NSE-Web-Prospectus-2014

NSE-Web-Prospectus-2014

NSE-Web-Prospectus-2014

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

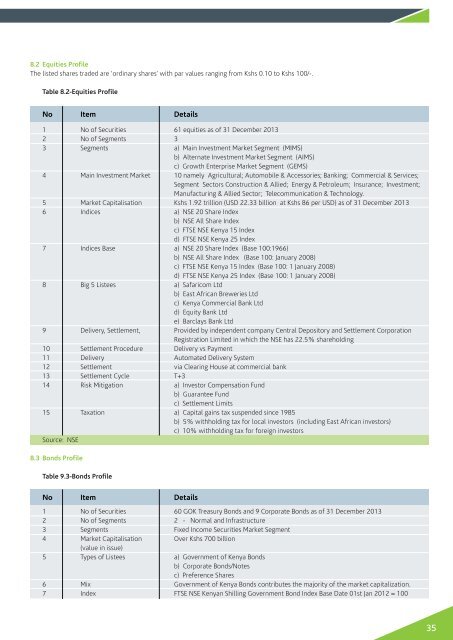

8.2 Equities ProfileThe listed shares traded are ‘ordinary shares’ with par values ranging from Kshs 0.10 to Kshs 100/-.Table 8.2-Equities ProfileNo Item Details1 No of Securities 61 equities as of 31 December 20132 No of Segments 33 Segments a) Main Investment Market Segment (MIMS)b) Alternate Investment Market Segment (AIMS)c) Growth Enterprise Market Segment (GEMS)4 Main Investment Market 10 namely Agricultural; Automobile & Accessories; Banking; Commercial & Services;Segment Sectors Construction & Allied; Energy & Petroleum; Insurance; Investment;Manufacturing & Allied Sector; Telecommunication & Technology.5 Market Capitalisation Kshs 1.92 trillion (USD 22.33 billion at Kshs 86 per USD) as of 31 December 20136 Indices a) <strong>NSE</strong> 20 Share Indexb) <strong>NSE</strong> All Share Indexc) FTSE <strong>NSE</strong> Kenya 15 Indexd) FTSE <strong>NSE</strong> Kenya 25 Index7 Indices Base a) <strong>NSE</strong> 20 Share Index (Base 100:1966)b) <strong>NSE</strong> All Share Index (Base 100: January 2008)c) FTSE <strong>NSE</strong> Kenya 15 Index (Base 100: 1 January 2008)d) FTSE <strong>NSE</strong> Kenya 25 Index (Base 100: 1 January 2008)8 Big 5 Listees a) Safaricom Ltdb) East African Breweries Ltdc) Kenya Commercial Bank Ltdd) Equity Bank Ltde) Barclays Bank Ltd9 Delivery, Settlement, Provided by independent company Central Depository and Settlement CorporationRegistration Limited in which the <strong>NSE</strong> has 22.5% shareholding10 Settlement Procedure Delivery vs Payment11 Delivery Automated Delivery System12 Settlement via Clearing House at commercial bank13 Settlement Cycle T+314 Risk Mitigation a) Investor Compensation Fundb) Guarantee Fundc) Settlement Limits15 Taxation a) Capital gains tax suspended since 1985b) 5% withholding tax for local investors (including East African investors)c) 10% withholding tax for foreign investorsSource: <strong>NSE</strong>8.3 Bonds ProfileTable 9.3-Bonds ProfileNo Item Details1 No of Securities 60 GOK Treasury Bonds and 9 Corporate Bonds as of 31 December 20132 No of Segments 2 - Normal and Infrastructure3 Segments Fixed Income Securities Market Segment4 Market Capitalisation Over Kshs 700 billion(value in issue)5 Types of Listees a) Government of Kenya Bondsb) Corporate Bonds/Notesc) Preference Shares6 Mix Government of Kenya Bonds contributes the majority of the market capitalization.7 Index FTSE <strong>NSE</strong> Kenyan Shilling Government Bond Index Base Date 01st Jan 2012 = 10035