NSE-Web-Prospectus-2014

NSE-Web-Prospectus-2014

NSE-Web-Prospectus-2014

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

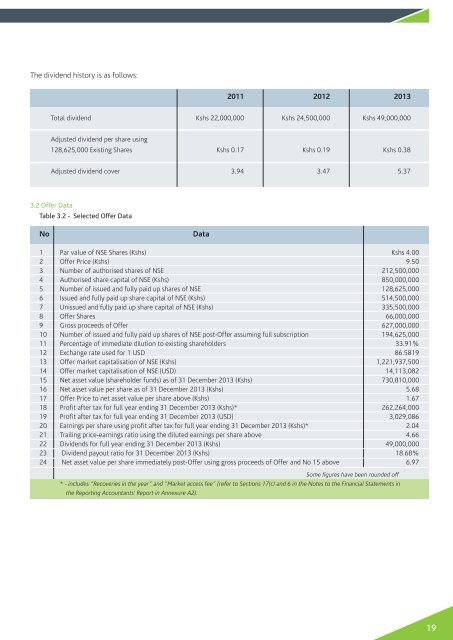

The dividend history is as follows:2011 2012 2013Total dividend Kshs 22,000,000 Kshs 24,500,000 Kshs 49,000,000Adjusted dividend per share using128,625,000 Existing Shares Kshs 0.17 Kshs 0.19 Kshs 0.38Adjusted dividend cover 3.94 3.47 5.373.2 Offer DataTable 3.2 - Selected Offer DataNoData1 Par value of <strong>NSE</strong> Shares (Kshs) Kshs 4.002 Offer Price (Kshs) 9.503 Number of authorised shares of <strong>NSE</strong> 212,500,0004 Authorised share capital of <strong>NSE</strong> (Kshs) 850,000,0005 Number of issued and fully paid up shares of <strong>NSE</strong> 128,625,0006 Issued and fully paid up share capital of <strong>NSE</strong> (Kshs) 514,500,0007 Unissued and fully paid up share capital of <strong>NSE</strong> (Kshs) 335,500,0008 Offer Shares 66,000,0009 Gross proceeds of Offer 627,000,00010 Number of issued and fully paid up shares of <strong>NSE</strong> post-Offer assuming full subscription 194,625,00011 Percentage of immediate dilution to existing shareholders 33.91%12 Exchange rate used for 1 USD 86.581913 Offer market capitalisation of <strong>NSE</strong> (Kshs) 1,221,937,50014 Offer market capitalisation of <strong>NSE</strong> (USD) 14,113,08215 Net asset value (shareholder funds) as of 31 December 2013 (Kshs) 730,810,00016 Net asset value per share as of 31 December 2013 (Kshs) 5.6817 Offer Price to net asset value per share above (Kshs) 1.6718 Profit after tax for full year ending 31 December 2013 (Kshs)* 262,264,00019 Profit after tax for full year ending 31 December 2013 (USD) 3,029,08620 Earnings per share using profit after tax for full year ending 31 December 2013 (Kshs)* 2.0421 Trailing price-earnings ratio using the diluted earnings per share above 4.6622 Dividends for full year ending 31 December 2013 (Kshs) 49,000,00023 Dividend payout ratio for 31 December 2013 (Kshs) 18.68%24 Net asset value per share immediately post-Offer using gross proceeds of Offer and No 15 above 6.97Some figures have been rounded off* - includes “Recoveries in the year” and “Market access fee” (refer to Sections 17(c) and 6 in the Notes to the Financial Statements inthe Reporting Accountants’ Report in Annexure A2).19