Serving Kuwait for 60 Years - National Bank of Kuwait

Serving Kuwait for 60 Years - National Bank of Kuwait

Serving Kuwait for 60 Years - National Bank of Kuwait

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

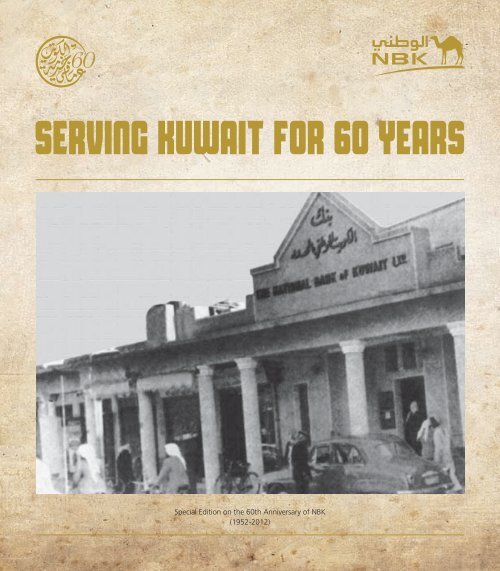

<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> <strong>Years</strong>Special Edition on the <strong>60</strong>th Anniversary <strong>of</strong> NBK(1952-2012)

من وثائق اخلارجية البريطانيةبتاريخ 6 ابريل 1952

3Need <strong>for</strong> a <strong>National</strong> <strong>Bank</strong>...Be<strong>for</strong>e 1952 there was only one bank operating in <strong>Kuwait</strong>: the British <strong>Bank</strong> <strong>of</strong> the Middle East, which had beeninaugurated in 1942 during World War II. In 1949, the management in <strong>Kuwait</strong> became increasingly aware that<strong>Kuwait</strong>i citizens were dissatisfied with the level <strong>of</strong> service they were receiving from the bank. Their needs were notbeing met. <strong>Kuwait</strong>i merchants were unhappy at being treated as second class customers.In a now celebrated incident, a prominent <strong>Kuwait</strong>i merchant was surprised and shocked to have his request <strong>for</strong> aloan <strong>of</strong> 10,000 rupees turned down. He was told he needed to provide a guarantor. News quickly spread all overtown.This rejection drove him to go see the Amir, along with a group <strong>of</strong> other prominent merchants. They describedthe discriminatory treatment they received at the hands <strong>of</strong> the bank. They asked his permission to set up a newbank, a national bank with their own capital. The Amir readily pledged his support.They agreed that the new bank should serve the national interest, contribute to economic growth and take goodcare <strong>of</strong> customers’ deposits.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

The decree dated 19 May 1952announcing the establishment <strong>of</strong>the <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong>

5The Establishment <strong>of</strong> NBK...On 19 May 1952 the Amir <strong>of</strong> <strong>Kuwait</strong>, Sheikh Abdullah Al Salem Al Sabah, issued an Amiri Decree setting up the<strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong>. It was to be the first local bank and the first shareholding company not only in <strong>Kuwait</strong>but in the entire Gulf region.The bank’s aims and objectives were further broadened in a Memorandum <strong>of</strong> Association, along with itsamendments, effective from 15 April 1961.The following pages are a unique record <strong>of</strong> the bank’s history from its modest beginnings to the regionalpowerhouse it is today. It started in premises no greater than three shops. A handful <strong>of</strong> employees relied onprimitive banking tools. Everything was done by hand. Today it is one <strong>of</strong> the largest, safest and most pr<strong>of</strong>itablebanks in the region. It has a huge international network, with branches, representative <strong>of</strong>fices and subsidiaries inthe world’s most important business and financial centers.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

Khalid Al-Zaid Al-KhalidAhmed Al-Saud Al-KhalidKhalifa Al-Khalid A-GhunaimYousef Abdulaziz Al-FulaijSayed Ali Sayed SuleimanKhalid Abdullatif Al-HamadYousef Ahmed Al-GhanimMohamed AbdulmohsenAl-KhurafiAbdulaziz Al-Hamad Al-SagerThe Founders

