Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Enteral ProductReimbursement GuideforSkilled Nursing FacilitiesandHomecare ProvidersMAY 2002

Kendall and <strong>Mead</strong> <strong>Johnson</strong> <strong>Nutrition</strong>als are workingtogether to deliver quality nutrition support to patients inhospitals, home care, and nursing homes.Please use this manual to educate yourself, your staff andyour patients on the complexities of enteral nutritionreimbursement. Check the actual requirements of theapplicable payer to make sure your claims are consistent withcoverage criteria and processed properly.Kendall and <strong>Mead</strong> <strong>Johnson</strong> <strong>Nutrition</strong>als would like tothank Allison Cherney of Cherney and Associates foreditorial assistance of this manual.Tyco Healthcare Group15 Hampshire StreetMansfield, MA 02048www.kendallhq.com<strong>Mead</strong> <strong>Johnson</strong> <strong>Nutrition</strong>als2400 West Lloyd ExpresswayEvansville, IN 47721www.meadjohnson.com

PREFACEThe purpose of this manual is to assist clinicians andbilling personnel with understanding how to appropriatelybill payers for enteral products. The manual is divided intosix major sections in order to assist homecare providersand skilled nursing facilities with this task.Section I outlines the clinical rationale for enteralnutrition and administration options. Section II describesthe different types of payers and methods of managed carecost containment. Section III describes the billing ofenteral products to Medicare for skilled nursing facilities.Section IV describes the process for billing enteralproducts to private and managed care payers for skillednursing facilities. Section V summarizes the billingprocesses for enteral products to Medicare <strong>by</strong> homecareproviders. Section VI details how homecare companiescan bill private and managed care payers. Each sectionhighlights the billing forms, codes and general guidelinesfor billing enteral products.This manual provides general guidelines only forskilled nursing facilities and homecare companies.Providers should not in any way interpret this guide asa guarantee of reimbursement. In all cases, providersshould consult with the applicable payer to confirmdocumentation and coverage requirements. Suchrequirements may vary <strong>by</strong> payer, insurance plan orgeographic area.May, 2002 1

TABLE OF CONTENTSPREFACE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1SECTION I – ENTERAL PRODUCTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5TYPES OF ENTERAL PRODUCTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5ENTERAL FEEDING ADMINISTRATION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5SECTION II – TYPES OF PAYERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6MEDICARE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Part A: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Part B (Supplementary Insurance): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6MEDICAID . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6PRIVATE PAYERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Commercial Insurance Companies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Blue Cross and Blue Shield Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6MANAGED CARE ORGANIZATIONS (MCOS). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Health Maintenance Organizations (HMOs) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Preferred Provider Organizations (PPOs) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Self-Insured Employers and Third Party Administrators (TPAs). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7COST CONTAINMENT MECHANISMS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Pretreatment Review (Precertification) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Concurrent Review . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Retrospective Review. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Case Management. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Selective Provider Contracting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Gatekeepers or PCP Models . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9Benefit Coverage Limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9SECTION III – MEDICARE BILLING FOR ENTERAL PRODUCTSIN SKILLED NURSING FACILITIES (SNFS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10REIMBURSEMENT OVERVIEW . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10RESOURCE UTILIZATION GROUPS III CLASSIFICATIONS (RUGS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11MINIMUM DATA SET (MDS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14MDS Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14PPS BILLING FORMS AND CODING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14SECTION IV – SNF GUIDELINES FOR BILLING ENTERALS TO MANAGED CARE ORGANIZATIONS . . . 40FEE-FOR-SERVICE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40PER DIEMS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40CAPITATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40CODES, CLAIM FORMS AND DOCUMENTATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40INSURANCE VERIFICATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40TIMELY FILING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41MEDICAL DOCUMENTATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41SECTION V – ENTERAL BILLING FOR PART B MEDICARE PROVIDERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42DETERMINING ELIGIBILITY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42Provider Eligibility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42ENTERAL PRODUCT COVERAGE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44Product Payment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44MEDICARE CLAIMS FORMS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44Medicare Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48Enteral <strong>Nutrition</strong> . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48Rental and Purchase Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 482

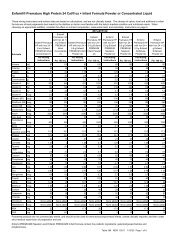

LIST OF EXHIBITSExhibit 1 - RUG III Urban Rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12Exhibit 2 - RUG III Rural Rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13Exhibit 3 - Sample MDS Form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15-37Exhibit 4 - Sample UB-92 Form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38-39Exhibit 5 - DMEPOS Claims Jurisdiction <strong>by</strong> Region . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43Exhibit 6 - Sample HCFA-1500 Claim Form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45-46Exhibit 7 - HCPCS Codes for Enteral Supplies and Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47Exhibit 8 - Medicare Approved Medical <strong>Nutrition</strong> Products Provided <strong>by</strong> <strong>Mead</strong> <strong>Johnson</strong> . . . . . . . . . . . . . . . 49Exhibit 9 - Enteral Therapy Diagnoses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51Exhibit 10 - Sample CMN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54-55Exhibit 11 - Medicare Timely Filing Limits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56Exhibit 12 - Medical Appeals Process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58-59Exhibit 13 - Diagnoses Generally Accepted Indications for Enteral Therapy with ICD-9-CM Codes. . . . . . . 61Exhibit 14 - Clinical Conditions for Swallowing Disorders with ICD-9-CM Code . . . . . . . . . . . . . . . . . . . . . 62Exhibit 15 - Indications for Use and Required Justification for Reimbursement of a Category IV Formula . . 63-66Exhibit 16 - Enteral Products Reference Guide: 1998 – 2002 Medicare IIC Rates . . . . . . . . . . . . . . . . . . . 67-68Exhibit 17 - Methods of Establishing Capitation Rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 714

