FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

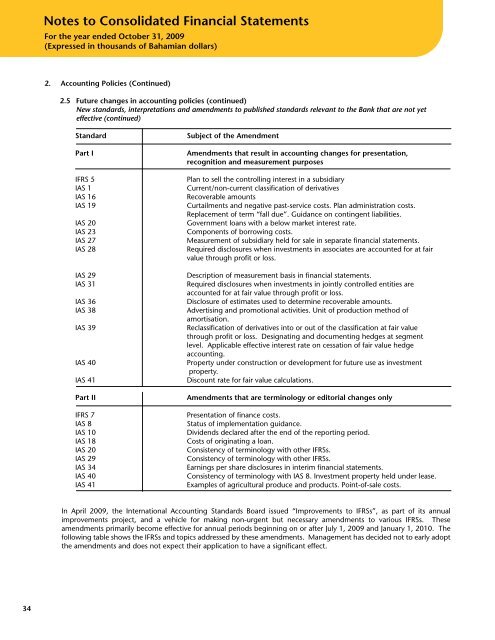

Notes to Consolidated Financial StatementsFor the year ended October 31, 2009(Expressed in thousands of Bahamian dollars)2. Accounting Policies (Continued)2.5 Future changes in accounting policies (continued)New standards, interpretations and amendments to published standards relevant to the <strong>Bank</strong> that are not yeteffective (continued)StandardPart IIFRS 5IAS 1IAS 16IAS 19IAS 20IAS 23IAS 27IAS 28IAS 29IAS 31IAS 36IAS 38IAS 39IAS 40IAS 41Part IIIFRS 7IAS 8IAS 10IAS 18IAS 20IAS 29IAS 34IAS 40IAS 41Subject of the AmendmentAmendments that result in accounting changes for presentation,recognition and measurement purposesPlan to sell the controlling interest in a subsidiaryCurrent/non-current classification of derivativesRecoverable amountsCurtailments and negative past-service costs. Plan administration costs.Replacement of term “fall due”. Guidance on contingent liabilities.Government loans with a below market interest rate.Components of borrowing costs.Measurement of subsidiary held for sale in separate financial statements.Required disclosures when investments in associates are accounted for at fairvalue through profit or loss.Description of measurement basis in financial statements.Required disclosures when investments in jointly controlled entities areaccounted for at fair value through profit or loss.Disclosure of estimates used to determine recoverable amounts.Advertising and promotional activities. Unit of production method ofamortisation.Reclassification of derivatives into or out of the classification at fair valuethrough profit or loss. Designating and documenting hedges at segmentlevel. Applicable effective interest rate on cessation of fair value hedgeaccounting.Property under construction or development for future use as investmentproperty.Discount rate for fair value calculations.Amendments that are terminology or editorial changes onlyPresentation of finance costs.Status of implementation guidance.Dividends declared after the end of the reporting period.Costs of originating a loan.Consistency of terminology with other IFRSs.Consistency of terminology with other IFRSs.Earnings per share disclosures in interim financial statements.Consistency of terminology with IAS 8. Investment property held under lease.Examples of agricultural produce and products. Point-of-sale costs.In April 2009, the <strong>International</strong> Accounting Standards Board issued “Improvements to IFRSs”, as part of its annualimprovements project, and a vehicle for making non-urgent but necessary amendments to various IFRSs. Theseamendments primarily become effective for annual periods beginning on or after July 1, 2009 and January 1, 2010. Thefollowing table shows the IFRSs and topics addressed by these amendments. Management has decided not to early adoptthe amendments and does not expect their application to have a significant effect.34