7Difficulties Faced by the Founders...The road was not easy <strong>for</strong> the founders <strong>of</strong> NBK. They were faced with many obstacles. These began when theideas <strong>for</strong> the bank were still on the drawing board. The founders managed to overcome these obstacles throughtheir own determination and wise judgement and thanks to the support <strong>of</strong> the Amir <strong>of</strong> <strong>Kuwait</strong>, the late SheikhAbdullah Al Salem Al Sabah. It has since been a story <strong>of</strong> glorious success and dazzling achievements even in times<strong>of</strong> adversity.The prominent <strong>Kuwait</strong>is who met the Amir on that auspicious occasion to present their proposals <strong>for</strong> establishingthe bank were:• Khalid Al-Zaid Al-Khalid• Khalifa Al-Khalid A-Ghunaim• Sayed Ali Sayed Suleiman• Yousef Ahmed Al-Ghanim• Abdulaziz Al-Hamad Al-Sager• Ahmed Al-Saud Al-Khalid• Khalid Abdullatif Al-Hamad• Yousef Abdulaziz Al-Fulaij• Mohamed Abdulmohsen Al-KhurafiThe first obstacle they faced was Article 18/B <strong>of</strong> the Memorandum <strong>of</strong> Association <strong>of</strong> the British <strong>Bank</strong> <strong>of</strong> the MiddleEast which was signed by the <strong>Kuwait</strong>i government. This had protected the British <strong>Bank</strong> <strong>of</strong> the Middle East and givenit a monopoly by agreeing that no other bank could be established in <strong>Kuwait</strong>. The Amir ruled that he could not stopthe opening <strong>of</strong> a national bank in the country and he granted his approval to the new venture.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

9The decision aroused the interest <strong>of</strong> the British representative in <strong>Kuwait</strong> because <strong>of</strong> the competition it posed tothe British <strong>Bank</strong> <strong>of</strong> the Middle East. Confidential British Foreign Office documents, since released into the publicdomain, described the support given by the Amir and his negotiations with the British to overcome the obstaclesto establish the bank.On 19 May 1952 the <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> was established. All the directors on the board, the shareholdersand the founders were leading <strong>Kuwait</strong>i merchants. The bank had a start-up capital <strong>of</strong> 13,100,000 rupees,equivalent to one million <strong>Kuwait</strong>i dinars divided into 13,100 shares <strong>of</strong> 1,000 rupees each.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

The minutes <strong>of</strong> the first meeting<strong>of</strong> the Board <strong>of</strong> Directorsdated 8 August 1952

11Cornerstone...With the support given by the Amir, the founders <strong>of</strong> NBK made the first executive decisions <strong>for</strong> the bank to startoperating. They hired a qualified and experienced British banker to manage the bank. They recruited the firststaff. They rented premises in a suitable location and installed the furniture and equipment they needed.On 15 November 1952, NBK was <strong>of</strong>ficially inaugurated as a shareholding company with a mission to carry outstandard banking activities. It was the birth <strong>of</strong> the first national bank and the first shareholding company in<strong>Kuwait</strong> and the Gulf.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

British Foreign Office cabledated 9 October 1952

13The Journey Begins...NBK opened its doors <strong>for</strong> business <strong>for</strong> the first time in a small building on New Street, in the heart <strong>of</strong> <strong>Kuwait</strong>’scommercial district. It had only a handful <strong>of</strong> staff that started with basic banking activities like supplying creditto commercial customers, currency exchange, and ordinary cash transactions: taking deposits and allowingwithdrawals.Over time, NBK quickly showed its pr<strong>of</strong>essionalism and capability in its contribution to the development <strong>of</strong><strong>Kuwait</strong>. NBK provided the complete range <strong>of</strong> services to private customers and corporate clients alike. It financedinfrastructure projects that began in the 1950s as the nascent state broke free from decades <strong>of</strong> British dominationinto a new era <strong>of</strong> freedom and economic independence. This new sense <strong>of</strong> economic independence spread inturn to the region _ something that might not have happened if it were not <strong>for</strong> the farsightedness and drive<strong>of</strong> those <strong>Kuwait</strong>i merchants and the unstinting support <strong>of</strong> the Amir who laid the foundations <strong>of</strong> the <strong>Kuwait</strong>iconstitution and the evolution <strong>of</strong> <strong>Kuwait</strong>.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

<strong>Kuwait</strong> in the 1950s

15<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

NBK opens <strong>for</strong> business:15 November 1952

17At the Heart <strong>of</strong> <strong>Kuwait</strong>’s Development Era...NBK twice played a key role in the replacement <strong>of</strong> <strong>Kuwait</strong>’s local currency. First, in May 1959, when the Indianrupee was replaced by what became known as the Gulf rupee. And again in 1961 when the Monetary Councilwithdrew the Gulf rupee and introduced the <strong>Kuwait</strong>i dinar as the unit <strong>of</strong> exchange <strong>of</strong> the newly independent andsovereign state <strong>of</strong> <strong>Kuwait</strong> and asserted control over its fiscal affairs.During the 1970s, NBK continued to finance major projects in infrastructure as the state used its oil exportrevenues <strong>for</strong> national development and modernisation. It contributed to projects including desalination plants,power stations, roads and bridges, oil field expansion and refining capacity, hospitals and schools _ all projectsbuilding <strong>Kuwait</strong>’s future.This was NBK’s growth period. The bank grew in size and underwent its own development, restructuring andorganisational changes to respond to the challenges and demands <strong>of</strong> the booming economy.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

A historic photograph <strong>of</strong> the first daythe bank opened <strong>for</strong> business,15 November 1952