SECTION I – ENTERAL PRODUCTSTYPES OF ENTERAL PRODUCTSThere are over 200 enteral nutrition formulas on themarket today. The majority of these fall into two differentcategories — oral and tube feeding. Oral formulas arethose that a patient can drink. These include productssuch as Boost ® and Choice dm ® Beverages. Most oralformulas are used for meal replacement, nutritionalsupplementation, and additional nutrition for the at riskpatient population. Oral formulas generally taste goodand are available in a variety of flavors, such aschocolate, vanilla, or strawberry.The second type of formula is tube feeding.These enteral formulas also contain all of theessential nutrients, and they are unflavored. Tubefeedings vary in concentration and are administeredvia different types of feeding tubes (i.e., nasogastric,gastrostomy, jejunostomy). Tube feeding formulascome in various concentrations that range from one totwo calories per mL (milliliter).ENTERAL FEEDING ADMINISTRATIONEnteral products can be administered <strong>by</strong> mouth orvia a feeding tube. Tube feedings are generallyprescribed when a patient either can’t tolerate food <strong>by</strong>mouth or they are unable to swallow due to a stroke,esophageal cancer or malnutrition. Enteral products areavailable either in cans or ready-to-hang containers forpatients. The ready to hang containers come in 1000 mLand 1500 mL sizes and are made of either rigid orflexible plastic. When the patient is ready to receive theirformula, the bag or bottle is spiked with anadministration set and hung from an I.V. pole.Tube feedings can be given to a patient via the nose(nasogastric administration), stomach (gastrostomy) orthrough the small bowel (jejunostomy). Nasogastric or“NG” tubes are typically inserted at the patient’s bedside.To perform this procedure, a tube is inserted through thepatient’s nose, down through the throat and into thestomach. The primary advantage of nasogastric feedings isthat they are relatively easy to set up and to discontinue.The major disadvantage to these types of feedings is thatthey are uncomfortable for the patient because there is asmall tube in their body at all times. Normally, a patienthas a nasogastric feeding from one to three months.Roughly 20% of all enteral patients in skilled nursingfacilities and in the home care setting receive enteralproducts via nasogastric administration.The most common form of enteral productadministration (estimated at 80%) is via a gastrostomy or“G” tube. A gastrostomy requires that a surgical incisionbe made into a patient’s stomach or that the tube is placedvia endoscopy. This procedure leaves a permanent stoma,or hole, in the patient’s stomach. A PEG (PercutaneousEndoscopically placed Gastrostomy) tube, unlike anasogastric tube, is a permanent placement. However, thistype of administration is not as noticeable or asuncomfortable as an NG tube.Enteral formulas that are administered via NG orgastric tubes for patients are given either via gravity orpump administration. A gravity feeding means that theformula drips regularly from the natural pull of gravity,while pump feeding uses an electronic device that movesthe formula into the patient. Enteral pumps have a rotaryperistaltic action that administers small drips at variousrates to the patient. A typical administration rate is 80 mLper hour. Pumps typically run from 18 to 24 hours per day.Enteral pumps, like most enteral products, are availablefrom a number of manufacturers.Usually, the clinician who is responsible for setting upthe enteral formula, determines whether or not the formulawill be administered via gravity or pump. Some cliniciansbelieve that gravity administration is superior while othersbelieve that pump administration is better for the patient.Another form of administration of enteral formulas iswith a jejunostomy. A jejunostomy tube is placedsurgically into a patient’s intestinal tract. Jejunostomiesare used for patients who cannot digest their food well inthe stomach. They are most commonly placed forcritically ill patients. As such, jejunostomies are rarelyseen in skilled nursing facility or home care settings.From a reimbursement perspective, it is importantto understand which enteral products are being used, aswell as the method of administration. Typically, oralproduct administration is not paid for <strong>by</strong> Medicare nor<strong>by</strong> most Medicaid programs because it is considered adietary supplement (refer to your state Medicaid lawsfor details). However, there are some private indemnityand managed care programs that will pay for oralproducts. Payment for these products is dependent uponthe type of insurance policy that a patient has, as well asindividual reimbursement rates established <strong>by</strong> theinsurance company.Medicare and most Medicaid programs will generallyreimburse for tube fed products that are administered <strong>by</strong>nasogastric, gastric or jejunostomy routes. Medicare hasvery specific criteria <strong>by</strong> which these products will be paidfor. These criteria are included later in this guidebook.Medicare will also generally pay for the administration ofenteral products <strong>by</strong> gravity or <strong>by</strong> pump. Private andmanaged care payers vary widely on their reimbursementof enteral products. Most of these organizations need tosee documentation that enteral products are medicallynecessary before they will reimburse for products. Pleaseconsult your private and managed care payers for specificdetails pertaining to enteral nutrition reimbursement.May, 2002 5

SECTION II – TYPES OF PAYERSThere are two major types of payers for enteralproducts. There are government payers, which includeMedicare and Medicaid, and private payers, which arepublicly or privately held. The following is a summary ofeach of these payer types and their general coveragepolicies for enteral nutrition.MEDICAREMedicare is the federally funded program for peopleover the age of 65 or for those who have been disabledfor at least 25 consecutive months. Medicare also coversthose with end-stage renal disease. Medicare patientscan either be paid directly through their Medicarebenefits or they can opt to become part of a Medicarerisk or health maintenance organization (HMO)program. If Medicare members select to participate in anHMO, then their enteral product coverage is establishedand paid for according to the rules of the HMO.The Medicare program is administered <strong>by</strong> the HealthCare Financing Administration (HCFA). HCFA interpretsthe laws for Medicare as set for the federal governmentand administers the Medicare program.Medicare is comprised of two parts, Part A and Part B.Through these two parts, Medicare pays for different typesof provider services as follows:Part A:➝ Inpatient hospital services➝ Outpatient hospital services➝ Skilled nursing facility (SNF) services➝ Home health agencies (HHAs)Part B (Supplementary Insurance):➝ Physician services➝ Durable medical equipment (DME) providersIt is important to understand which part ofMedicare covers a particular provider’s servicesbecause the billing forms, billing codes, reimbursementcriteria, and reimbursement amounts are differentbetween Part A and Part B.MEDICAIDMedicaid is a program for the impoverished that isadministered individually <strong>by</strong> each state. As such, subjectto certain federal requirements each state sets individualcriteria for what constitutes “poverty,” and each statealso establishes a separate coverage criteria for enteralproducts. In order to find out how an individual statecovers enteral products, contact the state agency directly.Although reimbursement varies from state to state,Medicaid payment rates for enteral products aregenerally lower than Medicare, private, and managedcare rates.6PRIVATE PAYERSThere are a wide variety of private payers in theUnited States. The two largest categories of privatepayers are commercial insurance companies and BlueCross/Blue Shield plans.Commercial Insurance CompaniesCommercial insurance companies have diversecoverage and payment policy methodologies. Coveragefor enteral products and services is determined <strong>by</strong> eachcompany as well as <strong>by</strong> each type of insurance plan atthe company. Coverage for enteral products will bedetermined after a review of all of the provisionswithin the individual policy, as well as plan-specificpolicies and practices.In general, commercial insurance companies pay forenteral products and services based upon “usual andcustomary” charges. These charges are determined basedupon historical data for enteral product charges, as well asgeographic area differences. The percentage of “usual andcustomary” charges paid <strong>by</strong> the commercial insurancecompany depends on the individual patient’s policy. Youshould consult the specific payer for coverage criteria.Blue Cross and Blue Shield PlansBlue Cross and Blue Shield is one of the largestprivate payers in the United States with over 80 plansavailable nationwide. Although each of the BlueCross/Blue Shield plans operates as a separate anddistinct entity, these plans are loosely affiliated with eachother through the national Blue Cross and Blue Shieldassociation. Coverage policies and reimbursement forenteral nutrition products varies with each individualBlue Cross and Blue Shield plan. Each of these plans hasa physician panel that makes all of the coverage andreimbursement decisions. You should consult the specificplan for coverage criteria.MANAGED CARE ORGANIZATIONS (MCOS)The vast majority of health plans today are subject tosome form of managed care, meaning that there arerestrictions placed on provider selection or the number andtypes of services that will be covered <strong>by</strong> the plan.Health Maintenance Organizations (HMOs)HMOs are corporations that are state licensed toassume the financial responsibility for medical services totheir members. Where traditional insurance companies areresponsible for reimbursing their beneficiaries for the costof healthcare, HMOs are responsible for providingcomprehensive healthcare services at a fixed price. HMOsreceive a fixed payment from their members and they inturn, must manage benefit payments accordingly. Becauseof this, HMOs have the most strict cost controlmechanisms of any type of managed care organization.HMOs service the commercial (under 65), senior/Medicare(over 65) and many Medicaid (impoverished) members.May, 2002

