The Economics of the Russian Nuclear Power Industry - Bellona

The Economics of the Russian Nuclear Power Industry - Bellona

The Economics of the Russian Nuclear Power Industry - Bellona

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

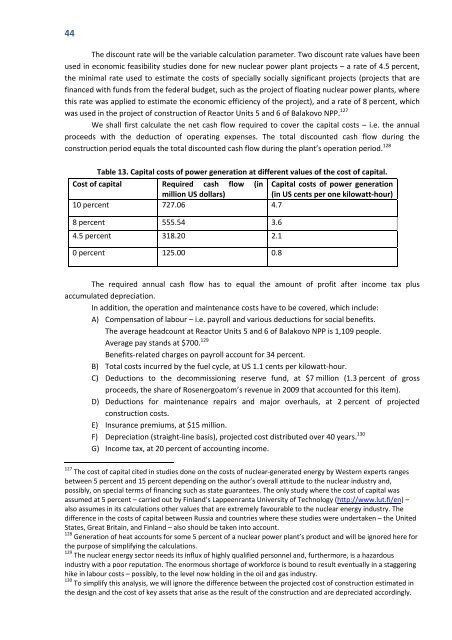

44<strong>The</strong> discount rate will be <strong>the</strong> variable calculation parameter. Two discount rate values have beenused in economic feasibility studies done for new nuclear power plant projects – a rate <strong>of</strong> 4.5 percent,<strong>the</strong> minimal rate used to estimate <strong>the</strong> costs <strong>of</strong> specially socially significant projects (projects that arefinanced with funds from <strong>the</strong> federal budget, such as <strong>the</strong> project <strong>of</strong> floating nuclear power plants, wherethis rate was applied to estimate <strong>the</strong> economic efficiency <strong>of</strong> <strong>the</strong> project), and a rate <strong>of</strong> 8 percent, whichwas used in <strong>the</strong> project <strong>of</strong> construction <strong>of</strong> Reactor Units 5 and 6 <strong>of</strong> Balakovo NPP. 127We shall first calculate <strong>the</strong> net cash flow required to cover <strong>the</strong> capital costs – i.e. <strong>the</strong> annualproceeds with <strong>the</strong> deduction <strong>of</strong> operating expenses. <strong>The</strong> total discounted cash flow during <strong>the</strong>construction period equals <strong>the</strong> total discounted cash flow during <strong>the</strong> plant’s operation period. 128Table 13. Capital costs <strong>of</strong> power generation at different values <strong>of</strong> <strong>the</strong> cost <strong>of</strong> capital.Cost <strong>of</strong> capital Required cash flow (in Capital costs <strong>of</strong> power generationmillion US dollars)(in US cents per one kilowatt‐hour)10 percent 727.06 4.78 percent 555.54 3.64.5 percent 318.20 2.10 percent 125.00 0.8<strong>The</strong> required annual cash flow has to equal <strong>the</strong> amount <strong>of</strong> pr<strong>of</strong>it after income tax plusaccumulated depreciation.In addition, <strong>the</strong> operation and maintenance costs have to be covered, which include:A) Compensation <strong>of</strong> labour – i.e. payroll and various deductions for social benefits.<strong>The</strong> average headcount at Reactor Units 5 and 6 <strong>of</strong> Balakovo NPP is 1,109 people.Average pay stands at $700. 129Benefits‐related charges on payroll account for 34 percent.B) Total costs incurred by <strong>the</strong> fuel cycle, at US 1.1 cents per kilowatt‐hour.C) Deductions to <strong>the</strong> decommissioning reserve fund, at $7 million (1.3 percent <strong>of</strong> grossproceeds, <strong>the</strong> share <strong>of</strong> Rosenergoatom’s revenue in 2009 that accounted for this item).D) Deductions for maintenance repairs and major overhauls, at 2 percent <strong>of</strong> projectedconstruction costs.E) Insurance premiums, at $15 million.F) Depreciation (straight‐line basis), projected cost distributed over 40 years. 130G) Income tax, at 20 percent <strong>of</strong> accounting income.127 <strong>The</strong> cost <strong>of</strong> capital cited in studies done on <strong>the</strong> costs <strong>of</strong> nuclear‐generated energy by Western experts rangesbetween 5 percent and 15 percent depending on <strong>the</strong> author’s overall attitude to <strong>the</strong> nuclear industry and,possibly, on special terms <strong>of</strong> financing such as state guarantees. <strong>The</strong> only study where <strong>the</strong> cost <strong>of</strong> capital wasassumed at 5 percent – carried out by Finland’s Lappeenranta University <strong>of</strong> Technology (http://www.lut.fi/en) –also assumes in its calculations o<strong>the</strong>r values that are extremely favourable to <strong>the</strong> nuclear energy industry. <strong>The</strong>difference in <strong>the</strong> costs <strong>of</strong> capital between Russia and countries where <strong>the</strong>se studies were undertaken – <strong>the</strong> UnitedStates, Great Britain, and Finland – also should be taken into account.128 Generation <strong>of</strong> heat accounts for some 5 percent <strong>of</strong> a nuclear power plant’s product and will be ignored here for<strong>the</strong> purpose <strong>of</strong> simplifying <strong>the</strong> calculations.129 <strong>The</strong> nuclear energy sector needs its influx <strong>of</strong> highly qualified personnel and, fur<strong>the</strong>rmore, is a hazardousindustry with a poor reputation. <strong>The</strong> enormous shortage <strong>of</strong> workforce is bound to result eventually in a staggeringhike in labour costs – possibly, to <strong>the</strong> level now holding in <strong>the</strong> oil and gas industry.130 To simplify this analysis, we will ignore <strong>the</strong> difference between <strong>the</strong> projected cost <strong>of</strong> construction estimated in<strong>the</strong> design and <strong>the</strong> cost <strong>of</strong> key assets that arise as <strong>the</strong> result <strong>of</strong> <strong>the</strong> construction and are depreciated accordingly.