FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

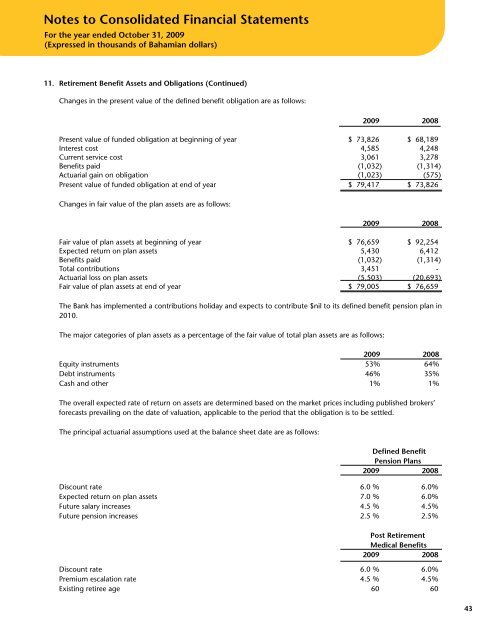

Notes to Consolidated Financial StatementsFor the year ended October 31, 2009(Expressed in thousands of Bahamian dollars)11. Retirement Benefit Assets and Obligations (Continued)Changes in the present value of the defined benefit obligation are as follows:2009 2008Present value of funded obligation at beginning of year $ 73,826 $ 68,189Interest cost 4,585 4,248Current service cost 3,061 3,278Benefits paid (1,032) (1,314)Actuarial gain on obligation (1,023) (575)Present value of funded obligation at end of year $ 79,417 $ 73,826Changes in fair value of the plan assets are as follows:2009 2008Fair value of plan assets at beginning of year $ 76,659 $ 92,254Expected return on plan assets 5,430 6,412Benefits paid (1,032) (1,314)Total contributions 3,451 -Actuarial loss on plan assets (5,503) (20,693)Fair value of plan assets at end of year $ 79,005 $ 76,659The <strong>Bank</strong> has implemented a contributions holiday and expects to contribute $nil to its defined benefit pension plan in2010.The major categories of plan assets as a percentage of the fair value of total plan assets are as follows:2009 2008Equity instruments 53% 64%Debt instruments 46% 35%Cash and other 1% 1%The overall expected rate of return on assets are determined based on the market prices including published brokers’forecasts prevailing on the date of valuation, applicable to the period that the obligation is to be settled.The principal actuarial assumptions used at the balance sheet date are as follows:Defined BenefitPension Plans2009 2008Discount rate 6.0 % 6.0%Expected return on plan assets 7.0 % 6.0%Future salary increases 4.5 % 4.5%Future pension increases 2.5 % 2.5%Post RetirementMedical Benefits2009 2008Discount rate 6.0 % 6.0%Premium escalation rate 4.5 % 4.5%Existing retiree age 60 6043