Preferred Provider Organizations (PPOs)PPOs are organizations that contract with healthcareproviders at a discount to provide services to theirbeneficiaries. Some PPOs are just contracting entitieswhile others contract with providers as well as processclaims, assume financial risk, market to employers, andperform various cost control functions.The coverage for enteral products in skilled nursingfacilities and homecare companies varies extensively <strong>by</strong>individual PPO. However, most PPOs will generally pay80% to 90% of preferred (those on contract) providercharges and 50% to 70% of non-preferred (those not oncontract) provider charges. Some PPOs charge the patienta co-payment amount, while others waive the co-paymentwhen preferred providers are used. You should consultwith the specific PPO for coverage criteria andreimbursement rates.Self-Insured Employers and Third PartyAdministrators (TPAs)A growing number of U.S. companies are becomingself-insured and are assuming the financial risk for theiremployees’ health benefits. About one-third of selfinsuredemployers are “self-administered,” meaning theydo their own provider contracting, cost containment, andclaims administration. The other two-thirds rely on a ThirdParty Administrator (TPA) to handle this function.Self-insured employers that are self-administered willdetermine the benefits for enteral nutrition products andservices, as well as review and pay covered claims. Selfinsuredemployers that use a TPA will rely on the TPA toadminister benefits to employees.COST CONTAINMENT MECHANISMSThere are a number of different cost containmentmechanisms in managed care. Those that affect thereimbursement of enteral products are reviewed in thefollowing section.Pretreatment Review (Precertification)Pretreatment review programs, sometimes called“precertification” or “precert” programs, are now acommon component of “managed” insurance plans. Withpretreatment review, either the patient or the provider mustcall an 800 number to request authorization for theplanned service. These programs may be patient-driven,meaning the patient is supposed to call the reviewprogram, which then contacts the provider, or providerdrivenmeaning the patient gives the insurance card withthe review program phone number to the provider so thatthe provider can call the review program.In precertification programs, nurses review themedical necessity of the proposed treatment, using criteriawhich vary from one review program to another. Thesenurses usually have access to physician consultants forreview of more complex cases. The review programpersonnel may work for an insurer, HMO, PPO, ThirdParty Administrator (TPA), or for a separate utilizationreview company under contract to one of these payers.Precertification programs also differ with respect towhich entity bears the financial burden of compliancewith the review program. In a managed insurance plan,the patient is typically at risk for having the carereimbursed at a 10% to 30% lower rate if pretreatment is<strong>by</strong>passed. In PPOs or HMOs, the compliance burdenmore often resides with the provider. The penalty for noncompliancecan range from reimbursement at a lowerrate, to a “black mark” on the provider’s utilizationreview profile, to denial of reimbursement for the serviceprovided without authorization.The list of services that require pretreatment reviewvaries widely among insurers’ plans. Almost all programsrequire review of hospital admissions. Most requirereview of significant outpatient surgeries or procedures.Policies on skilled nursing facility, homecare and otherancillary services vary widely. The safest practice for anyprovider or patient is to call the review program 800number and check on the review program’s policies.One aspect of preauthorization review programs thatcan confuse providers and lead to unpaid claims is theissue of exactly what it means when a proposed service is“precertified” or “preauthorized.” Most programs areresponsible only for determining that the proposed servicemeets medical necessity guidelines based on theinformation they were given during the request forauthorization. Reimbursement may still be denied evenwhen preauthorization has been obtained for one or moreof the following reasons:May, 2002 7❏❏The patient is not covered <strong>by</strong> the insurance planat the time the service is providedThe service provided is not covered under thebenefit plan❏ The patient has exhausted the relevant benefitsavailable under their insurance❏ The patient’s condition changed afterpreauthorization was obtained, making theservices no longer medically necessary in thereview programs’ judgment❏ Information provided during the preauthorizationrequest is subsequently determined to besubstantially inaccurate or incomplete leading toa different conclusion as to the medical necessityof the serviceThe same office that handles preauthorization mayalso verify eligibility and benefits for the proposedservice, but more often this is a different department.Sometimes skilled nursing facility or homecare servicescan be authorized and paid for even when the patient’sbenefit plan does not cover the proposed service or whenbenefits for these services have been exhausted. If theseservices are not provided in a benefit plan and the patientwould require more expensive inpatient or outpatienthospital services, the review program may, nevertheless,approve and agree to pay for these services. The reviewprograms case management department usually handlesconsideration for such exceptions.

Concurrent ReviewConcurrent review refers to review that occurs duringthe course of treatment. An example of concurrent reviewwould be when a skilled nursing facility’s (SNFs) utilizationreview coordinator checks on inpatients to ensure that theystill require services. Almost all precertification programsalso have a concurrent review component. For example, inresponse to a request for a cancer patient to receive enteraltherapy at home, the managed care company’s reviewprogram would typically grant authorization for a limitednumber of days. They would also require that the homecareprovider or the patient’s physician call to update them on thepatient’s clinical situation after a specified number of daysso that they can assess whether the services continue to meettheir medical necessity guidelines.Retrospective ReviewRetrospective review means review of treatment afterthe treatment has occurred. Retrospective review canoccur either before or after a claim is paid. In retrospectivereview, managed care companies examine claims data toidentify selected claims or providers for which additionalinformation or more intensive scrutiny is needed.Most insurers have long had systems for catchingclaims with missing or nonsensical procedure or diagnosticdata, and they require additional information before theseclaims are paid. In recent years, these systems have becomemore sophisticated. For example, computerized logic maycompare the procedure with the patient’s diagnosis, with arequirement that the two be consistent. It is not clearwhether such systems actually deter provision of medicallyunnecessary services. However, these programs do forceproviders to pay much more careful attention to the datathey submit on claims if they want to avoid payment delays.Another form of retrospective review that is becomingmuch more heavily used <strong>by</strong> managed care organizations is“provider profiling.” Insurers or HMOs are organizing theirclaims data into databases that permit a wide range ofanalyses. For example, they might compare allgastroenterologists in terms of their average use of hospitaldays per patient, average lab tests per patient, and averagehomecare expenses per patient. If one has utilizationstatistics that differ significantly from those of the others,the managed care company might choose to conduct moredetailed analyses using the claims database, or might decideto have a medical director or utilization review committeereview selected medical records of this gastroenterologist.Some MCOs have discontinued these practices however,because of the high cost of administration.Actions that a managed care organization can takebased on retrospective review vary <strong>by</strong> the type of managedcare organization and the specific problems identified inthe review; potential actions include:❏ Denial of payment for a specific claim8❏❏Request a provider return payments already madefor disputed claimsUnder some risk-sharing arrangements, link bonusesor withhold payments to utilization numbers derivedfrom retrospective utilization analyses❏❏Subject the provider to more rigorous pretreatmentreview or case managementPlace the provider under less rigorous review(based on a favorable profile)❏ Remove the provider from the contractednetwork or not renew its contractCase ManagementThe terms utilization review and case managementcan mean different things to different managed careorganizations. Although case management often has autilization review component to it, case managementdiffers from utilization review in several respects.While utilization review personnel essentially processtransactions (treatment authorization requests), casemanagers spend much more time on a small number ofcases (between 30 and 60). Case management involves amore intense effort to understand the clinical andpsychosocial issues of a particular patient. Case managersusually have broader authority and purpose than utilizationreview personnel. While case managers may make medicalnecessity determinations for their cases, they oftenproactively organize treatment plans; help select skillednursing facility, homecare, and other ancillary providers;and negotiate prices for these services.Case management programs are often linked toutilization review programs so that appropriate cases canbe identified and referred to case management in a timelymanner. Managed care organizations (MCOs) differ withrespect to the criteria they use for initiating casemanagement. Most programs use criteria that look atdiagnoses and treatment.Selective Provider ContractingThe most powerful method that managed carecompanies have for controlling costs is through providercontracting. Under conventional insurance, no contractexists between the provider and the insurer. This leavesproviders free to set their fees, and gives insurers limitedleverage in their dealings with providers. By definition,PPOs and HMOs have contracts with providers (althoughnot necessarily with homecare providers).Through contracts, PPOs and HMOs control theircosts <strong>by</strong> having providers agree to accept fees specified <strong>by</strong>the contract and cooperate with various utilizationmanagement features. In contracting with PPOs andHMOs, providers agree to accept fees that are almostalways lower than their usual fees in return for the flow ofpatients that they expect to receive from the managed careplan. PPOs and HMOs are able to deliver patients to theircontracted providers because they contract with a limitedset of providers and because most plans usually grow theirenrollment over time.Besides discounted fees, provider contracts allowmanaged care firms to control costs <strong>by</strong> having providersagree to cooperate with utilization review, refer to othercontracted providers, and adhere to practice guidelines.May, 2002