19True Value During Crisis...The 1980s posed very serious challenges to the banking system in <strong>Kuwait</strong> and NBK proved its worth. It supportedthe economy <strong>of</strong> the state in good times and bad. In the collapse <strong>of</strong> the banking system in 1982 triggered bythe Souq Al-Manakh crisis, NBK alone was able to weather the storm thanks to its responsible, balanced andconservative attitude towards risk.NBK had issued reports and other publications prior to the collapse warning <strong>of</strong> the impending dangers <strong>of</strong> a crash.1983 was another milestone in the bank’s history. For the first time in thirty years, the bank appointed an Arab torun the bank when Ibrahim Shukri Dabdoub was made CEO.NBK rose to the next major challenge after Iraq invaded <strong>Kuwait</strong> in 1990. The bank transferred its operationsabroad and continued to function as best as it was able. It met all its commitments to clients and otherinternational banks. NBK also played a major role in funding reconstruction projects in <strong>Kuwait</strong> after its liberation.The bank’s outstanding per<strong>for</strong>mance in these two crises bolstered its reputation <strong>for</strong> reliability and trustworthinessboth at home and abroad.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

A group shot <strong>of</strong> the first NBK team,dated spring 1953

21Fuelling the <strong>Kuwait</strong>i Economy...The liberation in 1991 demanded different services and during the 1990s NBK was able to extend and managehuge loans including one <strong>of</strong> $5.5bn to the government <strong>of</strong> <strong>Kuwait</strong>, the largest ever loan at the time in the Arabworld. Another very large piece <strong>of</strong> financing was a $1.25bn loan to the Equate petrochemicals joint venture.The 1990s were a golden era <strong>for</strong> the bank. It was a period <strong>of</strong> development and great prosperity throughoutthe region and the wider world. NBK expanded. The bank now has more than 67 branches in <strong>Kuwait</strong> as wellas branches, representative <strong>of</strong>fices and subsidiaries in New York, London, Paris, Geneva, Singapore, Turkey andChina as well as Egypt, Lebanon, Bahrain, Jordan, Qatar, the UAE, Iraq and Saudi Arabia.Today, in the second decade <strong>of</strong> the 21st century, NBK is com<strong>for</strong>table per<strong>for</strong>ming on the world stage as a leadingfinancial institution <strong>of</strong>fering comprehensive banking services to private and corporate clients, always true to itsheritage <strong>of</strong> safety first.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

NBK opened its first stand-alone Head Office building in Al Mubarakiya in 1963. The opening ceremony was attended by the <strong>for</strong>eignminister Sheikh Sabah Al Ahmed Al Jaber Al Sabah, who later became the Amir <strong>of</strong> <strong>Kuwait</strong>, and the finance minister the lateAmir Sheikh Jaber Al Ahmad Al Jaber Al Sabah and other distinguished representatives <strong>of</strong> leading merchant families in <strong>Kuwait</strong>.

23<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

The entrance <strong>of</strong> the New Street branchfrom Safat Square, NBK’s first home

25The Highest Credit Rating...Despite the succession <strong>of</strong> crises, NBK has continued to hold the highest ratings from credit rating agencies <strong>of</strong> anybank in the Middle East. Recently, Standard and Poor’s affirmed NBK’s long term credit ratings <strong>of</strong> A+ based onstrong capitalisation, a stable management team and sound earning generation capabilities. The agency also citedthe consistently held leading market position and NBK’s outper<strong>for</strong>mance <strong>of</strong> its peers in crises. NBK is rated AA- byFitch and Aa3 by Moody’s, and all ratings carry a stable outlook.NBK and Financial Crises...NBK proved its perseverance not only in the Souq Al-Manakh crisis and after the Iraqi invasion. It also demonstratedthe bank’s fundamental strengths in response to difficult financial markets during the Asian market collapse, theglobal financial crisis and the Eurozone debacle. NBK not only survived but continued to operate pr<strong>of</strong>itably in excess<strong>of</strong> all expectations thanks to the conservative policy <strong>of</strong> the bank with regard to risk management, its clear strategicvision and its experienced and stable management.The Safest <strong>Bank</strong>...NBK has long been recognized <strong>for</strong> its excellent management and record <strong>for</strong> sound banking practices. It prides itselfon its rigorous risk management and its fiscal conservatism, as a place where depositors can feel secure in theknowledge that their investments are in safe keeping. The bank’s success rests on the very solid foundation <strong>of</strong> a verysound system <strong>of</strong> managing risk and <strong>of</strong> corporate governance. NBK is the only bank in the Middle East to be chosenby Global Finance among the world’s safest 50 banks <strong>for</strong> five consecutive years.<strong>Serving</strong> <strong>Kuwait</strong> <strong>for</strong> <strong>60</strong> years

القاعة املصرفية لفرع املركز الرئيسي لبنك الكويت الوطني في منطقة املباركية عام 1963

The main banking hall at Head Office in Al Mubarakiya in 1963