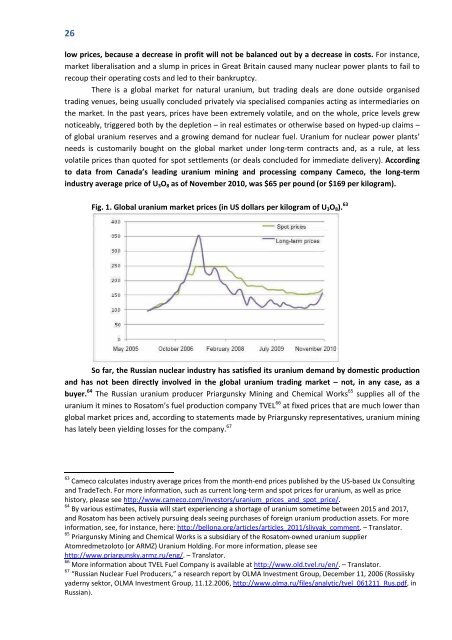

26low prices, because a decrease in pr<strong>of</strong>it will not be balanced out by a decrease in costs. For instance,market liberalisation and a slump in prices in Great Britain caused many nuclear power plants to fail torecoup <strong>the</strong>ir operating costs and led to <strong>the</strong>ir bankruptcy.<strong>The</strong>re is a global market for natural uranium, but trading deals are done outside organisedtrading venues, being usually concluded privately via specialised companies acting as intermediaries on<strong>the</strong> market. In <strong>the</strong> past years, prices have been extremely volatile, and on <strong>the</strong> whole, price levels grewnoticeably, triggered both by <strong>the</strong> depletion – in real estimates or o<strong>the</strong>rwise based on hyped‐up claims –<strong>of</strong> global uranium reserves and a growing demand for nuclear fuel. Uranium for nuclear power plants’needs is customarily bought on <strong>the</strong> global market under long‐term contracts and, as a rule, at lessvolatile prices than quoted for spot settlements (or deals concluded for immediate delivery). Accordingto data from Canada’s leading uranium mining and processing company Cameco, <strong>the</strong> long‐termindustry average price <strong>of</strong> U 3 O 8 as <strong>of</strong> November 2010, was $65 per pound (or $169 per kilogram).Fig. 1. Global uranium market prices (in US dollars per kilogram <strong>of</strong> U 3 O 8 ). 63So far, <strong>the</strong> <strong>Russian</strong> nuclear industry has satisfied its uranium demand by domestic productionand has not been directly involved in <strong>the</strong> global uranium trading market – not, in any case, as abuyer. 64 <strong>The</strong> <strong>Russian</strong> uranium producer Priargunsky Mining and Chemical Works 65 supplies all <strong>of</strong> <strong>the</strong>uranium it mines to Rosatom’s fuel production company TVEL 66 at fixed prices that are much lower thanglobal market prices and, according to statements made by Priargunsky representatives, uranium mininghas lately been yielding losses for <strong>the</strong> company. 6763 Cameco calculates industry average prices from <strong>the</strong> month‐end prices published by <strong>the</strong> US‐based Ux Consultingand TradeTech. For more information, such as current long‐term and spot prices for uranium, as well as pricehistory, please see http://www.cameco.com/investors/uranium_prices_and_spot_price/.64 By various estimates, Russia will start experiencing a shortage <strong>of</strong> uranium sometime between 2015 and 2017,and Rosatom has been actively pursuing deals seeing purchases <strong>of</strong> foreign uranium production assets. For moreinformation, see, for instance, here: http://bellona.org/articles/articles_2011/slivyak_comment. – Translator.65 Priargunsky Mining and Chemical Works is a subsidiary <strong>of</strong> <strong>the</strong> Rosatom‐owned uranium supplierAtomredmetzoloto (or ARMZ) Uranium Holding. For more information, please seehttp://www.priargunsky.armz.ru/eng/. – Translator.66 More information about TVEL Fuel Company is available at http://www.old.tvel.ru/en/. – Translator.67 “<strong>Russian</strong> <strong>Nuclear</strong> Fuel Producers,” a research report by OLMA Investment Group, December 11, 2006 (Rossiiskyyaderny sektor, OLMA Investment Group, 11.12.2006, http://www.olma.ru/files/analytic/tvel_061211_Rus.pdf, in<strong>Russian</strong>).