Gatekeepers or PCP ModelsA gatekeeper is a primary care physician (PCP).Primary care physicians can be family practitioners, generalpractitioners, or pediatricians who are responsible forauthorizing other services for a defined panel of patientsassigned to the gatekeeper or PCP. Compensation to the PCPis linked in some way to the cost of the services used <strong>by</strong> thePCP’s patients. Gatekeepers are most often used <strong>by</strong> HMOsto control the usage of specialty services. Usually, a patientcannot be referred to a specialist without the gatekeeper’sauthorization. Gatekeeper arrangements have generallybeen found to be very effective in controlling costs.However, many patients don’t like these arrangements.Benefit Coverage LimitationsManaged care organizations also control costs <strong>by</strong>limiting the types of products used and the extent of servicesprovided. Some limitations are specified in plan documentsdistributed to patients. For example, a plan’s benefit may belimited to five homecare visits for enteral patients or 20skilled nursing facility days. Other limitations are matters ofpolicy that are only communicated when a treatmentauthorization request is received. A managed careorganization may have a policy of not paying for a particulartype of enteral pump because they are perceived to be moreexpensive than gravity administration. This restriction wouldnot appear in any plan documentation. You should clarify anybenefit coverage limitations prior to initiation of treatment.May, 2002 9

SECTION III – MEDICARE BILLING FOR ENTERAL PRODUCTS INSKILLED NURSING FACILITIES (SNFS)Skilled nursing facilities can bill Medicare, Medicaid,private indemnity or managed care payers for theirservices. Medicare covers SNF services through Part A fora period of 100 days per episode of illness, despite howsick a patient may be during this course of illness. A benefitperiod starts in the hospital for a period of at least threedays. The benefit period ends with discharge from theskilled nursing facility. If the patient is not in the hospitalor SNF for 60 consecutive days, the patient may qualify fora new benefit period assuming all of the required criteriaare met. In order to qualify for Part A Medicare benefits inan SNF, all of the following criteria must be met:❏❏❏❏❏❏The patient has been in the hospital for at leastthree consecutive days or 72 hours for acondition to be considered “medicallynecessary” <strong>by</strong> MedicareThe patient must have been discharged within30 days following this hospitalizationThe patient will be treated for either the samecondition that was present at the time ofdischarge or the medical condition that aroseduring the hospital stayThe patient requires skilled nursing care orrehabilitation services (e.g., physical therapy)every day they are in the SNFThe services can only be delivered <strong>by</strong> the SNF(i.e., they can’t be cared for at home)The SNF providing the services is MedicareCertified (SNFs typically have a Medicaredistinct unit that is certified)REIMBURSEMENT OVERVIEWMedicare reimbursement represents an average of10% of the typical SNF’s payment mix. Traditionally,SNFs have been paid on a cost-related basis throughMedicare Part A for their services. With escalatingMedicare expenditures for SNF services, the federalgovernment passed the 1997 Balanced Budget Act (BBA)which moved SNF reimbursement from a cost basis to aProspective Payment System (PPS).Prior to the BBA, Medicare reimbursed skillednursing facilities on three different levels based on thethree major components of costs – routine operatingexpenses, ancillary services, and capital expenses. Ingeneral, routine operating services were paid on an actualcost basis up to a per diem limit; ancillary services werepaid on a reasonable cost basis; and capital expenses werepaid on a pass through basis. Separate cost limits wereapplied to hospital-based and freestanding SNFs and tourban and rural SNFs. New providers were exempt fromthese limits for the first three years of operation. Facilitiescould receive exemption payments if they could10demonstrate that their Medicare case mix was sufficientlyhigher than average to warrant higher payments.Ancillary services costs, however, constituted agrowing share of SNF expenditures. This growth wasbecause ancillary services were not subject to a per diemcost limit and were rarely reviewed <strong>by</strong> Medicare. Mostancillary services were reimbursed under Part A.However, ancillary services could be reimbursed underMedicare Part B if they were not directly furnished <strong>by</strong> theSNF or if patients were not covered <strong>by</strong> Part A. In general,the different accounting systems for Part A and Part Bmean that Medicare could not readily monitor totalprogram spending for the SNF patients.The Prospective Payment System (PPS) went intoeffect in July of 1998, and the BBA moved skilled nursingfacilities into a per diem prospective payment system. ThePPS rates cover routine, ancillary and capital costs. Thisincludes items and services for which payment hadpreviously been made under Part B with a few exceptions(e.g., physician and psychologist services). Under the newsystem, an SNF receives a payment that is derived from ablend of a case mix-adjusted Federal Rate and a facilityspecificrate based on the facility’s historical costs. Thisblend begins in the SNF’s first fiscal year after July of1998. Also, it changes over a three year period in a waythat weights the Federal Rate ever more heavily withpayments reflecting 25% of the Federal Rate in the firstyear, 50% in the second year, 75% in the third year and100% thereafter.Separate rates were derived for SNFs in urban andrural areas, and further adjustments were made ofgeographic variations in wage rates and case mix. TheFederal Rates also adjusted to account for a facility’s casemix using a resident classification system (ResourceUtilization Groups III). Exception payments for case mixare eliminated from the Federal Rate.Facility-specific rates are based on fiscal year 1995cost reports, trended forward. Those rates are updatedfrom 1995 <strong>by</strong> the SNF market basket percentage increaseminus one percentage point. Included in the facilityspecificper diem rate is an estimate of the amount payableunder Part B for covered SNF services furnished duringfiscal year 1995. In contrast to the Federal Rates, facilityspecificrates include exceptions to the routine cost limits.The BBA also provided for a Consolidated Billingmeasure. This meant that essentially all Medicare claims forservices delivered in the SNF (including those billed underPart B) be submitted <strong>by</strong> the SNF, regardless of whether theservice was provided <strong>by</strong> the in-house staff or externalentities (e.g., independent therapists). Consolidated Billingrequirements were to be effective for SNF residents whosestays are covered under Part A. These measures wereintended to secure a full accounting for all costs associatedMay, 2002

with treating Medicare beneficiaries in the facilities, thusproviding an incentive to limit the previously unrestrainedgrowth in ancillary services. The Consolidated Billingmeasure has been put on indefinite hold <strong>by</strong> HCFA but maybe subject to implementation at any time.The Consolidated Billing measure would have forcedSNFs to bill for enteral products through Part A, ratherthan having the option to bill through Part B. SNFs wouldhave also had to bill for other Part B products in thismanner, among them, prosthetics and orthotics, surgicaldressings and supplies, parenteral nutrition, laboratory andinpatient services.The Consolidated Billing measure applied to servicesthat were delivered to SNF residents, who were not yet onthe Prospective Payment System, during their Part A stay.It also applied to SNF residents who had exhausted theirPart A stay (they were past their 100 days of benefits) andwere eligible for Part B billing. Certain services wereexcluded from this benefit including:❏ Erythropojetin (EPO) for certain dialysis patients❏ Hospice care❏ Certain ambulance trips❏ Physician services❏❏❏❏Nurse practitioners and CNs working with aphysicianCertified nurse midwivesQualified psychologistsHome dialysisA skilled nursing facility resident is defined as abeneficiary who is admitted to a Medicare participatingSNF (or to the non-participating portion of a nursing homethat also includes a Medicare participating SNF)regardless of whether Part A covers the stay.All services were to be submitted in a HCFA-1450.All services including those furnished <strong>by</strong> an outsidesupplier, were to be included on the Part A bill. The resultof this provision would have been that SNFs would nolonger be able to “unbundle” services to an outsidesupplier then submit these on a separate bill to the Part Bcarrier. Instead, the SNF would have to either provideenteral services directly or through a subcontractor, andbill Medicare directly (versus having the Part B providerbill Medicare). All claims would have been paid directly tothe SNF which would in turn, pay any subcontractors.HCFA projects that the PPS will reduce MedicareSNF payments <strong>by</strong> approximately 21% on average whenPPS is fully implemented. Because Medicare represents anaverage of 10% of the typical SNF’s payer mix, HCFApredicted that total revenue for SNFs will be reduced <strong>by</strong>about 2.1% on average.RESOURCE UTILIZATION GROUPS IIICLASSIFICATIONS (RUGS)The PPS system for SNFs is based on what is knownas RUG-III, a 44-group classification system that wasdesigned and tested for Medicare and Medicaid nursinghome patients. It classifies patients into homogeneousgroups according to health and functional characteristicsand the amount and type of resources they use.Information used to classify patients into RUG-III groupsis derived from the Minimum Data Set (MDS). Unlikehospital DRGs, which classify patients based on a perdischarge basis, RUG-III was developed to classifypatients on a per diem cost basis. The initial set ofgroupings of the RUG-III system is a hierarchyrepresenting residents grouped according to their clinicalcharacteristics (rehabilitation, extensive services, specialcare, clinically complex, impaired cognition, behaviorproblems, and reduced physical function). Within each setof clinical characteristics, patients are grouped into morerefined categories representing resource-use requirements.The rehabilitation category is divided into five levels ofservices intensity, for example, based on the total minutesof therapy received per week, the days of therapy per weekand the number of different types of therapy received.Residents whose clinical conditions do not require therapyare classified into descending order of severity, based onnumber of services used and the amount of time andresources required for their care. Although the RUG-IIIbased payment system is already in operation, HCFA iscontinuing research into further refinements of it, with acurrent focus on the cost of non-therapy ancillary services.The following Exhibits 1 and 2 are the RUG-IIIclassifications for rural and urban areas. Theclassifications and rates are subject to change.Providers should consult with the applicable MedicareIntermediary for applicable classifications and rates.May, 2002 11

