctober 2001.The smelter complex processed a record79 800 kilograms of matte this year, a13% increase on 2000. Concentrating andsmelting costs increased from R30 to R32 perton (6.8%) and were well contained given theamount of construction work in the area.RefineriesThe Refineries’ solid performance was sustainedand the cost per refined platinum ounce wascontained to an increase of only 7.4% despitesubstantial cost increases in reagents andchemicals.The completion of process enhancements at theEnhanced Precious Metals Refinery (EPMR) led tomuch improved performance in the rhodiumand iridium circuits with a further release ofmetal from process inventories. A programme offine-tuning the EPMR circuit will commence inthe new financial year at a capital cost of someR50 million. These will allow for throughput inexcess of 2 million ounces of platinum per year,along with associated pgms.People and technologyThe concept of unlocking the potential of ourpeople is a key strategic driver for <strong>Impala</strong>. As ouremployees’ skills increase, the need for newtechnology to improve performance further andensure our position as industry leader inefficiencies becomes increasingly important.Thus, a strategy combining the performance ofour people and advances in technology, willcontinue to deliver the improvements inefficiencies for which the company has becomeknown within the industry.Five years ago <strong>Impala</strong> introduced the Fixcoprocess with the "One team – one vision"concept central to that initiative. The aim ofFixco was to secure <strong>Impala</strong>’s long-term futurethrough a real reduction in unit costs at a timewhen the company was viewed ascompetitively disadvantaged by its high cost ofproduction and labouring under a capitalinefficient expenditure programme. Thisobjective was achieved by drawing on thecombined energies and initiatives of the peopleof <strong>Impala</strong> – and with a dramatic decrease in thelabour force – resulted in <strong>Impala</strong> boasting thehighest productivity levels in the South Africanhard rock mining industry.During 1999/2000, Implats realised, however, thatthe impetus of the initial Fixco process hadlargely dissipated and that, with certain once-offinitiatives having being achieved, step-changeimprovements were unlikely.New Fixco initiativesA highlight of the year was undoubtedly the reenergisingof the Fixco process by thecombined management/employee team as partof <strong>Impala</strong>’s core “One team – one vision”philosophy. This vision continues to have as itsaim the delivery of just over a million ounces ofplatinum per annum from the <strong>Impala</strong> lease areaover the life-of-mine, with unit costs in line withor better than inflation and an affordable capitalfunding programme.The management-employee Fixco committee isfocused on three key areas, headgrade,recoveries and efficiencies and has identified 18separate initiatives and appointed a championat mine level to lead each initiative. Thecommittee meets on a regular basis to evaluateprogress and determine new objectives. Majoradvances have been achieved during the year:• Production efficiencies across the operationare up from 40m 2 per employee to 41m 2 peremployee, which equals the previous recordachievement in 1999;• A 5% reduction in compressed air usageachieved;• A 3% improvement was recorded in Merenskyheadgrade in the last quarter.

33In the past a great deal of emphasis was placedon reducing employee numbers, but no majordecrease is anticipated over the next few years.Instead, the implementation of Fixco and othercontrol mechanisms to identify and addressproblem areas are poised to deliver the requisiteimprovements in productivity.Breakthrough technologyFrom trackless mining to new cutting andblasting techniques, leading to better minelayouts, improved safety and productivity areexpected to provide further impetus to <strong>Impala</strong>’sdrive for the highest efficiencies and lowestcosts in the industry.ExplorationEvaluation of the <strong>Impala</strong> lease area continuedduring the year with a 3D seismic surveyextending to the southern border of theproperty and to 1 800 metres below surface.Fifteen boreholes were drilled in the deeper partof the lease area to supplement seismic surveys,while 86 shallow boreholes were drilled toevaluate the Merensky open-cast potential.Implats is currently engaged in a number ofnew technology initiatives either directly or inpartnerships with research organisations,suppliers and other companies. This thrust isaimed at mechanisation that can be applied to arelatively narrow, tabular hard rock orebody. Thechallenge is to tap the appropriate technologyto deliver cost reductions, productivityimprovements and improved safety.Active technology initiativesName Strategic Description Objective Targeted monthlyPartneradvance (m)Penetrating Brandrill A plastic cartridge, filled with To continuously mine/break 60Cone Fracture Limited propellant, initiated by an with non-explosive propellant(PCF) electronic detonator using drill holesMini Disk Cutter CSIR A low profile cutter with To continuously mine a breast 140(MDC) Miningtek mini disks or longwall stopeOscillating Disk AMIRA A 300 mm oscillating disc To continuously mine a breast 120Cutter (ODC) International (single or multiple) or longwall stope and a tunnelPneumatic Drill Rigs Novatek Drills Pneumatic operated drills Accurate, less strenuous, stope Notmounted on a single or drilling applicabledouble boomHydropower Drill Rigs Novatek Drills Hydro-power operated closed Accurate, less strenuous, stope Notcircuit drills mounted on a drilling with improved applicablesingle or double boomefficiencyMineral Resource GMSI Integrated production info Electronic planning with NotManagement system comprising a suite rolling short, medium and applicableof GMSI moduleslife-of-mine planLow Profile Not Employing trackless mining Mechanisation of stoping 30Trackless applicable techniques at a 1.5 metre operationsMiningstope width* Current face advance with manual mining methods = 22 m 2

