You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

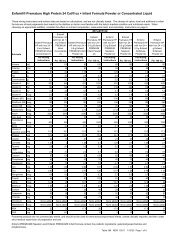

ENTERAL PRODUCT COVERAGEEnteral products, equipment, and supplies are covered underthe prosthetic device benefit provision which requires that thepatient must have a permanently inoperative internal body organor function. In order for the patient to be covered <strong>by</strong> Medicare,the need for enteral feeding must be medically documented. Thereason for this is that enteral products are covered under theprosthetic device benefit and patients need to have a DME deviceto receive coverage under this provision.Although Part B providers (which are typically infusiontherapy companies, home medical equipment (HME) companies,DME companies, or physicians) provide a service as well asproducts, there is no specific reimbursement for the servicesprovided as it is incorporated into the product reimbursement.Enteral nutrition products are covered under the“prosthetic device” benefit. In order for Medicare to reimbursefor enteral products, the patient must have a permanently nonfunctioningbody organ. In the case of enteral nutrition, the“body organ” is the non-functioning gastrointestinal tract.Medicare uses a definition of 90 days for permanence. If at theonset of therapy, a patient is expected to require enteral therapyfor a minimum of 90 days, then the test of permanence must bemet. The nasogastric or jejunostomy tube is the “device” thatreplaces the non-functioning swallowing mechanism for thepatient from Medicare’s standpoint.In addition, the patient must have the following:➝ Permanent non-function of the structures (GI tract)that permit food to reach the small bowel, or➝ Disease of the small bowel that impairs digestionand absorption of the oral diet, and➝ At least 20 to 35 calories per kilogram of bodyweight per dayThe patient’s condition must be either:➝ Anatomic (obstruction due to head and neck cancer,reconstructive surgery, etc.), or➝ Due to motility disorder (such as severe dysphagiafollowing a stroke) with the possibility that GIfunction could improve in the futureMedicare Part B may cover patients with partialimpairment; some examples include:➝ A patient with dysphagia who can swallow onlysmall amounts of food➝ A patient with Crohn’s disease who requiresprolonged infusion of enteral nutrition to overcomea problem with absorptionThe need for enteral nutrition formulas that are denoted <strong>by</strong>HCFAs Common Procedure Coding System (HCPCS)categories III, IV, V and VI must be justified. Additionaldocumentation is required to support the medical necessity ofthese formulas for categories III, IV, V and VI. Usually it isnecessary to show that general-purpose products were usedunsuccessfully in the past.Areas that are not covered <strong>by</strong> Medicare Part B include:❏ Temporary GI tract impairments for a period of timeless than three months❏ Enteral products administered orally❏ Patients who refuse or forget to eat or who do noteat for lack of appetite❏ Anorexia or nausea associated with mood disordersand end stage diseases❏ Dietary supplements❏ Ba<strong>by</strong> food and other regular grocery products thatare blenderized and fed enterally44Product PaymentEnteral products are reimbursed on a reasonable chargemethodology <strong>by</strong> Medicare. These prices are historically updatedon an annual basis and are either increased or decreased. Medicarewill pay 80% of the allowed upon amount for each billed item andthe patient or another insurance carrier is responsible for the 20%portion. The 20% portion cannot be routinely written off <strong>by</strong> law,until a genuine collection effort has been made <strong>by</strong> the provider. Agenuine collection effort is defined as:➝ A bill is sent to the patient➝ The provider uses the same collections proceduresfor all patients➝ The collection efforts must include follow-ups, suchas phone calls and lettersIn each calendar year, the Medicare beneficiary mustsatisfy a Part B deductible before Medicare payment can bemade. The expenses for non-covered items or reasonablecharge reductions do not count toward satisfying thisdeductible. Any Part B provider claim can satisfy thisdeductible. In other words, if the patient pays the deductible toa physician who is seen earlier in the year, then an HMEprovider’s claim submitted later in the year will be processedwithout the deductible. The Part B deductible for 2000 was$100 but it is subject to change each year.MEDICARE CLAIMS FORMSMedicare claims are submitted on an HCFA-1500 form(see Exhibit 6). These forms are available at www.hcfa.gov andmay also be ordered from private printing companies or fromthe Government Printing Office (GPO). The forms areavailable at varying prices in several formats: single sheet, twopartsnap apart, and one or two-part continuous feed. A printnegative is also available for purchase. Bulk orders are subjectto discount and some customization is available.The GPO accepts credit card orders between the hours of8:00 am and 4:30 pm, Eastern Standard Time. You can place acredit card order <strong>by</strong> calling (202) 783-3238 between thesehours. Mail orders are accepted with check or money orderattached and sent to the following address:U.S. Government Printing OfficeSuperintendent of DocumentsWashington, DC 20402The following are guidelines on completing the HCFA-1500:❏ The HCFA-1500 form needs to be completedaccurately in order to receive Medicare reimbursement❏ The DMERCs are interested in receiving electronic claimsbecause they reduce the burden of handling paperwork❏ Where a paper claim needs to be sent in, only astandard claim will be accepted; a standard claim isone without any attachments that are consideredunnecessary (e.g., those that could have beencompleted <strong>by</strong> filling in the HCFA-1500); anyattachments to the claims will be consideredunnecessary and will be returned to the provider❏ Contact the DMERC responsible for your region toobtain specific directions on how to complete theHCFA-1500; make sure you obtain updated rulesand regulations as well as code information forclaims; when contacting the DMERC, ask questionsabout Medicare as the primary insurance carrier andMEDIGAP and Medicare as the secondaryinsurance provider❏ Where there may be a denial because of HCFA-1500information, make sure that this is reviewed carefullyand becomes a part of the document completion processMay, 2002