12EXHIBIT 1 - RUG III URBAN RATES

EXHIBIT 2 - RUG III RURAL RATES13

The following services are either included orexcluded in the PPS per diem rates:➝ Nursing care➝ Therapy services (e.g., physical therapy)➝ Routine costs and overhead➝ Capital expenditures➝ Outpatient stays over 23 hours➝ Drugs➝ Supplies➝ Transportation➝ Physician services➝ Emergency room services➝ DialysisEnteral products and services are specificallycalculated into two RUG categories:14➝“Special” RUG-III classification defined as“MS, Qud or CP with ADLSUM>=10,Respiratory therapy = 7 days, Tube Fed andAphasia; Rad. Rx, Rx for SurgicalWounds/Lesions or ulcers; Fever withDehydration; Pneumonia, Vomiting, WeightLoss or Tube.” Capital expenditures➝ “Clinically Complex” which is defined as“Burns, Coma, Septicemia, Pneumonia, Footwounds, Internal bleeding, Dehydrated, Tubefed (minimum 501 mL Fluid, 26% calories),Oxygen, Hemiplegia (ADLSUM>=10),Chemotherapy, Dialysis, Days Dr. visit 1 orderchange 4 or more days, Days Dr. visit, orderchange two or more days, Diabetes withinjection 7 days and order change => two days.”When the RUG rates were developed <strong>by</strong> HCFA, theyincorporated the minimum criteria for enterals of coveragefor tube feedings only where a minimum of 51% ofcalories are delivered via tube feeding or at least 26% oftotal calories and 500 mL of total fluid volume delivereddaily. There were no other specific inclusions of enteralproducts in the RUG III rates.MINIMUM DATA SET (MDS)The MDS 2.0 is a 109-item resident assessment formthat is used to determine an SNF patient’s condition. Theinformation from the MDS is in turn used to determine apatient’s RUG category, which determines the per diemrate for the patient.The MDS contains standard demographic data foridentification including resident name, social securitynumber, Medicare number, Medicaid number, gender,race/ethnicity and birth date. Other areas included in theMDS are:❏ Customary routines❏ Cognitive patterns❏ Communication/hearing patterns❏ Vision patterns❏❏❏❏❏❏❏❏❏❏❏❏❏❏Mood and behavior patternsPsychosocial well-beingPhysical functioning and structural problemsContinence statusDisease diagnosisHeart conditionsOral/nutritional statusOral/dental statusSkin conditionActivity pursuit patternsMedicationsSpecial treatment and proceduresDischarge potential and overall statusParticipation in assessmentThe following pages (Exhibit 3) are a sample copy ofthe MDS.MDS RequirementsThe following are MDS 2.0 requirements:❏ The form must be transmitted in a standardizedformat in accordance with HCFA specifications❏ The form must be electronically encoded❏ The facility must retain a copy of the MDS inpatient’s file❏ For Medicare Part A (PPS) coverage, the MDSassessment must be conducted on days 7, 14,30, 60 and 90❏ The MDS must be completed and filed in atimely manner to ensure MedicarereimbursementPPS BILLING FORMS AND CODINGAs with billing prior to PPS, billing takes place on theUB-92 form (see Exhibit 4). The billing codes for non-PPSSNF patients are found in the UB-92 National UniformBilling Data Specification as Developed <strong>by</strong> the NationalUniform Billing Committee. These codes are three-digitcodes that signify the types of services provided. Thiscoding reference may be obtained through the AmericanHospital Association at (312) 422-3000. The RUG III codesare used to delineate the daily rate charges for Medicare.The following Exhibit 4 is a sample UB-92 form:For comprehensive instructions on how to completethe UB-92, MDS 2.0 and related forms, the following arereferences:➝ HCFA’s web site www.hcfa.gov➝➝UB-92 National Uniform Billing Data ElementSpecifications as Developed <strong>by</strong> the NationalUniform Billing Committee, available throughthe American Hospital Association in Chicago,Illinois at 312-422-3000The HCFA SNF Manual, which is available fordownload on HCFA’s web site www.hcfa.govMay, 2002

EXHIBIT 3 - SAMPLE MDS FORM15

16EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)17

18EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)19

20EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)21

22EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)23

24EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)25

26EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)27

28EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)29

30EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)31

32EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)33

34EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)35

36EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)

