Guide to the General Index of Financial Information ... - New Learner

Guide to the General Index of Financial Information ... - New Learner

Guide to the General Index of Financial Information ... - New Learner

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

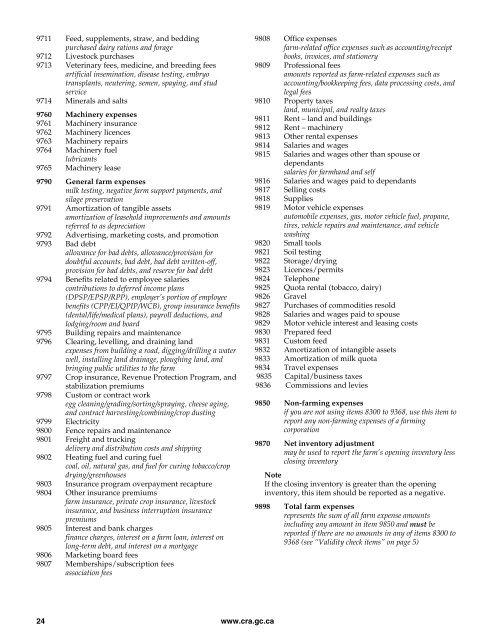

9711 Feed, supplements, straw, and beddingpurchased dairy rations and forage9712 Lives<strong>to</strong>ck purchases9713 Veterinary fees, medicine, and breeding feesartificial insemination, disease testing, embryotransplants, neutering, semen, spaying, and studservice9714 Minerals and salts9760 Machinery expenses9761 Machinery insurance9762 Machinery licences9763 Machinery repairs9764 Machinery fuellubricants9765 Machinery lease9790 <strong>General</strong> farm expensesmilk testing, negative farm support payments, andsilage preservation9791 Amortization <strong>of</strong> tangible assetsamortization <strong>of</strong> leasehold improvements and amountsreferred <strong>to</strong> as depreciation9792 Advertising, marketing costs, and promotion9793 Bad debtallowance for bad debts, allowance/provision fordoubtful accounts, bad debt, bad debt written-<strong>of</strong>f,provision for bad debts, and reserve for bad debt9794 Benefits related <strong>to</strong> employee salariescontributions <strong>to</strong> deferred income plans(DPSP/EPSP/RPP), employer’s portion <strong>of</strong> employeebenefits (CPP/EI/QPIP/WCB), group insurance benefits(dental/life/medical plans), payroll deductions, andlodging/room and board9795 Building repairs and maintenance9796 Clearing, levelling, and draining landexpenses from building a road, digging/drilling a waterwell, installing land drainage, ploughing land, andbringing public utilities <strong>to</strong> <strong>the</strong> farm9797 Crop insurance, Revenue Protection Program, andstabilization premiums9798 Cus<strong>to</strong>m or contract workegg cleaning/grading/sorting/spraying, cheese aging,and contract harvesting/combining/crop dusting9799 Electricity9800 Fence repairs and maintenance9801 Freight and truckingdelivery and distribution costs and shipping9802 Heating fuel and curing fuelcoal, oil, natural gas, and fuel for curing <strong>to</strong>bacco/cropdrying/greenhouses9803 Insurance program overpayment recapture9804 O<strong>the</strong>r insurance premiumsfarm insurance, private crop insurance, lives<strong>to</strong>ckinsurance, and business interruption insurancepremiums9805 Interest and bank chargesfinance charges, interest on a farm loan, interest onlong-term debt, and interest on a mortgage9806 Marketing board fees9807 Memberships/subscription feesassociation fees9808 Office expensesfarm-related <strong>of</strong>fice expenses such as accounting/receiptbooks, invoices, and stationery9809 Pr<strong>of</strong>essional feesamounts reported as farm-related expenses such asaccounting/bookkeeping fees, data processing costs, andlegal fees9810 Property taxesland, municipal, and realty taxes9811 Rent – land and buildings9812 Rent – machinery9813 O<strong>the</strong>r rental expenses9814 Salaries and wages9815 Salaries and wages o<strong>the</strong>r than spouse ordependantssalaries for farmhand and self9816 Salaries and wages paid <strong>to</strong> dependants9817 Selling costs9818 Supplies9819 Mo<strong>to</strong>r vehicle expensesau<strong>to</strong>mobile expenses, gas, mo<strong>to</strong>r vehicle fuel, propane,tires, vehicle repairs and maintenance, and vehiclewashing9820 Small <strong>to</strong>ols9821 Soil testing9822 S<strong>to</strong>rage/drying9823 Licences/permits9824 Telephone9825 Quota rental (<strong>to</strong>bacco, dairy)9826 Gravel9827 Purchases <strong>of</strong> commodities resold9828 Salaries and wages paid <strong>to</strong> spouse9829 Mo<strong>to</strong>r vehicle interest and leasing costs9830 Prepared feed9831 Cus<strong>to</strong>m feed9832 Amortization <strong>of</strong> intangible assets9833 Amortization <strong>of</strong> milk quota9834 Travel expenses9835 Capital/business taxes9836 Commissions and levies9850 Non-farming expensesif you are not using items 8300 <strong>to</strong> 9368, use this item <strong>to</strong>report any non-farming expenses <strong>of</strong> a farmingcorporation9870 Net inven<strong>to</strong>ry adjustmentmay be used <strong>to</strong> report <strong>the</strong> farm’s opening inven<strong>to</strong>ry lessclosing inven<strong>to</strong>ryNoteIf <strong>the</strong> closing inven<strong>to</strong>ry is greater than <strong>the</strong> openinginven<strong>to</strong>ry, this item should be reported as a negative.9898 Total farm expensesrepresents <strong>the</strong> sum <strong>of</strong> all farm expense amountsincluding any amount in item 9850 and must bereported if <strong>the</strong>re are no amounts in any <strong>of</strong> items 8300 <strong>to</strong>9368 (see “Validity check items” on page 5)24www.cra.gc.ca