27For instance, estimates done in 2006 by <strong>the</strong> Moscow‐based investment company OLMA, 68 whichbased its analysis on a quarterly performance report issued by Priargunsky, pegged <strong>the</strong> average cost <strong>of</strong>uranium sold by <strong>the</strong> company in 2005 at $16.5 per pound <strong>of</strong> U 3 O 8 , or $36.5 per kilogram (though adifferent figure was named by Priargunsky’s top management, namely, $14.5 per pound <strong>of</strong> uraniumconcentrate, or $32 per kilogram). On <strong>the</strong> global spot market, uranium concentrate was sold at <strong>the</strong> timefor $28.5 per pound, or $63 per kilogram.Because <strong>the</strong> entire nuclear fuel cycle in Russia is managed wholly within <strong>the</strong> vast corporatestructure <strong>of</strong> Rosatom , it is suspected that transfer pricing 69 is at play in <strong>the</strong> <strong>Russian</strong> nuclear domain, aset <strong>of</strong> conditions and agreements on adjustment <strong>of</strong> charges for goods and services, established in orderto mitigate <strong>the</strong> industry’s tax burden and ensure cross‐subsidisation. In addition, so‐called tollmanufacturingschemes – where a company processes raw materials that remain <strong>the</strong> customer’sproperty, so it is not <strong>the</strong> product that is <strong>the</strong> subject <strong>of</strong> a purchase‐and‐sale contract, but conversion,enrichment, and fuel production services – are in use. All <strong>of</strong> this complicates a reliable analysis <strong>of</strong> truelevels <strong>of</strong> costs <strong>the</strong> industry bears when purchasing fresh nuclear fuel – even though in <strong>the</strong> view <strong>of</strong>analysts from <strong>the</strong> Bank <strong>of</strong> Moscow, 70 for instance, fuel fabrication prices in Russia approach those on <strong>the</strong>global market.Judging by estimates compiled by <strong>the</strong> above‐mentioned investment experts, <strong>the</strong> <strong>Russian</strong> nuclearfuel cycle, expressed in cost shares <strong>of</strong> services rendered in <strong>the</strong> fuel production chain, looks as follows(estimates here apply to <strong>the</strong> fuel used by reactors <strong>of</strong> <strong>the</strong> VVER‐1000 71 design):Table 7. Cost shares <strong>of</strong> services comprising <strong>the</strong> nuclear fuel cycle in Russia, in investment expertestimates (percentage shares <strong>of</strong> total fuel costs).Expense category Bank <strong>of</strong> Moscow OLMA Investment GroupUranium mining 50 percent 42 percentConversion 3 percent 6 percentEnrichment 38 percent 36 percentFuel fabrication 9 percent 16 percentTOTAL 100 percent 100 percentIn <strong>the</strong> West, separate markets exist to purchase and sell conversion, enrichment, and fuelfabrication services, and prices on <strong>the</strong>se markets have in <strong>the</strong> past several years shown an upward trend,much like uranium prices examined above. See, for instance, <strong>the</strong> following charts from <strong>the</strong> US‐based UxConsulting Company illustrating global price fluctuations for uranium conversion and enrichmentservices (Fig. 2 and 3).68 Ibid.69 A practice <strong>of</strong> internal charges between branches <strong>of</strong> <strong>the</strong> same company adopted by multi‐jurisdictional firms(including multinationals) so that <strong>the</strong>ir accounting practices result in reported high incomes and pr<strong>of</strong>its in thosegeographical areas with low tax rates. From <strong>the</strong> Glossary <strong>of</strong> Regulation Terms, <strong>the</strong> Body <strong>of</strong> Knowledge onInfrastructure Regulation, http://www.regulationbody<strong>of</strong>knowledge.org/. – Translator.70 Yury Volov. <strong>Nuclear</strong> fuel cycle: From uranium to nuclear fuel, an analytical review. Bank <strong>of</strong> Moscow, May 6,2008. (Volov Yu. Kompanii yadernogo tsikla. Ot urana k yadernomu toplivu, Bank <strong>of</strong> Moscow, 06.05.2008,http://www.bm.ru/common/img/uploaded/files/file_13985.pdf, in <strong>Russian</strong>).71 RBMK reactors, ano<strong>the</strong>r Soviet‐designed series, use cheaper fuel with a relatively lesser level <strong>of</strong> uranium‐235enrichment. (<strong>The</strong> <strong>Russian</strong> abbreviation RBMK stands for “high‐power channel‐type reactor” and represents agraphite‐moderated reactor technology that was developed for commercial energy‐producing operation in <strong>the</strong>1960s. <strong>The</strong> first such commercial reactor, an RBMK‐1000, was launched in Russia at Leningrad <strong>Nuclear</strong> <strong>Power</strong>Plant. It was also an RBMK‐1000 reactor that exploded in 1986 at Chernobyl’s Unit 4. RBMK‐1000s are stilloperated at three nuclear power plants in Russia, namely, Leningrad and Kursk NPPs, and Smolensk NPP (inSmolensk Region, Central European Russia). – Translator).

- Page 2 and 3: …Nuclear power generation is the

- Page 4 and 5: Translator’s notes:Rules of etiqu

- Page 6 and 7: 6ForewordThe economy of the Russian

- Page 8 and 9: 8of everything that the nuclear pow

- Page 10 and 11: 10Real costs of nuclear power plant

- Page 12 and 13: 12Energy Potential Development,”

- Page 14 and 15: 14noticeably higher than the regula

- Page 16 and 17: 16came to 2.2 billion kilowatt‐ho

- Page 18 and 19: 183. Problems of nuclear power indu

- Page 20 and 21: 20requirements: If a wrong decision

- Page 22 and 23: 22Property and liability insurance;

- Page 24 and 25: 24Depreciation 10,911,630 9,312,654

- Page 28 and 29: 28Fig. 2. Spot prices for U 3 O 8 c

- Page 30 and 31: 30uranium needs and the demand it h

- Page 32 and 33: 32remains unclear what can be done

- Page 34 and 35: 34For instance, British energy comp

- Page 36 and 37: 36But Rosenergoatom’s real expens

- Page 38 and 39: 38contribution benefit plans, inclu

- Page 40 and 41: 40Table 11. Costs of decommissionin

- Page 42 and 43: 42And thirdly, traditional approach

- Page 44 and 45: 44The discount rate will be the var

- Page 46 and 47: 46Cost ofcapitalTable 15. Price of

- Page 48 and 49: 48operation as a baseload generatin

- Page 50 and 51: 505 percent0 percent367.0 614.3 3.7

- Page 52 and 53: 52The idea to develop the sector of

- Page 54 and 55: 54Even if we assume that the direct

- Page 56 and 57: 56Furthermore, the total cost of bu

- Page 58 and 59: 5811. Instructional guidelines for

- Page 60: 60Greenpeace, 01.04.2004,http://www