Guide to the General Index of Financial Information ... - New Learner

Guide to the General Index of Financial Information ... - New Learner

Guide to the General Index of Financial Information ... - New Learner

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

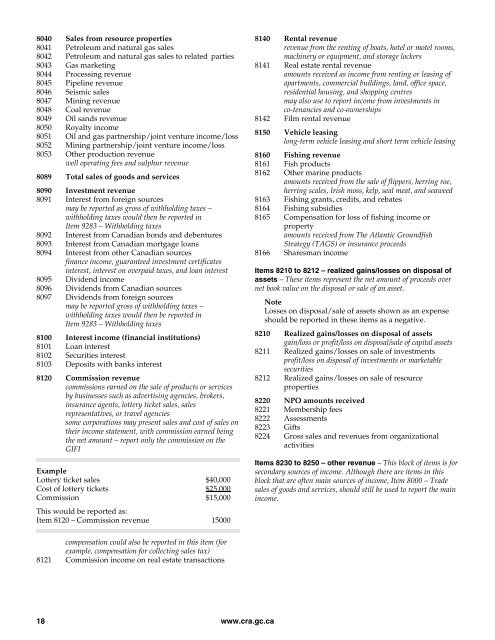

8040 Sales from resource properties8041 Petroleum and natural gas sales8042 Petroleum and natural gas sales <strong>to</strong> related parties8043 Gas marketing8044 Processing revenue8045 Pipeline revenue8046 Seismic sales8047 Mining revenue8048 Coal revenue8049 Oil sands revenue8050 Royalty income8051 Oil and gas partnership/joint venture income/loss8052 Mining partnership/joint venture income/loss8053 O<strong>the</strong>r production revenuewell operating fees and sulphur revenue8089 Total sales <strong>of</strong> goods and services8090 Investment revenue8091 Interest from foreign sourcesmay be reported as gross <strong>of</strong> withholding taxes –withholding taxes would <strong>the</strong>n be reported inItem 9283 – Withholding taxes8092 Interest from Canadian bonds and debentures8093 Interest from Canadian mortgage loans8094 Interest from o<strong>the</strong>r Canadian sourcesfinance income, guaranteed investment certificatesinterest, interest on overpaid taxes, and loan interest8095 Dividend income8096 Dividends from Canadian sources8097 Dividends from foreign sourcesmay be reported gross <strong>of</strong> withholding taxes –withholding taxes would <strong>the</strong>n be reported inItem 9283 – Withholding taxes8100 Interest income (financial institutions)8101 Loan interest8102 Securities interest8103 Deposits with banks interest8120 Commission revenuecommissions earned on <strong>the</strong> sale <strong>of</strong> products or servicesby businesses such as advertising agencies, brokers,insurance agents, lottery ticket sales, salesrepresentatives, or travel agenciessome corporations may present sales and cost <strong>of</strong> sales on<strong>the</strong>ir income statement, with commission earned being<strong>the</strong> net amount – report only <strong>the</strong> commission on <strong>the</strong>GIFIExampleLottery ticket sales $40,000Cost <strong>of</strong> lottery tickets $25,000Commission $15,000This would be reported as:Item 8120 – Commission revenue 150008140 Rental revenuerevenue from <strong>the</strong> renting <strong>of</strong> boats, hotel or motel rooms,machinery or equipment, and s<strong>to</strong>rage lockers8141 Real estate rental revenueamounts received as income from renting or leasing <strong>of</strong>apartments, commercial buildings, land, <strong>of</strong>fice space,residential housing, and shopping centresmay also use <strong>to</strong> report income from investments inco-tenancies and co-ownerships8142 Film rental revenue8150 Vehicle leasinglong-term vehicle leasing and short term vehicle leasing8160 Fishing revenue8161 Fish products8162 O<strong>the</strong>r marine productsamounts received from <strong>the</strong> sale <strong>of</strong> flippers, herring roe,herring scales, Irish moss, kelp, seal meat, and seaweed8163 Fishing grants, credits, and rebates8164 Fishing subsidies8165 Compensation for loss <strong>of</strong> fishing income orpropertyamounts received from The Atlantic GroundfishStrategy (TAGS) or insurance proceeds8166 Sharesman incomeItems 8210 <strong>to</strong> 8212 – realized gains/losses on disposal <strong>of</strong>assets – These items represent <strong>the</strong> net amount <strong>of</strong> proceeds overnet book value on <strong>the</strong> disposal or sale <strong>of</strong> an asset.NoteLosses on disposal/sale <strong>of</strong> assets shown as an expenseshould be reported in <strong>the</strong>se items as a negative.8210 Realized gains/losses on disposal <strong>of</strong> assetsgain/loss or pr<strong>of</strong>it/loss on disposal/sale <strong>of</strong> capital assets8211 Realized gains/losses on sale <strong>of</strong> investmentspr<strong>of</strong>it/loss on disposal <strong>of</strong> investments or marketablesecurities8212 Realized gains/losses on sale <strong>of</strong> resourceproperties8220 NPO amounts received8221 Membership fees8222 Assessments8223 Gifts8224 Gross sales and revenues from organizationalactivitiesItems 8230 <strong>to</strong> 8250 – o<strong>the</strong>r revenue – This block <strong>of</strong> items is forsecondary sources <strong>of</strong> income. Although <strong>the</strong>re are items in thisblock that are <strong>of</strong>ten main sources <strong>of</strong> income, Item 8000 – Tradesales <strong>of</strong> goods and services, should still be used <strong>to</strong> report <strong>the</strong> mainincome.compensation could also be reported in this item (forexample, compensation for collecting sales tax)8121 Commission income on real estate transactions18www.cra.gc.ca