Major newplatinummine on theEastern LimbDrilling at the box-cut atthe Winnaarshoek projecton the eastern limb of theBushveld Complex. Theproject will see thedevelopment of a majornew platinum mine in arelatively underdevelopedarea, involving the creationof 1 500 new jobs.

35WinnaarshoekIn December 2000, Implats acquired PlatexcoInc, a Toronto-listed junior mining company, forC$191 million (R950 million).Located on the eastern limb of the BushveldComplex, near the town of Steelpoort in SouthAfrica’s Northern Province, the Winnaarshoekproject has the potential for the development ofa mine producing 175 000 ounces of platinumfor at least 30 years.Mineral rightsThe project comprises the Winnaarshoekproperty as well as the mineral rights associatedwith adjacent properties Clapham, and portionsof Driekop and Forest Hill. The Driekop mineralrights are subject to a 1.5% royalty payable toeach of Anglo <strong>Platinum</strong> and the LebowaMinerals Trust calculated on the value of themetals contained in the concentrate.Major empowerment initiativeThe project will be held 80% by Implats andsome 10% each by Mmakau Mining (Pty)Limited and community-based investors fromthe Northern Province. Mmakau Mining is a wellestablishedmining concern chaired by itsfounding shareholder, Bridgette Radebe.Both Mmakau Mining and the communityempowerment participants will be representedon the board of the Winnaarshoek project andMmakau Mining will also be represented on theproject’s executive committee. This arrangementprovides a major black empowermentparticipation in a large-scale pgm project. It isexpected that the financing for theempowerment transaction and the NorthernProvince empowerment participants will befinalised by the end of 2001.Mining and processingExtensive exploration drilling has beenconducted since January 2001 and will continuefor the remainder of the year and into next year,targeting specifically the shallower areas fromthe outcrop to 450 metres below surface. Theexploration results will facilitate mine planningin respect of the underlying geological structure,grade, resources and reserves estimates and therock engineering requirements for mechanisedmining.The mine will utilise a mechanised pillar and stallmining method with dense media separation toremove waste. The orebody will be accessed bymeans of two separate decline shafts, sunk onreeffrom the outcrop position, situatedapproximately 1 300 metres apart on strike.Decline development will begin in mid-2002,with the first production from stoping byDecember 2002. <strong>Full</strong> mill production will bereached by 2004. Mining will first concentrate onthe UG2 reef, with development on theMerensky reef commencing later.The project has entered into a life-of-mineconcentrate purchase agreement with IRS forthe smelting, refining and marketing of itsconcentrate.Capital cost for the project is estimated at someR1.6 billion spread over the first four years of theproject. It is intended that this will be fundedjointly from Implats’ internal resources and bythe capital raised by the empowermentpartners.During the expected mine life over 30 years, themine will employ some 1 500 people in arelatively remote and underdeveloped area. Anumber of environmental and social challengesremain and a dedicated team is in place toensure that the positive influences of the minebalance any potential negative influences onthe surrounding environment and communities.Winnaarshoek ProjectPurchase priceC$191 million (R950 million)Mineral Resource45.4 million tons-Merensky22.9 million tons-UG2Planned production175 000 Pt oz paCapital expenditureR1.6 billion over 4 yearsJob creation1 500 employeesLife-of-mine30 years<strong>Full</strong> production 2004

CrocodileRiver openedunder budgetExcavating portal area pit no 1 atBarplats’ Crocodile River mine. Themine was brought into productionunder budget in February 2001, justone year after approval for the reopeningwas given by the board.