FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

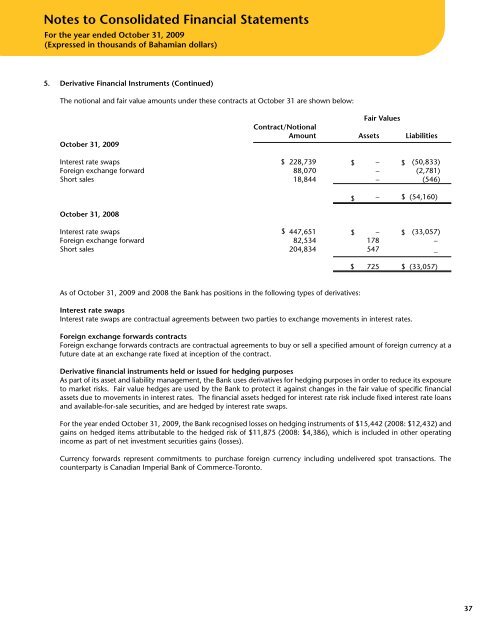

Notes to Consolidated Financial StatementsFor the year ended October 31, 2009(Expressed in thousands of Bahamian dollars)5. Derivative Financial Instruments (Continued)The notional and fair value amounts under these contracts at October 31 are shown below:October 31, 2009Fair ValuesContract/NotionalAmount Assets LiabilitiesInterest rate swaps $ 228,739 $ – $ (50,833)Foreign exchange forward 88,070 – (2,781)Short sales 18,844 – (546)$– $ (54,160)October 31, 2008Interest rate swaps $ 447,651 $ – $ (33,057)Foreign exchange forward 82,534 178 –Short sales 204,834 547 _$ 725 $ (33,057)As of October 31, 2009 and 2008 the <strong>Bank</strong> has positions in the following types of derivatives:Interest rate swapsInterest rate swaps are contractual agreements between two parties to exchange movements in interest rates.Foreign exchange forwards contractsForeign exchange forwards contracts are contractual agreements to buy or sell a specified amount of foreign currency at afuture date at an exchange rate fixed at inception of the contract.Derivative financial instruments held or issued for hedging purposesAs part of its asset and liability management, the <strong>Bank</strong> uses derivatives for hedging purposes in order to reduce its exposureto market risks. Fair value hedges are used by the <strong>Bank</strong> to protect it against changes in the fair value of specific financialassets due to movements in interest rates. The financial assets hedged for interest rate risk include fixed interest rate loansand available-for-sale securities, and are hedged by interest rate swaps.For the year ended October 31, 2009, the <strong>Bank</strong> recognised losses on hedging instruments of $15,442 (2008: $12,432) andgains on hedged items attributable to the hedged risk of $11,875 (2008: $4,386), which is included in other operatingincome as part of net investment securities gains (losses).Currency forwards represent commitments to purchase foreign currency including undelivered spot transactions. Thecounterparty is Canadian Imperial <strong>Bank</strong> of Commerce-Toronto.37