EXHIBIT 3 - SAMPLE MDS FORM (CONTINUED)37

38EXHIBIT 4 - SAMPLE UB-92 FORM

EXHIBIT 4 - SAMPLE UB-92 FORM (CONTINUED)39

SECTION IV – SNF GUIDELINES FOR BILLING ENTERALS TOMANAGED CARE ORGANIZATIONSIt is interesting to note that the billing of skillednursing services to private indemnity and managed carepayers has most commonly been done on a per diem (ordaily) basis as is now the preferred method <strong>by</strong> Medicareunder the PPS regulations. There are however, otherbilling methodologies that may be acceptable to managedcare organizations, which include:FEE-FOR-SERVICEThis uncommon billing methodology is essentially aline <strong>by</strong> line bill for all services, drugs, and products givento the SNF patient. Because fee-for-service billsessentially have no limit, they are generally not accepted<strong>by</strong> managed care organizations.PER DIEMSA per diem bill is a flat daily rate for SNF services.Generally, per diem rates are all inclusive of the services,drugs, and supplies needed <strong>by</strong> a patient. These rates areeither established on a case-<strong>by</strong>-case basis where<strong>by</strong> themanaged care organization (MCO) or the skilled nursingfacility (SNF) will sign a contract for specific rates.Contracted per diem rates include a number of differentlevels of service and associated pricing. Levels of serviceare typically associated with a patient’s acuity orsickness level. If your organization has contracts inplace, get a copy of the fee structures in place for eachmanaged care contract as well as pricing guidelines forindividual price negotiations.CAPITATIONCapitation is a relatively rare form of billing for SNFservices. Capitation is a per member, per month (PMPM)rate that is paid for each member in a managed careorganization. Capitation rates are different for commercial(under 65), Medicare and Medicaid members. Self-insuredemployers and HMOs most commonly pay capitationrates to providers. An HMO, for example, may have10,000 members and contract with a particular SNF toservice all of its members at a fee of $10 PMPM. The SNFin this example, would receive a check in the amount of$100,000 per month for this contract, and, in turn, be liablefor all of the SNF services referred for the members.The problem with capitation in the SNF populationis that the utilization of services is so different aroundthe U.S. that it is nearly impossible to set a rate that willmeet the actual utilization of services in the SNF. SomeSNFs have been able to obtain projections for theserates <strong>by</strong> various contractual means. Those that haven’t,have experienced losses on their agreements, dependingupon how they have been set and how well theymanaged patients stays in the SNF. For moreinformation on capitation see “The Capitation and RiskSharing Guidebook.”40CODES, CLAIM FORMS AND DOCUMENTATIONThe claim forms that are acceptable to MCOs varybased upon the sophistication of the organization. MostMCOs prefer to receive a completed UB-92 form to billfee-for-service or per diem rates. Those with capitationrate structures may prefer detailed utilization reportsversus individual claims on members as the SNF is beingpaid on a PMPM basis and may not require any specificclaim forms be completed.There are generally three options for billing SNFservices to private payers. These are 1) use the codes in theNational Uniform Billing Data Element Specifications(ordering information provided in Section III), 2) Developand use your own internal codes or 3) use the Part B codes.It is essential to negotiate contracts with MCOs thatdelineate the codes that will be used with each payer.These codes should be detailed in the payer contract alongwith specific billing and payment terms.MCOs also require different types of documentationthat needs to be identified during the insuranceverification process. Documentation can include:❏ UB-92 or internal claims forms❏ Medicare forms❏ Physician orders❏ Nursing notes or RUG-III assessment forms❏ Certificates of medical necessity❏ Specific follow-up letters from the patient’sphysician documenting specific MCO requestsAdditional documentation, such as a specificdescription of the SNF services, may be required forcommercial insurance carriers that are unfamiliar withthe specific services or billing methodology of the SNF.Supportive documentation may also be required ifclaims are denied.INSURANCE VERIFICATIONInsurance verification is critical to complete prior toaccepting a private indemnity or managed care patient.The objectives of insurance verifications are tounderstand the policy benefits for the patient andnegotiate a rate structure for the stay. Withoutappropriate insurance verification, the SNF mayexperience a higher rate of denials.Information that needs to be obtained for insuranceverification includes:❏ Patient name and date of birth❏ Insurance company name and phone number❏Insured name, ID number, Group number andrelationship to patientMay, 2002

❏❏❏❏❏❏❏SNF coverage datesSNF coverage policies for enteral productsSNF reimbursement amounts for facilityservices and enteral therapyDeductibles, lifetime maximums, remainingcoverage availableAny policy restrictions including pre-existingdiagnoses, limits on SNF stays and participationrequirements or contracts for SNF providersBilling requirements including claim formcodes, documentation and billing submittaladdressAuthorization requirements includingauthorization number, authorization period,authorization processTIMELY FILINGManaged care organizations (MCOs) have differentpolicies on the timely filings of claims. Some MCOsattempt to shorten the timely filing requirements to 30 to60 days, but this may be unreasonable for yourorganization. A minimal timely filing of 90 days shouldbe requested, and a period of one year is ideal. Thereimbursement department should work closely with themanaged care contracting department to ensure contractsare written in a reasonable manner. Whatever the timelyfiling limits may be, bill as soon as possible afterservices are rendered and conduct timely claim statusfollow-up.MEDICAL DOCUMENTATIONEven when insurance verification takes place,insurance companies will only approve services “subjectto medical necessity.” Private insurance companies do notrequire, nor do they prefer, Medicare CMNs, so these arenot recommended.Medical documentation needed is a single page ofpatient information that is signed <strong>by</strong> the prescribingphysician. Sometimes these are called letters of medicalnecessity (LOMN). These can be completed in a letter orform and they typically need to include:❏ The patient’s name❏ The insured’s name❏ Patient diagnosis❏❏❏❏Type(s) of enteral products and servicesrenderedMethod of administrationEstimated durationThe provider name, address, telephone numberand federal tax identification number❏ The prescribing physician’s name, address,telephone number, signature and dateManaged care payers often require a precertification(precert) or prior authorization before services aredelivered and/or to continue services. Sometimes these areverbal and other times there is a paper certificationgenerated that needs to be submitted with the claim form.Other times there is a certification number that needs to beput on the claim form. Providers should review precertificationrequirements with the payer and with intakeand billing staff to ensure compliance with applicablerules.May, 2002 41

SECTION V – ENTERAL BILLING FOR PART BMEDICARE PROVIDERSMedicare Part B or the Supplemental Medical Insurance Program (SMIP), is a voluntary program financed from premiumpayments from Medicare enrollees with funds from the federal government. Since Part B or SMIP is voluntary, Medicareenrollees can terminate their participation in the program as follows:➝ By voluntary request➝ By failure to pay premiums➝For an individual under the age of 65 who has Part A coverage which has been terminated, the Part B coveragewill automatically terminateDETERMINING ELIGIBILITYMedicare eligibility is determined <strong>by</strong> the Medicare Health Insurance card. This card includes the member’s name, sex, claimnumber, effective dates and the type of insurance covered <strong>by</strong> Medicare [hospital insurance (Part A), medical insurance (Part B)]:HEALTH INSURANCESOCIAL SECURITY ACTNAMENAME OF BENEFICIARYJANE DOEHIC NUMBERCLAIM NUMBER000-00-0000-ASEXFEMALESEXHOSPITAL INSURANCE(PART A COVERAGE)MEDICAL INSURANCE(PART B COVERAGE)IS ENTITLED TOEFFECTIVE DATEHOSPITAL INSURANCE 1-1-00MEDICAL INSURANCE 1-1-00SIGN HERE:________________________________________________EFFECTIVE DATEHOSPITAL INSURANCEEFFECTIVE DATEMEDICAL INSURANCEThe dates are important to denote because Medicare will not pay for care given prior to the eligibility date. Medicare willalso not pay for services provided after the termination date and unfortunately, this date will not appear on the identification card.Provider EligibilityIn order to become a Part B provider, a Medicare provider number has to be obtained <strong>by</strong> the National SupplierClearinghouse (NSC):National Supplier ClearinghouseP.O. Box 100142Columbia, SC 29202-3142Telephone: (801) 754-3951Medicare claims for all enteral nutrition products and services need to be submitted to one of four Durable MedicalEquipment Regional Carriers (DMERC). Each DMERC is responsible for processing the claims within a specific geographicregion of the United States. Exhibit 5 shows which DMERC is responsible for your state. It is important to note that a claimfor enteral nutrition must be sent to the regional DMERC based on the state of the patient’s permanent residence, not the statein which the supplier operates. This is important for companies that cross state lines when delivering services.It is important to note that Medicare allowables may vary <strong>by</strong> DMERC. The four DMERCs and their respective states arelisted in following Exhibit 5.42May, 2002

EXHIBIT 5 - DMEPOS* CLAIMS JURISDICTION BY REGIONREGION AREGION BREGION CREGION DMetraHealthP.O. Box 6800Willkes-Barre, PA18773-6800(717) 735-9445Adminastar FederalP.O. Box 7078Indianapolis, IN46207-7078(317) 577-5722PalmettoGovernment BenefitsServicesP.O. Box 100141Columbia, SC 29202(803) 691-4300Cigna CorporationP.O. Box 690Nashville, TN 37202(615) 251-8182ConnecticutDelawareMaineMassachusettsNew HampshireNew JerseyNew YorkPennsylvaniaRhode IslandVermontDistrict of ColumbiaIllinoisIndianaMarylandMichiganMinnesotaOhioVirginiaWest VirginiaWisconsinAlabamaArkansasColoradoFloridaGeorgiaKentuckyLouisianaMississippiNew MexicoNorth CarolinaOklahomaPuerto RicoSouth CarolinaTennesseeTexasVirgin IslandsAlaskaAmerican SamoaArizonaCaliforniaGuamHawaiiIdahoIowaKansasMarianna IslandsMissouriMontanaNebraskaNevadaNorth DakotaOregonSouth DakotaUtahWashingtonWyoming*Durable Medical Equipment Prosthetics and OrthoticsMay, 200243

