You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

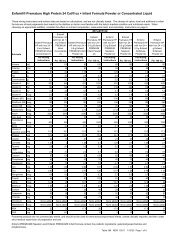

EXHIBIT 17 - METHODS OF ESTABLISHING CAPITATION RATESMethodPercentage of PremiumFlat PMPMGuaranteed RatesVariable Rates Based onDemographic DataRate$100 premium per month x 3% = $3 PMPM$3 PMPM for each eligible member$100 premium per month; 2% premium+ 1% premium guaranteeOr$2 PMPM rate + $1 PMPM guaranteeOther capitation rates can be established as specific set rateor a percentage based on age, sex, diagnoses or other criteriaA percentage premium rate means the provider and themanaged care organization agree to a percentage of thepremium, which is billed <strong>by</strong> the managed care organization.In the example above, the managed care organization bills a$100 premium per person and the provider is reimbursed3% of the premium amount. Percentage premiums areadvantageous if the provider is not interested in determiningeligibility for enrollees as is required with flat capitationrates. Calculation of a percentage premium rate willnecessitate the provider to analyze the premium informationgenerated <strong>by</strong> the managed care organization. Financialaudits may be a part of this process and should be includedin the contractual agreements between providers andmanaged care organizations.A flat per member per month rate is a very commoncalculation which is done in capitation. Flat rates make iteasy to compare one provider’s experience to another’s.Providers can translate flat pmpm rates into percentagepremium rates. The advantage of a flat pmpm rate is it iseasy to calculate, but the disadvantage is the provider mustkeep track of the number of enrollees or beneficiaries inthe managed care organization’s plan in order to calculatethe pmpm rate. This can be a cumbersome processrequiring the provider to receive, analyze, and audit themember data generated <strong>by</strong> the managed care organization.When this is too difficult a process, providers need toconsider a percentage premium rate.Guarantees are important to negotiate if the MCO isjust starting to market its services or there is limited or noutilization information available. In the example above,the capitation rate is calculated as a 2% premium paymentto the provider with a 1% premium guarantee rate. Theguarantee rate could also be calculated on a flat permember per month rate. For example, a $2 per member permonth rate and a $1 per member per month guarantee rate.A guarantee could also be calculated as a flat amount, forexample a $5,000 or $10,000 guarantee amount. Often,providers are asked to calculate a rate with limited data orexperience from the managed care organization. The useof a guarantee demonstrates the managed careorganization is committed to adding new enrollees andmeeting its marketing plans.Variable rates can be calculated in a wide variety ofsituations. Capitation rates are often calculated, and themost expensive or risky diagnoses or cases are excludedfrom the capitation rate. These diagnoses or cases canbecome carve outs from which a specific variablecapitation rate can be calculated. For example, aninfectious disease provider may want to carve out adiagnosis, such as AIDS, because of the unpredictable andpotentially high number of infections associated with thisdisease. Another example would be to develop a variablerate for a particular age group where the usage of providerservices would be extremely high. Product providers maycarve out certain types of equipment which are much moreexpensive than others. For example, a home equipmentsupplier might offer a capitation rate for usual equipment,but develop a variable rate for ventilators because oneventilator patient could represent an expense as high as thegeneral equipment for the member population.Managed care organizations do not particularly likecapitation rates with certain members not included in therate, especially if the provider does not offer a variable ratefor these members. In many markets, specialty providersare developing disease, age and other specific variablecapitation rates and these are often tied to diseasemanagement or carve out programs.INSURANCE VERIFICATIONInsurance verification is a critical process that needsto be performed to obtain reimbursement. Enteral servicesgenerally should not be provided before insuranceverification has taken place. If the provider starts enteralservices prior to verification, then there is a higher riskthat services won’t be covered or they will be paid at ahighly discounted rate.Most insurance verification information is obtained atthe point of intake for providers. Insurance verificationthen takes place with the patient’s primary and secondary(if in place) insurance companies. The phone numbers forinsurance verification can be found on the patient’sinsurance card or through the Kelly Insurance Directory.This directory can be ordered <strong>by</strong> calling 1-800-328-4144or through their web site at www.fbka.com.May, 2002 73