ENTERAL PRODUCT COVERAGEEnteral products, equipment, and supplies are covered underthe prosthetic device benefit provision which requires that thepatient must have a permanently inoperative internal body organor function. In order for the patient to be covered <strong>by</strong> Medicare,the need for enteral feeding must be medically documented. Thereason for this is that enteral products are covered under theprosthetic device benefit and patients need to have a DME deviceto receive coverage under this provision.Although Part B providers (which are typically infusiontherapy companies, home medical equipment (HME) companies,DME companies, or physicians) provide a service as well asproducts, there is no specific reimbursement for the servicesprovided as it is incorporated into the product reimbursement.Enteral nutrition products are covered under the“prosthetic device” benefit. In order for Medicare to reimbursefor enteral products, the patient must have a permanently nonfunctioningbody organ. In the case of enteral nutrition, the“body organ” is the non-functioning gastrointestinal tract.Medicare uses a definition of 90 days for permanence. If at theonset of therapy, a patient is expected to require enteral therapyfor a minimum of 90 days, then the test of permanence must bemet. The nasogastric or jejunostomy tube is the “device” thatreplaces the non-functioning swallowing mechanism for thepatient from Medicare’s standpoint.In addition, the patient must have the following:➝ Permanent non-function of the structures (GI tract)that permit food to reach the small bowel, or➝ Disease of the small bowel that impairs digestionand absorption of the oral diet, and➝ At least 20 to 35 calories per kilogram of bodyweight per dayThe patient’s condition must be either:➝ Anatomic (obstruction due to head and neck cancer,reconstructive surgery, etc.), or➝ Due to motility disorder (such as severe dysphagiafollowing a stroke) with the possibility that GIfunction could improve in the futureMedicare Part B may cover patients with partialimpairment; some examples include:➝ A patient with dysphagia who can swallow onlysmall amounts of food➝ A patient with Crohn’s disease who requiresprolonged infusion of enteral nutrition to overcomea problem with absorptionThe need for enteral nutrition formulas that are denoted <strong>by</strong>HCFAs Common Procedure Coding System (HCPCS)categories III, IV, V and VI must be justified. Additionaldocumentation is required to support the medical necessity ofthese formulas for categories III, IV, V and VI. Usually it isnecessary to show that general-purpose products were usedunsuccessfully in the past.Areas that are not covered <strong>by</strong> Medicare Part B include:❏ Temporary GI tract impairments for a period of timeless than three months❏ Enteral products administered orally❏ Patients who refuse or forget to eat or who do noteat for lack of appetite❏ Anorexia or nausea associated with mood disordersand end stage diseases❏ Dietary supplements❏ Ba<strong>by</strong> food and other regular grocery products thatare blenderized and fed enterally44Product PaymentEnteral products are reimbursed on a reasonable chargemethodology <strong>by</strong> Medicare. These prices are historically updatedon an annual basis and are either increased or decreased. Medicarewill pay 80% of the allowed upon amount for each billed item andthe patient or another insurance carrier is responsible for the 20%portion. The 20% portion cannot be routinely written off <strong>by</strong> law,until a genuine collection effort has been made <strong>by</strong> the provider. Agenuine collection effort is defined as:➝ A bill is sent to the patient➝ The provider uses the same collections proceduresfor all patients➝ The collection efforts must include follow-ups, suchas phone calls and lettersIn each calendar year, the Medicare beneficiary mustsatisfy a Part B deductible before Medicare payment can bemade. The expenses for non-covered items or reasonablecharge reductions do not count toward satisfying thisdeductible. Any Part B provider claim can satisfy thisdeductible. In other words, if the patient pays the deductible toa physician who is seen earlier in the year, then an HMEprovider’s claim submitted later in the year will be processedwithout the deductible. The Part B deductible for 2000 was$100 but it is subject to change each year.MEDICARE CLAIMS FORMSMedicare claims are submitted on an HCFA-1500 form(see Exhibit 6). These forms are available at www.hcfa.gov andmay also be ordered from private printing companies or fromthe Government Printing Office (GPO). The forms areavailable at varying prices in several formats: single sheet, twopartsnap apart, and one or two-part continuous feed. A printnegative is also available for purchase. Bulk orders are subjectto discount and some customization is available.The GPO accepts credit card orders between the hours of8:00 am and 4:30 pm, Eastern Standard Time. You can place acredit card order <strong>by</strong> calling (202) 783-3238 between thesehours. Mail orders are accepted with check or money orderattached and sent to the following address:U.S. Government Printing OfficeSuperintendent of DocumentsWashington, DC 20402The following are guidelines on completing the HCFA-1500:❏ The HCFA-1500 form needs to be completedaccurately in order to receive Medicare reimbursement❏ The DMERCs are interested in receiving electronic claimsbecause they reduce the burden of handling paperwork❏ Where a paper claim needs to be sent in, only astandard claim will be accepted; a standard claim isone without any attachments that are consideredunnecessary (e.g., those that could have beencompleted <strong>by</strong> filling in the HCFA-1500); anyattachments to the claims will be consideredunnecessary and will be returned to the provider❏ Contact the DMERC responsible for your region toobtain specific directions on how to complete theHCFA-1500; make sure you obtain updated rulesand regulations as well as code information forclaims; when contacting the DMERC, ask questionsabout Medicare as the primary insurance carrier andMEDIGAP and Medicare as the secondaryinsurance provider❏ Where there may be a denial because of HCFA-1500information, make sure that this is reviewed carefullyand becomes a part of the document completion processMay, 2002

EXHIBIT 6 – SAMPLE HCFA-1500 CLAIM FORM45

46EXHIBIT 6 – SAMPLE HCFA-1500 CLAIM FORM (CONTINUED)

Medicare CodesMedicare Part B uses the HCFA Procedural Coding System (HCPCS) to code enteral supplies and equipment. Thefollowing Exhibit 7 is a list of the codes that are approved for use in reimbursement:EXHIBIT 7 - HCPCS CODES FOR ENTERAL SUPPLIES AND EQUIPMENTCode Description What’s CoveredB4034 Syringe Supply Kit Feeding syringes, tape with wipes and any othersupplies to administer tube feeding via syringeB4035 Pump Supply Kit Pump sets, containers, feeding syringes, tapewith wipes and any other necessary suppliesB4036 Gravity Supply Kit Gavage sets, containers, feeding syringes, tapewith wipes and any other necessary suppliesB4081 Nasogastric (NG) Tube Medicare covers three NG tubes every threewith StyletmonthsB4082 Nasogastric (NG) Tube Medicare covers three NG tubes every threewithout StyletmonthsB4083 Stomach Tube – Levine Medicare covers three tubes every three monthsTypeB4084 Gastostomy/Jejunostomy Medicare covers one gastrotomy or jejunostomyTubetube every three monthsB4085 Gastostomy/Jejunostomy Gastostomy/jejunostomy tubes with external skinTube (Silicone with sliding ring) disks qualify for this category; low-profilegastostomy/jejunostomy tubes (Stomata) alsoqualify for this categoryE0776 NUXA IV pole for enteral therapy Purchased newE0776 UEXA IV pole for enteral therapy Purchased usedE0776 RRXA IV pole for enteral therapy RentalE0776 XA IV Pole RentalB9000 BP Pump Purchase (without alarm)B9000 RR Pump Rental (without alarm)B9002 RR Pump Rental (without alarm)The above codes may be subject to change <strong>by</strong> Medicare. Providers should verify the specificcodes recognized <strong>by</strong> the applicable Medicare claims processor (Exhibit 5) prior to use.47

Enteral <strong>Nutrition</strong>Enteral nutrition products are billed in units. A unit isdefined as 100 calories. Billing for ccs, mLs, cans used orcases used will result in underpayment or no payments atall from Medicare Part B. Enteral nutrition may be fed <strong>by</strong>syringe, gravity, or pump and Medicare Part B allows forone supply kit a day. The codes for these kits are (B4034)for syringe fed, (B4035) for pump fed, and (B4036) forgravity fed. The supply kit must correspond to the methodof feeding, and the per diem rate should cover all supplies(i.e., irrigation kit, syringes, tape, wipes, dressings) used inadministering enteral nutrition. If the medical necessity fora pump is not documented, reimbursement for the pumpsupply kit will usually be based on the least costlyalternative [e.g., gravity-fed supply kit (B4036)].Medicare Part B covers a feeding tube and it allowseither of the following:48➝One nasogastric tube per month* (B4081,B4082, B4083) or➝ One gastostomy or jejunostomy tube every threemonths* (B4084 or K0147)*DMERC region C allows three nasogastrictubes or one gastostomy or jejunostomy tube amonth. Providers should review specificcoverage criteria with their applicable DMERC.If a patient experiences complications with syringe orgravity administration, a pump (B9002) may be required.For a pump to be approved, it must be justified ondocumentation that accompanies the Certificate ofMedical Necessity (CMN). Examples of pumpjustification include:❏❏❏❏❏❏❏Gravity feeding is not satisfactory due to refluxand/or aspirationPatient has severe diarrheaPatient has dumping syndromeAdministration rate is less than 100mL/hourBlood glucose fluctuatesCirculatory overload is presentJejunostomy tube is used for feedingNote: Medicare will not reimburse for a pump toprevent possible complicationsSamples of wording for pump justification, whenapplicable, include the following:❏❏❏❏❏❏Patient experienced aspiration with gravityfeeding, resulting in pneumoniaGravity was used previously; patientexperienced vomiting, diarrhea, nauseaPatient cannot tolerate gravity feeding asevidenced <strong>by</strong> intractable diarrheaContinuous infusion of nutrients is needed dueto history of nausea and vomitingPump is needed due to history of aspirationSevere contractures prevent positioning patientfor safe delivery of gravity feeding❏❏❏Patient requires controlled delivery of nutrientsto prevent fluid imbalance or overload due to(insert diagnosis)Continuous infusion of nutrients is needed dueto high caloric needs and volume required <strong>by</strong>patient to maintain an ideal body weight; unableto maintain this using gravity feedingContinuous slow infusion of nutrients neededdue to history of dumping syndrome❏ Patient is a brittle diabetic and requirescontrolled delivery of ≤100cc formula per hourto maintain insulin/blood glucose balanceThere are two options for pump billing and these arerental or purchase:Rental and Purchase OptionsMedicare pump rental payments are limited to 15months, assuming that medical criteria are met <strong>by</strong> thebeneficiary. The patient is granted 15 months of pumprental despite a change in supplier. After 15 months, thesupplier must continue to provide the pump as long asmedically necessary. No additional rental payments willbe made <strong>by</strong> Medicare. The provider can still bill for theenteral feeding supplies (i.e., pump set, gastrostomy tube,etc).The beneficiary has the option to purchase the pumpany time during the rental period. The following aregeneral guidelines on pump rentals and purchases:❏❏❏❏❏❏The supplier must notify the beneficiary orbeneficiary’s legal representative of the purchaseoption with the initial claim and in the 10thrental monthIf the beneficiary or beneficiary’s legalrepresentative decides to purchase the pump, thesupplier must transfer the title for the equipmentto the patient in the 13th month of rental; at thattime, the beneficiary assumes all responsibilityfor maintenance and repair of the pumpIf the beneficiary chooses to continue rentingthe pump, the supplier will receive an additionalfive months of rental payments, assumingmedical need continuesIf the beneficiary decides to purchase the pumpin the middle of a rental period, the supplier willreceive the used purchase allowance minus theamount allowed to date for rentalsIf the beneficiary rents the pump during theentire 15 month period, the supplier is entitledto periodic maintenance and servicingpayments; maintenance and servicing includerepair and extensive maintenance (e.g.,breakdown of sealed components; testsrequiring specialized equipment not available tothe beneficiary or nursing home)The DMERC will pay only for actual incidentsof maintenance and servicingMay, 2002

❏❏❏The supplier should keep written proof ofmaintenance and servicing on fileMedicare allows maintenance and servicingcharges of one-half of one month’s rental everysix months after the rental period is exhaustedWhen billing, the supplier must use theappropriate modifiers; Medicare has devicemodifiers that indicate rental or purchase status;the modifiers follow the appropriate pumpHCPCS code (B9000 or B9002)➝ KH – used with initial month of pump rental➝➝KI – used during the 2 nd and 3 rd months of rentalKJ – used during the 4 th through 15 th monthsof rental➝➝BP – beneficiary elected to purchase thepump; used with first claim and on the 9 th ,10 th , 11 th or 12 th month of rentalBR – beneficiary refused purchase option➝ BU – beneficiary or his/her legalrepresentative was informed of option topurchase pump, but failed to respond; rentalpayments will continue through the 15 th monthEnteral FormulasMedicare classifies enteral nutrition formulas into sixcategories* based on on nutritional composition. Thefollowing Exhibit 8 is a list of the Medicare Part Bcoverage of <strong>Mead</strong> <strong>Johnson</strong> formulas:*Categorization may be subject to change. Any reimbursement should be confirmed with your Medicare DMERC.May, 2002 49

EXHIBIT 8 – MEDICARE APPROVED MEDICAL NUTRITION PRODUCTSPROVIDED BY MEAD JOHNSONHCPCS Category Description <strong>Mead</strong> <strong>Johnson</strong> Products Billable UnitsCode(per 8 oz can)B4150 Category I – ($0.61 per unit) Boost ® 2.4Semi-synthetic Intact Boost ® Breeze * 1.6Protein/Protein Isolates Boost ® with Fiber 2.4Boost ® High Protein 2.4Isocal ® 2.5Isocal ® HN 2.5Isocal ® HN Plus 2.8Kindercal ® 2.5Portagen ® 21.34**Ultracal ® 2.5Ultracal ® HN Plus 2.8B4152 Category II – ($0.51 per unit) Boost Plus ® 3.6Calorically Dense: Intact Comply ® 3.55Protein/Protein Isolates Deliver ® 2.0 4.7Respalor ® 3.55B4153 Category III – ($1.74 per unit) Criticare HN ® 2.5Hydrolyzed Protein/Amino Acid IntensiCal ® 5.1Subdue ® 2.4Subdue ® Plus 3.6B4154 Category IV – ($1.12 per unit) Choice DM ® TF 2.5Defined Formula for Special Choice DM ® Beverage 2.2Metabolic Needs Lipisorb ® 3.2Magnacal ® Renal 4.7Protain XL ® 2.37TraumaCal ® 3.55B4155 Category V – ($1.12 per unit) Casec ® 10.75**Modular Components Moducal ® 13.99**MCT Oil$72.52 per bottleMicrolipid ®4.0 per 3 ozNote: Comply ® ,Magnacal ® , Microlipid ® , and Protain XL ® are registered trademarks of Sherwood Services, AG. All othersare registered trademarks of <strong>Mead</strong> <strong>Johnson</strong> & Company.*Classification pending.**Per one can of powder.50